February 2025 Market Insights

Welcome to the February edition of the Market Insights column brought to you by the Kenanga Digital Investing (KDI) team. In this edition, Our Head of Portfolio Management, Wu Kin Hoe, will discuss the latest financial news and share his insights on how to make the most of today’s market.

Market Recap

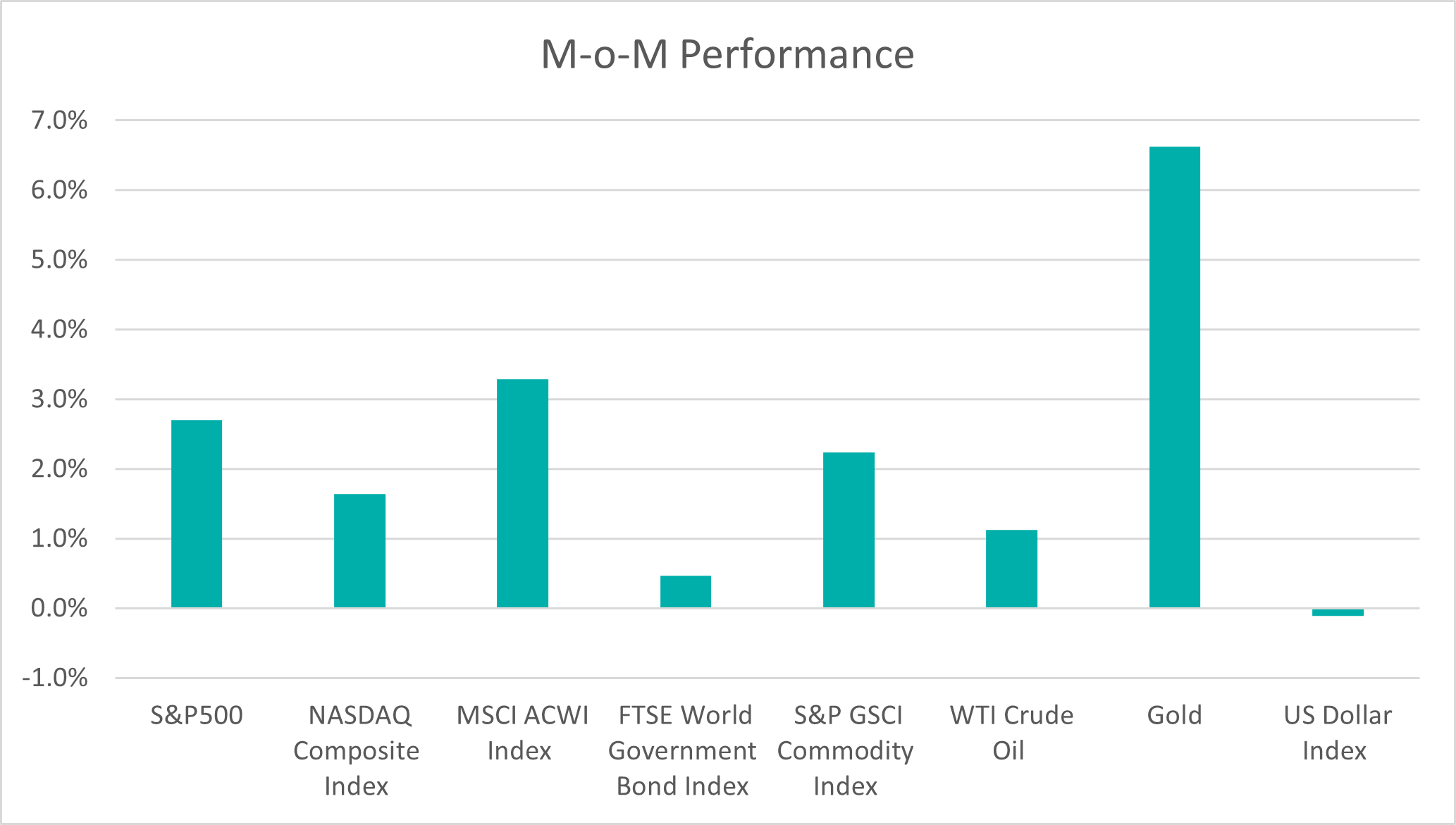

Chart 1: Index Performance in January 2025

Market

Risk assets performed well in January 2025, rebounding from the decline in December 2024. The S&P 500, Nasdaq Composite Index and MSCI ACWI were up by 2.7%, 1.6% and 3.3% respectively for the month.

