March 2025 Market Insights

Welcome to the March edition of the Market Insights column brought to you by the Kenanga Digital Investing (KDI) team. In this edition, Our Head of Portfolio Management, Wu Kin Hoe, will discuss the latest financial news and share his insights on how to make the most of today’s market.

Market Recap

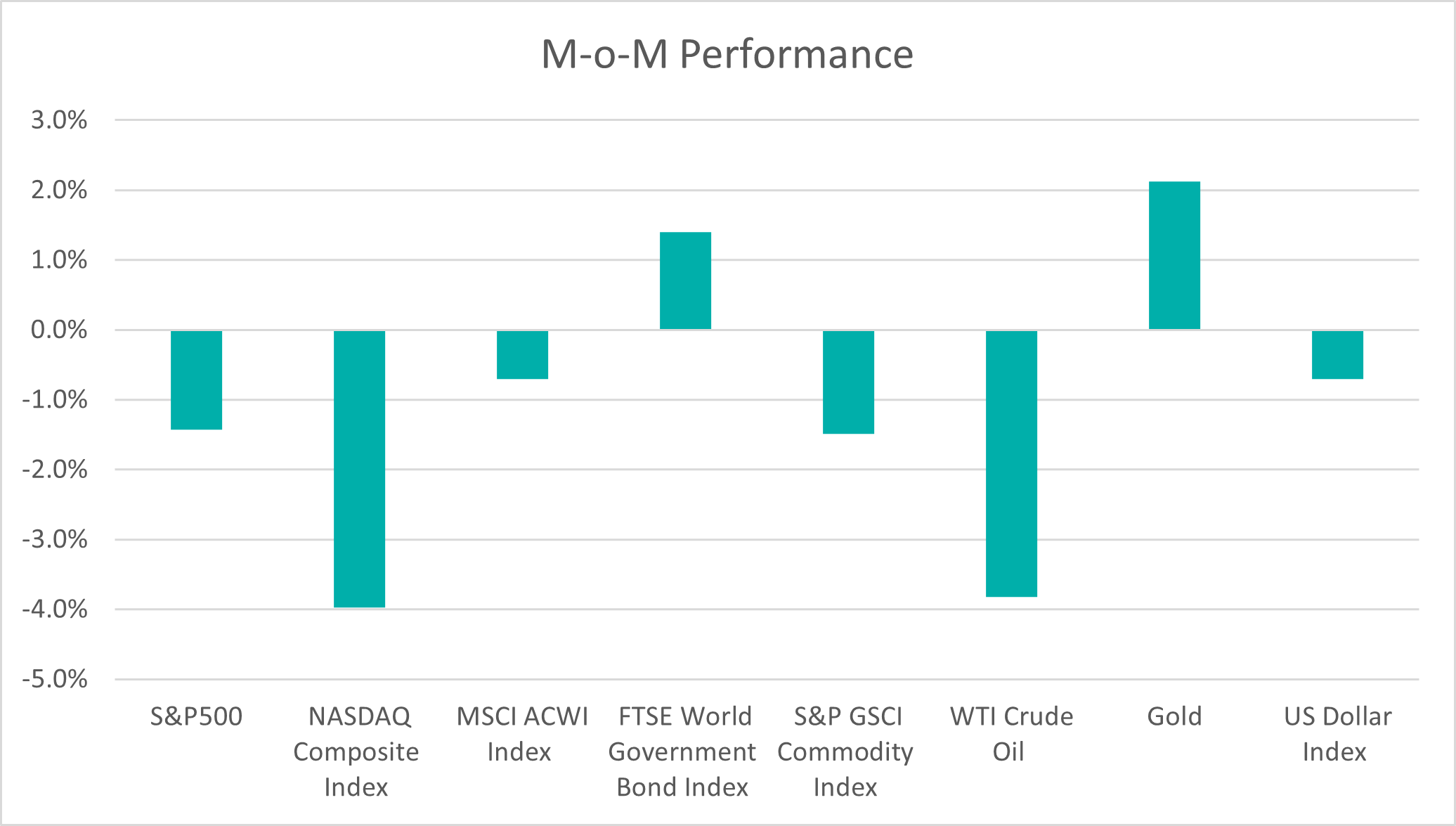

Chart 1: Index Performance in February 2025

Market

US stocks fell in February amid some softer economic data and concerns about the potential impact of trade tariffs on the economy. The S&P 500 and Nasdaq Composite Index saw declines of 1.4% and 4.0% respectively for the month.

