October 2023 Market Insights

Welcome to the October edition of the Market Insights column brought to you by the Kenanga Digital Investing (KDI) team. In this edition, Our Head of Digital Investing, Cheong Yew Huan, will discuss the latest financial news and share his insights on how to make the most of today’s market.

Market Recap

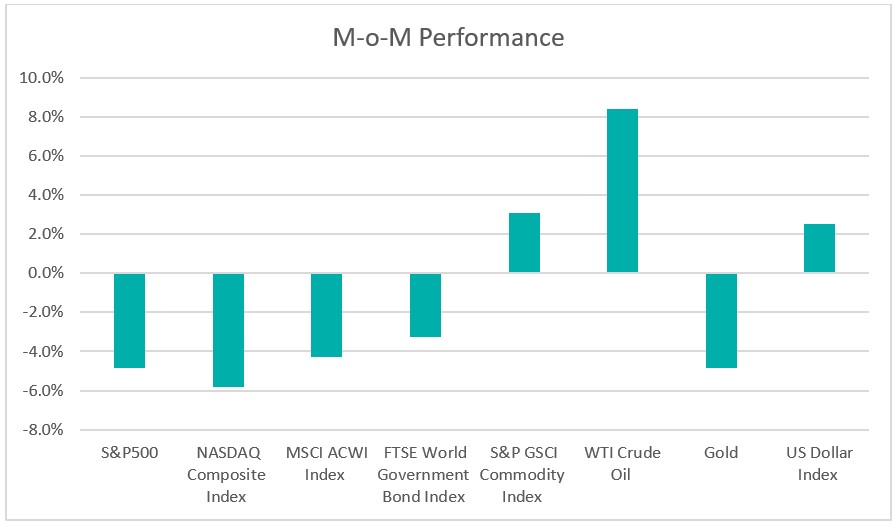

Chart 1: Index Performance in September 2023

Market

In September 2023, major equity indices experienced a decline, with MSCI’s AC World index recording a decrease of 4.3%. US stock indexes reached their lowest point since June, primarily due to the Tech giants, including Apple, Microsoft, Amazon and Alphabet, weighing down the overall performance of US stock benchmarks. Market anxiety was further heightened by concerns about a potential US government shutdown, while mixed economic data had a dampening effect on investors’ willingness to take risks.

For fixed income, US Treasury yields surged to reach new multiyear peaks with the 10-year Treasury yield, a benchmark for long-term interest rates, climbing to 4.5711%, while the two-year yield continued to rise, surpassing the 5% mark. This surge in yields was driven by the Federal Reserve’s latest quarterly Summary Economic Projections, which suggested that additional interest rate hikes might be required to curb inflation. This indicates the possibility of an extended period of elevated interest rates and the accompanying economic implications.

The S&P GSCI Commodity Index saw an increase of 3.1%, primarily driven by a strong rally in oil prices. Oil prices experienced their fourth consecutive monthly rise, closing above US$90 per barrel in September 2023. This surge in oil prices was influenced by Saudi Arabia and Russia, who extended their supply cuts until the end of the year as part of the OPEC+ group’s strategy. The rise in oil prices suggests the likelihood of an extended period of elevated interest rates. Conversely, the price of gold declined below the $1,900 mark, reaching a seven-month low. This drop was observed in the context of a surge in US bond yields.

In the currency markets, the US Dollar strengthened against a basket of currencies, with the US Dollar Index registering a 2.5% increase, closing at 106.17.

Outlook

The US Federal Reserve decided to keep its benchmark interest rate unchanged during the September FOMC meeting, maintaining the benchmark borrowing rate at a range of 5.25% to 5.5%. The Fed indicated its readiness to increase rates further if necessary, suggesting that rates are likely to remain elevated for an extended period.

On the economic front, the data released was mixed. Consumer spending exhibited resilience with US retail sales in August showing a 0.6% increase compared to July. However, the unemployment rate rose to 3.8%, marking its highest level since February 2022, up from 3.5% in July. Additionally, the consumer confidence index declined to 103.0 this month, its lowest point since May, down from an upwardly revised 108.7 in August, according to The Conference Board.

Moreover, the market’s attention has shifted towards the imminent end-of-month deadline for a potential US government shutdown. Moody’s Investors Service has warned that a government shutdown could have adverse consequences on the US’s credit rating.

