December 2025 Market Insights

Market Recap

Market

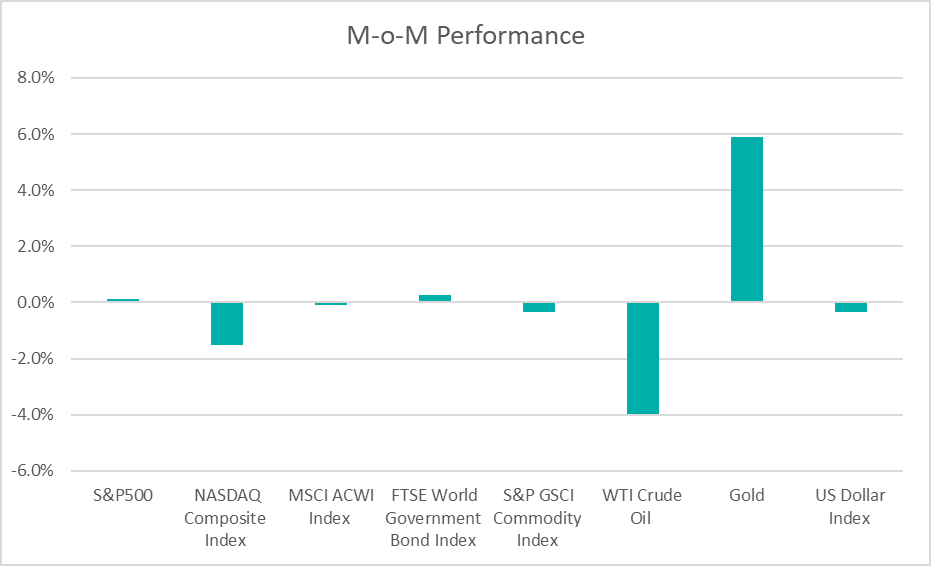

November 2025’s global financial landscape was marked by heightened caution and significant policy uncertainty following the record-breaking 43-day U.S. government shutdown, which ended on November 13. Equity markets were tepid as the S&P 500, Nasdaq Composite and MSCI All-Country World Index moved only by 0.1%, -1.5% and -0.1% respectively for the month.

Despite the US Federal Reserve’s (‘Fed’) shift to an easing cycle (3 cuts executed including 1 in Dec), the long end of the US Treasury curve remained sticky at around 4%; it has since climbed to 4.14 – 4.18% after the latest rate cut in December. As of mid-December 2025, CME FedWatch data indicated a 24% chance of 25bps rate cut at the US Fed’s upcoming 28 January 2026 meeting.

WTI crude eased to $58 per barrel by end-November, driven by weakening industrial activity and persistent oversupply in the market. On the other hand, gold continued to serve its function a resilient safe-haven asset, holding strong at $4,239 per ounce. Bitcoin corrected by 17% to $90,899 by end-November.

The US dollar weakened against the Malaysian Ringgit, ending November-2025 at 4.133, from 4.189 in October. To date, the Malaysian ringgit appreciated by 7.6% against the U.S. dollar.

Note: All macroeconomic data are sourced from Bloomberg; data current as of 30 November 2025.

Outlook

Analysis by the Congressional Budget Office, a nonpartisan agency, indicated that the shutdown shaved between 1 and 2 percentage points off annualized GDP growth in the 4th quarter of 2025. Another consequence of the shutdown was the non-release of crucial official statistics, notably the inflation and payroll numbers. Private-sector datasets point to a softening labour market, which could signal easing wage pressures and potential implications for consumer demand.

Despite operating under a “information vacuum”, the Fed cut its rate by 25 basis points (bps) in its December meeting to 3.50 – 3.75%, a three-year low. This marked the third successive rate cut of the year. The cut confirms the US central bank’s clear prioritization of economic and labour market downside risks over elevated inflation concerns. The Fed’s internal division over the latest cut suggests that broader support for further cuts is lacking unless upcoming data strongly demonstrates significant labour market weakness.

China’s economy is showing a clear two-track dynamic. Domestic demand and internal growth drivers are losing momentum, reflecting softer consumer spending and investment trends. Retail sales rose just 1.3% year-on-year (YoY) in November, well below expectation of +2.9%. In contrast, exports remain a bright spot, climbing 5.9% YoY versus the 4% forecast, reinforcing China’s position in global trade and partially offsetting domestic weakness.

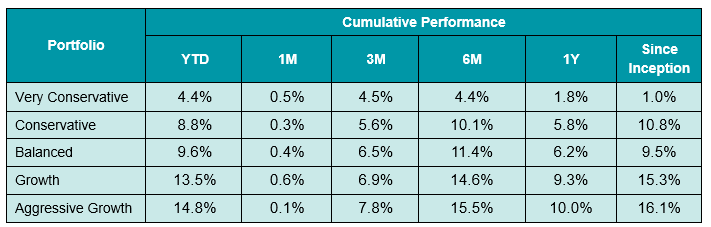

The provided table offers information on the cumulative performance of selected KDI portfolios since their launch on February 15, 2022. The portfolio returns (in USD) range from 1.0% to 16.1%. Year-to date, the portfolios recorded returns within a range of 4.4% to 14.8%.

The tech-heavy Nasdaq Composite Index returned -1.5% for the month, underperforming the S&P500 Index which managed a modest gain of +0.1%. The pullback was concentrated in AI high-flyers such as Palantir Technologies and Nvidia, as investors rotated out of high-growth names amid valuation concerns and profit-taking. In contrast, small cap indices outperformed with the S&P SmallCap 600 gaining +2.51%, led by defensive sectors such as healthcare and materials.

