June 2025 Market Insights

Welcome to the June edition of the Market Insights column brought to you by the Kenanga Digital Investing (KDI) team. In this edition, Our Head of Portfolio Management, Wu Kin Hoe, will discuss the latest financial news and share his insights on how to make the most of today’s market.

Market Recap

Market

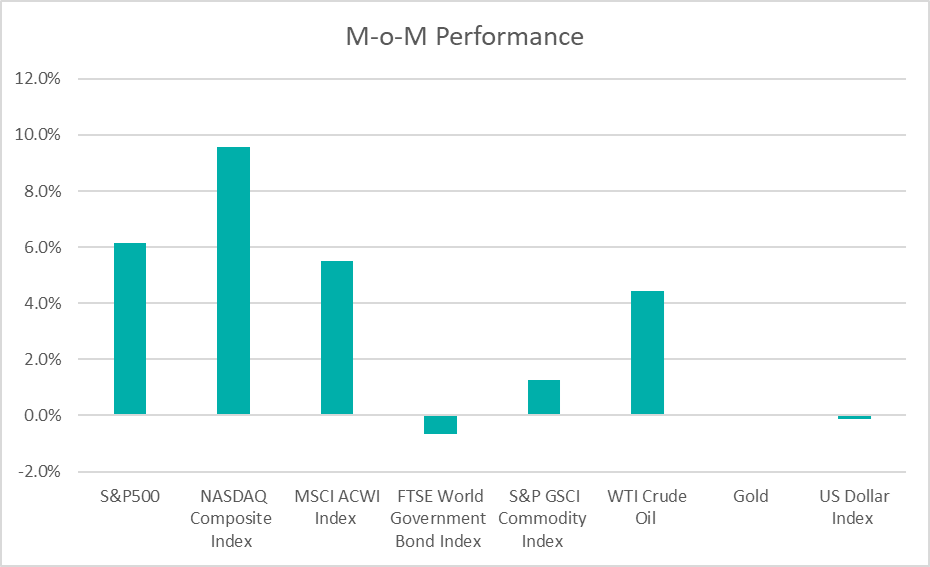

Global markets staged a strong recovery in May, building on April’s low as trade tensions eased following the temporary rollback of the US-China tariffs. The S&P 500 and Nasdaq Composite rose by 6% and 10% in May 2025, marking its strongest single month gain since November 2023.

US treasuries weakened in May with 10-year yield rising by 24 basis points to 4.4% on rising fiscal concerns. President Trump’s proposed budget is projected to add several trillion dollars to the deficit over the next decade, raising fears about long-term debt sustainability. This was compounded by Moody’s downgrade of the US sovereign credit rating. As of end-May 2025, CME FedWatch data indicated a 96% chance of no change at the US Federal Reserve’s upcoming 18 June meeting, suggesting no change to the Fed’s “wait and see” stance on rates.

The S&P GSCI Commodity Index gained slightly in May as crude oil recovered by 4% amid an improved demand outlook and easing trade tensions. Gold was little changed at $3,289 per ounce. Bitcoin rallied by 11.1%, hitting an all-time high of $112,000 on 22-May-2025. Meanwhile, the US dollar weakened slightly against the Malaysian Ringgit, ending May-2025 at 4.2565, down from 4.3158 in April.

Outlook

US recession fears have somewhat cooled in May as concerns over tariffs eased. Data confirmed that the US economy contracted in Q1 2025 as businesses rushed to stockpile goods ahead of President Trump’s sweeping tariff policies. The labour market remained resilient with non-farm payrolls showing 177,000 jobs were added in April. Inflation as measured by the PCE Price Index eased to 2.1% in April, down from 2.3% in March, inching closer to the 2% target.

At its recent May meeting, the Fed decided to keep interest rates unchanged. Despite the heightened uncertainty, Fed Chair Jerome Powell still expressed confidence in the US economy but warned that the risks of higher inflation and unemployment had risen, further clouding the economic outlook. The Fed’s policy rate has been unchanged since December 2024, as officials struggle to estimate the impact of US president Trump’s tariff policies.

