October 2025 Market Insights

Welcome to our Market Recap for September 2025. In this newsletter, we will share with you a brief recap on key economic data for the past month and our portfolio performance.

Market Recap

Market

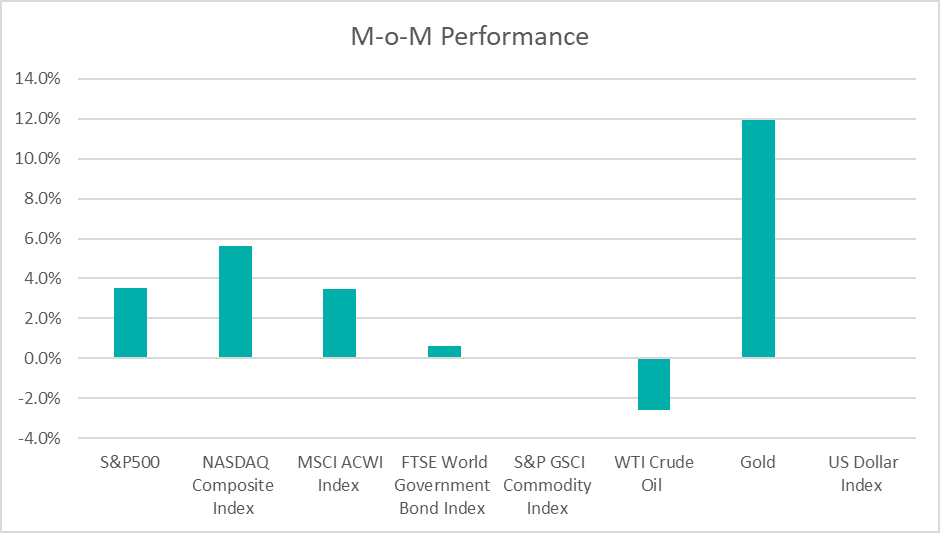

In September 2025, the U.S. Federal Reserve cut interest rates by 25 basis points to a target range of 4.00%–4.25%, responding to signs of labour market weakness. Inflation remained elevated, with August CPI rising 2.9% year-over-year (YoY), driven in part by new reciprocal tariffs amid global trade tensions. These shifts coincided with a U.S. government shutdown, adding further uncertainty to the economic outlook. Nevertheless, investors looked past these headwinds, and equity markets posted solid gains for the month with the S&P 500, Nasdaq, and MSCI ACWI Index up by 3.5%, 5.6% and 3.5% respectively.

Fixed income markets responded to the recent Fed rate cut by pricing in expectations for further easing by the end of 2025, which pushed Treasury yields lower. The yield on the 10-year U.S. Treasury Note settled around 4.15% at the end of September (Aug: 4.23%), reflecting the balance between the Fed cut (downward pressure) and fiscal/inflation concerns (upward pressure).

Gold, the traditional haven, experienced an unprecedented surge (+11.8%) throughout September, confirming its status as a hedge against monetary instability. This sustained bullish trajectory is driven by structural factors, primarily the strategic diversification by global central banks away from U.S. dollar-denominated reserves. In contrast, crude oil prices declined to $62 per barrel in September (from prior month’s $64), driven by expectations of global supply increases (OPEC+ unwinding cuts) and weakening overall demand. Bitcoin gained 4.7% in September, partially reversing the 7.8% loss in August.

The US dollar weakened against the Malaysian Ringgit, ending September-2025 at 4.207, from 4.225 in August. To date, the Malaysian ringgit appreciated by 5.9% against the U.S. dollar.

Outlook

The August CPI increased 0.4% month-over-month, pushing the year-over-year headline inflation rate to 2.9%. This represented the highest rate recorded since January. Compounding the inflationary struggle is the softening of the labour market: the unemployment rate ticked up modestly to 4.3% in August, and Nonfarm payroll employment grew by only 22,000 in August, showing little change since April. Moreover, the private sector began shedding jobs; the ADP National Employment Report indicated that private employers shed 32,000 jobs in September, confirming the necessity of the Fed’s pivot.

