September 2025 Market Insights

Welcome to our Market Recap for August 2025. In this newsletter, we will share with you a brief recap on key economic data for the past month and our portfolio performance.

Market Recap

Market

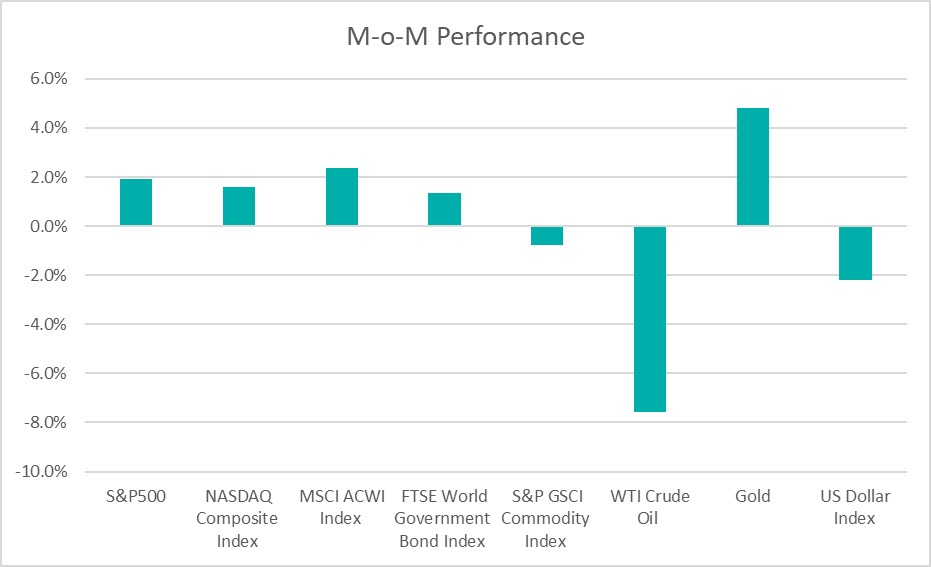

August 2025 was a month characterized by market resilience set against a backdrop of global uncertainty. Global stock market rally continued its ascent, as the S&P 500, Nasdaq Composite and MSCI All-Country World (ACWI) Index posted strong gains of 1.9%, 1.6% and 2.4% respectively in August, driven primarily by robust US corporate earnings.

Fixed-income markets performed well in August, with Treasury bond prices rallying and interest rates falling for the sixth time in eight months. The yield on the 10-year U.S. Treasuries, a key barometer for borrowing costs, ended the month at 4.23% (July: 4.37%). This rally was largely driven by rising market conviction that the Federal Reserve would soon cut interest rates, especially in light of the softening labour market data. As of end-August 2025, CME FedWatch data indicated an 86% chance of 25bps rate cut at the US Federal Reserve’s upcoming 17 Sept meeting.

The S&P GSCI Commodity Index experienced a slight dip of 0.8% as the fall in crude oil price (-7.6%) was largely offset by rising gold price (+4.8%). Gold prices rose for the seventh consecutive month, with spot gold trading at new all-time highs above $3,448 per ounce, fuelled by growing conviction that the Federal Reserve would cut interest rates in September. In contrast, crude oil prices decreased throughout the month. This decline was largely driven by concerns about oversupply, production increases, and a weakening global demand outlook. Bitcoin consolidated in August (-7.8% on-month) to $109,252.

The US dollar weakened against the Malaysian Ringgit, ending August-2025 at 4.225, from 4.265 in July. To date, the Malaysian ringgit appreciated by 5.1% against the U.S. dollar.

Outlook

While corporate earnings painted a picture of economic health, the broader macroeconomic data presented a more complex narrative. On the inflation front, the Consumer Price Index (CPI) increased by 0.4% in August, a pickup from July’s 0.2% rise. This brought the year-over-year CPI increase to 2.9%, up from 2.7% in the period ending in July. The labour market also signalled a softening trend. Total nonfarm payroll employment showed little change in August, adding a modest 22,000 jobs, continuing a sluggish pace of hiring that has persisted since April. This weakness in job creation was reflected in the unemployment rate, which ticked up to 4.3% in August from 4.2% in July.

The Federal Open Market Committee (FOMC) concluded its August meeting by leaving the federal funds rate unchanged in the 4.25%-4.50% range for the fifth consecutive time. While this decision was widely anticipated by markets, the underlying discussions and the final vote revealed a “divided” committee. For the first time, the meeting recorded two formal dissents pushing for an immediate 25-basis-point rate cut. Markets are overwhelmingly expecting the first rate cut to occur in September, with a 25-basis-point reduction seen as highly likely.

