KDI Investment Philosophy – Pushing Investment Boundaries with A.I.

Ask investors about the key to successful investing and unanimously, they will emphasise the importance of having a sound investment strategy. A good investment strategy, while crucial to achieving market alpha (the measure of the performance of an investment compared to benchmark index), is governed by a set of beliefs which is known as an investment philosophy.

Although investment strategies can be influenced by short term biases, a proven investment philosophy should be able to stand the test of time, no matter in a bull or bear market – enabling control over emotions, shutting out market noise and focusing on the long-term outcome.

Robo Advisor – Making Use of Investment Automation

Forming the cornerstone of KDI’s investment philosophy is the application of computer algorithms to perform our investment processes – what we call our robo-advisor. Computerized robo-advisor algorithms are perfect for investing due to their inherent efficiency allowing for effective cost management and elimination of human bias.

At Kenanga Digital Investing (KDI), our investment philosophy is hinged upon being fully Artificial Intelligence (A.I.) based. KDI Invest is the latest newcomer to the investment ecosystem that integrates a multi-faceted approach from data analysis, machine learning, asset allocation to trading and rebalancing. This is achieved with the custom-configured robo-advisor algorithm.

Fully A.I. Driven Digital Investment Manager

Staying true to KDI’s investment philosophy, KDI Invest applies a wealth of investing knowledge amassed by the largest independent investment bank in Malaysia, Kenanga Investment Bank Berhad.

Tapping on this existing knowledge base, KDI is able to perform complex data analysis using current live market and retrospective economic data via machine learning. Examples of such data include Consumer Price Index (CPI), commodity prices, volatility level, interest rates, earnings data, market liquidity data, financial ratios, and more.

In addition to the traditional branches of fundamental analysis and technical analysis, KDI’s proprietary model is also capable of understanding various rules-based strategies that may be best applied in different market conditions. With this, investors can own a dynamic portfolio that is always up to date and reactive to market movements, regardless of a bull or bear market.

Personalized Digital Portfolio Management

KDI Invest uses digital technology from investor onboarding all the way to dynamic portfolio rebalancing. With the understanding that market conditions are ever-evolving, KDI takes into account that investors’ investment goals and risk profile may also change from time to time. This digitalized portfolio management system provides a holistic view of the client’s risk tolerance levels, age group, and investment horizons.

Understanding each client’s profile on a broad-based level allows KDI to optimize asset allocation in accordance with Nobel Prize winner Harry Markowitz’s Modern Portfolio Theory (MPT). The MPT suggests that it is possible for investors to design an optimal portfolio to maximize returns by taking on a quantifiable amount of risk. Simply put, the MPT is the source of the phrase, “high risk leads to high returns”.

In the event that the asset allocation has deviated significantly from the targeted asset allocation, rebalancing is automatically performed via A.I. This mitigates human biases as they tend to feel emotionally attached to their holdings, even if it’s an investment gone sour. Regardless of unit trust or exchange-traded funds (ETF), A.I. is impartial and disciplined.

Looking Beyond the Horizon

“You don’t drive forward while looking in the rear-view mirror” is a saying that is synonymous with KDI’s investment philosophy. While KDI assesses historical data just as how we would look in the rear-view mirror before changing lanes, its decision to change lanes ultimately depends on where we, the investor, would like to go. KDI’s strategic asset allocation is monitored and rebalanced dynamically based on a forward-looking, A.I. driven market outlook that works 24/7 to maximize portfolio performance.

A.I. Based Downside Protection Strategy

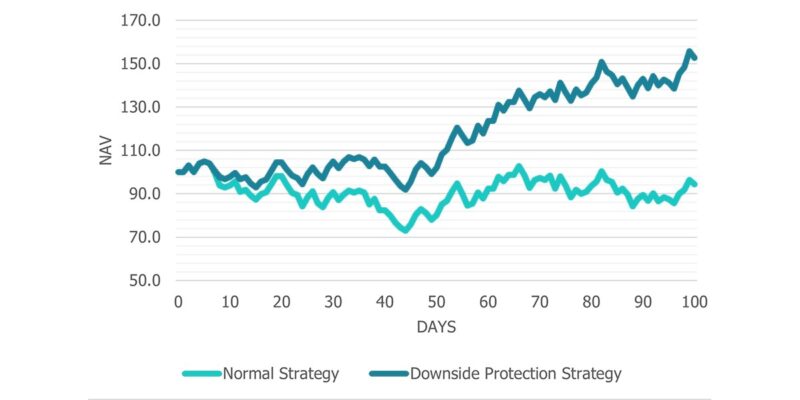

We all know how painful it is to recuperate from investment losses. As a matter of fact, any amount of investment loss will require a higher degree of return in order to break even. For example, an investment loss of 25% will require a subsequent gain of 33% to recover,. This can be avoided with constant monitoring and strict implementation of downside protection strategies.

Image is an illustration of downside protection strategy on randomized performance portfolio: uptrends

are unchanged while the downside is limited to a fixed percentage.

Indeed, a simple portfolio simulation like the above shows that implementing a downside protection strategy in a “sideways” performing portfolio can result in substantially better performance, after only 100 days. Hence at KDI Invest, downside protection is a major priority. In the event of increased market volatility, KDI’s A.I. based downside protection strategy automatically switches risky assets into low-risk assets to protect customers’ investment.

KDI Invest: Growing Your Investment More Efficient Than Any Human

Here’s an irresistible investment proposition:

What if you could hire a reputable fund manager that efficiently monitors your investment 24/7, understands your risk appetite completely to tailor-make your investment portfolio and always strives to achieve market return benchmarks: All these for as low as zero management fee?

KDI Invest now allows you access to an investment avenue that encompasses world class assets and connects to global investment trends that provide some of the most attractive investment returns in town. Log on Kenanga Digital Investing to find out more about KDI Invest.