July 2024 Market Insights

Welcome to the July edition of the Market Insights column brought to you by the Kenanga Digital Investing (KDI) team. In this edition, Our Head of Digital Investing, Cheong Yew Huan, will discuss the latest financial news and share his insights on how to make the most of today’s market.

Market Recap

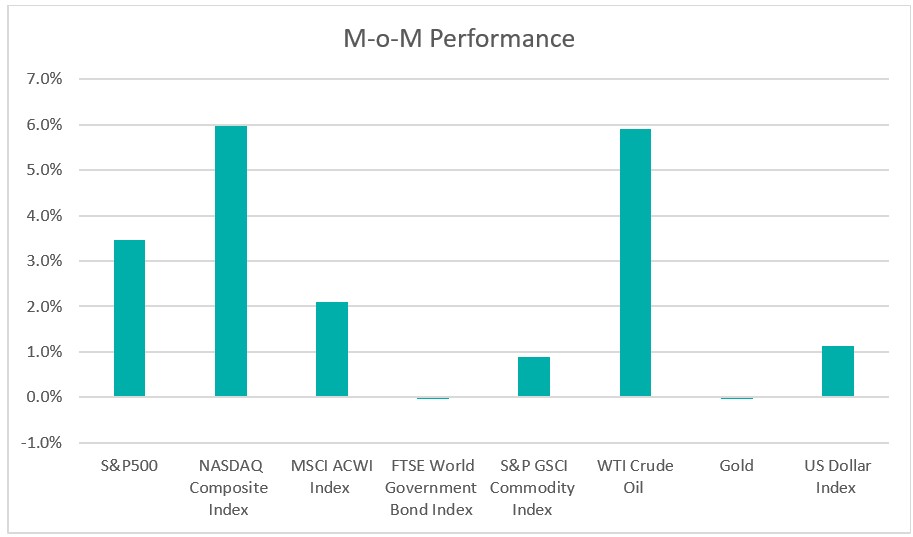

Chart 1: Index Performance in June 2024

Market

In June 2024, global stocks saw significant gains. The MSCI ACWI Index rose by 2.1%, while the S&P 500 increased by 3.5% and the Nasdaq Composite Index surged by 6%. The S&P 500 and Nasdaq reached record highs this year, driven by technology and other growth stocks, which saw gains of 14% and 18.1% respectively in the first half of the year. The ‘Magnificent Seven’—Alphabet (Google), Amazon.com, Apple, Meta Platforms, Microsoft, NVIDIA, and Tesla—have been key drivers, benefiting from the ongoing generative artificial intelligence (AI) revolution.

The FTSE World Government Bond Index remained relatively flat with minimal changes throughout the month. Concerns about slowing economic growth caused U.S. Treasury yields to decrease in June. The yield on the 10-year Treasury fell nearly 10 basis points to 4.3961%, while the 2-year Treasury yield dropped 11 basis points to 4.7535%. Investors closely monitored economic data for insights into the future of the economy and monetary policy.

In the commodities space, WTI crude oil increased by 5.9% during the month, surpassing US$80 per barrel. The price surged in the fourth week of the month, ending a three-week decline due to expectations of rising summer fuel consumption and a tightening oil supply in the third quarter. Gold trade remained relatively stable in June, showing little change for the month as investors are currently awaiting economic data and better insight into the U.S. central bank’s timeline regarding potential interest rate cuts. However, it has posted a year-to-date gain of 12.8%.

The dollar index regained traction, climbing to a fresh two-month high. The market is awaiting more clues about the Fed’s rate path, which is expected to strongly influence the dollar’s performance.

Outlook

U.S. retail sales in May saw a marginal increase of 0.1% following a revised 0.2% decline in April, indicating a sluggish second-quarter economic performance. Inflation and high interest rates have led households to prioritize essential spending over discretionary items. Although inflation shows signs of moderation, it remains a concern. The Federal Reserve is expected to maintain a cautious approach to interest rate cuts, with forecasts suggesting possibly only one rate reduction this year, aiming to balance economic growth with inflation control. Overall, the outlook suggests a mixed economic landscape characterized by cautious consumer behavior, moderated economic activity, and ongoing adjustments in monetary policy to manage inflation and support growth.

