KDI Save

Accelerate your savings with a fixed* return rate, credited daily.

Turbocharge your cash with KDI Save and enjoy top tier returns of 4.0% Effective Annual Rate (EAR)*. Forget about projected returns, lock-in periods, management fees, withdrawal limits, and hassles. And the cherry on top – enjoy daily returns!

*T&Cs apply

KDI Save

Accelerate your savings with a fixed* return rate, credited daily.

Turbocharge your cash with KDI Save and enjoy top tier returns of 4.0% Effective Annual Return (EAR)*. Forget about projected returns, lock-in periods, management fees, withdrawal limits, and hassles. And the cherry on top – enjoy daily returns!

*T&Cs apply

Rewarding Returns, with KDI Save

Rewarding Returns, with KDI Save

KDI Save Fees & Expenses

| Amount invested in KDI Save | Annual Management Fees | Expense Ratio |

|---|---|---|

| Any amount | 0.00% | 0.00% |

Unlock your daily returns today. Start earning with KDI Save!

KDI Save FAQ

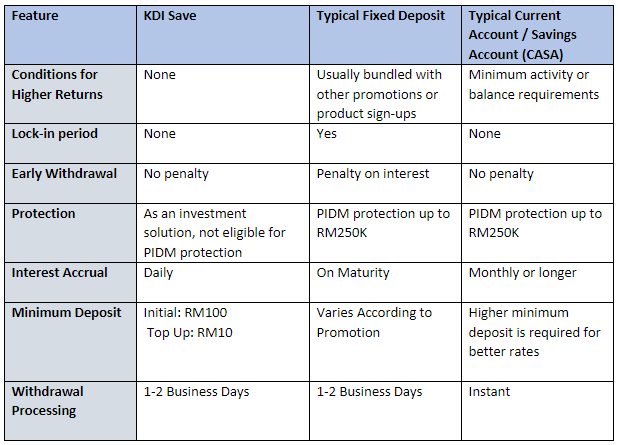

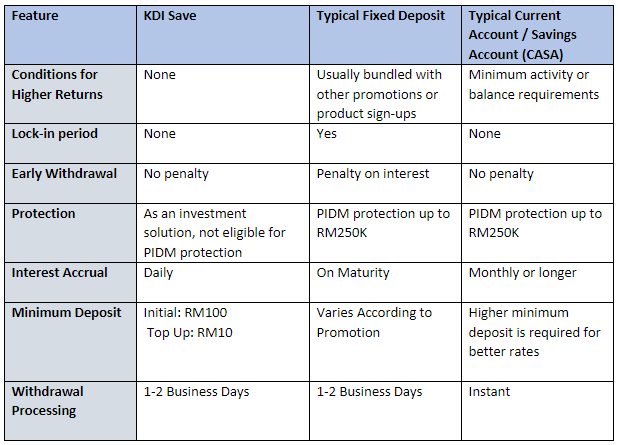

What is the difference between KDI Save and traditional bank savings products?

KDI Save is an investment solution that invests in high quality Ringgit-based money market and/or fixed income financial instruments. Traditional bank savings products such as fixed deposits (FD) and Current Account and Savings Account (CASA) products are deposits placed with banks in return for interest. KDI Save derives returns from its underlying investments, while bank savings commit to returns at a given interest rate backed by returns on loans issued, fees collected, investments, and other income generating activities.

Like traditional savings products, KDI Save offers a stated rate of return on your funds. In contrast with fixed deposits, KDI Save does not enforce any lock-ins on deposits, as funds may be withdrawn at any time. Plus, interest is accrued and credited on a daily basis, unlike FD's and CASA accounts that credit interest monthly or more. As an investment solution, KDI Save is not eligible for deposit insurance protection under Perbadanan Insurans Deposit Malaysia (PIDM).

What is Effective Annual Rate (EAR)?

The Effective Annual Rate is the interest actually earned on your investment as a result of compounding the interest and principal over time. A higher number of compounding periods results in higher EAR.

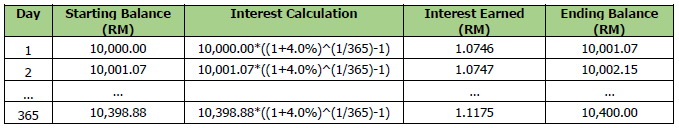

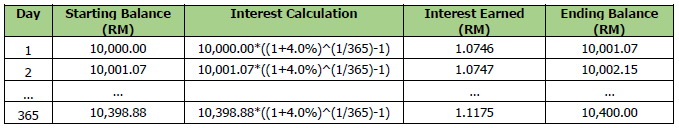

To compute the daily return rate on your KDI Save investment, you may use the following formula:

Daily Interest Amount=Value of investment × ((1+EAR)^(1⁄365)-1 )

Example 1: For RM10,000 deposited with KDI Save on day one

In Example 1, your savings of RM10,000.00 will compound to RM10,400.00 after one year of daily compounding, providing a return of 4%.

