FAQ

Getting Started

How do I sign up for a Kenanga Digital Investing (KDI) account?

You can sign up on our website’s homepage (Click Here) or download our app (Kenanga Digital Investing) from Play Store or Apple store

Please click on the “Register” button to follow the step-by-step instructions and within approximately 5 to 10 minutes, you will have completed the sign-up process.

Once you have successfully completed the sign-up process, your application will be submitted for approval processing, which will be as quick as 1 to 2 working days. We will send you an email to your registered email address regarding your account opening status.

We require your personal information for verification purposes and to comply with the requirements under the applicable laws. Your information is also needed for our machine learning A.I. to analyze and construct the most suitable portfolio based on your risk profile.

All information collected is safely stored with us in our databases, in accordance with the Personal Data Protection Act 2010 and other applicable laws.

What documents do I need to open a Kenanga Digital Investing (KDI) account?

If you are a Malaysian, you are required to upload a digital image or picture of the front and back of your National Registration Identity Card (NRIC) when you sign-up for our platform.

If you are a Non-Malaysian, but are a permanent resident holding a Malaysian bank account, you are required to provide a digital image or picture of your passport with your personal details when you sign-up for our platform.

Note that we are unable to onboard any U.S. Citizens or those U.S. Green Card holders.

What is the minimum age to open an account with Kenanga Digital Investing (KDI)?

The minimum age requirement to open an account with us is 18 years old.

I am a Non-Malaysian, can I still open an account?

If you are a Non-Malaysian, but are a permanent resident holding a Malaysian bank account, then you are eligible to open an account. However, you will not be able to open an account if you are a US citizen or a US Green Cardholder.

I am Malaysian but currently living overseas. Can I invest in Kenanga Digital Investing (KDI)?

Yes, as long as you have a bank account in Malaysia and you are not holding a US Green Card and/or are a US citizen.

Why do you need to collect my personal information?

We require your personal information for verification purposes and to comply with the requirements under the applicable laws. Your information is also needed for our machine learning A.I. to analyze and construct the most suitable portfolio based on your risk profile.

All information collected is safely stored with us in our databases, in accordance with the Personal Data Protection Act 2010 and other applicable laws.

How do I find my Tax Identification Number (TIN)?

You can find your tax identification number on your tax returns form.

What is the purpose of a Know Your Customer (KYC) process during your sign-up?

The KYC process is a requirement imposed by the regulators for us to conduct background checks on your end before we onboard you as our customer.

Besides, the KYC process helps us to understand your risk profile so that our A.I. builds a portfolio that caters to your investment objectives and preferences.

If I have already done a KYC checking with another financial institution or with other financial products and services of Kenanga Investment Bank Bhd, do I need to do it again with Kenanga Digital Investing (KDI)?

Yes, our KYC process is still needed as part of our client onboarding process in compliance with statutory regulations.

Why are FEP rules applicable to me?

The Foreign Exchange Policy (FEP) rules are a set of foreign exchange rules issued by Bank Negara Malaysia. The FEP rules will apply to you if you have Domestic Ringgit Borrowing(s), your annual investment limit abroad (in US-ETF portfolio) combine with your domestic ringgit borrowings is capped at RM1 million for the calendar year in question.

Please take note that this limit is refreshed every year on 1st January.

Domestic Ringgit Borrowing(s) is defined as having more than 1 car(s) or housing loan(s).

What should I do once my Kenanga Digital Investing (KDI) account is opened?

Once your account has been approved, an email will be sent to your registered email address. You may activate your account by clicking on the link provided. This will prompt you to login on Kenanga Digital Investing (KDI), where you will key in your login and password which was created during the sign-up process.

Then, you may start choosing an investment portfolio that you like (KDI Save and/or KDI Invest) and proceed to the Deposit section to start your journey with us!

You may refer to the FAQ on "How do I deposit funds into my KDI Save and/or KDI Invest accounts?" for detailed steps on deposits.

What are the payment options to start my investment account?

Kenanga Digital Investing (KDI) can accept both online and offline deposits.

For online deposits, online banking is available via Kenanga Digital Investing (KDI) platform.

For offline deposits, we accept cheque deposits via our designated Custodian Maybank Account. However, note that the deposit amount must be RM50,000 and above.

Is there any investment lock-in period?

No, there is no investment lock-in period or penalties for investments in both KDI Invest and KDI Save. You may withdraw the funds from your account at any time.

Please take note that there is a minimum withdrawal amount. For KDI Save, the minimum withdrawal amount is RM10. For KDI Invest, the minimum withdrawal amount is RM100.

KDI recommends that investors to adopt a time horizon longer than one year for KDI Invest products. While you are able to withdraw your funds at any time, investors should allow at least a three-year time horizon to manage and ‘smooth out’ risk over various market cycles for optimal results.

We recommend KDI Save for those looking at shorter-term investment tenures of less than a year. KDI Save is a flexible, no-strings-attached alternative to term savings products like Fixed Deposits.

Vulnerable Client

Who are vulnerable clients? If i am vulnerable, how can KDI support me?

A vulnerable client may be anyone who feels they are facing a personal circumstance, including financial difficulties, accessibility needs, mental-health challenges; or just not feeling confident about their literary, financial knowledge or digital skills.

If you identify as a vulnerable client or have specific needs or concerns, our team is available to provide extra assistance, guidance, and flexibility to help you access and manage your account.

You can contact our Customer Service team by filling the contact form here to discuss your unique needs. Our representatives are trained to provide tailored assistance, and we’ll work together to address your needs.

What are the factors that may contribute to a person's vulnerability?

There are a few factors that may contribute to vulnerability.

These include but are not limited to:

Health related factors – physical or mental disabilities or illnesses that affect the ability to carry out daily tasks, or to make an informed decision.

Adverse Life events –major life events resulting in temporary or long term financial hardship such as unemployment, or death or total permanent disability of the main breadwinner.

Financial Resilience – low ability to withstand financial shocks such as individuals who are overly-indebted or experiencing cash flow problems, or have no savings.

Financial literacy – possessing limited knowledge of financial matters or low confidence in managing finances, or low capability in other relevant areas such as literacy, language or digital skills.

Age - Senior citizens, in particular tend to have a lower technological proficiency.

Upon filling in the Contact Form relating to a vulnerable status, what do I do next?

If you have successfully submitted the Contact Form, our representatives will contact you via email and provide you with a declaration form. Should you require alternative means of assistance, please feel free to reach out via any of the contact methods provided. If you are not reachable via email, we will follow up via a phone call too. Do ensure both email address and phone numbers provided are accurate and in use.

If I have trouble with the declaration form, can I request for the Customer Service representative to call me?

Yes, if requested, we call you to provide verbal assistance. Alternatively, if we are unable to reach you by email, our team will follow up with a phone call.

Is this declaration mandatory, and can I refuse to complete the declaration?

This declaration is mandatory. Failure or refusal to complete may result in the account opening application being rejected.

How will KDI use my information and will it be shared with any other parties?

Clients who declare their vulnerability will be contacted by our Customer Service representative to further understand their unique needs. The information provided will be securely protected and not used for any unauthorised purposes. For more information, please refer to Kenanga Group’s Personal Data Protection Notice at https://www.kenanga.com.my/pdp/

What is KDI's responsibility towards vulnerable clients?

At KDI, we are governed by the Guidelines on Conduct for Capital Market Intermediaries issued by the Securities Commission Malaysia which requires us to have in place relevant processes to enable us and our representatives to respond appropriately to vulnerable clients.

General

What are the benefits of investing in Kenanga Digital Investing (KDI)?

The conventional investment avenues such as unit trusts are wrapped with upfront fees or sales charges, lock-in periods, hidden fees and penalties, not to mention the very lengthy forms you have to fill out!

We at Kenanga Digital Investing (KDI) believe that you should have the flexibility to save, invest and earn as it suits you and not be paying unnecessary fees that eat into your investment returns. We do not believe investments have to be complicated and we have simplified that for you at Kenanga Digital Investing (KDI) .

For starters, you can easily sign-up with us via the Kenanga Digital Investing (KDI) platform which is available on the Play Store or Apple Store as well as on the Web (Click here) and Web Mobile and there are no upfront fees or sales charges when you open an account with us. You have the flexibility to deposit, withdraw and switch between your investments and risk profiles as and when you want, wherever you are, without fees charged by Kenanga Digital Investing (KDI) on your day to day transactions

Note: For KDI Invest, Investors are still subject to annual management fee charged by Kenanga Digital Investing (KDI) and other transaction fees such as currency conversion rates charged by appointed banks and ETF expense ratio fees charged on the fund level. For more info on these fees go to our pricing page.

