May 2025 Market Insights

Welcome to the May edition of the Market Insights column brought to you by the Kenanga Digital Investing (KDI) team. In this edition, Our Head of Portfolio Management, Wu Kin Hoe, will discuss the latest financial news and share his insights on how to make the most of today’s market.

Market Recap

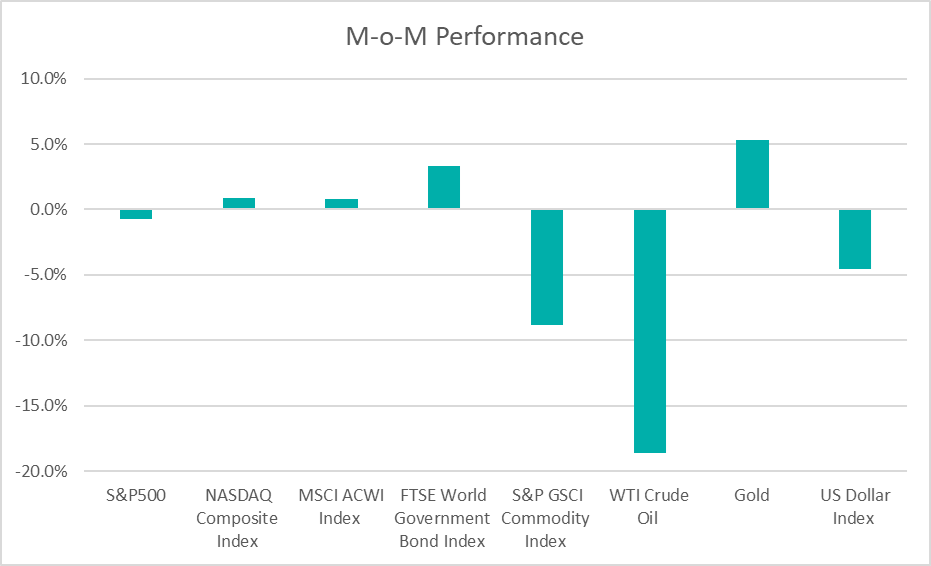

Chart 1: Index Performance in April 2025

Market

April was a rollercoaster month for global stock markets, with dramatic swings in response to the latest tariff announcements, retaliatory measures and ‘tit-for-tat’ political statements. Despite the turbulence, global indices managed to close at almost the same level it started, underscoring the unpredictable nature of the current market environment.

US treasury yields declined as the market priced in a higher likelihood of interest rate cuts. As of end-April 2025, CME FedWatch data indicated a 63% probability of a 25 basis point cut and a 33% chance of no change at the US Federal Reserve’s upcoming 18 June meeting.

The S&P GSCI Commodity Index declined along with oil price by 9% and 19% respectively, due to market expectations of oversupply and uncertainty around tariff talks between the US and China. Partly offsetting the decline, gold rose to $3,289 per ounce, up 5.3% month-over-month, as investors sought safety amid uncertainties surrounding US president Trump’s policies. Bitcoin rallied amid recent market turmoil, rising by 14% in April.

The US dollar weakened against the Malaysian Ringgit at 4.3158, vs. March’s 4.4383 as policy uncertainties diminished the greenback’s safe-haven status.

Outlook

Mixed US economic data point to further uncertainty ahead. GDP contracted at an annualized rate of 0.3% in 1Q25, undershooting the consensus forecast of +0.3%. The weaker-than-expected print was primarily driven by a one-off frontloading of imports ahead of tariff implementation, suggesting the headline figure overstates the underlying softness in economic activity. Job growth and consumer confidence both moderated in April, potentially reflecting the early effects of the Trump administration’s steep tariffs and uncertain trade policy environment. More positively, both US and China agreed to rollback tariffs for 90 days and continue trade negotiations in what US president Trump dubbed a “total reset” with China.

At its recent May meeting, the Fed decided to keep interest rates unchanged. Despite the heightened uncertainty, Fed Chair Jerome Powell still expressed confidence in the US economy but warned that the risks of higher inflation and unemployment had risen, further clouding the economic outlook. The Fed’s policy rate has been unchanged since December 2024, as officials struggle to estimate the impact of US president Trump’s tariff policies.