China’s economy shows signs of weakness in August as retail sales and industrial output miss forecasts. Industrial output rose 5.7%, the slowest pace of growth since November and trailing June’s rate of 6.8%. Retail sales added 3.7% in the month, down from 4.8% in June. Authorities have set a full-year growth target of around 5% for 2025, in line with last year. GDP added 5.2% in the second quarter on a year earlier.

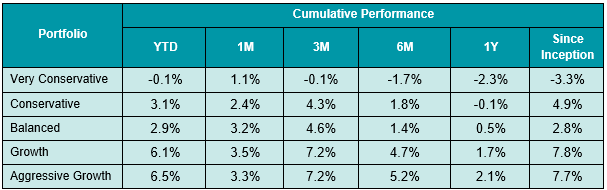

The provided table offers information on the cumulative performance of selected KDI portfolios since their launch on February 15, 2022. The portfolio returns (in USD) range from -3.3% to 7.8%. Year-to date, the portfolios recorded returns within a range of -0.1% to 6.5%.

The S&P500 index is up by 9.98% this year to end of July. A notable development was the broadening of this rally, as market gains extended beyond the megacap tech giants to encompass small- and mid-sized companies and previously lagging sectors, such as Healthcare, Materials, and Energy, which were among the best-performing S&P 500 sectors in August.

US trade and economic policies continue to be a significant source of uncertainty. Starting August 1st, the US implemented a new tariff framework under President Trump that imposes steep “reciprocal” duties ranging from 10% to 41% on imports from dozens of countries. A key development is the extension of the US-China tariff truce by 90 days to November 10th. The extension provides both nations with more time to negotiate a broader trade agreement and has been credited with sparking a positive market response. Separately, a significant trade deal was finalized between US and the European Union in late July, which helped avert a full-blown trade war for both sides.