Kenanga Digital Investing (KDI) is also fully A.I. driven which means that it manages your portfolio around the clock. It meticulously checks it against market performance to help you make the most out of your investments and ensure your investments generate the best possible returns based on your risk profile. So, start your journey with us, sit back and watch your money grow!

What are the investment services offered by Kenanga Digital Investing (KDI)?

At present, Kenanga Digital Investing (KDI) offers a Ringgit-based Cash Management Fund (CMF) and it is known as KDI Save.

Our Exchange Traded Funds (ETF) portfolio, which is US Dollar based, is known as KDI Invest.

What is machine learning AI?

As the phrase suggests, ‘machine learning is a system that is "smart" enough to improve itself based on data inputs. In today's world, we have many different examples of automated machines that do not require human intervention such as self-driving vehicles, modern image recognition, speech recognition programs and automated spam filters among others. These are examples of machines that have learned use past data to make future judgments.

How does Kenanga Digital Investing (KDI)'s technology work?

Kenanga Digital Investing (KDI)'s technology involves training our algorithms to continue to improve their predictions in a progressive manner by using a combination of historical data, mathematical optimizations, and data analytics. The algorithms adopt machine learning A.I. techniques to improve their predictions by comparing their predictions against live data outcomes in real-time, adjusting its computational variables and predicting again, all in rapid succession, without being explicitly programmed to do so. That's machine learning.

How is Kenanga Digital Investing (KDI) different from investing in mutual funds or unit trusts?

A study published in the Journal of Financial Planning (2018) found that investors who use a behavior-modified approach or investing with removed emotions saw returns up to 23% higher over 10 years. Conventional investment avenues such as unit trusts are shrouded with upfront fees or sales charges, hidden fees and penalties that eat into your returns. These types of investments tend to limit your cash flow flexibility due to lock-in periods. And nobody likes to fill up a very lengthy form just to sign-up!

So that is why at Kenanga Digital Investing (KDI) , our A.I. investment strategies are data-driven with predictive abilities, meaning our approach towards investments is not emotionally driven, unlike conventional unit trust and mutual funds which are typically actively managed by a human fund manager.

We also believe that you should not pay unnecessary fees and at Kenanga Digital Investing (KDI) we have done just that. You have the flexibility to deposit, withdraw and switch between your investments and risk profiles as and when you want, wherever you are, as we don’t charge you any fees or penalties for these actions.

And signing up has never been as easy with Kenanga Digital Investing (KDI) . It just takes you approximately 5 to 10 minutes and you will be on your way to growing your wealth.

What investment outcome does Kenanga Digital Investing (KDI) aim for?

Our goal at Kenanga Digital Investing (KDI) is to ensure you achieve good risk-adjusted returns by predicting market trends across different asset classes to come up with a portfolio which maximizes returns while minimizing volatility over the medium to long-term. Essentially, we want to ensure that your returns are more consistent over a longer period.

How does Kenanga Digital Investing (KDI)'s use A.I. in its investment process?

At Kenanga Digital Investing (KDI), our Robo-advisor uses machine learning Artificial Intelligence (A.I.) that is driven by complex mathematical calculations, lots of real-time data and investor behavioral patterns to devise algorithms that will provide you with best-fit investment advice.

Our A.I.-driven investment solution has been designed to be forward-thinking and transparent, with the ability to balance your portfolio and predict risk-reward levels automatically.

Your Robo-advisor tracks your portfolio meticulously and checks it against market performance to help you make the most out of your investments. This way, you have peace of mind knowing that we are working around the clock to ensure you get the returns you deserve.

Do humans have a role in Kenanga Digital Investing (KDI)?

As our investment systems are fully automated, human intervention is minimal. At Kenanga Digital Investing (KDI) , our team performs the external checking, monitoring and fine-tuning to ensure the system is doing well to identify the best possible returns for your chosen portfolio based on your risk appetite. And of course, our friendly customer service team is ever ready to assist you in any inquiries or complaints that you have. We take our customer’s satisfaction very seriously and will be glad to hear your thoughts on our products and services.

Why is Kenanga Digital Investing (KDI)'s machine learning A.I. better than humans in managing investment risks?

Global investment markets keep moving as one part of the world goes to sleep and another part starts its workday. Human capacity in managing this is extremely limited due to factors such as high volumes and emotional judgements that may affect investing outcomes. For tracking investment risks, one must cover huge volumes of data in real-time, all the time. Today, computing power has advanced tremendously. Hence, at Kenanga Digital Investing (KDI) , we've built our system to ensure minimal human intervention where factors, such as the human element of emotions and the lack of ability to process voluminous data efficiently, are addressed.

What are Kenanga Digital Investing (KDI)'s proprietary technology?

Kenanga Digital Investing (KDI) 's system contains two key proprietary technologies i.e. Kenanga Digital Investing (KDI) Digital Asset Allocation System (DAAS) and Kenanga Digital Investing (KDI) Risk Profiler. The "smart" machine learning behind KDI DAAS constructs an optimal diversified portfolio based on predictive analytics which explores patterns in historical data and identifies market risk and opportunities. For risk profiling, our proprietary machine recommends a bespoke asset allocation based on your risk appetite.

What does the Kenanga Digital Investing (KDI) Digital Asset Allocation System do?

Kenanga Digital Investing (KDI) Digital Asset Allocation System (DAAS) is based on the principles of Markowitz’s Nobel Prize-winning Modern Portfolio Theory ("MPT"), blending our predictive algorithms with real-time data to form a diversified investment portfolio where the risk-return outcome fits your personal risk profile identified by our KDI Risk Profiler.

Why is Kenanga Digital Investing (KDI) much more than a typical robo-adviser?

There are many robo-advisors or digital investment management platforms to choose from, but often these investment strategies are still focussed on ‘pre-made’ model portfolios, requiring a lot of human intervention, implying that portfolio rebalancing is very much driven by ‘human emotions’ as opposed to data. This also means they may not be able to adapt as quickly during rapid changes in market conditions. In fact, some robo-advisors are just your typical unit trust or mutual funds outfits showing a ‘digital shopfront with a human kitchen’.

We at Kenanga Digital Investing (KDI) set ourselves apart by using a fully automated, A.I. driven robo-advisor where your investment portfolios are designed to match your risk profile using real-time market data and risk-return predictions. It also means that your portfolio’s rebalancing is done as and when needed to reduce overtrading.

Why should I invest globally instead of focusing on my own market?

The world today is globally connected and various asset classes have developed relationships with each other. Investing globally allows you to access to a wider variety of companies, industries and asset classes, which essentially means you gain access to more investment opportunities for a truly diversified portfolio. This would otherwise be out of reach for an ordinary investor given the financial and regulatory hurdles of international investing. Through Kenanga Digital Investing (KDI), you get to enjoy global investments without these hurdles and at very low costs!

Does Kenanga Digital Investing (KDI) accept joint accounts?

No, KDI registration itself is for personal use only. We do not accept joint names within a KDI account as we only allow opening of personal accounts.

However, we are pleased to inform that deposits into your KDI account can now come from a joint bank account. Please do ensure the registered name for your KDI account is the same as one of the names stated inside the joint bank account.

Upon verifying your deposit, our Customer Service team may contact you to obtain proof of remittance should there be any discrepancies in bank details. Should we reach out for such verifications, please prepare the front page of your latest bank statement. Should there be any discrepancies to the details, we will be processing a full refund of your deposit. Expect to receive your refund within 5 working days once we have received & confirmed the details of your provided bank statement.

What is Kenanga Digital Investing (KDI) Risk Profiler?

Kenanga Digital Investing (KDI) Risk Profiler is an algorithm-driven system that determines your risk tolerance by evaluating your financial status, age, time horizon, financial goals and risk appetite in a few simple questions. This allows our A.I. driven Robo-advisor to select an optimized portfolio based on your risk profile.

Are KDI Save and KDI Invest portfolios Shariah compliance?

No, the investment portfolios under KDI Save and KDI Invest are not Shariah-compliant.

If I wish to trade and/or wish invest short term (less than one year), can I open a Kenanga Digital Investing (KDI) account?

Kenanga Digital Investing (KDI) is not a trading platform nor do we offer trading-style investments. Investments in capital markets require risk management over volatile market cycles. Therefore, time horizons are very important elements in adopting a proper investing approach.

