What Are the Options to Invest with My Excess Cash?

The basic principles of how one manages money boil down to three elements: spending, saving and investing. Simple to understand, difficult to master.

In Malaysia, the dependence on Employees Provident Fund (EPF) withdrawals in response to the Covid-19 pandemic resulted in lower savings across the country. Worse still, prior to the pandemic, the retirement savings rate of Malaysians was already low, as EPF statistics showed that two out of three EPF members aged 54 have retirement savings of less than RM50,000, putting them at risk of living below the poverty line.

According to the RinggitPlus 2018 Malaysian Financial Literacy Survey, as many as 59% of Malaysians do not have enough savings to last for more than 3 months, and that 34% admitted to spending equal to or more than their monthly salary.

First You Save, Then You Invest

We hae all heard the advice to ‘save for a rainy day’ countless times. Of course, there are many who are able to save a good portion of their earnings, allocated to their investment of choice, but somehow the growth of their nest egg is just too low to keep up with the times.

Let’s go through the current investment landscape in Malaysia and see if some of these points may realign your journey to a better investing approach.

Typical Investment Avenues in Malaysia

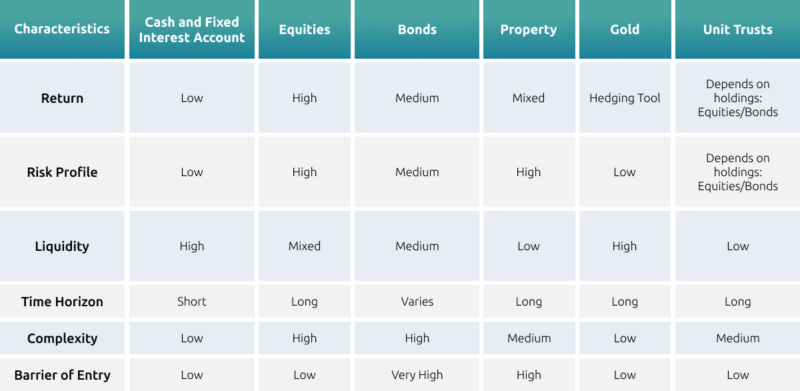

The range of investment options in Malaysia is still growing. That being said, we still have plenty of access to innovative financial products in the market. Let us discuss some of the more common types of investments available in the current marketplace:

At first glance, the variety of investment tools available can look intimidating. This is even before including other fintech-driven alternative investments, like cryptocurrency, Non-Fungible Token (NFT), equity crowdfunding, peer-to-peer lending, and more, which have very different risk and return profiles to traditional investments and may not be ideal for the starting or average investor.

Robo-advisory: A New Investment Option

With all the fintech-driven innovations in the market, the evolution of the investment landscape has empowered the public to utilise investing tools that were once exclusively available only to fund management firms and professional investors.

Innovating on the traditional fund management approach,KDI is a fresh new robo advisory platform that leverages on Artificial Intelligence (A.I.), providing professional portfolio management services at an affordable rate, with low minimum investment.

KDI Invest utilises algorithmic investing that performs portfolio management in accordance with your risk appetite, ensuring that your investment goals are well matched to your unique circumstances.

By investing in Exchange-Traded Funds (ETF), investors are able to obtain diversified exposure while still achieving economies of scale in terms of cost, ultimately leading to an increased risk-adjusted return. KDI Invest also offers a 0% Management Fee for amounts invested of RM3,000 and below, providing an affordable investment entry for a wider group of aspiring investors.

KDI Save– Protecting Your Assets

On the other hand, KDI Save revolutionises the typical fixed deposit account by offering better interest rates without sacrificing flexibility in terms of liquidity.

From now until 31st December 2022, KDI Save offers a market-beating interest rate of 3% per annum for an investment amount of up to RM200,000. Excess amounts above RM200,000 will be entitled to a base return of 2.25% per annum.

Combined together, both aspects of KDI represent a holistic platform that appeals to both groups of money-savers as well as investors. Find us here for more information on how KDI can transform the way we save and invest.