August 2025 Market Insights

Welcome to our Market Recap for July 2025. In this newsletter, we will share with you a brief recap on key economic data for the past month and our portfolio performance.

Market Recap

Market

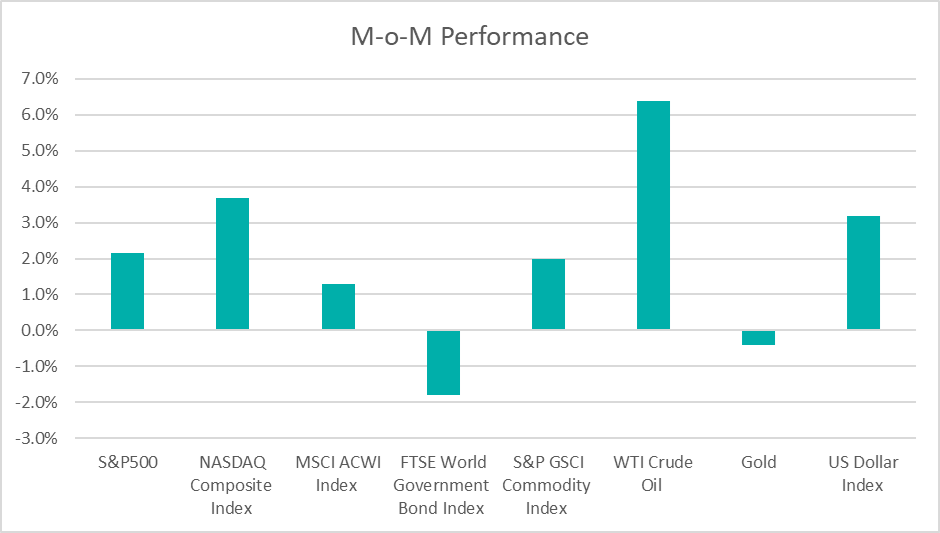

July 2025 witnessed continued, albeit moderating, positive momentum across global markets, building on the strong recovery observed in previous months. The S&P 500 continued its strong +2.2% advance in July, marking its third consecutive monthly gain. The Nasdaq Composite, heavily weighted towards technology, outperformed with a +3.7% rise in July.

The 10-year US Treasury yield concluded July at 4.37%, an increase from June’s 4.23%. This has since declined, driven by softer-than-expected inflation data, disappointing employment figures, and the implementation of a new round of tariffs by President Donald Trump starting August 1st. As of end-July 2025, CME FedWatch data indicated a 62% chance of no change at the US Federal Reserve’s upcoming 17 Sept meeting.

The S&P GSCI Commodity Index experienced a significant increase of 3.5%, primarily driven by crude oil prices, as strong demand pushed prices up by 6.4% to $69.26/barrel by end-July 2025. Bitcoin experienced a significant rally in July (+9.1% on-month) to $118,454.

The US dollar strengthened against the Malaysian Ringgit, ending July-2025 at 4.265, from 4.210 in June.

Outlook

In July 2025, the U.S. economy showed signs of uneven momentum. Gross domestic product (GDP) rebounded with 3.0% annualized growth in Q2, but job creation slowed sharply, with only 73,000 new jobs and a rising unemployment rate of 4.2%. Inflation moderated slightly, with headline CPI at 2.7%, though core inflation remained sticky at 3.1%.

The Federal Reserve held interest rates steady at its July 2025 meeting, maintaining the 4.25%-4.50% target range. Chairman Powell reiterated a data-dependent approach, emphasizing that while inflation is trending downwards, the Federal Reserve requires more consistent evidence before considering rate cuts. Markets are overwhelmingly expecting the first rate cut to occur in September, with a 25-basis-point reduction seen as highly likely.

China’s economy also presents a mixed picture. While industrial output and trade data both perked up in June, retail sales growth slowed down in June, which suggests that the impact of earlier fiscal stimulus measures may be waning. China’s GDP grew 5.2% in the April-June quarter from a year earlier, slowing from 5.4% in the first quarter, but just ahead of market expectation of 5.1%.

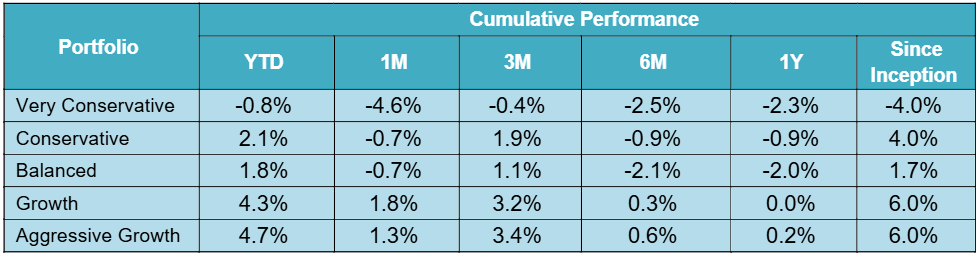

The provided table offers information on the cumulative performance of selected KDI portfolios since their launch on February 15, 2022. The portfolio returns (in USD) range from -4% to 6%. Year-to date, the portfolios recorded returns within a range of -0.8% to 4.7%.