In contrast, China’s economy beat expectations to expand by 5.4% in the 1Q25, keeping it broadly on track to meet this year’s official target of 5%. March data show solid retail sales and industrial output data – both numbers topped analysts’ forecasts – suggesting that stimulus measures announced in March may have been effective in bolstering the world’s second-largest economy. Looking ahead, the picture looks more challenging as tariff uncertainty continue to cloud market outlook. However, the latest tariff truce between the US and China offers a positive albeit temporary reprieve for both countries.

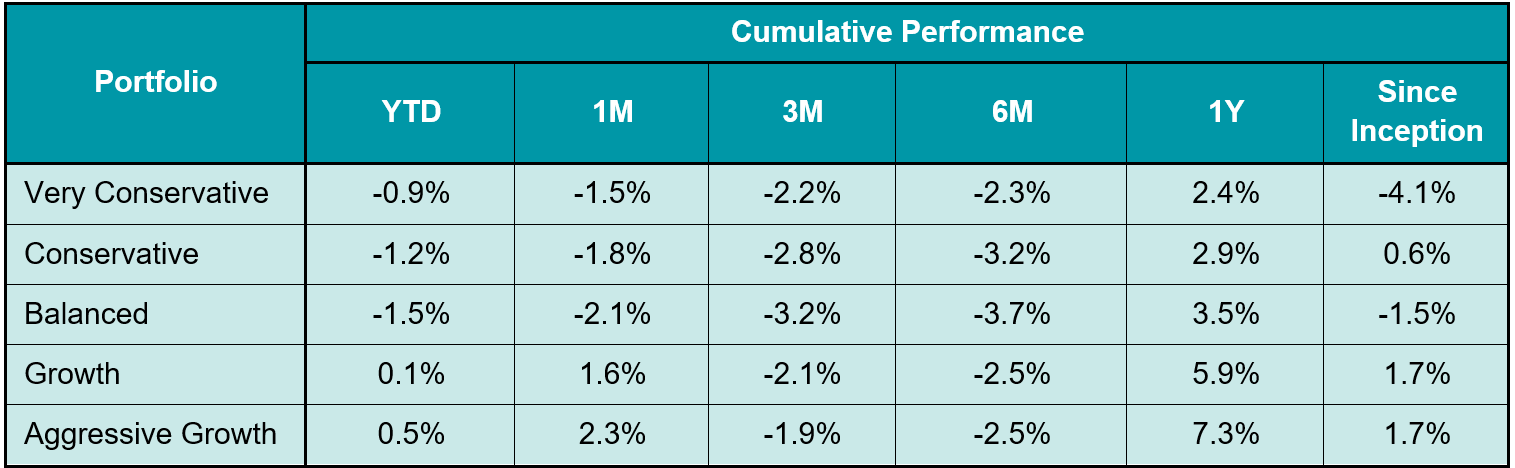

Table 1: KDI Invest Portfolio Performance as at 30 April 2025

The provided table offers information on the cumulative performance of selected KDI portfolios since their launch on February 15, 2022. The portfolio returns (in USD) range from -4.1% to 1.7%. Year-to date, the portfolios recorded returns within a range of -0.9% to 0.5%.

The S&P500 index has declined by 5.3% this year to end-April 2025, led by declines in the consumer discretionary and technology sectors, as tariffs stoke recession worries. The healthcare, consumer staples and utilities sectors have held up better, indicating market rotation into defensive sectors.

Looking ahead, US trade and economic policies are expected to be major drivers of market volatility. The recent tariff truce between the US and China represents a substantial de-escalation in trade tensions, though it remains to be seen if a lasting agreement can be reached as negotiations continue.

KDI’s portfolios are well diversified to withstand market fluctuations, and will remain vigilant in monitoring changes, adjusting asset allocation when necessary. As market volatility rises, the portfolios may shift to a risk reduction mode to protect downside. This strategy aims to safeguard your investments during uncertain times while remaining poised to take advantage of favourable conditions. Our portfolios have outperformed the S&P 500 Index this year, thanks to strategic positioning in defensive assets as part of our risk reduction strategy.