For KDI Invest (where the underlying assets are largely based in capital markets and commodities type asset classes which are invested through ETFs), Kenanga Digital Investing (KDI) recommends that investors to adopt a time horizon longer than one year. While you are able to withdraw your funds at any time, investors should allow at least a three-year time horizon to manage and ‘smooth out risk over various market cycles for optimal results.

But we understand that you have day-to-day payment obligations which require flexibility. That’s why we recommend KDI Save for those looking at shorter-term investment tenures of less than a year. KDI Save is a flexible, no-strings-attached alternative to term savings products like Fixed Deposits. KDI Save is designed to ensure you get similar or better than a basic fixed deposit rate while enjoying the flexibility of being able to deposit and withdraw at any time without penalties and at your convenience.

How does Kenanga Digital Investing (KDI) minimise the tax impact on my portfolio?

Kenanga Digital Investing (KDI) does not offer any tax advice nor any tax planning services in our investment portfolios.

If I am working at a financial institution or an organisation which has investment restrictions, can I still open a Kenanga Digital Investing (KDI) account?

Yes, you can still open a Kenanga Digital Investing (KDI) account.

Usually, policies on employee investment restrictions are in place to address insider dealing or conflicts of interest concerns. These may involve dealing restrictions in securities where one has possession of material non-public information concerning such securities, or disclosures/approvals before dealing in securities.

KDI Invest solely invests in Exchange-traded Funds (ETFs) using Artificial Intelligence (A.I.) driven technology to execute investment decisions. ETFs are commonly excluded from such restrictions as the employee does not have control over the basket of securities underlying the ETF.

KDI Save is also excluded from the restrictions as it invests in money market / fixed income type instruments that are not related to insider dealing or conflicts of interests.

While an organization's policies may not be specific to both KDI Invest and KDI Save from dealing restrictions, it is always advisable to consult your relevant compliance/supervisor before opening your Kenanga Digital Investing (KDI) account with us.

If needed, Kenanga Digital Investing (KDI) will provide a written confirmation that the Kenanga Digital Investing (KDI) account is a discretionary investment management service if your employer/organization requires one to meet its compliance requirements.

Please contact us via our Contact Form and our Customer Service team will proceed to contact you for further validation.

General KDI Save

What is KDI Save

KDI Save offers a hassle-free cash management solution with daily returns and no fees. All funds are placed in a portfolio of high-quality Ringgit-based money market and/or fixed income financial instruments. KDI Save derives returns from investments of varying maturity periods.

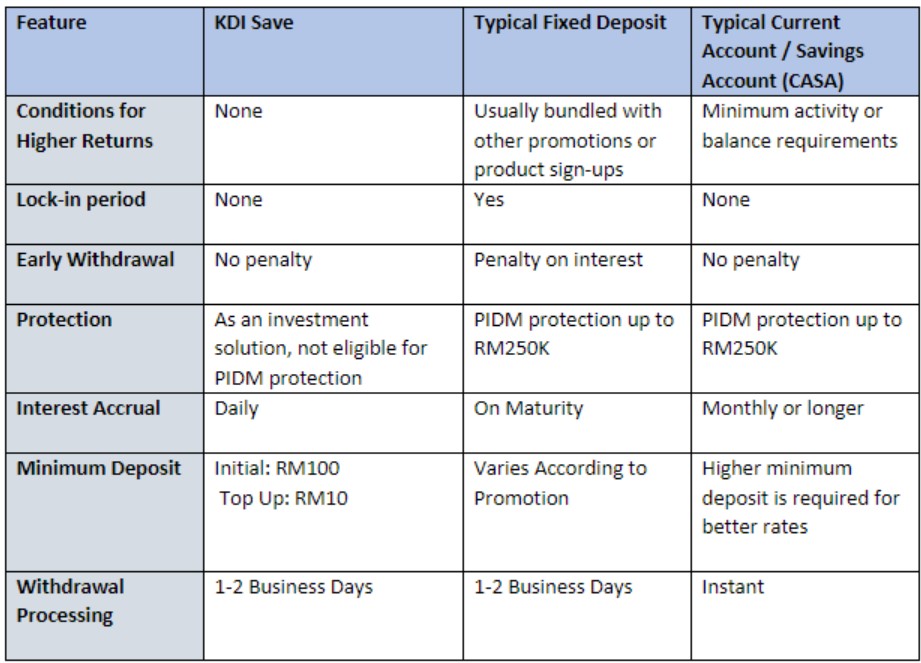

What is the difference between KDI Save and traditional bank savings products?

KDI Save is an investment solution that invests in high quality Ringgit-based money market and/or fixed income financial instruments. Traditional bank savings products such as fixed deposits (FD) and Current Account and Savings Account (CASA) products are deposits placed with banks in return for interest. KDI Save derives returns from its underlying investments, while bank savings commit to returns at a given interest rate backed by returns on loans issued, fees collected, investments, and other income generating activities.

Like traditional savings products, KDI Save offers a stated rate of return on your funds. In contrast with fixed deposits, KDI Save does not enforce any lock-ins on deposits, as funds may be withdrawn at any time. Plus, interest is accrued and credited on a daily basis, unlike FD's and CASA accounts that credit interest monthly or more. As an investment solution, KDI Save is not eligible for deposit insurance protection under Perbadanan Insurans Deposit Malaysia (PIDM).

What is Effective Annual Rate (EAR)?

The Effective Annual Rate is the interest actually earned on your investment as a result of compounding the interest and principal over time. A higher number of compounding periods results in higher EAR.

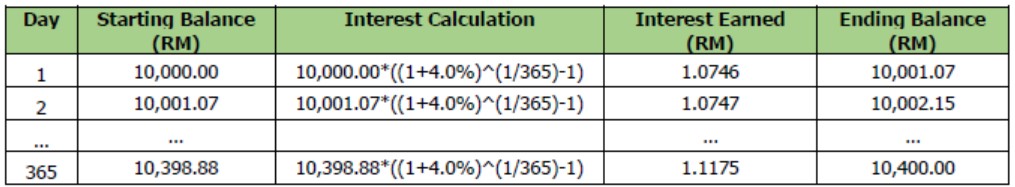

To compute the daily return rate on your KDI Save investment, you may use the following formula:

Daily Interest Amount=Value of investment × ((1+EAR)^(1⁄365)-1 )

Example 1: For RM10,000 deposited with KDI Save on day one

In Example 1, your savings of RM10,000.00 will compound to RM10,400.00 after one year of daily compounding, providing a return of 4%.

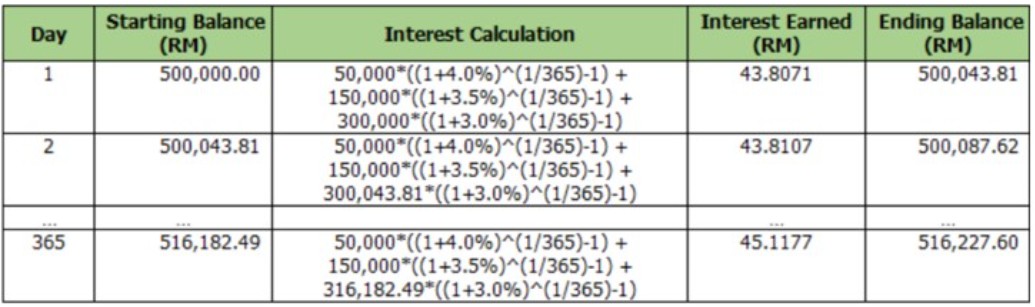

Example 2: For RM500,000 deposited with KDI Save on day one

In Example 2, your savings of RM500,000.00 will compound to RM516,227.60 after one year of daily compounding, providing a return of 3.25%.

What are the forms of returns from KDI Save ?

You earn daily interest rate, which is based on effective annual rate (EAR) calculation and is reflected in the daily value gain of your KDI Save account.

Can I change my risk profile for KDI Save?

KDI Save is only a cash management account that enables you to earn returns above savings rate and thus, there is no option for changing of risk profile for your KDI Save account.

Is my interest earned from KDI Save taxed?

The interest received from KDI Save is fully exempted from personal income tax.