Treasury yields softened by 21 – 33 basis points, as investors turned to the relative safety of government debt. According to CME FedWatch, the market is now pricing in a 97% chance of no rate cut at the U.S. Federal Reserve’s (‘Fed’) upcoming March 2025 meeting.

Commodities experienced a general decline due to concerns that tariffs might hinder economic activity and subsequently reduce demand. Crude oil was particularly affected as the OPEC oil cartel plans to increase output in April, its first since 2022. However, gold edged up to $2,858 per ounce, up 2.1% month-over-month, as investors sought safety amid uncertainties surrounding US President Donald Trump’s policies.

The U.S. dollar remained largely unchanged in February with the USDMYR exchange rate at 4.4625, vs. January’s 4.4602.

Outlook

Whereas the US had been by far the fastest growing major developed economy late last year and into January, February saw the US expansion decelerate. Several recent economic indicators have shown signs of weakening, such as consumer confidence, business activity, and retail sales. Additionally, the Trump administration’s ‘dramatic’ policy approach has created uncertainty for both consumer and business outlooks.

The Fed first reduced interest rate from its 23-year highs in September 2024 and made two further cuts before the end of 2024. The recent inflation reading is 3%, still above the Fed’s target of 2%. There are ongoing concerns that tariffs imposed by President Trump could drive up inflation further. Minutes from the January Federal Open Market Committee (FOMC) meeting indicated that policymakers want to see “further progress on inflation” before considering any further rate cuts. The Fed had kept rates on hold at the January meeting.

In the recently concluded annual parliamentary session, China has set an economic growth target for this year of “around 5%”. Industrial modernisation, technological self-reliance and expanding domestic demand all featured prominently in its catalogue of ten “major tasks” for the year ahead. Stimulating domestic spending was elevated from 3rd priority last year to the top task for 2025. In a rare move, Beijing raised its fiscal deficit – the difference between the government’s spending and revenue – by one percentage point to 4% of GDP, the highest level in decades. As well as a bigger headline deficit, the central government will also loosen the financial reins on local governments. The policies underline the government’s commitment to increase spending to shore up growth.

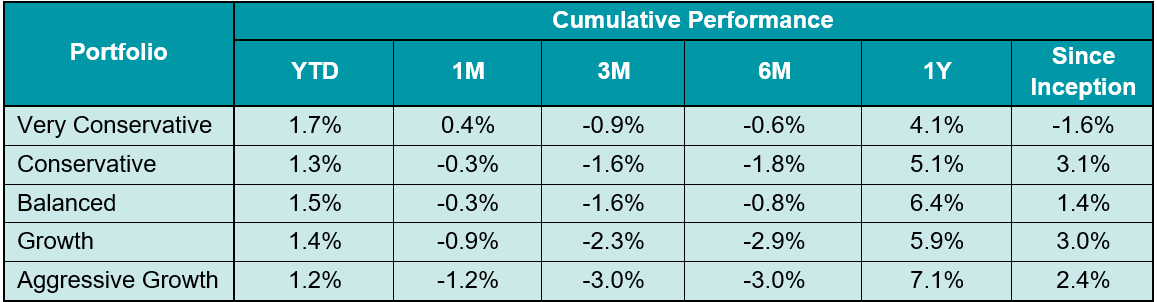

Table 1: KDI Invest Portfolio Performance as at 28 February 2025

The provided table offers information on the cumulative performance of selected KDI portfolios since their launch on February 15, 2022. The portfolio returns (in USD) range from -1.6% to 3.1%. Year-to date, the portfolios recorded returns within a range of 1.2% to 1.7%.

The S&P 500 commenced the year with a robust 2.7% return in January. However, the market has since turned red due to growing tariff fears and US growth worries. Additionally, persistent worries about the earnings sustainability of US mega-cap tech stocks, particularly those involved in artificial intelligence, also weighed on returns. Tech stocks tumbled by the most since 2022 — driving the tech-heavy Nasdaq Composite Index down by nearly 10% to date. On the flip side, healthcare, consumer staples and utilities have held up better, indicating market rotation into defensive sectors.

Looking ahead, several factors, including the mixed US economic outlook, hawkish tilt in the Fed monetary policy, stretched market valuations, and President Trump’s economic policies, could contribute to increased market volatility. President Trump’s promise of regulatory cuts and growth-focused policies initially lifted stocks following his November election victory. However, the shine has recently worn off due to growing concerns about their adverse economic and inflationary impacts.