The Federal Open Market Committee (FOMC) took decisive action on September 17, 2025, cutting the federal funds rate by 25 basis points (bps), thereby moving the target range to 4.00%–4.25%. This reduction, the first in the cycle since December, represents a significant shift in monetary policy focus. The primary catalyst for this pivot was the accumulating evidence of mounting downside risks to the U.S. labour market, despite baseline forecasts suggesting continued stable growth. Looking ahead, Federal Reserve Chair Jerome Powell signalled that future rate cuts are “probable” but contingent on incoming data, emphasizing the considerable uncertainty surrounding the economic outlook.

Economic data released by China in September 2025 highlights structural divergence. The value-added industrial output expanded 5.2% year-on-year in August, showing a material slowdown from the 5.7% rise reported in July, suggesting weakening external demand. However, the high-tech sector, supported by Beijing’s industrial policy, remains resilient: Investment in high-tech manufacturing surged 9.3% year-on-year in August, significantly outpacing the general industrial growth rate. Meanwhile, consumer activity was moderate, with retail sales growing 3.4% in August, and 9.6% year-to-date.

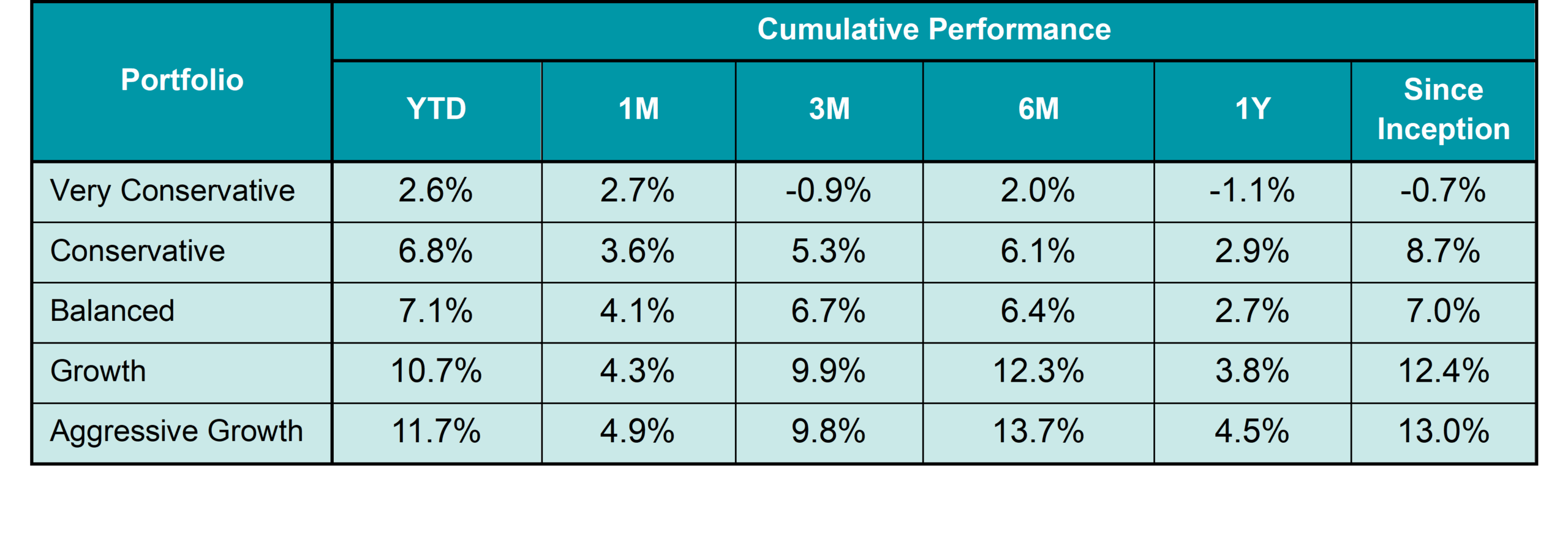

The provided table offers information on the cumulative performance of selected KDI portfolios since their launch on February 15, 2022. The portfolio returns (in USD) range from -0.7% to 13.0%. Year-to date, the portfolios recorded returns within a range of 2.6% to 11.7%.