In general, an individual resident enjoys tax exemption on interests received from:

(1) Negotiable certificate of deposit [Income Tax (Exemption) (No. 7) Order 2008]

(2) Rediscounting of banker's acceptance on repurchase agreement or any similar instrument of trade financing which is traded in money market fund [Income Tax (Exemption)(No. 7) Order 2008]

(3) Money deposited in any savings deposit, current deposit, fixed deposit or investment deposit with licensed banks [Income Tax (Exemption) (No. 7)Order 2008]

(4) Debentures or sukuk, other than convertible loan stock, approved or authorized by, or lodged with, the Securities Commission [Para 35, Sch 6 of Income Tax Act 1967]

Is KDI Save PIDM insured?

No, KDI Save is not PIDM insured. Nonetheless, we carefully protect your KDI Save deposits by investing in very low risk assets.

General KDI Invest

What are Exchange Traded Funds (ETFs)?

An ETF or exchange-traded fund is a type of security that collects a basket of multiple securities that matches its investment theme. ETFs trades on an exchange (just like an ordinary stock) and often track an underlying index, although an ETF can invest in any number of industry sectors or use various strategies. There are many types of ETFs, including bonds, industries, commodities and currencies ETFs.

ETFs are in many ways similar to mutual funds, but they are listed on exchanges and ETF shares trade throughout the day just like an ordinary stock does. By purchasing an ETF, you benefit from the combination of many stocks across various industries and better risk management through diversification at a lower cost than buying each stock individually.

Where are the ETFs under KDI Invest listed?

Your KDI Invest portfolio invests in ETFs listed on the stock exchanges in the United States of America (USA).

Does Kenanga Digital Investing (KDI) have a fixed or pre-determined list of ETFs that it invests in?

Yes, Kenanga Digital Investing (KDI) DAAS has screened a selected pool of ETFs which cover developed and emerging equities, fixed income, commodities and currencies.

Why isn’t Kenanga Digital Investing (KDI) investing in ETFs listed in non-US markets?

The USA stock exchanges offer the most liquid, deepest and widest range of ETFs covering asset classes across the world, compared to ETFs listed in other countries. This way, your investments get access to global investment trends.

Why are these Exchange Traded Funds (ETFs) useful for asset allocation?

Creating an investment portfolio using ETFs has certain benefits when it comes to the allocation of assets.

Firstly, as an ETF is a combination of securities, you already gain the diversification advantage of having to invest in all its subcomponent stocks and have exposure to the multiple types of industries. And this would lead to the second benefit of cost.

You have the advantage of buying at only a fraction of the transaction costs as well as ‘economies of scale’ advantages compared to if you were to invest into individual ETFs on your own.

Another benefit is also its liquidity as ETFs can be easily bought and sold throughout a trading day.

There is a high level of transparency as an ETF price is readily available on the stock exchange as compared to products such as unit trusts which prices are always indicative only.

Can I change my portfolio asset allocation for KDI Invest?

No. KDI Invest is a discretionary investment service. The portfolio asset allocation is generated by our real-time Kenanga Digital Investing (KDI) DAAS in accordance with your risk appetite to bring you the best possible returns on your investment. As such, you cannot change the portfolio allocation or select the ETFs of your choosing.

However, if you think that your current portfolio’s risk and returns does not suit your appetite, you can change your risk profile.

Login to Kenanga Digital Investing (KDI) > Click on "My Account" >Click on “My Profile”> and then Click on “Edit Risk Profile”> Choose your revised risk profile > Click on “Confirm”

Please read through to understand the risk profile that you intend to change to as different Risk Profile would correspond to different return and risk level associated to that profile.

Does Kenanga Digital Investing (KDI) have reference benchmarks to track and measure the performance of its recommended portfolios?

Yes. We Kenanga Digital Investing (KDI) tracks the portfolio performance closely in terms of whether the portfolio moves in tandem with the reference benchmark accordingly. The reference benchmark is based on an asset allocation that is within the probable asset class allocation ranges of your recommended portfolio. Kenanga Digital Investing (KDI) A.I. assesses the performance of your recommended portfolio by comparing the Sharpe Ratio and Maximum Drawdown with that of the reference benchmark.

For an understanding of the Sharpe Ratio and Maximum Drawdown, please refer to our "Glossary".

How does Kenanga Digital Investing (KDI) decide which ETFs to buy for my investment portfolio?

Kenanga Digital Investing (KDI) A.I. will decide this by assessing several criteria. They include your selected risk profile and timing of entry. You will receive a portfolio that is unique to you at the time of entry and consists of a selection of the selected pool of ETFs based on Kenanga Digital Investing (KDI) A.I. recommendations.

Will my KDI Invest investment portfolio be unique from other investors?

Yes, your KDI Invest is unique as Kenanga Digital Investing (KDI) DAAS system will customize a personal investment portfolio for you based on your risk appetite, period of investment as well as your age and it will predict an optimized risk-return portfolio based on the information you provide us.

How does Kenanga Digital Investing (KDI) Digital Asset Allocation System (DAAS) manage the risk-return framework for portfolio design and rebalancing?

For the portfolio design, Kenanga Digital Investing (KDI) DAAS works on a risk-return framework based on different data-driven criteria. The Kenanga Digital Investing (KDI) DAAS optimizes or predicts a portfolio asset allocation every day using the latest market information for each risk category that an investor is interested in. These categories may not necessarily be the same every day because our system uses real-time data to keep our risk-return models up-to-date 24/7. The predicted future portfolio(s) and the current portfolio are rebalanced to reflect real-time market-prices. Kenanga Digital Investing (KDI) only rebalances an individual's client portfolio when there is a statistical significance in the deviation between a given investor’s market priced portfolio and the predicted optimal portfolio in the relevant category the client belongs to.

How will Kenanga Digital Investing (KDI) A.I. perform during the extreme market conditions such as the Global Financial Crisis?

Kenanga Digital Investing (KDI) A.I. driven portfolios behaved very well in terms of riding the volatile market, during our simulated environment testing. The algorithm machine will rebalance the portfolio when there are signs that the market will be extremely volatile. The Sharpe Ratio outperformed many benchmark funds and the Maximum Drawdown was well controlled by comparison.

For an understanding of the Sharpe Ratio and Maximum Drawdown, please refer to our "Glossary".

How are my KDI Invest portfolio returns calculated?

Your portfolio returns will be seen under ‘Total Returns’ where Kenanga Digital Investing (KDI) DAAS will generate an indicative Net Asset Value (NAV). The indicative NAV is a unit value method to distinguish the different entry costs whenever investment money is topped up/withdrawn during the calendar year.

Your portfolio returns are calculated based on a time-weighted adjusted return and taking into consideration any inflow and outflow of investment money, including foreign currency conversions during the period under review.

What influences my KDI Invest returns and what kind of returns can I expect?

The returns of your KDI Invest portfolio will largely depend on your selected risk profile, which will determine your portfolio’s asset allocation strategy. For example, if you had chosen the ‘Aggressive’ risk profile, then you may be able to get a relatively higher return as compared to another investor who had chosen the ‘Conservative’ risk profile - but do bear in mind that the ‘Aggressive’ risk profile carries a greater exposure to risk in terms of market volatility. Other factors that do impact your returns are investment duration, investment costs (e.g. fees) and economic cycles or events.

Is there a cost to any currency conversion to USD for investing in KDI Invest ?

Yes, the foreign currency conversions are the daily currency rate as provided by the custodian.

All foreign currency conversions attract a cost. These currency conversion costs are imposed by third parties. Kenanga Digital Investing (KDI) will work with such third-parties to mitigate these costs. In the case of Kenanga Digital Investing (KDI)’s appointed broker, GTN Group Holding has committed to fixing the cost of currency conversion at 20 basis points (i.e. Rate of 0.2%) to be embedded in the applicable foreign exchange rate.

Why is there conversion of MYR into USD for the KDI Invest?

Your KDI Invest portfolio investments are conducted in USD because these portfolios invest in ETFs listed on the stock exchanges of the United States of America (USA). Hence, USD funds are required for the settlement of such transactions. Accordingly, all non-USD currencies including MYR funds are converted into USD in order to invest.

Can I switch my risk profile for KDI Invest and how to make the switch?

Yes, you are able to change your risk profile for your KDI Invest account.

If you do not have any existing investment or have no balance inside your KDI Invest account, then you will be able to immediately make the change. Please follow the steps below to make the change:

Login to Kenanga Digital Investing (KDI) > Click on “My Account” > Click on “My Profile” > Click on “Edit Risk Profile” > Select your new risk profile > Click on “Confirm” button. Once you have clicked on the confirm button, your updated risk profile will be displayed on the “My Profile” page and a notification email would be sent to your registered email address. You will also be able to immediately see a pop-up message confirming the risk profile change.

