December 2024 Market Insights

Welcome to the December edition of the Market Insights column brought to you by the Kenanga Digital Investing (KDI) team. In this edition, Our Head of Portfolio Management, Wu Kin Hoe, will discuss the latest financial news and share his insights on how to make the most of today’s market.

Market Recap

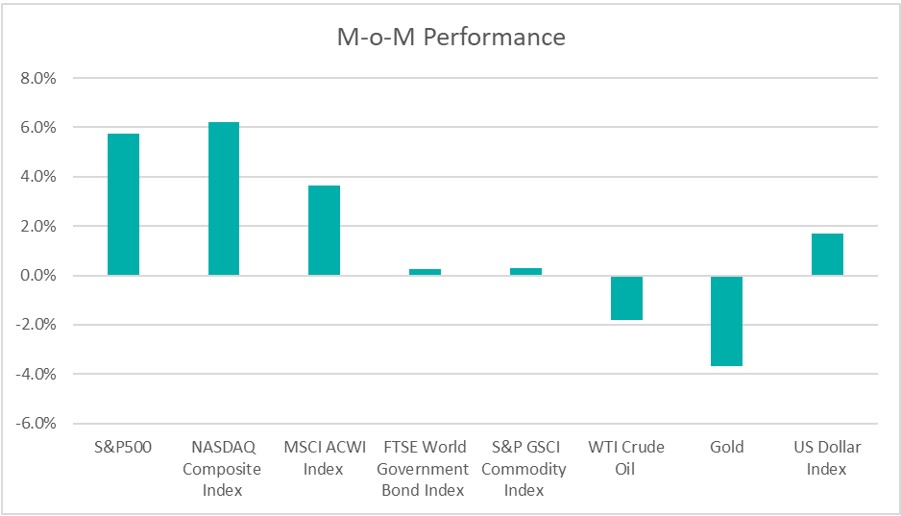

Chart 1: Index Performance in November 2024

Market

Global equity markets turned in an uneven performance in November as the S&P 500 and Nasdaq Composite returned 5.7 – 6.2%, while the MSCI ACWI Index rose by a lower 3.6% for the month.

U.S. Treasury yields retreated after President-elect Donald Trump nominated hedge fund manager Scott Bessent as Treasury Secretary. The nomination was well received by the market as the Wall Street veteran is seen as a safe and pragmatic choice for the role. Yields on the two-year and ten-year Treasuries declined by 2 and 12 bps month-on-month (MoM) to 4.15% and 4.17%, respectively. According to CME FedWatch, the market now sees a 87.1% chance of a 25-basis-point cut at the Fed’s December meeting.

In November, commodities had a similarly mixed performance. The S&P GSCI Commodity Index rose by 0.3% over the month thanks to firm agricultural and gas prices. However, crude oil prices remained soft at US$68 per barrel (-1.8% MoM). Meanwhile, gold declined by 3.7% to US$2,643 per ounce as demand for safe-haven assets ebbed after the conclusion of the US election.

The U.S. dollar index strengthened by 1.7% in November (and 5.3% since the start of October) due to investor expectations of dollar-positive policies such as domestic tax cuts and widespread imposition of tariffs with the aim of restoring US manufacturing competitiveness.

Outlook

US economic data came mostly in line with market expectations: initial jobless claims normalized to 213k after a weather-driven surge at the start of October, consumer spending increased solidly in October by 0.4%, unemployment rate held steady at 4.1% and average hourly earnings grew at a 4% annual rate. Core PCE inflation remained high at 2.8% on a year-on-year basis; above the US central bank’s target of 2%.

Overall, the broader economy has been growing strongly. The fourth quarter is on track to post a 3.3% annualized growth rate for GDP, according to the Atlanta Fed GDPNOW Estimate. Despite the strong economic backdrop, the Federal Reserve is still expected to cut interest rate by 25 basis points to 4.5% in the upcoming December meeting as the central bank looks to move rates towards a more neutral setting.

Meanwhile in China, over the past several months, the government began rolling out various stimulus measures aimed at reviving the flagging economy. The government recently released a statement that pledged to embrace a “moderately loose” monetary policy in 2025, marking its first major shift since 2011. The readout also states that they will take a “more proactive” approach on fiscal policy, stabilizing property and stock markets, while promising to “forcefully lift consumption”. Nevertheless, October economic data were a mixed bag with retail sales growing strongly, while industrial output and consumer inflation both came in softer than expected.

