November 2025 Market Insights

Welcome to our Market Recap for October 2025. In this newsletter, we will share with you a brief recap on key economic data for the past month and our portfolio performance.

Market Recap

Market

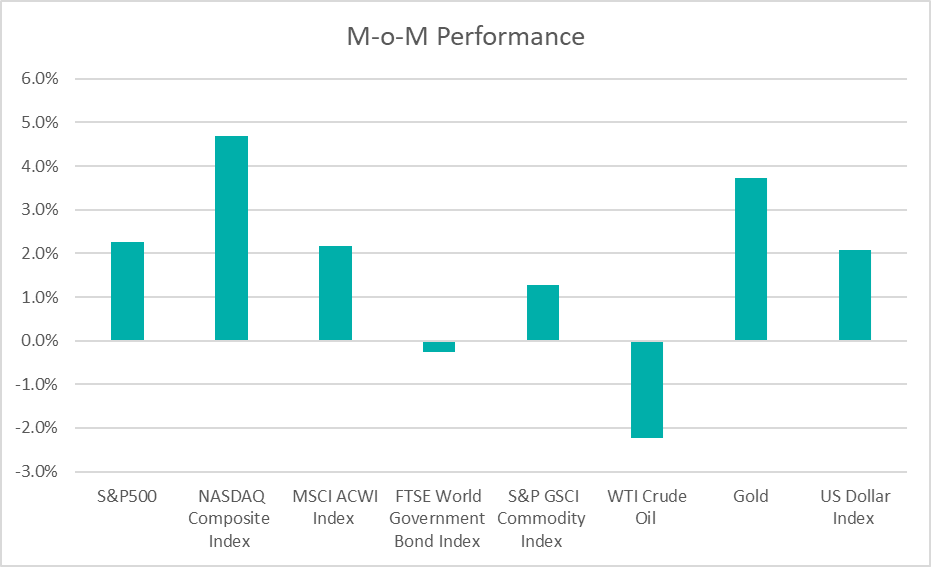

The month began with the onset of the longest US government shutdown in history, which commenced on October 1 and extended well into the following month. Despite the fiscal turmoil, equity markets posted robust returns in October 2025 – the S&P 500, Nasdaq Composite and MSCI All-Country World Index recorded strong gains of 2.3%, 4.7% and 2.2% respectively. The Federal Reserve (‘Fed’) capped off the month with the second interest rate cut of the year on October 29, lowering the Federal Funds Rate target range to 3.75%-4.00%.

Yields on both short- and long-dated U.S. Treasuries moved lower as markets priced in the Federal Reserve’s easing stance. The 10-year Treasury yield fell to a one-year low of 3.9% on October 22, reflecting investor expectation of further monetary accommodation amid moderating economic conditions. As of end-October 2025, CME FedWatch data indicated an 63% chance of 25bps rate cut at the US Fed’s upcoming 10 December meeting.

Crude oil prices exhibited bearish pressure due to fundamental oversupply concerns. WTI crude traded at $60.98 per barrel, down from $62.37 in the prior month. Conversely, spot gold prices demonstrated strong safe-haven demand, rebounding to nearly $4,000 per ounce. Bitcoin declined by -4.5% to $109,243 by end-October.

The US dollar weakened against the Malaysian Ringgit, ending October-2025 at 4.189, from 4.207 in September. To date, the Malaysian ringgit appreciated by 6.3% against the U.S. dollar.

Outlook

One of the consequences of the shutdown was the disruption to the flow of official economic data, creating a “data blackout” for policymakers and financial markets. Key reports that were indefinitely postponed or missed included the crucial Monthly Nonfarm Payrolls (NFP) reports for both September and October, the September Job Openings and Labor Turnover (JOLTs) report, and the Producer Price Index (PPI) releases for September and October. Non-government data sources such as the ADP’s National Employment Report showed only a modest job creation in October.

The Fed delivered the second interest rate reduction of the year, thereby moving the target range to 4.00%–4.25%. The justification for the cut was that while economic activity had been expanding at a moderate pace, job gains had slowed, and indicators suggested a recent increase in the downside risks to employment. This dovish pivot followed a raft of weak job releases and downward revisions preceding the shutdown, confirming the Fed’s view that the labour market was softening.

China’s economy exhibited deceleration at the start of the fourth quarter. Industrial production grew 4.9% year-on-year (YoY), a marked slowdown from the 6.5% recorded in September and falling below the 5.5% consensus forecast. Retail sales growth slowed to 2.9% YoY, extending the deceleration to a fifth consecutive month. The overall picture suggests that economic stability is reliant on the performance of its exporting factories and high-tech manufacturing, a dependence that is increasingly precarious given intensifying trade tensions with the US.

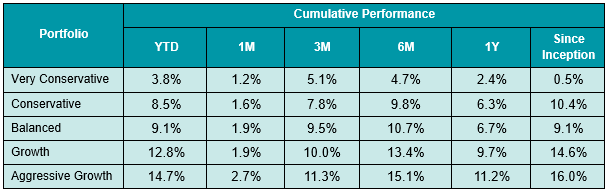

The provided table offers information on the cumulative performance of selected KDI portfolios since their launch on February 15, 2022. The portfolio returns (in USD) range from 0.5% to 16.0%. Year-to date, the portfolios recorded returns within a range of 3.8% to 14.7%.