However, if you have an existing investment amount in your KDI Invest account, you may follow the steps below:

Login to Kenanga Digital Investing (KDI) > Click on “My Account” > Click on “My Profile” > Click on “Edit Risk Profile” > Select your new risk profile > Click on “Confirm” button.

Once you have clicked on the “Confirm” button, there will be a pop message to “Confirm” or “Cancel” the newly selected risk profile as well as a note to inform you that the existing amount will be fully withdrawn so that it can be invested into your new portfolio with the newly chosen risk profile. This process will take up to 7 working days to be completed.

Upon completion, the new risk profile will be reflected on the “My Profile” page and a notification email confirming the change will be sent to your registered email address. You will also be able to see a pop-up message confirming the risk profile change upon your next login after the completion is done.

How long does it take for my KDI Invest account to change my risk profile?

If you do not have an existing balance in your KDI Invest account, the change would be immediately upon completion of the steps as mentioned in this question:

“Can I switch my risk profile for KDI Invest and how to make the switch?”

However, if there is an existing amount in your KDI Invest account, then it will require up to 7 working days for the change to be in effect after completion of the steps as mentioned in this question:

“Can I switch my risk profile for KDI Invest and how to make the switch?”

Do ETFs have dividends and do I get taxed on any of my dividends from KDI Invest?

For KDI Invest, dividends on the U.S. listed ETFs are subjected to a 30% U.S. withholding tax. You will receive after-tax dividends after withholding tax deductions** have been applied. For your convenience, all dividends you are eligible to receive will be automatically reinvested into your portfolio. As your dividend income is derived from outside Malaysia, these dividends are exempt from Malaysian taxes, as long as you are a Malaysian resident. So, there is no need to worry about taxes because we'll take care of it for you.

**Dividends qualified as ‘Qualified Interest Income’ will be refunded to you on a yearly basis.

Fees and Charges

Are there any fees and charges to open a KDI account?

No, Kenanga Digital Investing (KDI) does not charge any fees for account opening.

Are there any charges for investing into KDI Save?

There are zero fees charged for KDI Save because we believe you should not have to pay to save. And since it is a Ringgit-based product, no currency conversion costs apply.

Are there any charges for investing into KDI Invest?

There are 3 charges associated with investing into KDI Invest.

Firstly, KDI Invest charges a 0.70% fixed rate of management fee per annum (subject to 8% SST) for any invested amount.

Secondly, there are expense ratio fees charged by ETF fund level averaging at 0.2-1% per annum and it is already embedded in the fund price or, in other words, will be automatically deducted or offset from your investment’s NAV. The ETF charges an expense ratio fee to its shareholders (in this case, you would be a ‘fraction’ shareholder of the ETF when investing through KDI Invest) for the operations and management of the respective ETF.

The third and final charge would be a currency conversion cost up to 1.6% of amounts transferred to and from KDI Invest – it includes transfer from KDI Save to KDI Invest and vice versa, as well as making deposits to or withdrawals from KDI Invest. The currency conversion cost arises because KDI Invest’s underlying assets are U.S. Dollar based – these costs are charged by the Custodian Bank charged with holding your funds as required by law. Do note that any investment returns shown on your KDI dashboard is the net value after initial returns are offset by fees and charges. For detailed breakdown of your fees and charges, you may refer to your respective monthly statements. To retrieve your monthly statement, please refer to the steps below.

Please take note that effective 1st October 2025, any management fees imposed on your portfolio will be subjected to 8% SST (Sales and Service Tax).

Login to Kenanga Digital Investing (KDI) > Select "My Account" > Select "My Statement" tab > Select “year” > Click on “View Statement” to download.

Are there any fees being imposed such as sales, subscription, redemption, custodian, withdrawal penalty or closing fees?

No, Kenanga Digital Investing (KDI) does not charge any fees relating to sales, subscription, redemption, custodian, withdrawal penalties or closing of account.

Do I need to make any payments for management fees?

For KDI Save:

There are no management fees charged on your KDI Save portfolio regardless of the amount you invested. It’s absolutely FREE to invest in our KDI Save.

For KDI Invest:

A fixed management fee of 0.7% per annum (subject to 8% SST) will be applied to your invested amount. This fee will be automatically deducted from your KDI Invest portfolio.

Do note that any investment returns shown on your Kenanga Digital Investing (KDI) dashboard are the net value after initial returns are offset by fees and charges.

For detailed breakdown of your fees and charges, you may refer to your respective monthly statements. To retrieve your monthly statement, please refer to the steps below.

Login to Kenanga Digital Investing (KDI) > Select "My Account" > Select "My Statement" tab > Select “year” > Click on “View Statement” to download.

Alternatively, please refer to this question (Are there any charges for investing into KDI Invest?) for more details on charges.

Are there any charges for switching of risk profiles in KDI Invest?

No. There are no fees charged for switching risk profiles in KDI Invest.

Deposit, Withdrawal, and Transfer

How do I deposit funds into my KDI Save and/or KDI Invest accounts?

There are two ways to deposit, either via Online or Offline deposit.

Online Deposit:

You can make online deposits by logging into your KDI account where you will be able to transfer funds from your bank account via FPX. A minimum deposit of RM250 is required for KDI Invest while and a minimum of RM100 is required for KDI Save.

Steps for Online Deposit:

Login to Kenanga Digital Investing (KDI) > Select "Deposit" > Select "Online Deposit" > Input the amount respectively under KDI Save and/or KDI Invest > Click “Proceed”

Offline Deposit:

Offline Deposit:

For offline deposits, we accept cheque deposits via our designated Custodian Maybank Account. However, note that the deposit amount must be RM50,000 and above.

The cheques can be made payable to "PACIFIC TRUSTEES BERHAD FOR KIBB-DIM" and the Maybank Account Number 514012426181. You may deposit at any Maybank branch.

Upon completing the physical step above, you will be required to upload a digital image or picture of the cheque receipt during the deposit process.

Please follow the steps below for Offline Deposit:

Steps for Offline Deposit:

Login to KDI > Select "Deposit" > Select "Offline Deposit" > Input the amounts you want to deposit to both or either KDI Save and/or KDI Invest > Input the “Bank Name” and “Cheque Number” > Upload your cheque image > Click on “Proceed”

Are there any conditions for Deposit?

The conditions for Deposit are as follows:

KDI Save:

Minimum Initial Deposit = RM100

Minimum Subsequent Deposits = RM10

KDI Invest:

Minimum Initial Deposit = RM250

Minimum Subsequent Deposits = RM100

Is there a Deposit Limit per Transaction?

Offline Deposits:

There are no set transaction limits for offline deposits.

Online Deposits:

Online deposits made through FPX can go up to RM300,000 depending on your registered bank with KDI. However, please note that this limit is subject to several conditions. It is advisable to contact your respective bank to determine the specific limit for online transactions and your allowable daily limit. You may need to ensure that your bank account’s withdrawal limits are authorised with your bank.

Is there a minimum amount that I can deposit into my Kenanga Digital Investing (KDI) account?

Yes, the minimum investment amount for KDI Save is RM100 and for KDI Invest is RM250.

Which Financial Institutions do you accept deposits from?

Kenanga Digital Investing (KDI) utilizes the e-GHL payment gateway for a secure internet payment solution. So, you'll be able to select from a wide range of banks and they include:

Affin Bank

Alliance Bank Malaysia Berhad

Ambank Malaysia Berhad

Agrobank

Bank of China

Bank Islam Malaysia Berhad

Bank Kerjasama Rakyat Malaysia Berhad

Bank Muamalat Malaysia Berhad

Bank Simpanan Nasional Berhad

CIMB Bank Berhad

Kuwait Finance House

Maybank Berhad

OCBC Bank Berhad

Public Bank Berhad

RHB Bank Berhad

Standard Chartered Bank Malaysia Berhad

UOB Berhad

Hong Leong Bank Berhad

HSBC Bank Malaysia Berhad

Can I make multiple deposits?

Yes, you can make multiple deposits from your Kenanga Digital Investing (KDI) account on any working day.

Please do take note that any deposits done during the weekends or public holidays will require additional time because the procedures will only take place during working days.

Can I deposit from or withdraw to a joint bank account?

Yes, you may deposit from or withdraw to a joint bank account.

For deposits, you will need to ensure that one of the names in your joint bank account is the same as your registered name in your KDI account.