In China, the improvement in factory output and retail sales in August indicated early signs of stabilisation in the Chinese economy. However, despite these positive signs, the recovery of the Chinese economy remains delicate. A persistent cause for concern lies in the Chinese property sector, which continues to pose potential credit risks that extend across various sectors in the near term. This concern was underscored by a significant decline in Chinese property stocks, reaching their lowest levels since October 2011. The situation was further aggravated by the trading suspension of China Evergrande, a heavily indebted property giant, which highlighted additional stress within the industry. Moreover, the Chinese currency has depreciated by over 5% this year, making it one of the weakest-performing currencies among emerging Asian countries.

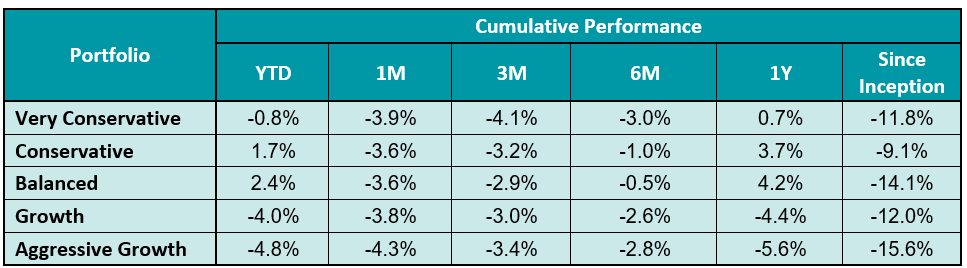

Table 1: KDI Invest Portfolio Performance As at 30 September 2023

Remarks:

Benchmark: Equity: MSCI ACWI Index + Fixed Income: FTSE World Government Bond Index

Past performance is not indicative of future results.

One significant trend in the global economy is the shift towards a prolonged period of higher interest rates. The impact of rising interest rates is already evident in the US housing market, where a resurgence in mortgage rates has led to a significant decline in homebuilding. Oil prices, which have surged by approximately 28% since June, further indicate concerns about elevated inflation. Adding to market volatility concerns is the potential for a US government shutdown at the end of September. The sluggish performance of the Chinese economy adds an additional layer of caution for investors. Key market drivers moving forward include central banks’ monetary policy decisions and economic data releases from China.

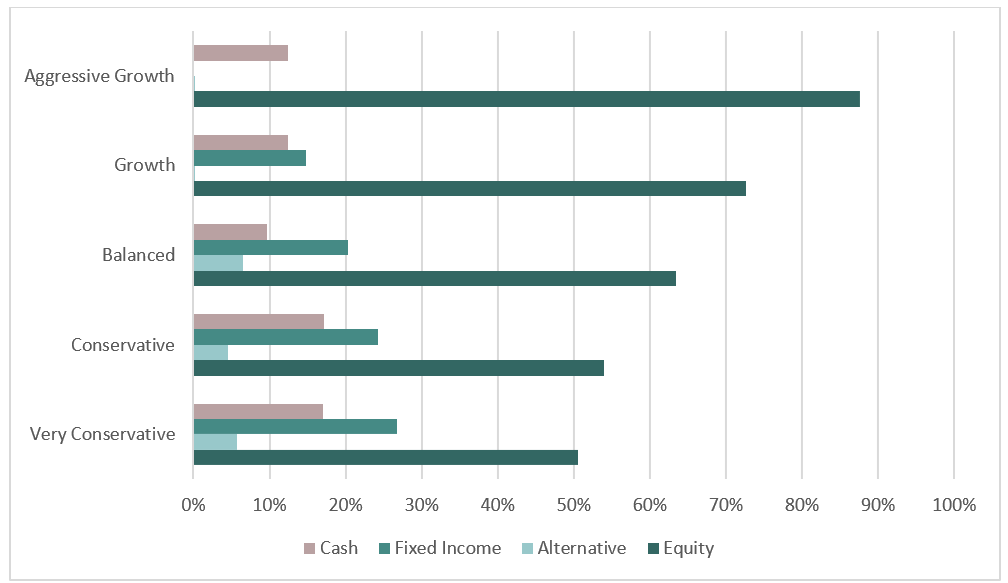

The KDI portfolios maintain diversification to ride through market volatility, with current allocation to equity ranging from 50% to 88%. Fixed income constitutes an allocation of up to 27%, while alternative investments, primarily in the gold ETF (GLD), make up to 7% of the portfolio. Cash holdings range from 10% to 17%.

Chart 2: Asset Class Exposure As at 30 September 2023

Please note that the above performance and asset class exposure are based on five proxy portfolios. Actual KDI Invest portfolio performance may vary from the above due to the customisation by the KDI robo-advisor A.I. based on investors’ risk profiling, as well as the timing of market entry.

Citation:

https://www.cnbc.com/2023/09/20/live-updates-fed-decision-september-2023.html