March 2022 Market Insights

Welcome to the second Market Insights column, brought to you by the Kenanga Digital Investing (KDI) team. Our Head of Digital Investing, Cheong Yew Huan will be running through the latest in global finance and how to best capitalise on market movements.

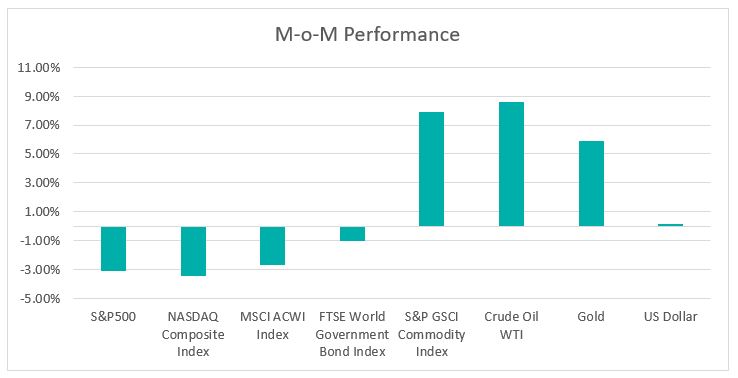

We started 2022 by experiencing negative returns for the first two months in most asset classes, a first since the pandemic began. The early days of 2022 were riddled with geopolitical tensions and the threat of impending interest rate hikes. Such bleak prospects meant that was little opportunities for equity and fixed income investors as bond yields also spiked. Major indices and sectors all fell across the board, with only commodities gaining by riding on the tailwinds of the Russia-Ukraine tensions.

Prelude to War?

The decade-long conflict revolving around the old Soviet Union is again making headlines as Russia, to global dismay, invaded Ukrainian territory leading to a burst of sanctions from multiple nations imposed on Russia. While sanctions or embargoes are not new to Russia – for example since the 2014 Crimean crisis – Russia’s RTSI Index still tanked by 50% after Russia’s invasion of Ukraine on 24 February 2022.

One possible avenue for retaliation for Russia is by restricting gas supplies to Europe which could pose a bigger problem to the region as close to 40% of natural gas used by Europe was imported from Russia. On the same note, Russia could also be feeling the brunt if gas supply were to be sanctioned, as it supplies more than 70% of its production to Europe.

Which explains why China’s role as a trading partner to Russia has been expanding of late. As a matter of fact, both nations have agreed to a 30-year contract of gas supply via a new pipeline. Under plans previously drawn up, Russia aimed to supply China with 38bcm of gas by pipeline by 2025. As the world embargoes Russia, China’s influence could make further headway into Russia. Just like the saying “the enemy of my enemy is my friend”, China could capitalize on this crisis, further preci pitating its rise in the global economy.

China

Regulatory crackdown has been the centre piece of action for the Chinese Communist Party (CCP) of late. China has initiated a multi-faceted approach involving multiple regulatory bodies focusing on fintech, personal data security, anti-competition, and online education.

Regulation is not always a bad thing, if correctly implemented. With the assurance of compliance by the companies, this could replenish investors’ confidence in a market where transparency is not among its best traits. Improving market confidence and growing consumption could provide the next catalyst for growth in China. Currently, 45% of total household consumption comes from the 30 largest cities in China. But trends are about to shift as lower tier cities are stepping up to fuel consumption upgrade on the back of rapid income growth and improving accessibility. Technology driven e-commerce sectors continue to be the driving force especially in rural areas.

U.S.

While the U.S. exceeded expectations by expanding at an annualized rate of 6.9% for its 2021 Q4 gross domestic product (GDP), a slowdown in global supply chains and a lack of fiscal policy support continues to be the central theme in driving the risk-off sentiment.

Further straining sentiment are comments from the Federal Reserve (Fed) chairman, which suggested that an interest rate hike of 0.25 basis points in March to be extremely likely. Given the latest January inflation data where consumer price index (CPI) surged 7.5% on an annualized basis, at this rate, the market is now pricing for the quantum of the hike, rather than just the possibility.

Commodities

Commodities continued to rally in February, as concerns grew that Russian exports of all commodities from oil to grains would be impacted by sanctions imposed by Western countries. Particularly of note is the cut off of Russian banks from the SWIFT international payment system. Meanwhile, Brent crude oil exceeded US$100 a barrel after Russia launched military attacks on Ukraine and the demand for safe-haven assets drove gold prices to above the US$1,900 level.

What’s Next?

We expect major asset classes will continue to undergo additional bouts of turbulence, particularly in U.S. equities, due to global tensions and potential interest rate hikes. The defensive and inflation hedged asset classes such as short-term bonds, Treasury inflation-protected securities (TIPS), basic materials and energy are likely to outperform if there is no sign of easing in inflation pressure and geopolitical risk.

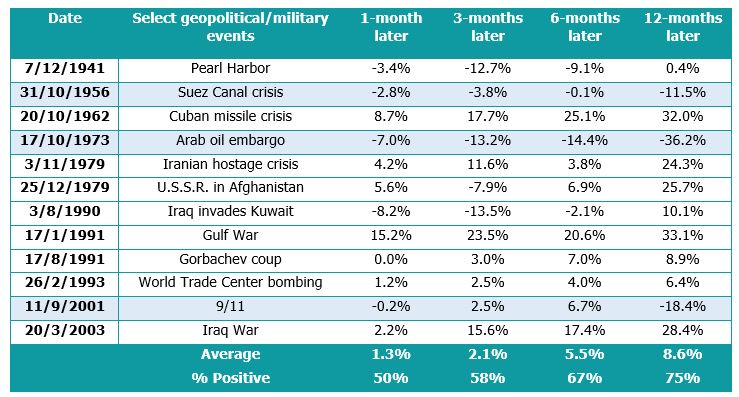

Table: S&P500 Performance During Geopolitical Events

Source: Truist IAG, FactSet. Grey shading represents down markets where the economy was in recession during the period.

To see further ahead, we try to look back to find context. Historically, geopolitical events created market volatility in the short-term. However, the market always recovered over the next 3 to 12-month period. Referring to the table above, the S&P500 posted positive returns within a 12-month period for 9 of 12 geopolitical events. For the other 3 geopolitical events (in year 1956, 1973 and 2001), the S&P500 performance was impacted by recession.

With the Russia-Ukraine conflict in the limelight, sentiment is likely to be dampened as investors brace for more volatility ahead, especially in the month of expected rate hikes. This of course generates buying opportunities in that small window, but how many investors can actually stay level-headed and capitalize on the right opportunities for medium to long term investments?

Emotions such as fear, greed, and anxiety are what make us uniquely human. However, the same emotions can prove to be detrimental to staying rational during periods of high volatility. Thus, it is crucial to ensure that emotions do not get in the way of making sound investment decisions.

KDI Invest: Taking the Emotions Out of Investing

KDI Invest is a fully automated and Artificial Intelligence (A.I.) driven robo-advisory platform. It uses actual data instead of human emotions in making investment decisions, minimizing behavioural biases. As Warren Buffet often says, “be fearful when others are greedy, and greedy when others are fearful”.

Did you know that in a study published in the Journal of Financial Planning, investors who use a behaviour-modified approach or investing with emotions removed actually saw higher returns of up to 23% over a 10-year period?

If you intend to stay rational during the coming market turbulence to capture the gains in the coming months, be sure to check out KDI Invest, where anyone can start investing like a pro.