For withdrawals, the monies will be remitted into the bank account that is registered with your KDI account.

Can I top up my investment account with a different currency?

No. We only accept Malaysin Ringgit (MYR) as our sole currency for both our KDI Save and KDI Invest.

Are there any conditions for Withdrawal?

The conditions for Withdrawal are as follows:

KDI Save:

Minimum withdrawal to your bank account = RM10

Minimum balance so that KDI Save remains invested = RM100

KDI Invest:

Minimum withdrawal to your bank account = RM100

Minimum balance so that KDI Invest remains invested = RM250

Can I withdraw from my Kenanga Digital Investing (KDI) account at any time?

Yes, you are able to withdraw your funds at any time, whether it is in KDI Save or KDI Invest account(s). You may login to Kenanga Digital Investing (KDI) at any time and proceed to make your withdrawal requests.

Steps for Withdrawal:

Login to Kenanga Digital Investing (KDI) > Select "Withdrawal" > Select withdrawal either from "KDI Save” or “KDI Invest" > Input the withdrawal amount respectively under KDI Save and/or KDI Invest > Click “Proceed”

Can I withdraw to a different bank account from the one I initially deposited?

Yes, you may withdraw from a different bank account as long as the bank account holder’s name is solely under your name.

However, you will first need to change your bank account details with these steps:

Steps to change Bank Account Details:

Login to Kenanga Digital Investing (KDI) > Select "My Account" > Select "My Profile" > To edit your bank account details, click on “EDIT” > Scroll to “Bank Account Details" > “Select your bank” > Fill in your revised Bank Account Number and Bank Account Holder Name> Click on “Save Changes”

How long does it take to get my KDI Invest and/or my KDI Save funded?

For online deposits, it will take up to 1 to 2 working days for KDI Save to reflect the funds deposited from the daily cut-off time of 11 am every working day.

For KDI Invest it will take between 4 to 5 working days and kindly note that the daily cut-off time is 8 am every working day.

For offline deposits, it will take up to 3 to 4 working days for KDI Save to reflect the funds deposited from the daily cut-off time of 11 am every working day.

For KDI Invest it will be between 6 to 7 working days from the daily cut-off time which would be 8 am every working day.

The longer duration compared to online deposits is due to the added cheque clearance procedures.

Note that the moment you have made any deposits you will immediately receive an email confirming the submission of the deposit. Upon confirmation of the deposit, you will receive another email.

Can my withdrawal be paid into a bank account other than my registered account?

For security purposes, withdrawals can only be made to your registered and verified bank account with us.

Is there a minimum balance to maintain in my KDI account?

Yes, there is a minimum balance requirement for both. For KDI Invest, there's a minimum balance requirement of RM250. The minimum balance requirement for KDI Save is RM100.

In the event that your account balance is lower than the required minimum balance, you will be prompted to make a full withdrawal or transfer on the affected account upon making a withdrawal or transfer request.

If I withdraw funds, how long does it take to get the funds back into my bank account?

For withdrawals from KDI Save, it will take up to 1 to 2 working days from the time of request for the funds to be transferred to your bank account.

For withdrawals from KDI Invest, it will take between 6 to 7 working days from the time of request for the funds to be transferred to your bank account.

Note that the moment you have made any withdrawal, you will immediately receive an email confirming on the submission of withdrawal request. Upon confirmation of the withdrawal, you will receive another email.

Please note that the actual amount you receive may vary due to fluctuations in your portfolio's value and currency exchange rates.

Are there any conditions for Transfers?

The conditions for Transfers are as follows:

KDI Save:

The minimum amount that can be transferred from KDI Invest to KDI Save is RM100.

KDI Invest:

If there is an existing investment already inside the KDI Invest account, the minimum amount that can be transferred from KDI Save to KDI Invest is RM100.

However, if there is no existing investment inside KDI Invest account, the minimum amount that can be transferred from KDI Save to KDI Invest is RM250.

Can I transfer funds from a joint bank account?

Yes, you may transfer your funds from a joint bank account during the deposit step. However, please ensure that one of the names in the joint bank account is the same as your registered name with your KDI account.

How long does it take to transfer from KDI Save to KDI Invest and vice versa?

For transfer of funds from KDI Save to KDI Invest, it will take between 4 to 5 working days before it is reflected in your KDI Invest account.

For transfer of funds from KDI Invest to KDI Save, it will take between 8 to 9 working days before it is reflected in your KDI Save account.

Note that the moment you have made any transfers between KDI Save to/from KDI Invest, you will immediately receive an email confirming on the transfer request. Upon confirmation of the transfer, you will receive another email.

Can I make multiple withdrawals?

Yes, you can make multiple withdrawal requests from your Kenanga Digital Investing (KDI) account on any working day.

Please do take note that any withdrawal requests during the weekends or public holidays will require additional time because the procedures will only take place during working days.

Will I be notified of transactions and funds movement?

Yes, you will get an email notification whenever you deposit to, withdraw from, and transfer any funds within your Kenanga Digital Investing (KDI) account.

You will also be able to view any transaction status under your Transaction Tab.

Login to Kenanga Digital Investing (KDI) > Select "Transaction" > You will be able to view all transaction details including the order number, order date, order time, product type, amount (MYR), transaction type and order status.

Are there transaction charges for deposits or withdrawals for KDI Save and KDI Invest?

Kenanga Digital Investing (KDI) does not charge any fees for transferring money in or out of your KDI Save account. Bank charges for sending and receiving Telegraphic Transfers (“TT”) will be borne by Kenanga Digital Investing (KDI).

For KDI Invest, when you perform a deposit or withdrawal, there will be a currency conversion of 0.2% charged by Kenanga Digital Investing (KDI)’s appointed bank.

Will I be able to deposit to/withdraw from both KDI Save and KDI Invest accounts at the same time?

For Deposit, you will be able to determine how much you would like to deposit into both or either KDI Save and/or KDI Invest each time you make a deposit.

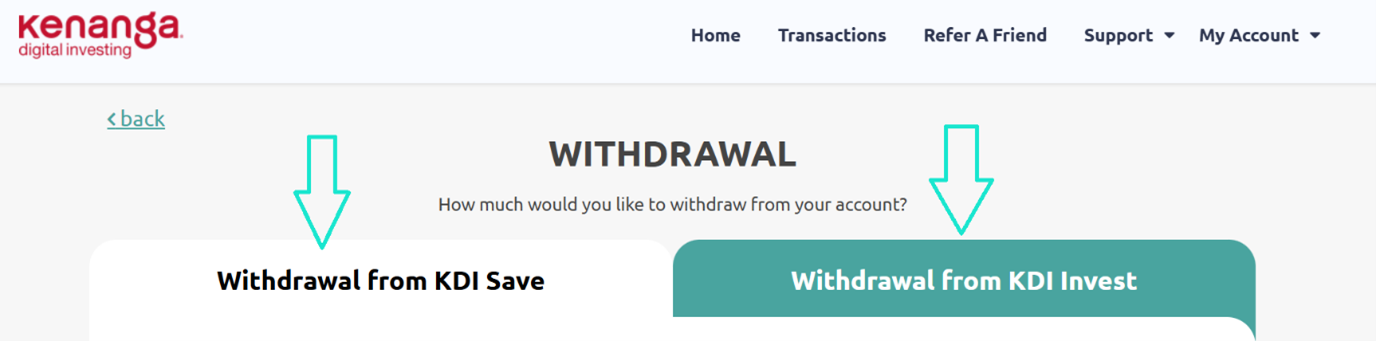

However, Withdrawals from KDI Save and KDI Invest can only be done separately.

Steps for Withdrawal:

Login to Kenanga Digital Investing (KDI) > Select "Withdrawal" > Select withdrawal either from "KDI Save” or “KDI Invest" > Input the withdrawal amount respectively under KDI Save and/or KDI Invest > Click “Proceed”

What happends if my cheque is cleared and successful but it is not acceptable during deposit because it was from a joint account or in a 3rd party name?

We do not accept any 3rd party deposits whereby the bank account holder name is not the same as your registered name with your KDI account.

Upon verifying your deposit, our Customer Service team may contact you to obtain proof of remittance should there be any discrepancies in bank details. Should we reach out for such verifications, please prepare the front page of your latest bank statement. Should there be any discrepancies to the details, we will be processing a full refund of your deposit. Expect to receive your refund within 5 working days once we have received & confirmed the details of your provided bank statement.