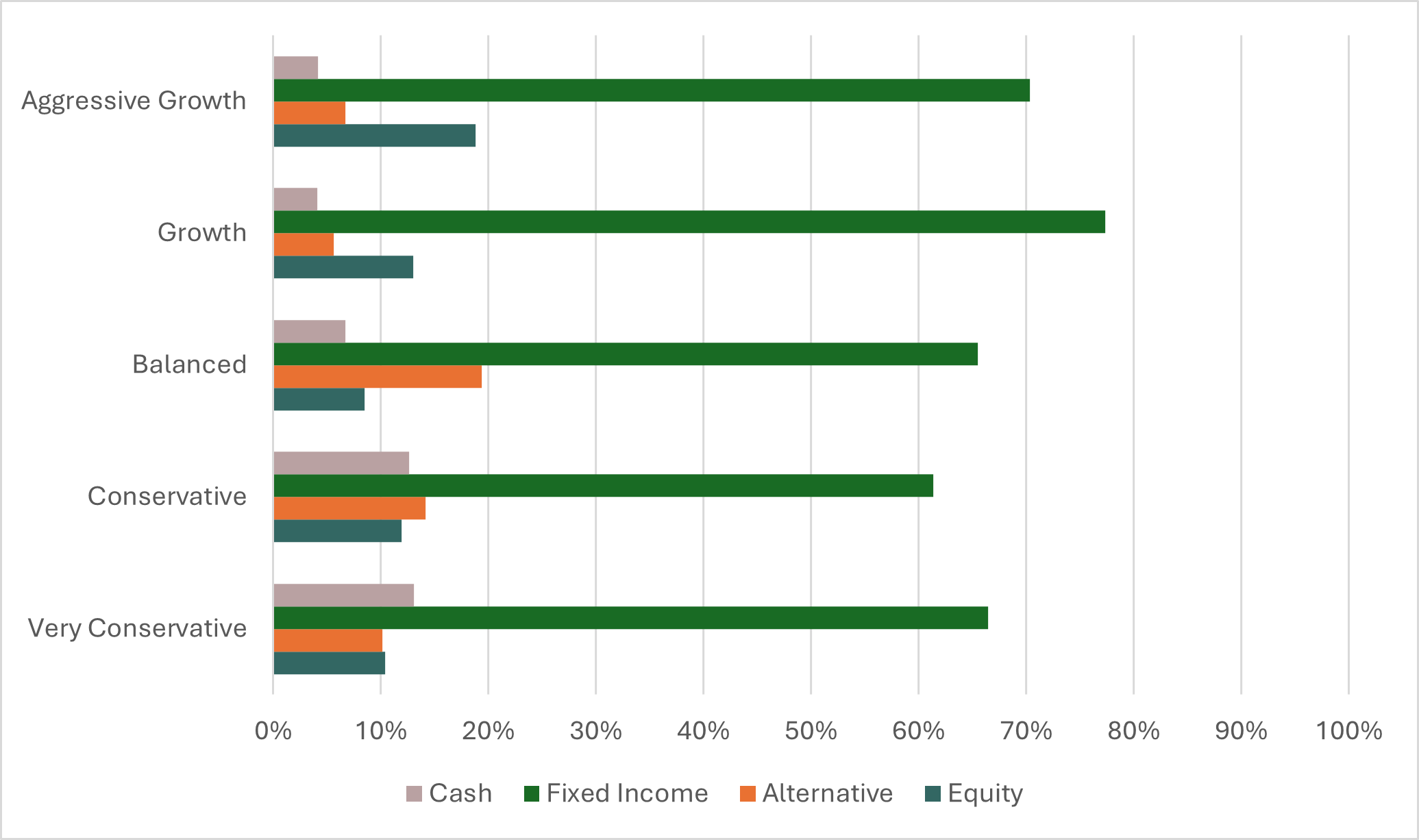

Chart 2: Asset Class Exposure as at 30 April 2025

Please note that the performance and asset class exposure mentioned above are derived from five proxy portfolios. The actual performance and exposure of KDI Invest portfolio may differ due to the customisation by our A.I. based robo-advisor that tailors the investment to individual risk profiles, as well as the timing of market entry.

Our Perspective: Rebuilding confidence in an era of uncertainty

April has been as a dramatic month for global investors. Uncertainty in trade policy directions has triggered sharp pullbacks and raised risk-aversion levels across various asset classes. As investors scramble for any semblance of long-term stabilisation in the short to medium term, we encourage our clients to focus on signals rather than market chatter. Our proprietary portfolio construction streamlines this process of ‘focus’ by analysing thousands of datapoints to construct portfolios that weather through unprecedented times like the present. Our models have taken advantage of the large selloffs to rebalance our holdings and to remain overweight in fixed income. Our recent outperformance against the benchmark reflects our enduring commitment to deliver long-term value for our clients. Moving forward, we aim to remain focused on the fundamentals rather than short-term noise, as markets tend to recover in the long run.

Citation:

https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html