Treasury yields softened by 3 – 4 basis points as inflation fears waned after the release of softer-than-expected inflation prints in mid-January. According to CME FedWatch, the market is now pricing in a 86.5% chance of no rate cut at the U.S. Federal Reserve’s March 2025 meeting.

In January, commodities saw positive returns with the S&P GSCI Commodity Index increasing by 2.2% for the month. Oil prices climbed to approximately $72.50 per barrel, a 1.1% month-over-month rise. Meanwhile, gold surged to $2,798 per ounce, up 6.6% month-over-month, as investors sought safety amid uncertainties surrounding US President Donald Trump’s policies.

The U.S. dollar remained broadly unchanged in January (4.4602 vs. December’s 4.4722).

Outlook

US economic data in December continue to paint a positive picture for the economy. Employment data came in stronger than expected – US added a surprising 256,000 jobs in December (vs. 165,000 expected) and the unemployment rate ticked down to 4.1%. The solid job market has sustained consumer spending, which surged at a 4.2% pace in the fourth quarter, the fastest in nearly 2 years. On the flip side, US fourth quarter GDP grew at a 2.3% annualised rate, a little below the 2.6% consensus, as a strike at Boeing depressed business investment in equipment and consumer strength ran down inventories.

The US Federal Reserve first reduced interest rate from its 23-year highs in September 2024 and made two further cuts before the end of 2024. However, in December policymakers signalled a slower pace of easing in 2025 amid sticky inflation and a strong economy. The recent inflation reading is 2.9%, still above the Fed’s target of 2%. Concerns linger about tariffs from US President Donald Trump, which could further stoke inflation.

China’s economy ended 2024 on better footing than expected helped by a flurry of stimulus measures, although threat of a new trade war with the US looms this year. China’s 4Q24 GDP grew by 5.4% year-on-year (estimate: +5%). Retail sales, exports and industrial production grew at a stronger than expected annual pace of 3.7%, 10.7% and 6.2% respectively. China is expected to unveil growth targets and stimulus plans during the annual parliament meeting in March 2025.

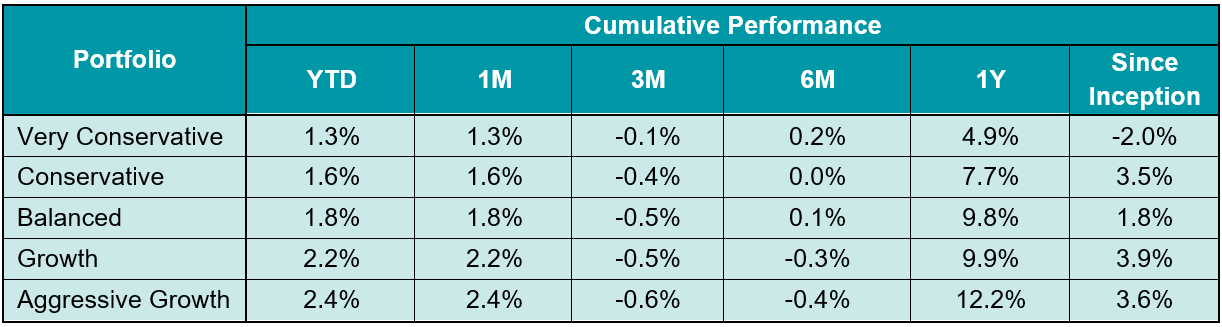

Table 1: KDI Invest Portfolio Performance as at 31 January 2025

The provided table offers information on the cumulative performance of selected KDI portfolios since their launch on February 15, 2022. The portfolio returns (in USD) range from -2.0% to 3.6%. Year-to date, all portfolios recorded positive returns within a range of 1.3% to 2.4%.

The S&P 500 managed a strong start to 2025 with a 2.78% return to date, although it has mostly moved sideways since end-January due to the Fed’s guidance of fewer rate cuts this year, tariff threats on Canada, Mexico and China, and emergence of Chinese AI model DeepSeek, which has triggered a global tech sell-off.

Looking ahead, several factors, including the positive US economic outlook, hawkish tilt in the Fed monetary policy, stretched market valuations, and President Trump’s economic policies, could contribute to increased market volatility. President Trump’s promise of big tax cuts, combined with his zeal for deregulation, will boost growth, especially in the short term. However, the new US administration’s penchant for protectionism and tariff flip-flops have heightened economic and geopolitical uncertainties.