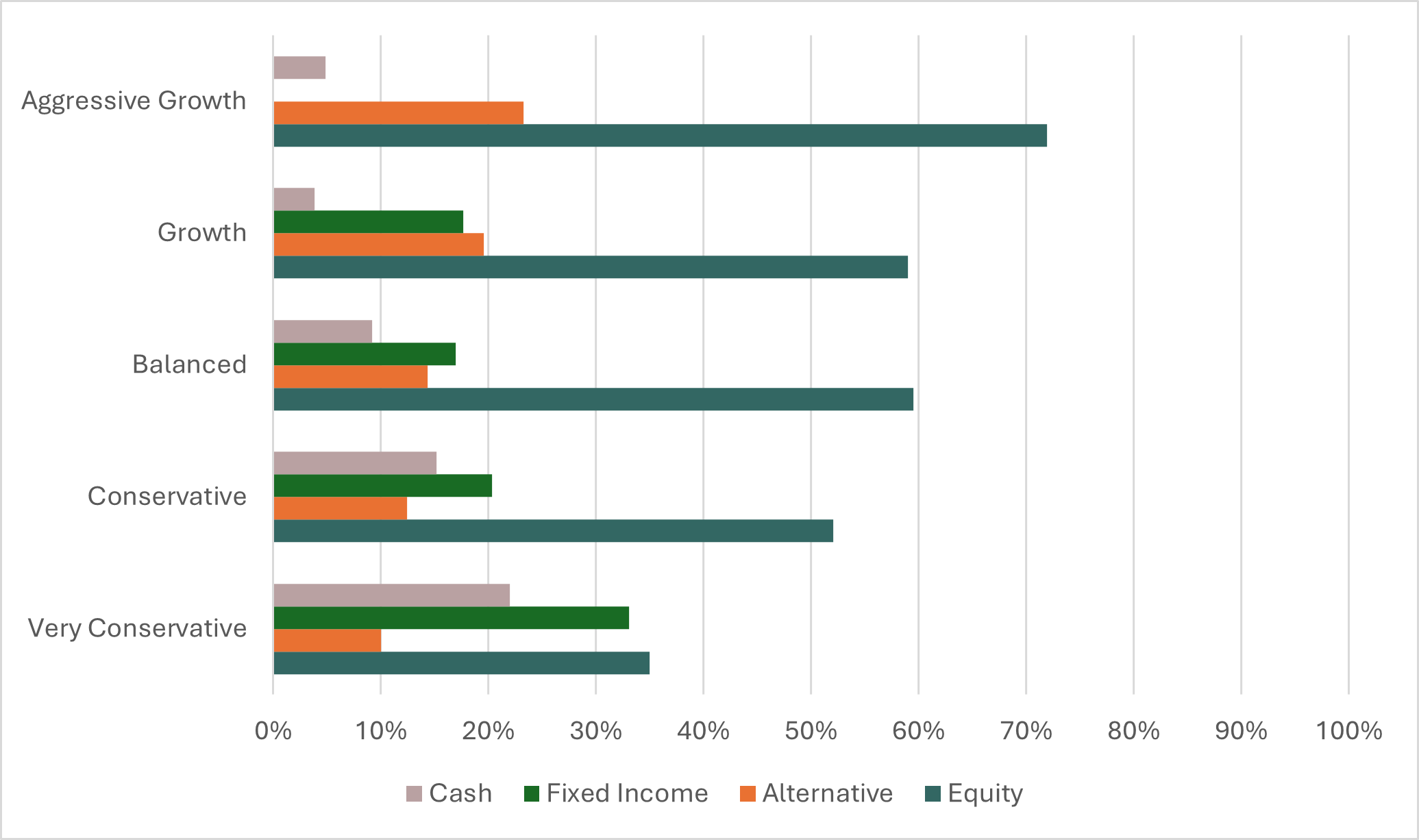

KDI’s portfolios are well diversified to withstand market fluctuations, and will remain vigilant in monitoring adjusting changes, asset allocation when necessary. As market volatility rises, the portfolios may shift to a risk reduction mode to protect downside. This strategy aims to safeguard your investments during uncertain times while remaining poised to take advantage of favourable conditions.

Kindly note that the performance and asset class exposure illustrated above are derived from five proxy portfolios. The actual performance and exposure of your investment portfolio may differ due to the customisation made by our proprietary algorithms that tailors the investment to your unique risk profile, as well as the timing of market entry.

Our Perspective: ‘Goldilocks’ gets a bit restless – not too hot, not too cold, but definitely far from predictable.

August has delivered encouraging performance for the equity markets, with major benchmarks returning solid gains despite chatter of global uncertainty. To recap, we saw decent gains across the board, with the S&P500 climbing up 1.9%, the Nasdaq was up 1.6% and the MSCI ACWI posted a gain of 2.4%, all buoyed by healthy corporate earnings. We also saw the bond market having a good run, with prices driving the benchmark 10-year note down from July’s 4.37% to finish at 4.23%, as bond traders positioned for what looks like an almost certain Fed pivot. We, however, saw a different story in commodities. Energy got hammered with sliding prices over supply glut fears, while precious metals continued to rally with gold breaking through the $3,400 mark as dovish Fed expectations intensified.

What’s fascinating is the disconnect we are currently seeing: corporate fundamentals seem robust, but the underlying economy is starting to show some fatigue. We can see that price pressures are building again with headline inflation moving back to 3%, with unemployment rates edged up to 4.3%. In the East, China is seen to be clearly downshifting with factory output being at its weakest pace since November, together with spending momentum fading. Taking a step back, we can expect global geopolitics stress to ease as China and the U.S. both expressed a mutual desire to negotiate a solution than a trade war. We highly encourage investors to remain invested and well-diversified across both regions and assets to combat risks from trade-related slowdowns or re-emergence of inflationary pressures. Looking ahead, we take a cautious stance but are moderately optimistic in the coming months as 2025 comes to an end.

Citation:

https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

https://www.reuters.com/business/wall-st-week-ahead-us-jobs-data-poses-hurdle-rate-cut-hopes-stocks-rally-2025-08-29/

Disclaimer

Kenanga Digital Investing (“KDI”) is licensed by the Securities Commission of Malaysia as a Digital Investment Management Company. KDI is authorised to carry out the business of fund management blending innovative technology into automated portfolio management services offered to clients under a license issued pursuant to Schedule 2 of the Capital Markets Services Act (CMSA) 2007.

Investment involves risk, including the possible loss of capital you invest. Past performance does not indicate future performance. Historical returns, expected returns, and probability projections are provided for informational and illustrative purposes, and may not reflect actual future performance. KDI does not assume any fiduciary responsibility or any liability for any consequences, financial or otherwise, arising from any transaction in reliance on such information. Investors should rely on their own evaluation or consult an independent financial, accounting, tax, legal or other professional advisers to access the merits and risks before investing.

Any forward-looking statements, predictions, projections or forecast on the economy, stock market, bond market or economic trends of the markets contained in this material are subject to the market influences and contingent upon matters outside the control of KDI and therefore may not be realised in the future. No representation is made as to the completeness and adequacy of the information to make an informed decision.

Neither the information, nor any opinion, contained in this article constitutes a promotion, recommendation, solicitation, invitation by KDI or its affiliates to buy or sell any securities, investment schemes or other financial instruments or services, nor shall any security, collective investment scheme, or other financial instruments or services be offered or sold to any person in any jurisdiction in which such offer, solicitation, purchase, or sale would be unlawful under the securities laws of such jurisdiction. This is not intended to be an invitation or offer made to the public to subscribe for any financial product or other transaction.

This information has not been reviewed by the Securities Commission of Malaysia.