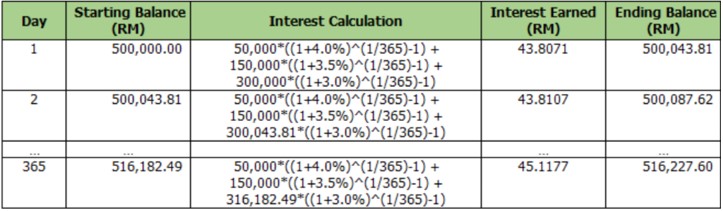

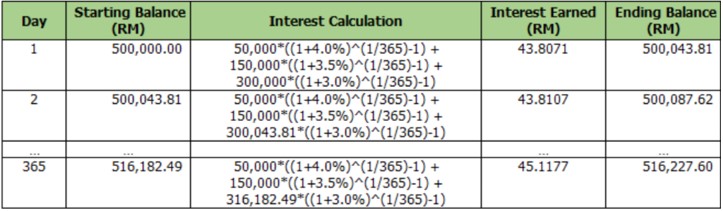

Example 2: For RM500,000 deposited with KDI Save on day one

In Example 2, your savings of RM500,000.00 will compound to RM516,227.60 after one year of daily compounding, providing a return of 3.25%.

What are the forms of returns from KDI Save ?

You earn daily interest rate, which is based on effective annual rate (EAR) calculation and is reflected in the daily value gain of your KDI Save account.

Can I change my risk profile for KDI Save?

KDI Save is only a cash management account that enables you to earn returns above savings rate and thus, there is no option for changing of risk profile for your KDI Save account.

Is my interest earned from KDI Save taxed?

The interest received from KDI Save is fully exempted from personal income tax.

In general, an individual resident enjoys tax exemption on interests received from:

(1) Negotiable certificate of deposit [Income Tax (Exemption) (No. 7) Order 2008]

(2) Rediscounting of banker's acceptance on repurchase agreement or any similar instrument of trade financing which is traded in money market fund [Income Tax (Exemption)(No. 7) Order 2008]

(3) Money deposited in any savings deposit, current deposit, fixed deposit or investment deposit with licensed banks [Income Tax (Exemption) (No. 7)Order 2008]

(4) Debentures or sukuk, other than convertible loan stock, approved or authorized by, or lodged with, the Securities Commission [Para 35, Sch 6 of Income Tax Act 1967]

Is KDI Save PIDM insured?

No, KDI Save is not PIDM insured. Nonetheless, we carefully protect your KDI Save deposits by investing in very low risk assets.

Rewarding Returns, with KDI Save

Benefits of KDI Save

KDI Save derives returns from deposits with varying maturity periods.

KDI Save FAQ

What is the difference between KDI Save and traditional bank savings products?

KDI Save is an investment solution that invests in high quality Ringgit-based money market and/or fixed income financial instruments. Traditional bank savings products such as fixed deposits (FD) and Current Account and Savings Account (CASA) products are deposits placed with banks in return for interest. KDI Save derives returns from its underlying investments, while bank savings commit to returns at a given interest rate backed by returns on loans issued, fees collected, investments, and other income generating activities.

Like traditional savings products, KDI Save offers a stated rate of return on your funds. In contrast with fixed deposits, KDI Save does not enforce any lock-ins on deposits, as funds may be withdrawn at any time. Plus, interest is accrued and credited on a daily basis, unlike FD's and CASA accounts that credit interest monthly or more. As an investment solution, KDI Save is not eligible for deposit insurance protection under Perbadanan Insurans Deposit Malaysia (PIDM).

What is Effective Annual Rate (EAR)?

The Effective Annual Rate is the interest actually earned on your investment as a result of compounding the interest and principal over time. A higher number of compounding periods results in higher EAR.

To compute the daily return rate on your KDI Save investment, you may use the following formula:

Daily Interest Amount=Value of investment × ((1+EAR)^(1⁄365)-1 )

Example 1: For RM10,000 deposited with KDI Save on day one

In Example 1, your savings of RM10,000.00 will compound to RM10,400.00 after one year of daily compounding, providing a return of 4%.

Example 2: For RM500,000 deposited with KDI Save on day one

In Example 2, your savings of RM500,000.00 will compound to RM516,227.60 after one year of daily compounding, providing a return of 3.25%.

What are the forms of returns from KDI Save ?

You earn daily interest rate, which is based on effective annual rate (EAR) calculation and is reflected in the daily value gain of your KDI Save account.

Can I change my risk profile for KDI Save?

KDI Save is only a cash management account that enables you to earn returns above savings rate and thus, there is no option for changing of risk profile for your KDI Save account.

Is my interest earned from KDI Save taxed?

The interest received from KDI Save is fully exempted from personal income tax.