China’s economy remained resilient in April. Industrial output rose 6.1%, beating estimates, while domestic consumption was up 5.1% – slightly below expectations. The urban unemployment rate for April, meanwhile stood at 5.1%, compared with 5.2% a month earlier. Overall, April data was a bit of a mixed bag, showing some moderation in growth as the tariff escalations shook global markets.

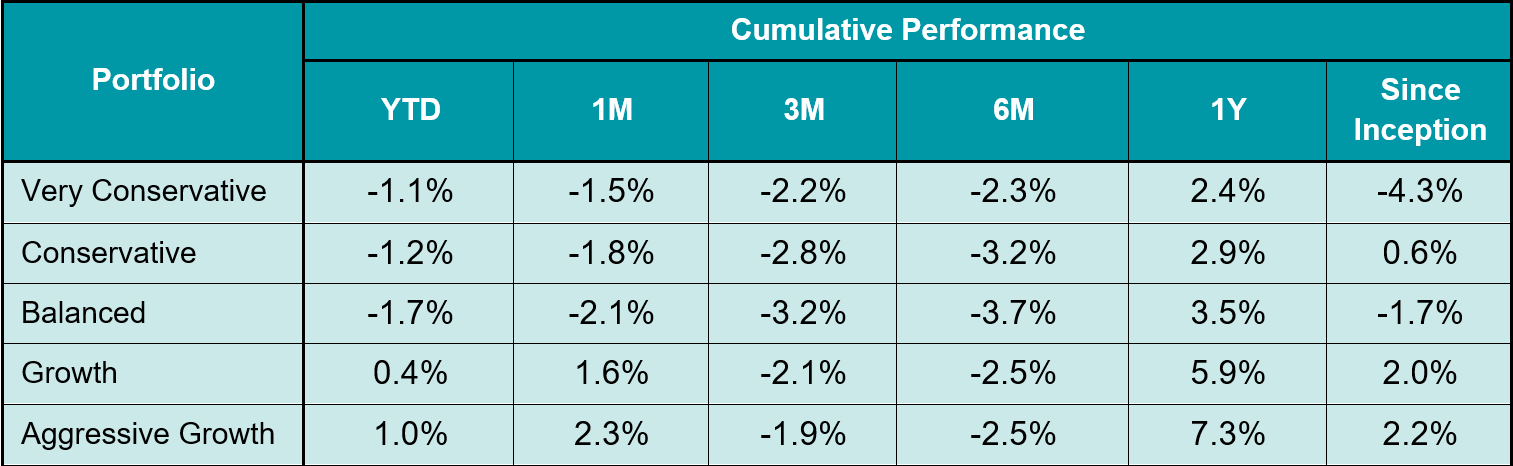

The provided table offers information on the cumulative performance of selected KDI portfolios since their launch on February 15, 2022. The portfolio returns (in USD) range from -4.3% to 2.2%. Year-to date, the portfolios recorded returns within a range of -1.7% to 1.0%.

The S&P500 index is up by 2.8% this year to end of May 2025 largely thanks to market optimism over a warmer US-China trade relationship. In May, the top performing sectors included industrials, information technology and financials while the healthcare sector lagged.

Looking ahead, US trade and economic policies are expected to be major drivers of market volatility. The recent tariff truce between the US and China represents a substantial de-escalation in trade tensions, though it remains to be seen if a lasting agreement can be reached as negotiations continue. However, with fresh conflicts arising in the Middle East, and domestic difficulties in the US, we expect market swings and shocks to continue to be a regular occurrence.