What happens if my cheque is cleared and successful but the amount is less than RM50,000?

We do not accept cheques with amounts that are less than RM50,000 for offline deposits. Upon verifying your deposit, our Customer Service team will contact you to obtain proof of remittance. Please prepare the front page of your latest bank statement and we will be processing the refund to you. Expect to receive your refunds within 5 working days once we have confirmed the details of your bank statement.

Can I deposit using Credit Card transactions?

We do not accept any credit card transactions for deposits.

I have accidentally made a deposit into KDI Invest but I had intended to deposit into KDI Save (or vice versa). Can the request be cancelled?

No, we are unable to cancel any transactions that were initiated and completed by a customer. Any transactions that have been completed are deemed as valid transactions and we are unable to suspend, cancel or reverse such transactions.

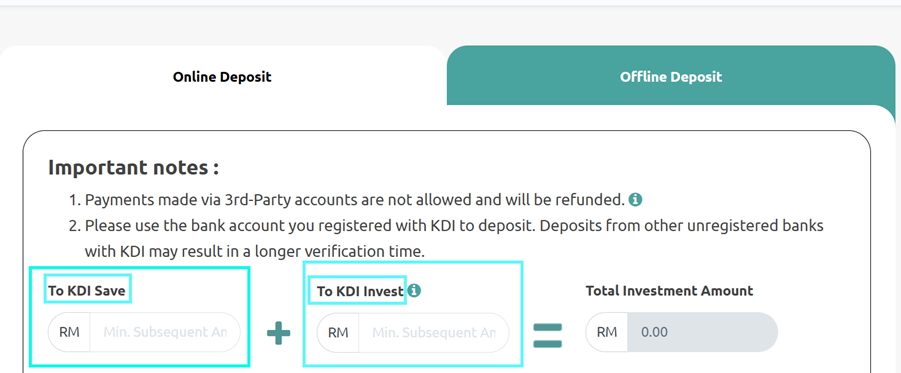

When depositing funds, a customer may choose whether to deposit into KDI Save, KDI Invest or both.

Please ensure that the deposit amount and all other details are accurate.

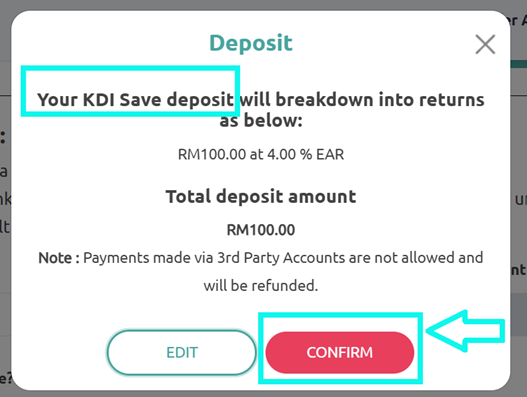

Please refer to the image below.

There will also be a confirmation window to complete the step.

Please be sure to read and check if the details are accurate before clicking on the “Confirm” button.

Upon clicking it, you are deemed to have agreed to submitting a confirmed request. No changes nor cancellations can be made to this transaction thereafter.

Please refer to the image below for the confirmation window.

I have accidentally made a transfer from KDI Save into KDI Invest but I had intended to withdraw from KDI Save (or vice versa). Can the request be cancelled?

No, we are unable to cancel any transactions that are initiated and completed by a customer. Any transactions that have been completed are deemed valid transactions and we are unable to suspend, cancel or reverse a transaction due to the closed nature of this system.

Please ensure that you confirm which KDI account to withdraw from. See image below for reference.

Note that clicking on the TRANSFER page will only allow you to transfer funds between your KDI Save and KDI Invest accounts. Withdrawals cannot be made on the TRANSFER page.

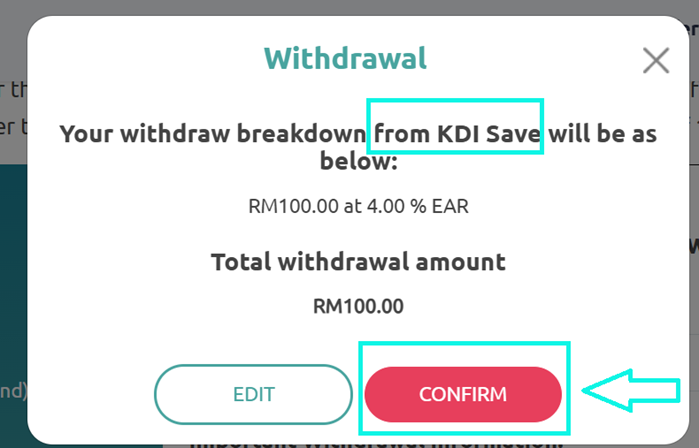

There will also be a confirmation window to complete the step. Please be sure to read and check that the details are accurate before clicking on the “Confirm” button.

Upon clicking it, you are deemed to have agreed to submitting a confirmed request. No changes nor cancellations can be made to this transaction thereafter.

Please refer to the image below for the confirmation window.

Managing Account

How do I edit my personal details?

You will be able to make changes to several personal details such as marital status (including spouse details), address and income as well as banking details.

Steps for editing personal details on all platforms:

Login to Kenanga Digital Investing (KDI) > Select "My Account" > "My Profile" > "Edit my account" > Make changes to your personal details > Click on “Save Changes”

Can I use e-wallet or any digital bank savings account to register with KDI?

Unfortunately, we do not accept any digital saving accounts or e-wallets at this moment.

You will not be able to deposit from, or withdraw to, such an account.

How do I change bank account details?

Steps to change Bank Account Details:

Login to Kenanga Digital Investing (KDI) > Select "My Account" > Select "My Profile" > To edit your bank account details, click on “EDIT” > Scroll to “Bank Account Details" > “Select your bank” > Fill in your revised Bank Account Number and Bank Account Holder Name> Click on “Save Changes”

How do I change the password upon logging in?

Steps to change the password

Login to Kenanga Digital Investing (KDI) > Select "My Account" > Click on “Change Password” > Proceed to fill in the old password, new password and confirm the new password > Click “Submit”

What if I forgot my password and how do I reset it?

Don’t worry! You can select "Forgot Password" from the login page to reset your password.

I changed my mobile number. What shall I do?

Yes, you are able to change your mobile number.

For Web and Web mobile: You may change your mobile number and the OTP code will be sent to your registered email address.

Steps for changing mobile number in Web & Web Mobile:

Login to Kenanga Digital Investing (KDI) > Click on "My Account" > Click on "My Profile" > "Edit my account" > Scroll to “Contact Details” > Input mobile number > Click on “Save Changes” > Key in OTP from email.

For Apps: You may change your mobile number and the OTP code will be sent to your registered email address.

Steps for changing mobile number in Apps:

Login to your KDI App > Click on “My Account” >Click on “My Profile” > Scroll down and click on “Edit My Account” > Scroll to “Contact Details” > Input mobile number > Click on “Save Changes” > Key in OTP from email.

Where can I see all my investments performance?

For Web and Web mobile:

Login to Kenanga Digital Investing (KDI) > Select "Home" > You will be able to view your Total Investment Summary > Click on “View Details” for KDI Save and/or KDI Invest to have a complete view of the Total Investment Summary, Assets Allocation and Geographical Allocation.

For Apps:

Login to your Kenanga Digital Investing (KDI) App > You will be able to immediately view your total investment summary. You will also be able to view the individual KDI Save portfolio and KDI Invest portfolio > Click on the “>“to view of the Total Investment Summary, Assets Allocation and Geographical Allocation.

Where can I view monthly statements of my investment portfolio with Kenanga Digital Investing (KDI)?

Steps to download for all platforms:

Login to Kenanga Digital Investing (KDI) > Select "My Account" > Select "My Statement" tab > Select “year” > Click on “View Statement” to download.

What is the reporting currency for my Kenanga Digital Investing (KDI) account?

The default reporting currency is Malaysian Ringgit (MYR).

How do I close my account?

Login to Kenanga Digital Investing (KDI) > Select “Support” on the top right > Click on “Submit Enquiry / Complaint” > Complete the form > Click on “Submit”.

Our Customer Service team will be in touch with you to proceed with the account closure procedure.

However, if you are not logged in:

On the KDI page > Select “Learn” on the top right > Click on “Contact Us”> Complete the form > Click on “Submit”.

Our Customer Service team will be in touch with you to proceed with the account closure procedure.

Tax & e-invoicing

Why does my registration require a Tax Identification Number (TIN)?