The Trump Administration has maintained its strategy of escalating global trade barriers, a major driver of heightened policy uncertainty across markets. U.S. consumers now face an average effective tariff rate of 16.8% – the highest level since 1934 and a dramatic jump from just 2.2% at the start of 2025. These elevated tariffs, combined with retaliatory measures from trading partners, are projected to impose a significant drag on the U.S. economy, contributing to persistent inflationary pressures and slower growth.

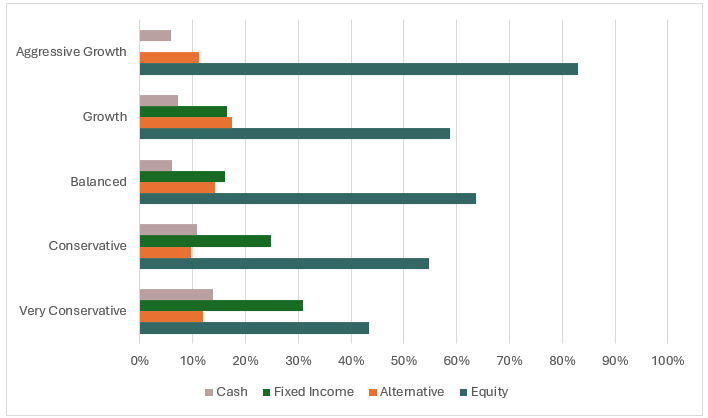

KDI’s portfolios are well diversified to withstand market fluctuations, and will remain vigilant in monitoring adjusting changes, asset allocation when necessary. As market volatility rises, the portfolios may shift to a risk reduction mode to protect downside. This strategy aims to safeguard your investments during uncertain times while remaining poised to take advantage of favourable conditions.

Kindly note that the performance and asset class exposure illustrated above are derived from five proxy portfolios. The actual performance and exposure of your investment portfolio may differ due to the customisation made by our proprietary algorithms that tailors the investment to your unique risk profile, as well as the timing of market entry.

Our Perspective: Are We (Finally) Out of the Woods?

As 2025 draws to a close, we would like to thank you for choosing KDI as your trusted partner in growing your long-term capital. The month of November marked a period of consolidation for global markets, with equity indices being largely range-bound as investors navigated policy uncertainty following the record-long U.S. government shutdown and an absence of key economic data. The Feds delivered its third consecutive rate cut earlier this month, lowering the policy rate to 3.50-3.75%. While the move reinforced the Fed’s focus on downside risks to growth and the labour markets, policymakers signalled a higher bar for further easing, given the ongoing uncertainty around inflation and patchy data. The bond markets echoed this caution, with long-dated treasury yields remaining elevated.

Gold continued to perform strongly, reaffirming its role as a hedge amid macro and geopolitical uncertainty, while oil prices weakened over concerns of oversupply and dampened industrial activity. Risk assets were largely mixed: tech stocks underperformed as investors rotated out of Big Tech, where small cap and defensive sectors showed relative resilience. Cryptocurrencies experienced broad declines, reflecting tighter liquidity and perioding deleveraging episodes. Geopolitics and trade policy remained key sources of uncertainty throughout 2025. Elevated tariff levels, the highest in decades, continued to weigh on global growth and contribute to inflationary pressures. Abroad, we’re seeing a slowdown in China’s domestic consumption and investment. Markets are watching closely on how Beijing responds to Washington’s trade policies, and how tensions are being managed with other trading partners.

Looking ahead to 2026, we will be keeping a pulse on three key questions: whether equity valuations remain justified, whether the U.S. economy can sustain a soft landing, and how markets navigate persistent geopolitical and fiscal challenges. 2025 has reminded us of the importance of risk management and diversification. For investors, several things remain clear: markets are evolving, but timeless principles still apply. Staying invested, cutting through the ‘noise’ and focusing on fundamentals remains to be the best way to navigate through uncertainty.

Citation:

https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

https://budgetlab.yale.edu/research/state-us-tariffs-november-17-2025

https://www.reuters.com/business/wall-st-week-ahead-feds-internal-split-puts-spotlight-powells-rate-guidance-2025-12-05/

Disclaimer

Kenanga Digital Investing (“KDI”) is licensed by the Securities Commission of Malaysia as a Digital Investment Management Company. KDI is authorised to carry out the business of fund management blending innovative technology into automated portfolio management services offered to clients under a license issued pursuant to Schedule 2 of the Capital Markets Services Act (CMSA) 2007.

Investment involves risk, including the possible loss of capital you invest. Past performance does not indicate future performance. Historical returns, expected returns, and probability projections are provided for informational and illustrative purposes, and may not reflect actual future performance. KDI does not assume any fiduciary responsibility or any liability for any consequences, financial or otherwise, arising from any transaction in reliance on such information. Investors should rely on their own evaluation or consult an independent financial, accounting, tax, legal or other professional advisers to access the merits and risks before investing.

Any forward-looking statements, predictions, projections or forecast on the economy, stock market, bond market or economic trends of the markets contained in this material are subject to the market influences and contingent upon matters outside the control of KDI and therefore may not be realised in the future. No representation is made as to the completeness and adequacy of the information to make an informed decision.

Neither the information, nor any opinion, contained in this article constitutes a promotion, recommendation, solicitation, invitation by KDI or its affiliates to buy or sell any securities, investment schemes or other financial instruments or services, nor shall any security, collective investment scheme, or other financial instruments or services be offered or sold to any person in any jurisdiction in which such offer, solicitation, purchase, or sale would be unlawful under the securities laws of such jurisdiction. This is not intended to be an invitation or offer made to the public to subscribe for any financial product or other transaction.

This information has not been reviewed by the Securities Commission of Malaysia.