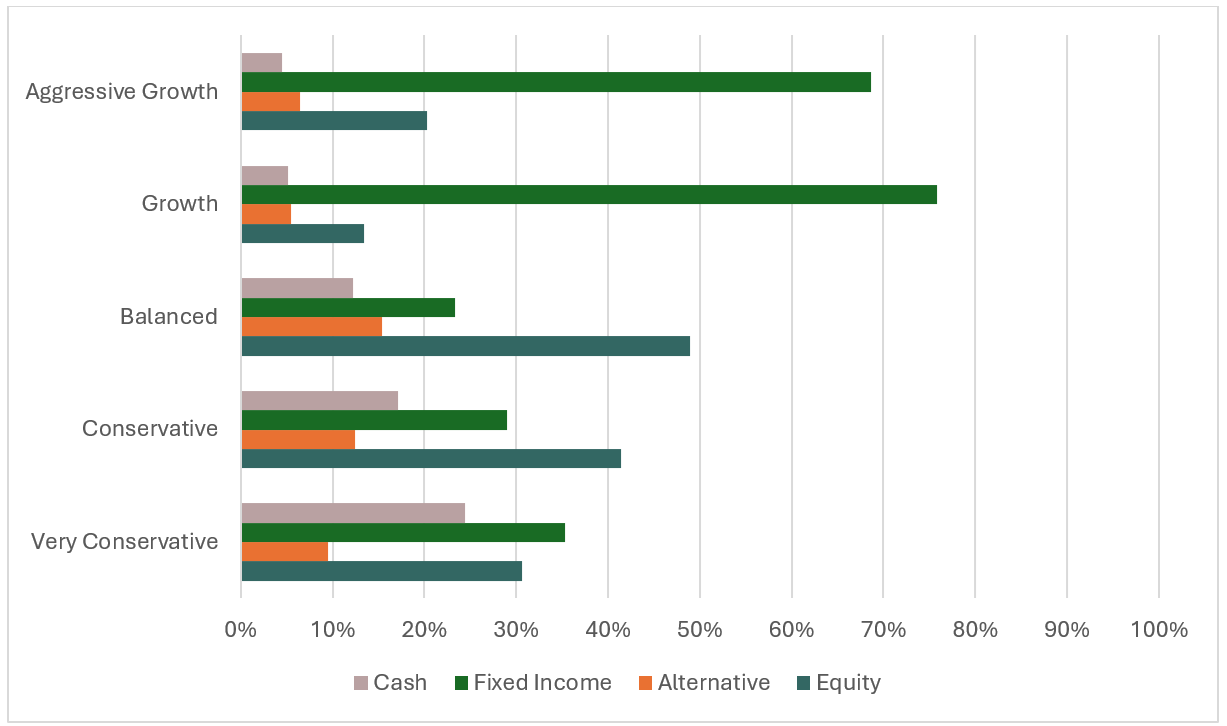

KDI’s portfolios are well diversified to withstand market fluctuations, and will remain vigilant in monitoring changes, adjusting asset allocation when necessary. As market volatility rises, the portfolios may shift to a risk reduction mode to protect downside. This strategy aims to safeguard your investments during uncertain times while remaining poised to take advantage of favourable conditions.

Kindly note that the performance and asset class exposure illustrated above are derived from five proxy portfolios. The actual performance and exposure of your investment portfolio may differ due to the customisation made by our proprietary algorithms that tailors the investment to your unique risk profile, as well as the timing of market entry.

Our Perspective: Rebuilding confidence in an era of uncertainty

May has marked a pivotal turning point for global markets, showing encouraging signs of stabilisation. Last month was also characterised by a broad rotation back into risk assets, with equities and high-yield credit rallying from the progressive easing of trade tension between the two global superpowers. The temporary rollback has provided much-needed clarity to allow meaningful recovery to take centre stage.

We are keeping a pulse on the ongoing conflicts unfolding in the Middle East and its impact on the broader markets. The fragile state of the region may require investors to brace for shocks in the coming quarters. Regardless, our stance on diversification remains unchanged: that a well-diversified portfolio should enable our clients to navigate both persistent inflation and weaker growth.

Looking ahead, we continue to be disciplined in our approach which prioritises long-term value creation over short-term ‘noise’. KDI’s advanced Artificial Intelligence (AI) driven algorithms continue to analyse thousands of economic datapoints to create meaningful allocations that capitalises on emerging opportunities, while ensuring risk management to be a top priority for our clients.

Citation:

https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

https://www.morningstar.com/economy/how-healthy-is-us-economy-heres-what-top-economic-indicators-say