August 2023 Market Insights

Brought to you by the Kenanga Digital Investing (KDI) team, here is our 19th Market Insights column. Our Head of Digital Investing, Cheong Yew Huan will discuss the latest in financial news and present his thoughts on making the most of today’s market.

Market Recap

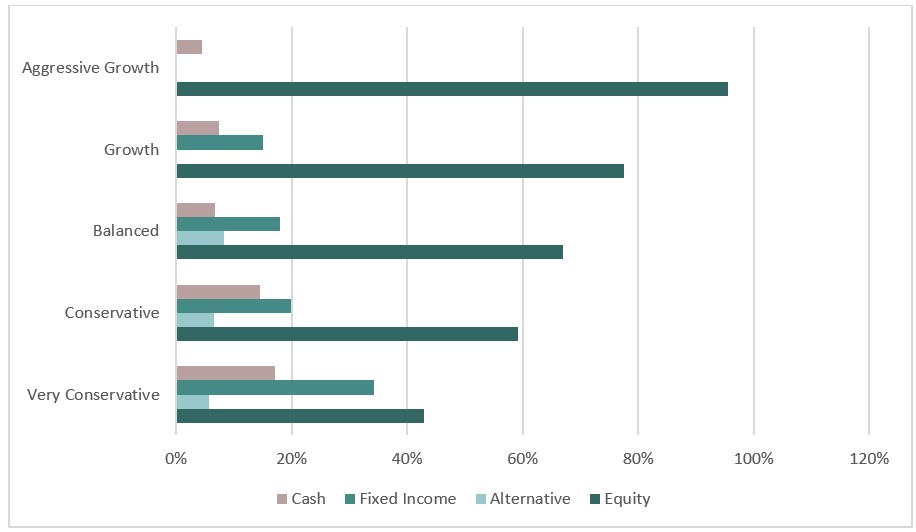

Chart 1: Index Performance in July 2023

Market

Global stocks performed well in July, with the MSCI All Country World Index up 3.6%. The Nasdaq Composite was up 4% during the month and has risen by 37.1% year-to-date. Meanwhile, the S&P 500 increased by 3.1% during the month, resulting in a year-to-date gain of 19.5%. The strong year-to-date rally was driven by an improving inflation outlook, robust company earnings, and the resilience of the U.S. economy.

The Federal Reserve decided to combat surging inflation by raising its target rate by 25 basis points, reaching a range of 5.25% to 5.5%. This move marks a 22-year high for the Fed rate, indicating the Fed’s intention to address inflationary pressures. As a result, both the two-year Treasury yield and the benchmark 10-year yield increased, closing at 4.8766% and 3.9588%, respectively. The bond investors were left evaluating how to navigate this sustained period of higher interest rates, with some believing it could potentially impact the growth of the U.S. economy.

The S&P GSCI Commodity Index recorded a 9.8% uptick, driven by a robust rally in oil prices. Oil prices saw a substantial 15.8% increase during the month, closing above the USD 80 per barrel mark. This surge was supported by a softer U.S. dollar, global tightening of oil supplies, and expectations for improved global economic growth. Gold prices experienced a 2.4% rise in July, reaching USD 1,965.09, with the anticipation that major global central banks may be nearing the end of their current monetary policy tightening cycles.

Despite the Federal Reserve having raised interest rates during the month, the US Dollar Index lost momentum, posting a monthly decline of 1% and marking its second consecutive month of losses. Traders are currently evaluating the potential conclusion of the Federal Reserve’s tightening cycle, contributing to a sense of uncertainty regarding the movement of the U.S. Dollar.

Outlook

In June, inflation moderated further, raising optimism that the Federal Reserve was approaching the conclusion of its cycle of tightening monetary policy. According to data published by the Bureau of Labor Statistics, the consumer price index saw a 3% growth in June compared to the previous year. The unemployment rate has stubbornly remained at a low level, and economic growth has consistently outpaced the standard pattern. The United States’ gross domestic product (GDP) expanded by 2.4% in the second quarter, demonstrating the economy’s resilience despite the backdrop of increasing interest rates, a result of the Federal Reserve’s assertive measures to curb inflation.

Based on the Factset report released on August 4th, 2023, 84% of the companies in the S&P 500 have reported actual results for Q2 2023 to date. Of these companies, 79% have reported actual EPS above estimates, which is above the 5-year average of 77% and above the 10-year average of 73%. Since June 30, positive earnings surprises reported by companies in multiple sectors (led by the Consumer Discretionary and Information Technology sectors) while Energy, Materials, and Health Care are reporting a year-over-year decline in earnings.