The Tax Identification Number (TIN) is required for tax reporting purposes and you are required to fill this in during registration if you are a non-Malaysian citizen. This is for FATCA and CRS reporting requirements. You will be able to find your TIN on your tax returns form.

For definitions of FATCA and CRS, please refer to the subsequent questions within this category.

(Refer to: What is FATCA? and What is CRS?)

What is FATCA?

The Foreign Account Tax Compliance Act (FATCA) is a tax law that compels U.S. citizens at home and abroad to file annual reports on any foreign account holdings.

What is CRS?

The Common Reporting Standard (CRS) is an internationally agreed standard for the automatic exchange of financial account information between jurisdictions for tax purposes, to better combat tax evasion and ensure tax compliance.

What does the CRS require?

CRS requires Kenanga Digital Investing (KDI) to collect certain information such as account holder’s name, address, country of tax residence, taxpayer identification number (TIN), date and place of birth, account number to report to local tax authorities.

How does FATCA and CRS apply to me if I am a Malaysian?

Under the FATCA / CRS rules, we are required to collect information on the country of tax residence of our customers to identify and classify each account holder's tax status and ensure we are in compliance with relevant AEOI tax regulations which include FATCA and CRS.

I am not sure about my tax status. What should I do?

You are advised to consult with the tax authorities or other tax advisors regarding your specific situation as Kenanga Digital Investing (KDI) is unable to provide any professional tax advice.

You may also refer to the link below from our Inland Revenue Board Of Malaysia:

Click Here

What must I do if my tax residency changes?

Should there be any changes in your tax residency status, please fill in our Contact Form.

Steps to change the tax residency

Login to Kenanga Digital Investing (KDI) > Select “Support” on the top right > Click on “Submit Enquiry / Complaint” > Complete the form > Click on “Submit”.

Our Customer Service team will be in touch with you to proceed to assist you with the tax residency changes.

Why do you need my tax residency information?

Your tax residency information is crucial to help us make the necessary filings according to income tax regulations.

What is an e-invoice?

An e-invoice is a digital record of a transactional exchange between a seller (supplier) and a purchaser (buyer), which goes through the government portal for validation and recordkeeping. E-Invoice contains information on (if available) :

- Management fee

- Interest paid

- Referral program rewards

Is e-Invoice applicable to all transactions within Malaysia only?

No, the issuance of e-invoice is also applicable for cross-border transactions. This includes management fees for KDI Invest portfolios of foreign assets. Do note that KDI itself is domiciled in Malaysia.

How can I get my e-invoice?

In order to obtain your monthly e-invoices, you may contact our Customer Service Team and request to opt in for the auto emailer of e-invoice. Please note that you are responsible for providing complete and accurate information to KDI for the issuance of the e-invoice. It is the customer's responsibility to adhere to and comply with IRBM’s e-Invoice regulations by providing up to date information.

Upon opting in, your next upcoming monthly e-invoices will be auto emailed to your latest email address registered with Kenanga Digital Investing (KDI) in the first week of every month.

To update your information:

- You may directly update your details via KDI App and ensure they are accurate.

- You may email to our Customer Service Team at digitalinvesting@kenanga.com.my and provide the details to be updated.

- You may fill in our Contact Us Form and our Customer Service Team will get in touch with you.

Where can I obtain more information regarding IRBM e-Invoice?

For more information on e-Invoicing, you may visit IRBM's website.

What is Sales and Service Tax (SST)?

SST stands for Sales and Service Tax and is a consumption tax in Malaysia that is charged on the sale of goods and services.

SST is made up of two separate taxes:

Sales Tax – This applies to taxable goods either manufactured in or imported into Malaysia

Service Tax – This applies to specific services provided by businesses in Malaysia. It is charged on taxable services such as the provision of financial services by any person regulated by Bank Negara Malaysia, Securities Commission and Labuan Financial Services Authority ("LFSA") in relation to fees, commissions or similar payments, unless specifically exempted.

Who is the collector/enforcement authority of SST in Malaysia and where can I get more information about SST?

The collector and enforcement authority of SST in Malaysia is the Royal Malaysian Customs Department ("Customs" or "RMCD").

A service tax will be applied at a rate of 8% to fees and charges listed in the Guide of Financial Services, unless they are specifically exempted.

For more information on SST, please refer to the RMCD website.

How does SST affect me as a KDI customer

The fees for managing your KDI Invest portfolio is a taxable service. This means that any management fees imposed on your KDI Invest portfolio will be subject to a 8% service tax.

Security and Protection

Where are my personal information stored?

The security and privacy of your information are very important to us. Your data is hosted on Amazon Web Services which runs 24/7 Intrusion Detection tests, amongst other updated security protocols.

Our system is also audited and tested by trusted external entities to protect your information and funds against ill-intentioned actors and to safeguard our servers against cyberattacks. Additionally, we also run regular security code reviews and penetration tests.

Do I own the ETFs in my KDI Invest Portfolio?

Yes, you are the owner of the ETFs in your KDI Invest portfolio. We appoint GTN Group Holding Ltd. (“GTN”) as our broker-dealer and custodian for the ETFs. Hence, the ETFs are technically held and owned by GTN. KDI’s legal entity, Kenanga Investment Bank Berhad, is a beneficiary of GTN. As you are an ETF investor of KDI, you are a beneficiary of KDI Portfolio Accounting ledger. Therefore, you are the owner of the ETFs in your KDI Invest Portfolio(s).

Does Kenanga Digital Investing (KDI) practice 2-Factor Authentications?

Yes, we do. As a Kenanga Digital Investing (KDI) client, you must set up 2-factor Authentication (2-FA) when creating your account. When you make changes to personal information such as mobile number, the 2-FA process will require you to enter a One-Time-Password (OTP) sent via email to your registered email address.

Note that during your sign-up process or changing of passwords, you are required to enter the OTP sent via SMS to your mobile number.

What happens to my investments if Kenanga Digital Investing (KDI) closes down, gets acquired/goes public?

To ensure that we never touch your money as required under the regulatory requirements, your money is safely held by our appointed custodian, Pacific Trustee Berhad.

Therefore, you will always have full access and claim to your investments and cash if the Kenanga Digital Investing (KDI) platform closes down, gets acquired, or anything that affects the business continuity of Kenanga Digital Investing (KDI).

About Us

What is Kenanga Digital Investing (KDI)?

Kenanga Digital Investing (KDI) is a fully automated Artificial Intelligence (A.I.) digital investment management platform (also known as ‘robo-advisory’) designed to revolutionize the way you invest your money. You gain access to global markets and extremely competitive cash management rates at very low fees.

Kenanga Digital Investing (KDI) is for everyone, no matter your level of investment knowledge. We have simplified the investment journey for you by removing unnecessary fees and hurdles so you can realize the full potential of your money. In a few simple steps, we will customise a portfolio just for you, bringing you well on your way to growing your wealth.

At Kenanga Digital Investing (KDI), we want you to be in complete control of your money. We’ve removed the limitations of conventional investments so you can deposit, withdraw, switch to different portfolios and realize your investments as and when you wish without any sales charges or penalties.

We bring you peace of mind knowing that your money is in safe hands. Kenanga Digital Investing (KDI) is regulated by the Securities Commission, Malaysia and is powered by Kenanga Investment Bank Berhad (KIBB), Malaysia’s leading independent investment bank for over 50 years.

Who are the people behind KDI's investment team?

All portfolios are managed and monitored closely by a team of experts, consisting of the portfolio manager and data scientist who possesses global investment knowledge, extensive data research capabilities as well as leveraging on the experiences and expertise of Kenanga Group. Kenanga Digital Investing (KDI) Investment Committee governs and supervises the investment strategies of Kenanga Digital Investing (KDI). The Investment Committee, which is composed of senior industry professionals and quantitative experts, will ensure that the investment strategy recommended by our A.I. algorithms meets the expectations for both risk and return, as well as ensure the proper governance of your funds.

Who are Kenanga Digital Investing (KDI) backers?

Kenanga Digital Investing (KDI) is one of the new financial initiatives of Kenanga Investment Bank Berhad (KIBB), following the success of its joint venture, Rakuten Trade. Known as Malaysia’s leading independent investment bank with over 50 years of experience, KIBB provides equity broking, investment banking, treasury, Islamic banking, listed derivatives, investment management, wealth management, structured lending and trade financing services. KIBB services are regulated by the Securities Commission Malaysia and Bank Negara Malaysia.