The S&P500 index is up by 9.98% this year to end of July. The performance has been highly concentrated in the technology, communications services, utilities and industrials sectors. Meanwhile, the healthcare, consumer discretionary and energy sectors have lagged. To date, 92% of S&P 500 companies had reported Q2 earnings. Of these, 81% beat EPS estimates, surpassing both the 5-year (78%) and 10-year (75%) averages.

US trade and economic policies continue to be a significant source of uncertainty. Starting August 1st, the US implemented a new tariff framework under President Trump that imposes steep “reciprocal” duties ranging from 10% to 41% on imports from dozens of countries. A key development is the extension of the US-China tariff truce by 90 days to November 10th. The extension provides both nations with more time to negotiate a broader trade agreement and has been credited with sparking a positive market response. Separately, a significant trade deal was finalized between US and the European Union in late July, which helped avert a full-blown trade war for both sides.

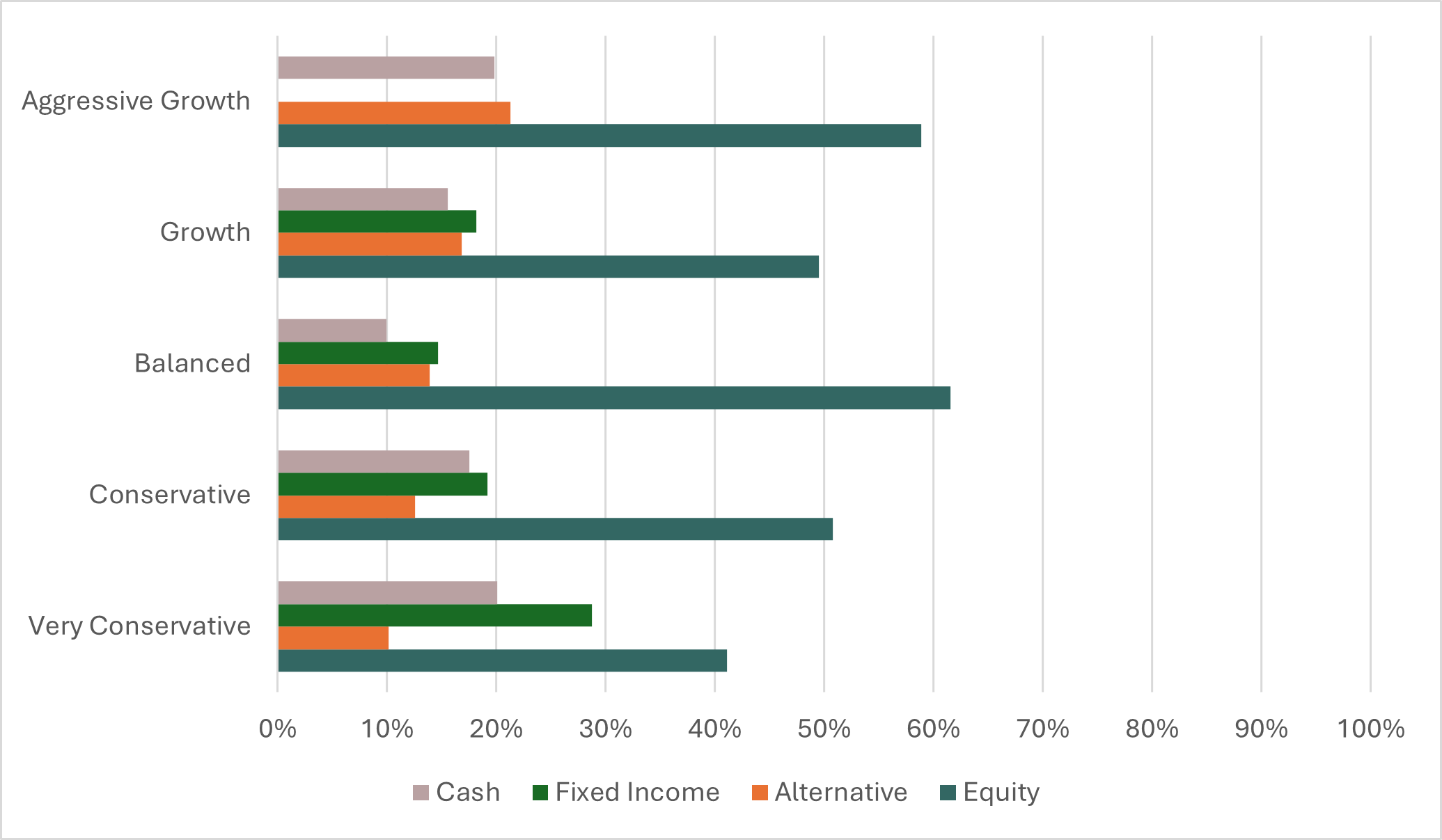

KDI’s portfolios are well diversified to withstand market fluctuations, and will remain vigilant in monitoring adjusting changes, asset allocation when necessary. As market volatility rises, the portfolios may shift to a risk reduction mode to protect downside. This strategy aims to safeguard your investments during uncertain times while remaining poised to take advantage of favourable conditions.

Kindly note that the performance and asset class exposure illustrated above are derived from five proxy portfolios. The actual performance and exposure of your investment portfolio may differ due to the customisation made by our proprietary algorithms that tailors the investment to your unique risk profile, as well as the timing of market entry.

Our Perspective: Time to focus on getting comfortably uncomfortable.

Economic data for the month of July was not exactly ‘picture perfect’, with slower growth and higher inflation. To recap, tariff-induced price hikes are starting to show up with core inflation figures coming in at 3.1% y-o-y, an increase of 30 basis points since the indicator bottomed earlier in May this year. This may imply that the impact of tariffs is not manifesting as a disruptive spike in prices, but more so a progressive pass-through that we could expect in the months ahead. We also saw job growth slowing and while unemployment claims fell, they remain meaningfully higher than in January. Considering the data, the S&P still managed to close above the 6,400-mark, hitting yet another all-time high as investors focus more on secular growth themes – including potentially a dovish Fed policy – and better-than-expected earnings. We also expect investors to start feeling ‘queasy’ given the macro backdrop, however, we encourage our clients to focus on the long-term and look beyond the short-term noise.

