What is Rebalancing?

From time to time, the stock market may experience high levels of trading and larger than usual price fluctuations in the broad market. These dramatic price movements often result in deviations from our intended asset allocation, causing a change in our portfolio that is not in line with our risk profile. One of the most important duties of portfolio managers is to achieve clients’ investment objectives in accordance with their risk profile and this often necessitates rebalancing.

Rebalancing is principally a risk management exercise that rearranges clients’ portfolios to be in line with their investment goals. It works by changing the weightage of investments back to the targeted strategic asset allocation via a series of transactions. In the case of KDI Invest, the weightage of our primary investment vehicle, Exchange-Traded Funds (ETFs), will be adjusted back to the weightage as determined by our algorithms.

Importance of Rebalancing

Although the famous investment adage of letting your winners run high holds true, such deviations may cause a mismatch in the investors’ risk profile. If this is left uncontrolled over a long period of time, resulting in an allocation drift, any market turbulence could lead to undesirable losses.

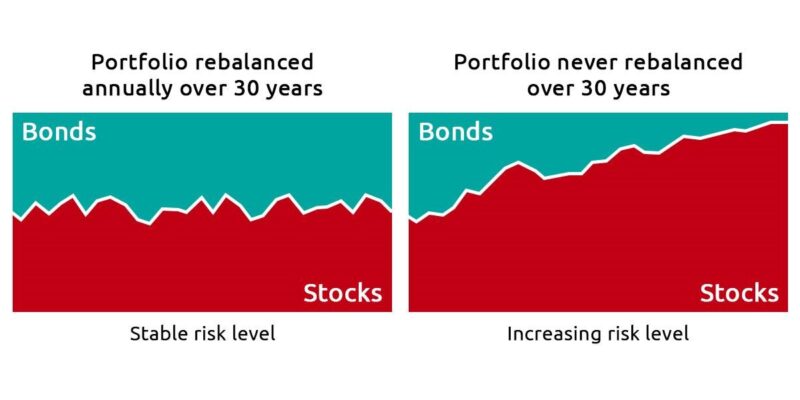

To better illustrate our point, let us consider two portfolios with a mixture of stocks and bonds where one is rebalanced, and the other remains untouched for the same amount of time.

The allocation drift in the portfolio that was never rebalanced will turn increasingly volatile over time primarily due to the higher risk and return characteristics of stocks compared to bonds.

Assuming an initial allocation of 50% stocks with an expected return of 8% p.a. and 50% bonds with an expected return of 4% p.a., the higher expected return of stocks will eventually be the primary source of return and risk, producing a portfolio that is no longer palatable for the investor.

This situation is also especially detrimental as the unique circumstances surrounding this investor have probably changed as they aged. According to the old rule of thumb where bond allocation is tied to age, aging by 30 years should suggest an increased allocation to bonds by at least 30%. Such an allocation is unachievable if the portfolio is not rebalanced from time to time.

How a Typical Rebalancing Works

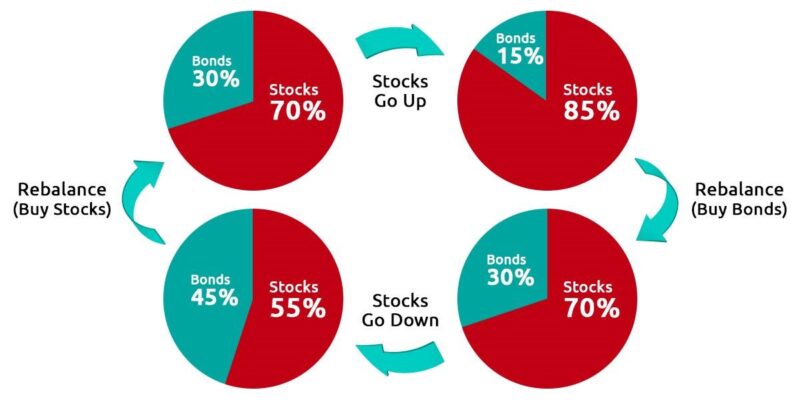

The whole rebalancing exercise can be summarised as a contrarian approach to investment. It seems counterintuitive at first to sell winners to purchase losers, but it represents the essential investment mantra which is “buy low, sell high”. Simply put, rebalancing accounts for market cyclicality and adjusts for appropriate risk levels.

How an A.I. Assisted Rebalancing Works

While the examples given are simplified, in real-world scenarios, rebalancing goes well beyond the typical 50-50 allocation to stocks and bonds. To achieve an optimum asset allocation in accordance with the Markowitz Portfolio Theory, a typical KDI Invest portfolio sets weightages with multi-decimal precision across a diversified pool of ETFs and a range of asset classes.

KDI Invest uses Artificial Intelligence (A.I.) to monitor market conditions and assign the appropriate weightages according to the unique circumstances of individual investors’ risk profiles. As a robo-advisor, the AI detects and automatically rebalances customer portfolios. if the actual ETF holdings deviate too far from the targeted weightages.

Invest efficiently! KDI Invest takes into account your special preferences with regards to your risk profile, ensuring that it will not deviate significantly overtime via the use of A.I.-assisted rebalancing. Click here to start investing with KDI now!