U.S. equity markets extended their robust performance in September. The broad-based gains reflect improved investor confidence, as the Fed cut interest rates for the first time this year. The top three best-performing U.S. equity sectors in September 2025 were Technology, Materials, and Utilities. Sector leadership continues to be driven by technology, with Information Technology up 60.6% since the April low. For materials, rare earth and specialty metals companies surged, driven by increased demand from the electric vehicle and renewable energy industries. Stable cash flows and dividend appeal made utilities attractive amid economic uncertainty and falling Treasury yields.

The Trump Administration has continued its strategy of escalating global trade barriers, a key source of the elevated policy uncertainty felt across markets. This policy has resulted in massive tariff implementation since August 2025. The sheer volume and scope of these new trade barriers are expected to structurally slow global commerce. The World Bank forecasts global growth will weaken significantly to 2.3% in 2025—a substantial downgrade from previous forecasts—specifically because of rising trade restrictions and heightened policy uncertainty.

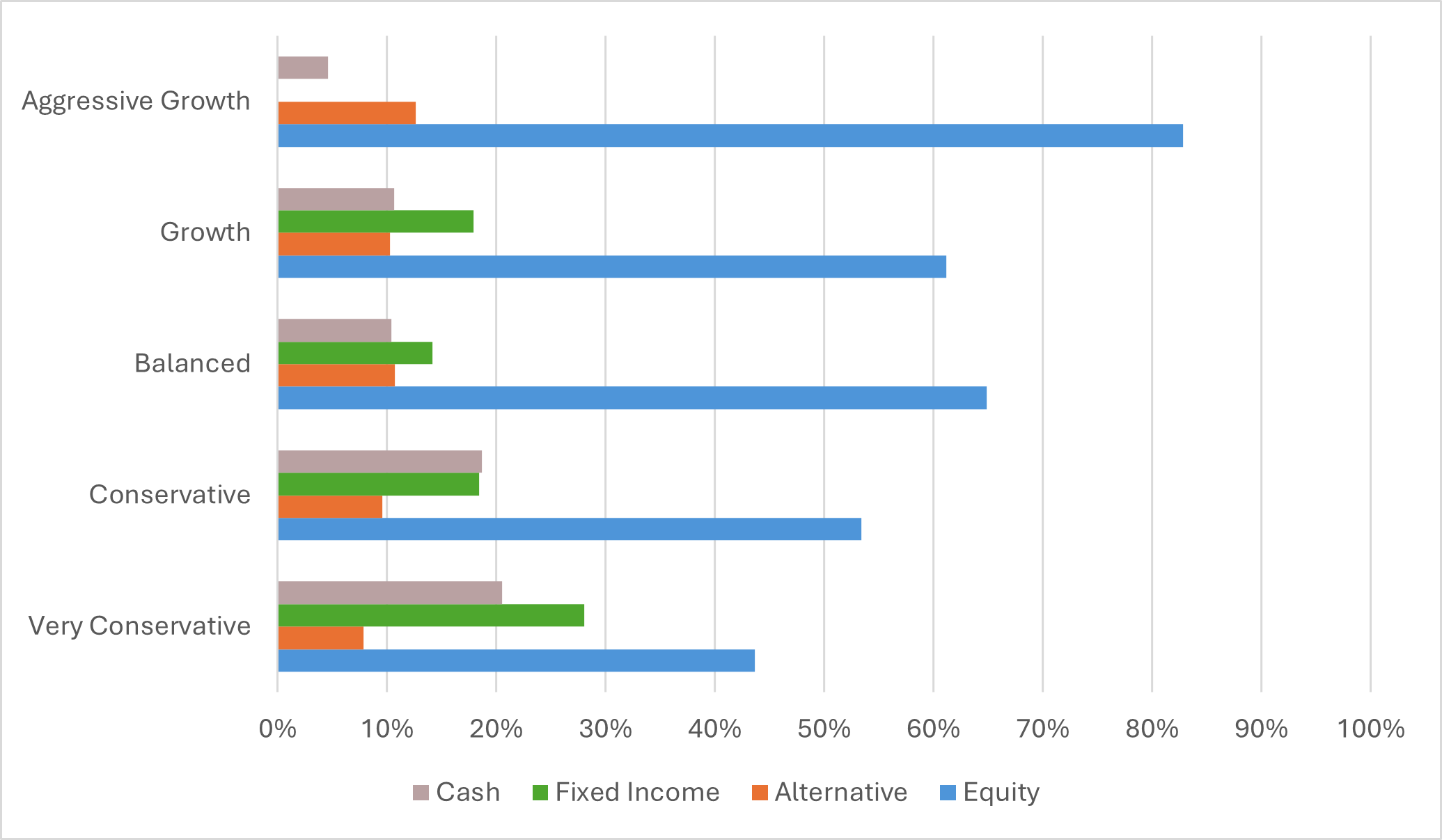

KDI’s portfolios are well diversified to withstand market fluctuations, and will remain vigilant in monitoring adjusting changes, asset allocation when necessary. As market volatility rises, the portfolios may shift to a risk reduction mode to protect downside. This strategy aims to safeguard your investments during uncertain times while remaining poised to take advantage of favourable conditions.

Kindly note that the performance and asset class exposure illustrated above are derived from five proxy portfolios. The actual performance and exposure of your investment portfolio may differ due to the customisation made by our proprietary algorithms that tailors the investment to your unique risk profile, as well as the timing of market entry.

Our Perspective: Are Markets Climbing the ‘Wall of Worry’?

Last month, the U.S. markets appeared to climb the proverbial “wall of worry”, with the S&P 500 gaining 3.5% and reaching new all-time highs despite a confluence of concerning economic signals. Investors have looked past elevated inflation (note the CPI figures growing at 2.9% YoY), the deteriorating labour market conditions, a government shutdown, and escalating trade tensions from the Trump Administration tariffs that is projected to cut global growth down to just 2.3% in this year. The Federal Reserve’s rate cut to 4.00%, its first reduction since December, provided support while gold’s 11.8% surge reflected growing monetary uncertainty as investors diversify away from dollar reserves.