KDI’s portfolios are well diversified to withstand market fluctuations, and will remain vigilant in monitoring changes, adjusting asset allocation when necessary. As market volatility rises, the portfolios may shift to a risk reduction mode to protect downside. This strategy aims to safeguard your investments during uncertain times while remaining poised to take advantage of favourable conditions.

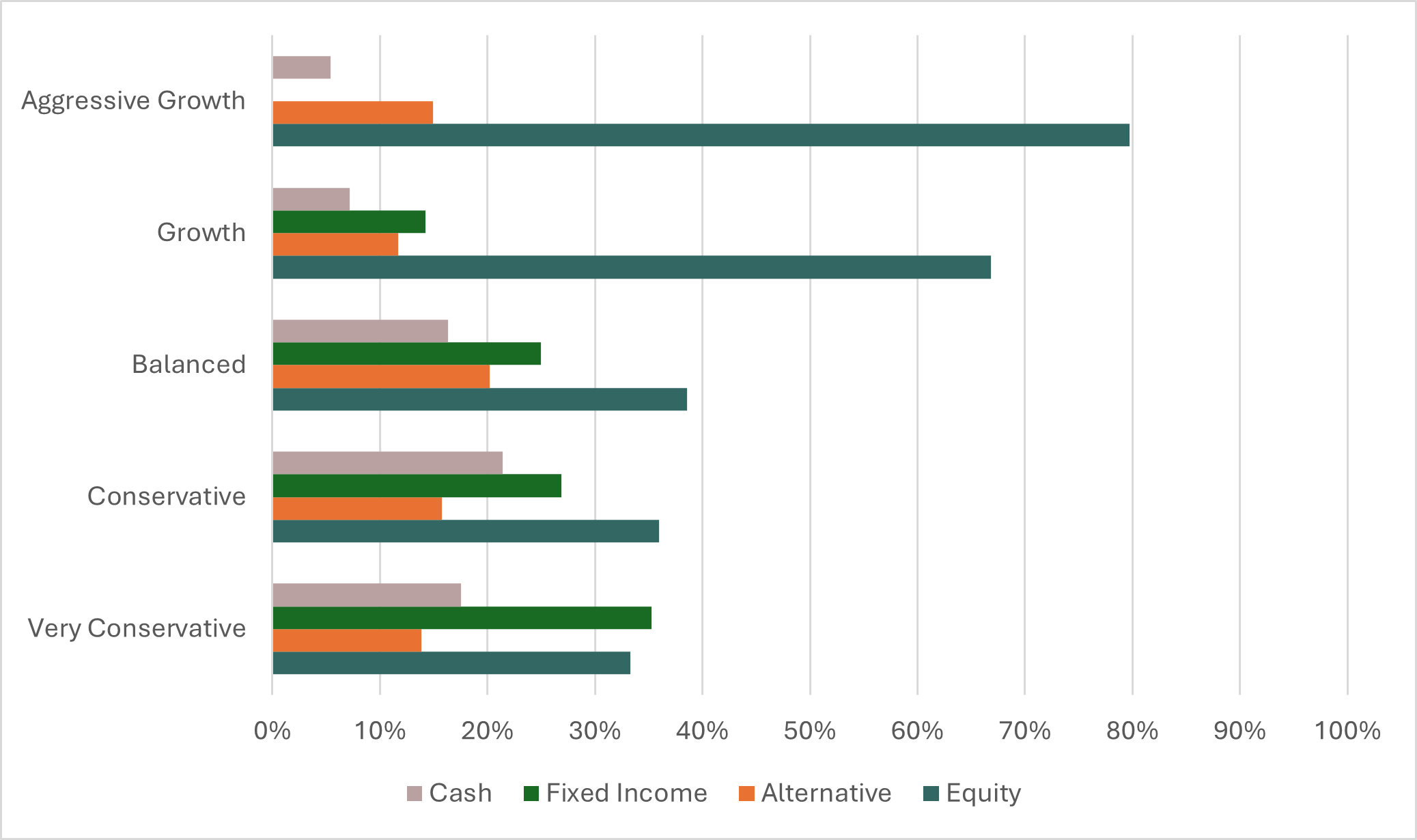

Chart 2: Asset Class Exposure as at 28 February 2025

Please note that the performance and asset class exposure mentioned above are derived from five proxy portfolios. The actual performance and exposure of KDI Invest portfolio may differ due to the customisation by our A.I. based robo-advisor that tailors the investment to individual risk profiles, as well as the timing of market entry.

Citation:

https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

https://www.reuters.com/markets/us/us-consumer-confidence-deteriorates-sharply-february-2025-02-25/