Looking ahead, we are placing a watchful eye on Trump’s policies and its implications on the markets. One of the most pressing short-term risks are the ongoing trade and tariff negotiations; namely the US’ largest trade partners (Canada, China, and Mexico) still need to be completed. We are also keeping a pulse on how Europe grapples with trade conflicts. Countries like Ireland and Germany that are heavily reliant on US exports are particularly affected. Despite the building anticipation of a rate cut by the Federal Reserve later in September, we remain cautious on how the ‘tug of war’ between the Federal Reserve and President Trump would transpire. The coming months promise no respite, with economic and geopolitical tensions providing both negative and positive impulses.

KDI Invest approaches the current context judiciously by taking an objective look at how we should frame the data and allocate capital. This enables our investors to better navigate through periods of uncertainty and benefit from long-term compounding growth by remaining invested.

Citation:

https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

Disclaimer

Kenanga Digital Investing (“KDI”) is licensed by the Securities Commission of Malaysia as a Digital Investment Management Company. KDI is authorised to carry out the business of fund management blending innovative technology into automated portfolio management services offered to clients under a license issued pursuant to Schedule 2 of the Capital Markets Services Act (CMSA) 2007.

Investment involves risk, including the possible loss of capital you invest. Past performance does not indicate future performance. Historical returns, expected returns, and probability projections are provided for informational and illustrative purposes, and may not reflect actual future performance. KDI does not assume any fiduciary responsibility or any liability for any consequences, financial or otherwise, arising from any transaction in reliance on such information. Investors should rely on their own evaluation or consult an independent financial, accounting, tax, legal or other professional advisers to access the merits and risks before investing.

Any forward-looking statements, predictions, projections or forecast on the economy, stock market, bond market or economic trends of the markets contained in this material are subject to the market influences and contingent upon matters outside the control of KDI and therefore may not be realised in the future. No representation is made as to the completeness and adequacy of the information to make an informed decision.

Neither the information, nor any opinion, contained in this article constitutes a promotion, recommendation, solicitation, invitation by KDI or its affiliates to buy or sell any securities, investment schemes or other financial instruments or services, nor shall any security, collective investment scheme, or other financial instruments or services be offered or sold to any person in any jurisdiction in which such offer, solicitation, purchase, or sale would be unlawful under the securities laws of such jurisdiction. This is not intended to be an invitation or offer made to the public to subscribe for any financial product or other transaction.

This information has not been reviewed by the Securities Commission of Malaysia.