August 2022 Market Insights

Brought to you by the Kenanga Digital Investing (KDI) team, here is our 7th Market Insights column. Our Head of Digital Investing, Cheong Yew Huan will discuss the latest in financial news and present his thoughts on making the most of today’s market.

Market Recap

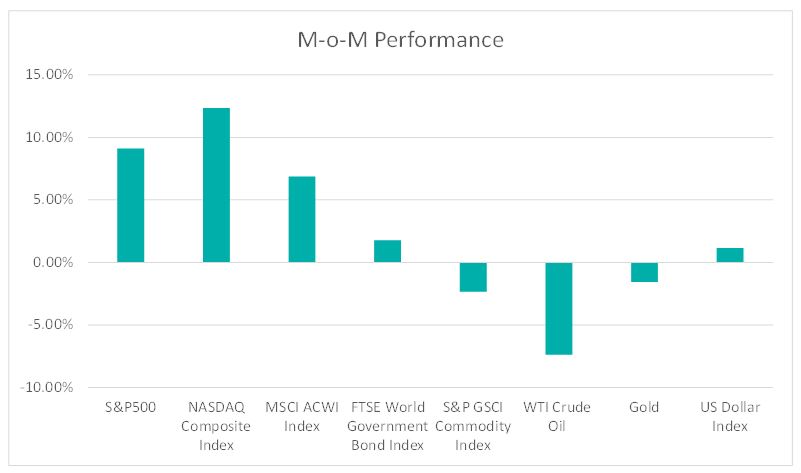

Chart 1: Index Performance in July 2022

Market

The S&P500 and the Nasdaq ended July with their biggest jump since 2020, with month-on-month gains of 9.1% and 12.3% respectively. The rally was driven by better-than-expected US corporate earnings results, along with investors’ speculation that the Fed may pull back in its aggressive move to curb inflation.

According to FactSet, 87% of the companies in the S&P500 have reported the second quarter of 2022 as of 5 August 2022. Of these companies, 75% of the companies have reported a positive EPS surprise and 70% of companies have reported a positive revenue surprise.

The fixed income market was dominated by concerns over the severity of the global economic downturn. The International Monetary Fund (IMF) cut its global growth projection and now expects the world economy to grow 3.2% this year, before slowing further to a 2.9% GDP rate in 2023. The World Bank last month also slashed its 2022 global growth outlook to 2.9% from an earlier estimate of 4.1%, citing the war in Ukraine, supply-chain disruptions, and the risk of stagflation as hampering growth.

The two-year and ten-year treasury yields closed at 2.8905% and 2.6580% respectively. The spread between the two and ten-year yields was negative 23 basis points. The US yield curve (the 2-year vs 10-year yield) was first inverted in early April this year. An inverted yield curve is widely interpreted as a precursor to a recession. Historically, extended inversion periods tend to foreshadow future market downturns. In 2006-2007, the yield curve inverted and acted as a precursor to the subprime crisis of 2008-2009. Similar conditions occurred in 2000, presaging the 2001-2003 market meltdown.

WTI Oil prices fell 7.4% in July amid concerns about slowing global oil demand. The global recession fears, returning oil supply from Libya, and the resumption of Russian gas flows to Europe helped ease supply restraints. The world food commodity prices declined significantly in July, as major cereal and vegetable oil prices recorded double-digit percentage declines, according to a report released by the Food and Agriculture Organization of the UN. The FAO Food Price Index, which tracks monthly changes in the international prices of a basket of commodity–traded food commodities, average 140.9 points in July, down 8.6% from June, thus marking the fourth consecutive monthly decline.

The US Dollar Index, which measures the currency against six counterparts, extended its rally and closed 1.16% higher at 105.98.

Investors have been looking for safe havens that offer protection in challenging economic times. The tightening monetary policy by US central bank also puts upward pressure on the dollar.

Outlook

The investors seem to be divided over the market outlook. The Federal Reserve delivered the expected 75 basis point hike at its July meeting, the second consecutive interest rate hike to fight against 40-year high inflation. The Fed’s aggressive monetary tightening has been creating concern about a US recession; especially the bond investors see more risks ahead and allocate more exposure to longer tenure government bonds which results in yield curve inversion.

On the other hand, the US labour market remains strong with the July unemployment rate falling to a pre-pandemic low of 3.5%. The non-farm payrolls increased by 528,000, much higher than the market expectation of 250,000.

The inflation is expected to moderate over the next couple of months given the recent drop in energy and other commodity prices and easing in global supply chain conditions after the gradual reopening of major cities in China after the anti-Covid lockdown.

Despite the signals of economic slowdown, US corporate earnings are projected to continue to grow. Analysts expect earnings growth of 5.8% for 3Q22 and 6.1% for 4Q22. For CY 2022, the earning growth is projected at 8.9%. Valuation-wise, the S&P500 forward 12-month P/E ratio is 17.5x, which is below the 5-year average of 18.6x.

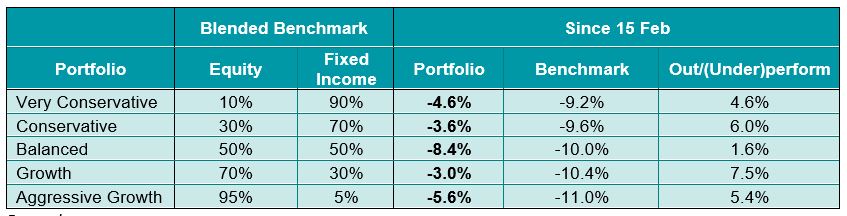

KDI Invest Portfolio Performance As of 31 July 2022

Remarks:

Benchmark: Equity: MSCI ACWI Index + Fixed Income: FTSE World Government Bond Index

Past performance is not indicative of future results.

The above table shows the performance of selected KDI portfolios since its launch on 15 February. The portfolio returns are ranging from -8.4% to -3.0%, outperforming the benchmark by 1.6% to 7.5%.

The rebalancing was triggered in the first week of August 2022. With the early signs of market stability, the robo-advisor A.I. increases the equity exposure for growth and aggressive growth portfolios. For balanced/conservative/very conservative portfolios, the investment strategies remain defensive with weighting towards fixed income. The rebalancing decision by KDI A.I. is data-driven and subject to the signals from the market and fundamental data.

The major changes in growth and aggressive growth portfolios are as follows:

• Increase equities with diversified exposure in the US, Europe, China, and Asia regions. The total equity exposure is between 73% and 97% of the total portfolio.

• Reduced weighting in fixed income and cash or cash-equivalent holdings exposure. For growth portfolios, the fixed income exposure is around 12% of the total portfolio post-rebalancing. The main exposure includes iShares Floating Rate Bond ETF (FLOT), iShares 7-10 Year Treasury Bond ETF (IEF), and iShares Short Treasury Bond ETF (SHV).

Please note that the above performance is based on five proxy portfolios. Actual KDI Invest portfolio performance may vary from the above due to the customization by the KDI robo-advisor A.I. based on investors’ risk profiling, as well as the timing of market entry.

Citation:

https://www.cnbc.com/2022/07/26/imf-cuts-global-gdp-forecast-as-economic-outlook-grows-gloomy.html

https://www.fao.org/newsroom/detail/global-food-commodity-prices-decline-in-july/en