U.S. large-cap equity indices demonstrated surprising resilience, underpinned by strong technological sector performance and record institutional capital deployment.

Key performing sectors included Information Technology, Health Care, and Consumer Discretionary. In contrast, the mid-cap and small-cap indices lagged significantly. the U.S. ETF industry gathered historic net inflows of $186billion in October, the highest monthly inflow on record. These historic inflows demonstrate a persistent institutional confidence in U.S. financial assets, likely anticipating that the Fed’s unambiguous shift toward monetary easing (the rate cut and end of QT) would ultimately stabilize asset valuations despite the ongoing fiscal uncertainty.

The Trump Administration has maintained its strategy of escalating global trade barriers, a major driver of heightened policy uncertainty across markets. Since August 2025, this approach has led to extensive tariff implementation, with new duties on pharmaceuticals, furniture, and heavy trucks taking effect on October 1. As a result, U.S. consumers now face an average effective tariff rate of 17.9%—the highest level since 1934. These elevated tariffs, combined with retaliatory measures from trading partners, are projected to impose a significant drag on the U.S. economy, contributing to persistent inflationary pressures and slower growth.

KDI’s portfolios are well diversified to withstand market fluctuations, and will remain vigilant in monitoring adjusting changes, asset allocation when necessary. As market volatility rises, the portfolios may shift to a risk reduction mode to protect downside. This strategy aims to safeguard your investments during uncertain times while remaining poised to take advantage of favourable conditions.

Chart 2: Asset Class Exposure (as at 31 October 2025).

Kindly note that the performance and asset class exposure illustrated above are derived from five proxy portfolios. The actual performance and exposure of your investment portfolio may differ due to the customisation made by our proprietary algorithms that tailors the investment to your unique risk profile, as well as the timing of market entry.

Our Perspective: Finding Clarity as we Wrap up the Year

Markets in October has been somewhat paradoxical with data pointing towards strength amid turmoil. Last month, we observed the longest U.S. government shutdown in history, placing policymakers in the dark. Equity markets delivered robust returns with the Nasdaq at 4.7% as the Fed cut rates to 3.75%-4.00%. Growth was primarily driven by the technology, healthcare and consumer sectors. Despite the this, significant headwinds are building as job markets softened. We also saw U.S. tariffs reaching their highest levels since 1934, which could fuel inflation and slower growth. Fears of trade tensions have been somewhat abated since a deal was struck with China during Trump’s high-profile meeting with President Xi Jinping. Signs of ‘goodwill’ are seen as both parties signed a temporary truce during the APEC Summit, despite the agreement not being binding. Concessions between the two are seen to be modest, but the tone shifted more meaningfully. We can expect biannual reviews of the policies to provide some degree of predictability as we move into 2026.

Abroad, we are seeing a slowdown in China’s economy, with industrial production and retail sales missing expectations for the fifth consecutive month. Across the East China Sea, Japan has elected its first female Prime Minister and President of the Liberal Democratic party, Sanae Takaichi. She is expected to apply the “Abenomics” playbook throughout her tenure, which the equity market is viewing as broadly positive. Taking a step back, we are starting to see that markets are now facing a delicate balance: monetary easing provides support but escalating tensions and slowing global growth present meaningful risks. At KDI, we turn to systematic processes to tune out the noise and build durable portfolios for our clients. We achieve this by taking a data-driven perspective of the markets, allowing our clients to benefit from better risk management. We encourage our clients to continue to remain invested by holding a long-term perspective, as markets tend to move upwards in the long-term. Investing in a diversified portfolio remains to be the most pragmatic approach to navigate through times of uncertainty – which tend to be episodic in hindsight.

Citation:

https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

https://budgetlab.yale.edu/research/state-us-tariffs-september-26-2025

Disclaimer

Kenanga Digital Investing (“KDI”) is licensed by the Securities Commission of Malaysia as a Digital Investment Management Company. KDI is authorised to carry out the business of fund management blending innovative technology into automated portfolio management services offered to clients under a license issued pursuant to Schedule 2 of the Capital Markets Services Act (CMSA) 2007.

Investment involves risk, including the possible loss of capital you invest. Past performance does not indicate future performance. Historical returns, expected returns, and probability projections are provided for informational and illustrative purposes, and may not reflect actual future performance. KDI does not assume any fiduciary responsibility or any liability for any consequences, financial or otherwise, arising from any transaction in reliance on such information. Investors should rely on their own evaluation or consult an independent financial, accounting, tax, legal or other professional advisers to access the merits and risks before investing.

Any forward-looking statements, predictions, projections or forecast on the economy, stock market, bond market or economic trends of the markets contained in this material are subject to the market influences and contingent upon matters outside the control of KDI and therefore may not be realised in the future. No representation is made as to the completeness and adequacy of the information to make an informed decision.

Neither the information, nor any opinion, contained in this article constitutes a promotion, recommendation, solicitation, invitation by KDI or its affiliates to buy or sell any securities, investment schemes or other financial instruments or services, nor shall any security, collective investment scheme, or other financial instruments or services be offered or sold to any person in any jurisdiction in which such offer, solicitation, purchase, or sale would be unlawful under the securities laws of such jurisdiction. This is not intended to be an invitation or offer made to the public to subscribe for any financial product or other transaction.

This information has not been reviewed by the Securities Commission of Malaysia.