While market volatility and policy uncertainty may tempt us to follow the herd into cash or reactive positioning, our philosophy at KDI remains anchored to a fundamental truth: long-term fundamentals matter more than short-term noise. We would like to remind our clients that our portfolios are designed to weather turbulence while capturing long-term compounding growth, allowing you to remain steadfast and fully invested. As we have demonstrated, our portfolios have generated positive returns for the month of September, with returns ranging from 2.6% to 11.7% (very conservative to aggressive growth respectively) further validating the wisdom of staying invested rather than attempting to time an unpredictable market.

Citation:

https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

https://www.bbc.com/news/articles/cn0xe5dvp47o

Disclaimer

Kenanga Digital Investing (“KDI”) is licensed by the Securities Commission of Malaysia as a Digital Investment Management Company. KDI is authorised to carry out the business of fund management blending innovative technology into automated portfolio management services offered to clients under a license issued pursuant to Schedule 2 of the Capital Markets Services Act (CMSA) 2007.

Investment involves risk, including the possible loss of capital you invest. Past performance does not indicate future performance. Historical returns, expected returns, and probability projections are provided for informational and illustrative purposes, and may not reflect actual future performance. KDI does not assume any fiduciary responsibility or any liability for any consequences, financial or otherwise, arising from any transaction in reliance on such information. Investors should rely on their own evaluation or consult an independent financial, accounting, tax, legal or other professional advisers to access the merits and risks before investing.

Any forward-looking statements, predictions, projections or forecast on the economy, stock market, bond market or economic trends of the markets contained in this material are subject to the market influences and contingent upon matters outside the control of KDI and therefore may not be realised in the future. No representation is made as to the completeness and adequacy of the information to make an informed decision.

Neither the information, nor any opinion, contained in this article constitutes a promotion, recommendation, solicitation, invitation by KDI or its affiliates to buy or sell any securities, investment schemes or other financial instruments or services, nor shall any security, collective investment scheme, or other financial instruments or services be offered or sold to any person in any jurisdiction in which such offer, solicitation, purchase, or sale would be unlawful under the securities laws of such jurisdiction. This is not intended to be an invitation or offer made to the public to subscribe for any financial product or other transaction.

This information has not been reviewed by the Securities Commission of Malaysia.