September 2022 Market Insights

Brought to you by the Kenanga Digital Investing (KDI) team, here is our 8th Market Insights column. Our Head of Digital Investing, Cheong Yew Huan will discuss the latest in financial news and present his thoughts on making the most of today’s market.

Market Recap

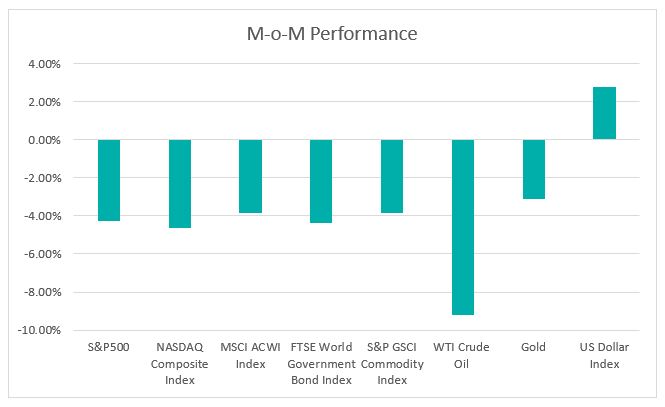

Chart 1: Index Performance in August 2022

Market

Global equities have been under selling pressure in August after a sharp rally from the June lows. The selling accelerated after Powell’s hawkish speech during the Jackson Hole symposium on the Federal Reserve’s commitment to lower inflation until closer to its 2% long-range goal. He warned that rising interest rates would cause “some pain” to the US economy.

The bond market sold off during the month with FTSE World Government Bond Index decreasing by 4.35%. The 2-year US treasury yield, which is sensitive to Fed rate hikes, rose sharply over the month to 3.4950%, the highest since 2007. The 10-year treasury yield closed at 3.196%. The US Treasury yield curve remains inverted with the 2-year treasury yield higher than 10 years US Treasury yield.

The WTI Crude Oil tumbled 9.2%, driven by the fears of energy demand will be impacted by slower global economic growth. The S&P GSCI Commodity Index slid 3.86% as the lockdown in major cities in China including Shenzhen, Guangzhou and Dalian added to worries that high inflation and interest rate hikes are denting commodities demand.

The US dollar continue to rally in August, driven by heightened risk aversion, tighter monetary policy and the Fed’s hawkish message on rising interest rates.

Outlook

The recent selling has placed downward pressure on equity and fixed income markets. The market is expected to remain choppy in the near term given increasing investor concerns that the aggressive monetary policy stance will lead to recession. The upcoming FOMC meeting in September will be the key event to be watched closely, whether any of the Fed’s efforts to tame inflation will come at the expense of the economy.

On the other hand, the market selling may price in more uncertainties. The global inflation pressures started to ease on the back of lower commodity prices. The US inflation seems to have passed its peak as CPI increased 8.5% year on year in July, down from 9.1% in June.

The economic data released recently defy signs of a worsening economy. The jobs markets in the US remain healthy with additional 315,000 jobs in August. The unemployment rate edged to 3.7% in August from 3.5% in July but is still close to a 50-year low.

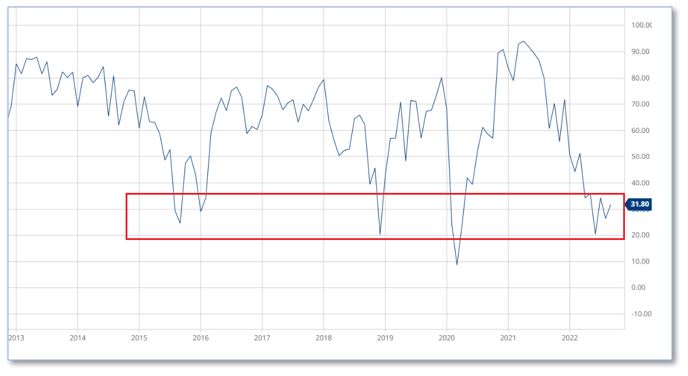

Valuation-wise, the S&P 500’s price-to-earnings ratio (P/E) is back down to about 17x from 18x after the selloff in August. In terms of market breadth, only 31.8% of S&P500 stocks are trading above their 200-day moving average. The index has come off from the peak of 94% in March 2021 and is now on the low side. (Please refer to the chart below). The index indicates that investor sentiment is bearish short-term. More potential upside over the long term with the downside risks has reflected in the recent market sell-off.

Chart 1: S&P500 Stocks Above 200-Day Average

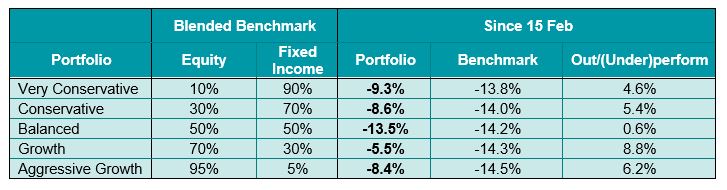

KDI Invest Portfolio Performance As at 31 August 2022

Remarks:

Benchmark: Equity: MSCI ACWI Index + Fixed Income: FTSE World Government Bond Index

Past performance is not indicative of future results.

The above table shows the performance of selected KDI portfolios since their launch on 15 February 2022. The portfolio returns are ranging from -13.5% to -5.5%, outperforming the benchmark by 0.6% to 8.8%.

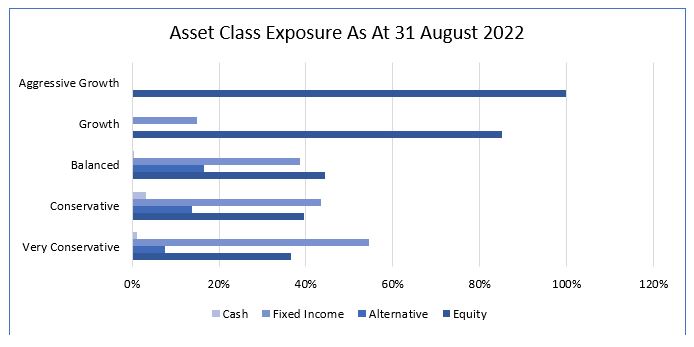

With the rebalancing triggered in early August 2022, the equity exposure is currently in the range between 37% and 100%. The Very Conservative and Conservative portfolio holdings are skewed towards fixed income with exposure ranging from 43% to 55%. The portfolio strategy remains intact with investing in multi-asset and diversified globally. All portfolios are customized based on investors’ risk tolerance and able to traverse through market volatility.

Please note that the above performance is based on five proxy portfolios. Actual KDI Invest portfolio performance may vary from the above due to the customization by the KDI robo-advisor A.I. based on investors’ risk profiling, as well as the timing of market entry.

Citation:

https://www.barchart.com/stocks/quotes/$S5TH/interactive-chart

https://www.theguardian.com/business/2022/sep/02/us-economy-adds-jobs-august