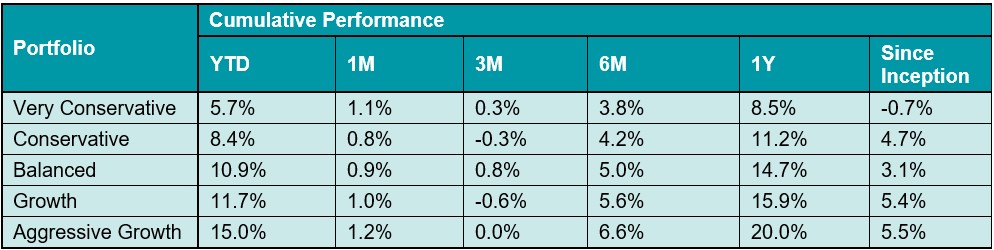

Table 1: KDI Invest Portfolio Performance as at 30 November 2024

The provided table offers information on the cumulative performance of selected KDI portfolios since their launch on February 15, 2022. The portfolio returns (in USD) range from -0.7% to 5.5%. Year-to date, all portfolios recorded positive returns within a range of 5.7% to 15.0%.

The S&P 500 Index rallied to record highs as at end-November 2024, indicating strong investor confidence in the second Trump presidency. Looking ahead, several factors, including the US economic outlook, shifts in the Fed monetary policy, stretched market valuations, and President-elect Trump’s communication style, could contribute to increased market volatility. Meanwhile, the US Federal Reserve is widely expected to cut interest rates by a quarter point on Dec 17-18.

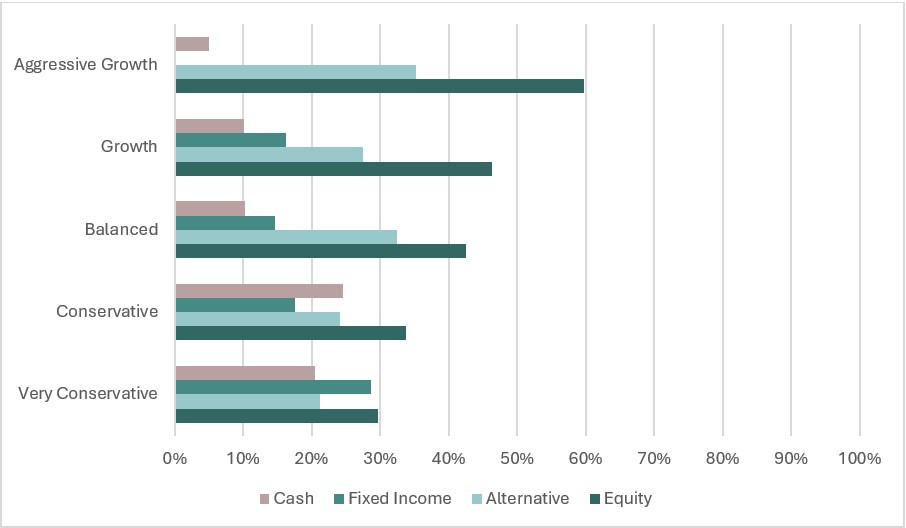

KDI’s portfolios are well diversified to withstand market fluctuations, and will remain vigilant in monitoring changes, adjusting asset allocation when necessary. This approach enables portfolios to capitalize on opportunities and potential benefits that may arise from these risks. Given the still favourable US economic tailwinds and a less assured interest rate easing cycle, KDI’s A.I. has dynamically shifted part of its fixed income allocation to developed market equity, which now make up between 21% and 54% of the portfolios.

Chart 2: Asset Class Exposure as at 30 November 2024

Please note that the performance and asset class exposure mentioned above are derived from five proxy portfolios. The actual performance and exposure of KDI Invest portfolio may differ due to the customization by our A.I. based robo-advisor that tailors the investment to individual risk profiles, as well as the timing of market entry.

Citation:

https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

https://www.reuters.com/markets/us/futures-inch-up-ahead-shortened-black-friday-session-2024-11-29/