China’s economic momentum continued to wane in July as the Caixin/S&P Global manufacturing purchasing managers’ index (PMI) dropped to 49.2, down from June’s 50.5. This fall fell short of the anticipated 50.3, catching analysts off guard. This decrease marked the first instance of economic contraction since April. During the second quarter, China’s economy saw a growth of 6.3% compared to a 4.5% expansion in 1Q23. Nevertheless, this growth rate fell notably short of the expected 7.3% increase, attributed to weakened demand both within the country and globally. Investors are currently looking past the concerning economic data, focusing instead on the potential economic support that might be provided by the government.

Following in the footsteps of the US Federal Reserve and the Bank of England, the European Central Bank has raised its key interest rates for the ninth successive time. In the second quarter, the economy of the eurozone experienced a growth of 0.3%, while the inflation rate decreased from 5.5% to 5.3% in July. The Eurozone’s recovery surpassing expectations implies that the European Central Bank may well proceed with additional interest rate increases in the coming months.

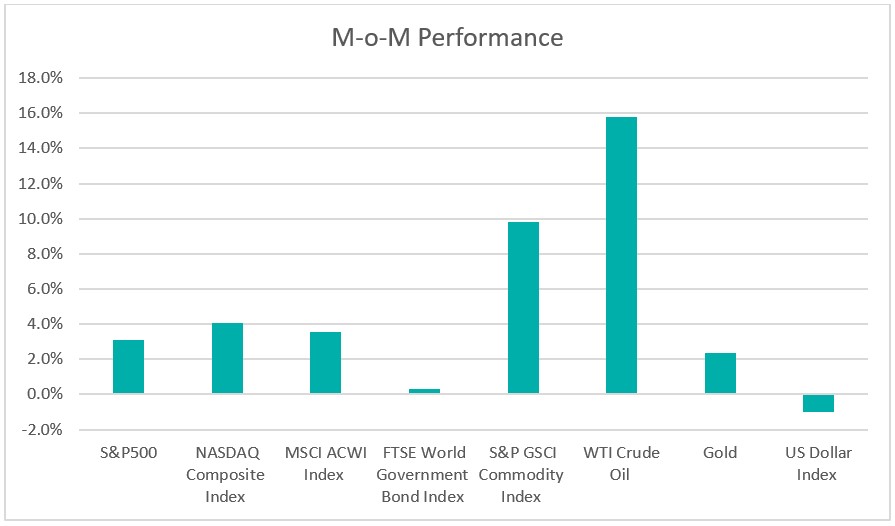

Table 1: KDI Invest Portfolio Performance As at 31 July 2023

Remarks:

Past performance is not indicative of future results.

The above table provides information on the cumulative performance of selected KDI portfolios since their launch on February 15, 2022. Year-to-date, all portfolios have experienced positive returns, ranging from 2.1% to 8.3%.

Stocks have experienced a strong rally this year, as US economic data has pointed to a resilient economy with cooling inflation and a solid labour market. With the improving inflation situation and both consumer spending and labour markets remaining robust, investors’ concerns about the possibility of a recession have reduced. Throughout this year, volatility in the stock market has remained minimal, and the performance in equities is likely to continue until significant risks to the global economy are mitigated. Additionally, global inflation rates have continued to decrease, raising expectations that central banks might soon reach the peak of their interest rate adjustments.

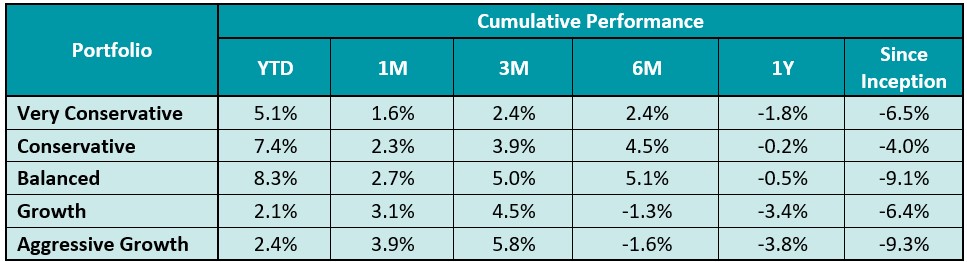

The KDI portfolios maintain diversification, allocating a significant portion to equity exposure ranging from 43% to 95%. Fixed income constitutes an allocation of up to 34%, while alternative investments, primarily in the gold ETF (GLD), make up to 8% of the portfolio. Cash holdings range from 5% to 17%.

Chart 2: Asset Class Exposure As at 31July 2023