KDI’s portfolios are well diversified to withstand market fluctuations, and will remain vigilant in monitoring changes, adjusting asset allocation when necessary. As market volatility rises, the portfolios may shift to a risk reduction mode to protect downside. This strategy aims to safeguard your investments during uncertain times while remaining poised to take advantage of favourable conditions.

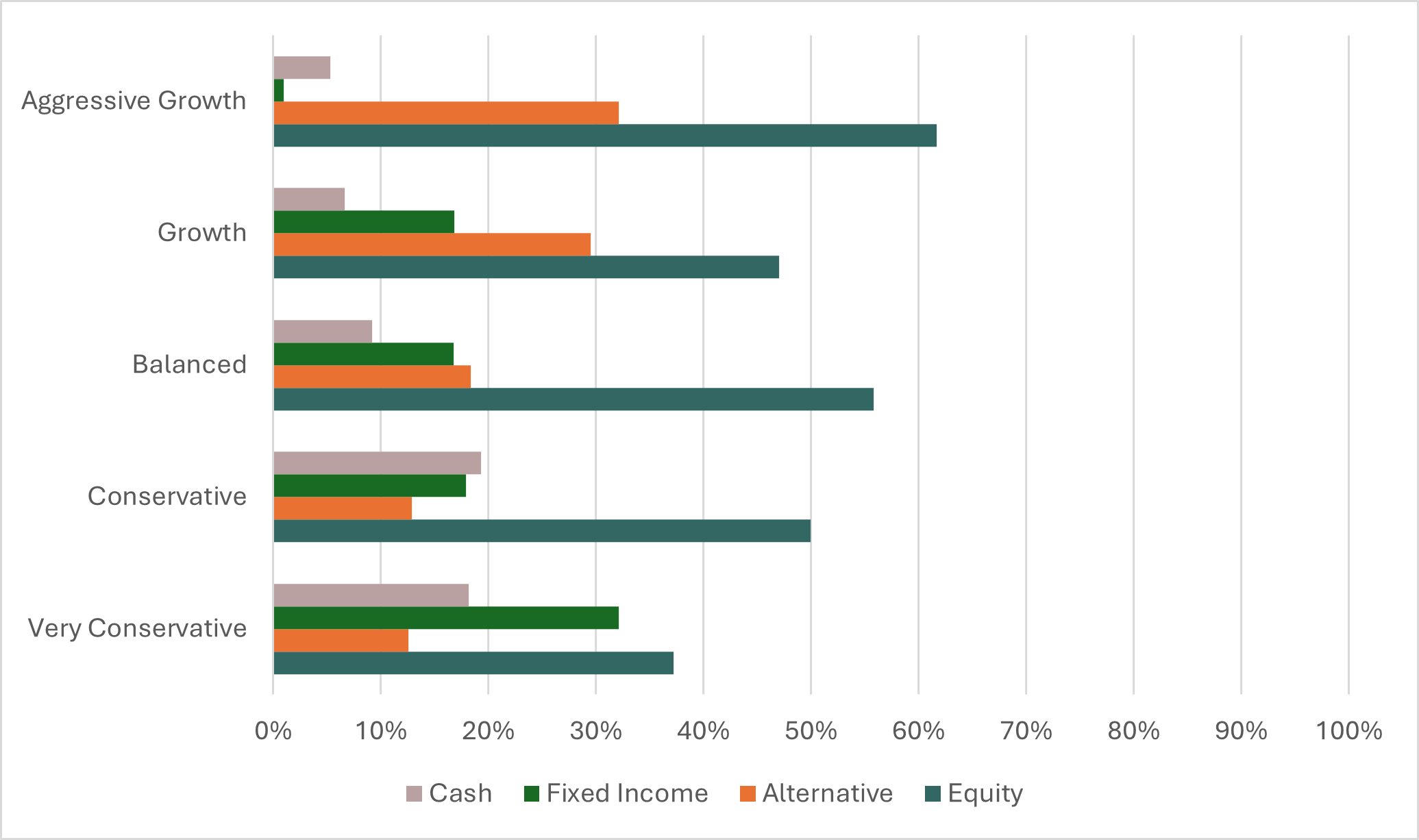

Chart 2: Asset Class Exposure as at 31 January 2025

Please note that the performance and asset class exposure mentioned above are derived from five proxy portfolios. The actual performance and exposure of KDI Invest portfolio may differ due to the customisation by our A.I. based robo-advisor that tailors the investment to individual risk profiles, as well as the timing of market entry.

Citation:

https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

https://www.reuters.com/markets/us/us-economy-slows-fourth-quarter-spending-robust-2025-01-30/