China’s economy faced deepening challenges as its housing market continued to slump, prompting calls for increased government intervention to bolster growth. The Chinese Yuan depreciated to a seven-month low against the dollar, reflecting market concerns over economic resilience. The People’s Bank of China maintained its key interest rate unchanged for the tenth consecutive month, citing concerns over Chinese Yuan stability amid pressure from the U.S. Federal Reserve’s monetary policies. Despite these challenges, China’s manufacturing sector showed resilience, with the Caixin PMI slightly improving to 51.8 in June. Analysts anticipate further policy support to revive economic momentum.

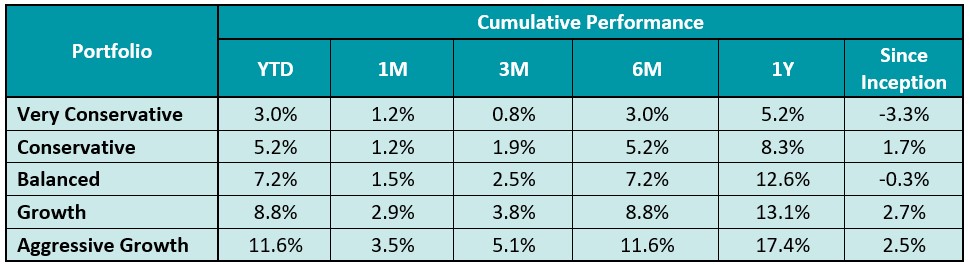

Table 1: KDI Invest Portfolio Performance as at 30 June 2024

The provided table offers information on the cumulative performance of selected KDI portfolios since their launch on February 15, 2022. The portfolio returns (in USD) range from -3.3% to 2.7%. Year-to date, all portfolios recorded positive returns within a range of 3.0% to 11.6%.

The year has been favorable for investment returns, especially in equity markets. Looking ahead, equities could potentially rise further, driven by enthusiasm for artificial intelligence. Markets remain focused on economic data and the possibility of future rate cuts. Inflation continues to be a primary concern, with the central bank monitoring signs of cooling inflation before considering an initial rate cut. The US 10-year Treasury yield, which moves inversely to bond prices, fluctuated between approximately 4.39% and 4.70% in the second quarter as the market digested data showing slowing inflation and signs of cooling economic growth in some indicators. Yields could decline further if weakening data strengthens the case for more rate cuts, prompting increased allocations to fixed income.

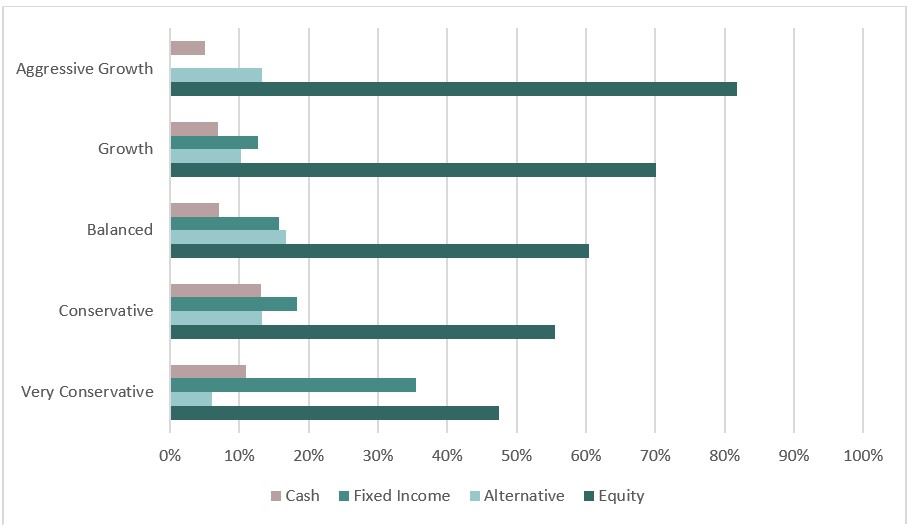

The KDI portfolios maintain diversification to navigate market volatility, with current equity allocations ranging from 47% to 82%. Fixed income constitutes up to 35% of the portfolio, while alternative investments, primarily in the gold ETF (GLD), make up to 17%. Cash holdings range from 5% to 13%.

Chart 2: Asset Class Exposure as at 30 June 2024

Please note that the performance and asset class exposure mentioned above are derived from five proxy portfolios. The actual performance and exposure of KDI Invest portfolio may differ due to the customisation by our A.I. based robo-advisor, which tailors investment to individual risk profiles, as well as the timing of market entry.

Citation:

https://edition.cnn.com/2024/07/01/business/china-economy-uneven-recovery-intl-hnk/index.html