In general, an individual resident enjoys tax exemption on interests received from:

(1) Negotiable certificate of deposit [Income Tax (Exemption) (No. 7) Order 2008]

(2) Rediscounting of banker's acceptance on repurchase agreement or any similar instrument of trade financing which is traded in money market fund [Income Tax (Exemption)(No. 7) Order 2008]

(3) Money deposited in any savings deposit, current deposit, fixed deposit or investment deposit with licensed banks [Income Tax (Exemption) (No. 7)Order 2008]

(4) Debentures or sukuk, other than convertible loan stock, approved or authorized by, or lodged with, the Securities Commission [Para 35, Sch 6 of Income Tax Act 1967]

Is KDI Save PIDM insured?

No, KDI Save is not PIDM insured. Nonetheless, we carefully protect your KDI Save deposits by investing in very low risk assets.

Terms & Conditions

Terms & Conditions

Effective Date

The Effective Annual Rates set out below shall be effective from 14th June 2023 (“Promotion Date”) and shall apply to all existing investments, as well as any new deposits made into KDI Save on or after the Promotion Date. This promotion supersedes all previous promotions for KDI Save.

Eligibility

To be eligible for this promotion, you must have a KDI Save account. Kenanga Investment Bank Berhad (“Kenanga”) may at its sole discretion reject any deposits made. Only a successful deposit will entitle you to this promotion. To avoid your deposit being rejected, please make sure that the deposit is made from your personal bank account.

Effective Annual Rates

Depositing funds into your KDI Save account from the Promotion Date will entitle you to enjoy different tiers of Effective Annual Rates based on the total amount of investments made into your KDI Save account:

| Tier | Investment Amount (RM) | Effective Annual Rate (%)* |

|---|---|---|

| Tier 1 | RM0.00-RM50,000.00 | 4.0 |

| Tier 2 | RM50,000.01 to RM200,000.00 | 3.5 |

| Base Tier | RM 200,000.01 and above | 3.0 |

* The Effective Annual Rate is the interest actually earned on your investment as a result of compounding the interest and principal over time.

For further information, please refer to the “General KDI Save” tab of the FAQ.

You may choose to do so by investing directly into your KDI Save account or by transferring your existing investments in KDI Invest to KDI Save on or after the Promotion Date.

Withdrawal Terms

You may withdraw your investment(s) at any time and there is no withdrawal limit. For investment(s) subject to this promotion, withdrawals will be based on the “First-In, Last-Out” principle that is, withdrawals will be made from the investment pool with the lowest return rate first until such investment has been exhausted before withdrawal is applied to the investment pools with the higher return rate.

General Terms and Conditions

- In the event you are found to have committed fraud and/or abuse of the system and/or any other scenario deemed as a violation of the terms stated herein at any point of time, Kenanga reserves the right at its sole discretion to disqualify and to cancel, withdraw, or recall any reward(s) granted. Kenanga shall have the right to initiate any action deemed necessary against the said customer.

- Kenanga reserves the right to vary the Effective Annual Rates at any time.

- All investments come with risks and KDI Save is subject to investment risks, including the possible loss of the principal amount invested. For example, given that the underlying investments for KDI Save include money market and fixed income instruments, there are credit/default risks and interest rate risks.

- Deposits placed under KDI Save are not protected under Perbadanan Insurans Deposit Malaysia (“PIDM”)

- Kenanga reserves the right to make changes to these Terms and Conditions at any time.

- Kenanga reserves the right to make further verifications and request for further personal identification details and documents, as well as the right to disqualify or withdraw your eligibility for the promotion at any time.

- Kenanga reserves the right to cancel, shorten, extend, suspend or terminate this promotion at any time, and the cancellation, extension, suspension or termination shall not entitle you to claim any compensation from Kenanga for any and all losses or damages suffered or incurred by a you as a result of the said cancellation, extension, suspension or termination.

- Kenanga shall not be liable for any claim made by you or for third-party claims or losses of any nature, including but not limited to, loss of profits, punitive, indirect, special, incidental, or consequential damages or for other damages and any related claims of any nature, including direct, indirect, third party, consequential or other damages resulting from or in connection with this promotion.

- In the event of misuse, fraud, manipulation, circumvention or a breach of the terms and conditions of this promotion, Kenanga is entitled to exclude you from participating in this promotion, on the basis of a suspicion and is not bound to inform you or to provide proof.

- Kenanga does not take any responsibility in the event you are prevented from participating in the promotion, as a result of certain technical restrictions or other limitations specific or force majeure which including but not limited to regulatory and/or government directive, act of God etc.

- This promotion is subject to the personal data and privacy policy and general terms and conditions available on the KDI website (“KDI T&Cs”): Platform Agreement, Account Opening Agreement, Privacy Policy, and Notice and Disclaimer.

- In the event of any inconsistency between these terms and conditions and any advertising, promotional, publicity and other materials relating to or in connection with this promotion, these terms and conditions shall prevail.