January 2025 Market Insights

Welcome to the January edition of the Market Insights column brought to you by the Kenanga Digital Investing (KDI) team. In this edition, Our Head of Portfolio Management, Wu Kin Hoe, will discuss the latest financial news and share his insights on how to make the most of today’s market.

Market Recap

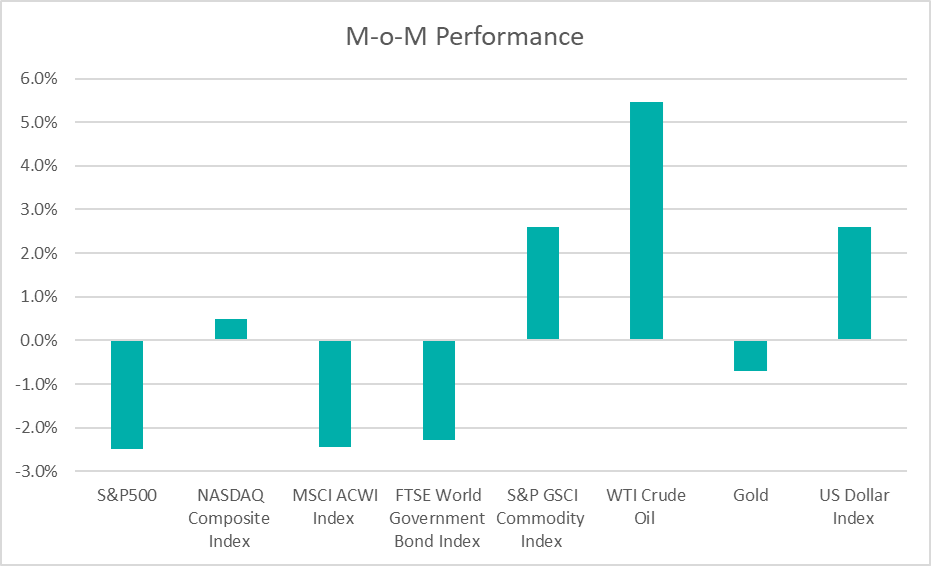

Chart 1: Index Performance in December 2024

Market

December 2024 was a challenging month for many risk assets, with notable declines in equities and bonds. The S&P 500 and MSCI ACWI were both lower by 2.5% for the month, while the Nasdaq Composite Index managed a slight gain of 0.5%; the latter was supported by technology stocks, which are seen as long-term compounders.

The bond market experienced volatility, with the 10-year U.S. Treasury yield rising to 4.58% by the end of December, from 4.18% in the prior month. This increase in yields put pressure on bond returns, resulting in a tough month for fixed-income assets. According to CME FedWatch, market now sees a 93.1% chance of no cut at the U.S. Federal Reserve’s January 2025 meeting.

In December, commodities saw a positive performance with the S&P GSCI Commodity Index up by 2.6% over the month. Oil prices rose to near US$72 per barrel (+5.5% MoM), driven by supply constraints and geopolitical tensions. Meanwhile, gold remained stable at US$2,625 per ounce.

The U.S. dollar strengthened slightly in December (4.4722 vs. October’s 4.4475) as rising U.S. Treasury yields widened the interest rate differential, increasing demand for US$-denominated asset.

Outlook

The latest available U.S. economic indicators suggest that the trends observed for much of 2024 remain in place as the year draws to a close. Third quarter GDP growth was revised upward to an annualized rate of 3.1%, driven by robust consumer spending. Previously, economic growth was estimated at 2.8%. Consumer spending, which accounts for more than two-thirds of economic activity, grew by 3.7%. This was its fastest growth in six quarters. Core PCE inflation remained high at 2.8% on a year-on-year basis; above the US central bank’s target of 2%.

Overall, the economic data painted a picture of steady growth, a resilient labour market, and ongoing inflationary pressures. Despite the strong economic backdrop, the Federal Reserve cut its key interest rate Wednesday by a quarter-point — its third cut this year — but also signalled that it expects to reduce rates more slowly next year than it previously envisioned, mostly because of still-elevated inflation.

China’s economy showed mixed performance in November 2024, with industrial production and exports showing resilience, while retail sales and fixed asset investment underperformed, amid ongoing challenges in the property sector. The government has since provided policy stimulus aimed at sustaining economic growth and addressing structural challenges. The World Bank recently raised its forecast for China’s economic growth in 2024 and 2025, reflecting the recent policy adjustments. It now expects China’s GDP to grow 4.9% and 4.5% in 2024 and 2025, compared with its previous projection of 4.8% and 4.1% respectively.

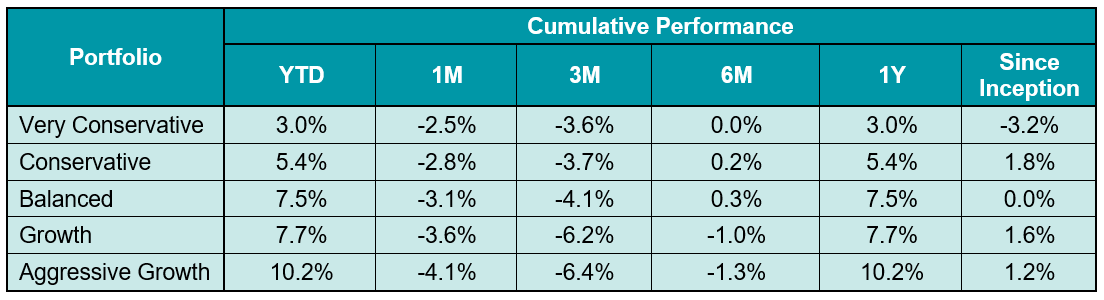

Table 1: KDI Invest Portfolio Performance as at 31 December 2024

The provided table offers information on the cumulative performance of selected KDI portfolios since their launch on February 15, 2022. The portfolio returns (in USD) range from -3.2% to 1.8%. Year-to date, all portfolios recorded positive returns within a range of 3.0% to 10.2%.

In 2024, the S&P 500 had a strong overall performance, ending the year with a return of 25.02%. This marked the first time in 25 years that the market achieved consecutive calendar year returns above 20%. KDI portfolios delivered strong returns throughout the year, although this was moderated by the strengthening Ringgit particularly in the 3Q24.

Looking ahead, several factors, including the US economic outlook, shifts in the Fed monetary policy, stretched market valuations, and President-elect Trump’s communication style, could contribute to increased market volatility. Anticipation of major U.S. policy shifts in 2025, including potential tariffs, deregulation and tax changes, has grown as Donald Trump prepares to take office in January 2025.

KDI’s portfolios are well diversified to withstand market fluctuations, and will remain vigilant in monitoring changes, adjusting asset allocation when necessary. This approach enables portfolios to capitalize on opportunities and potential benefits that may arise from these risks.

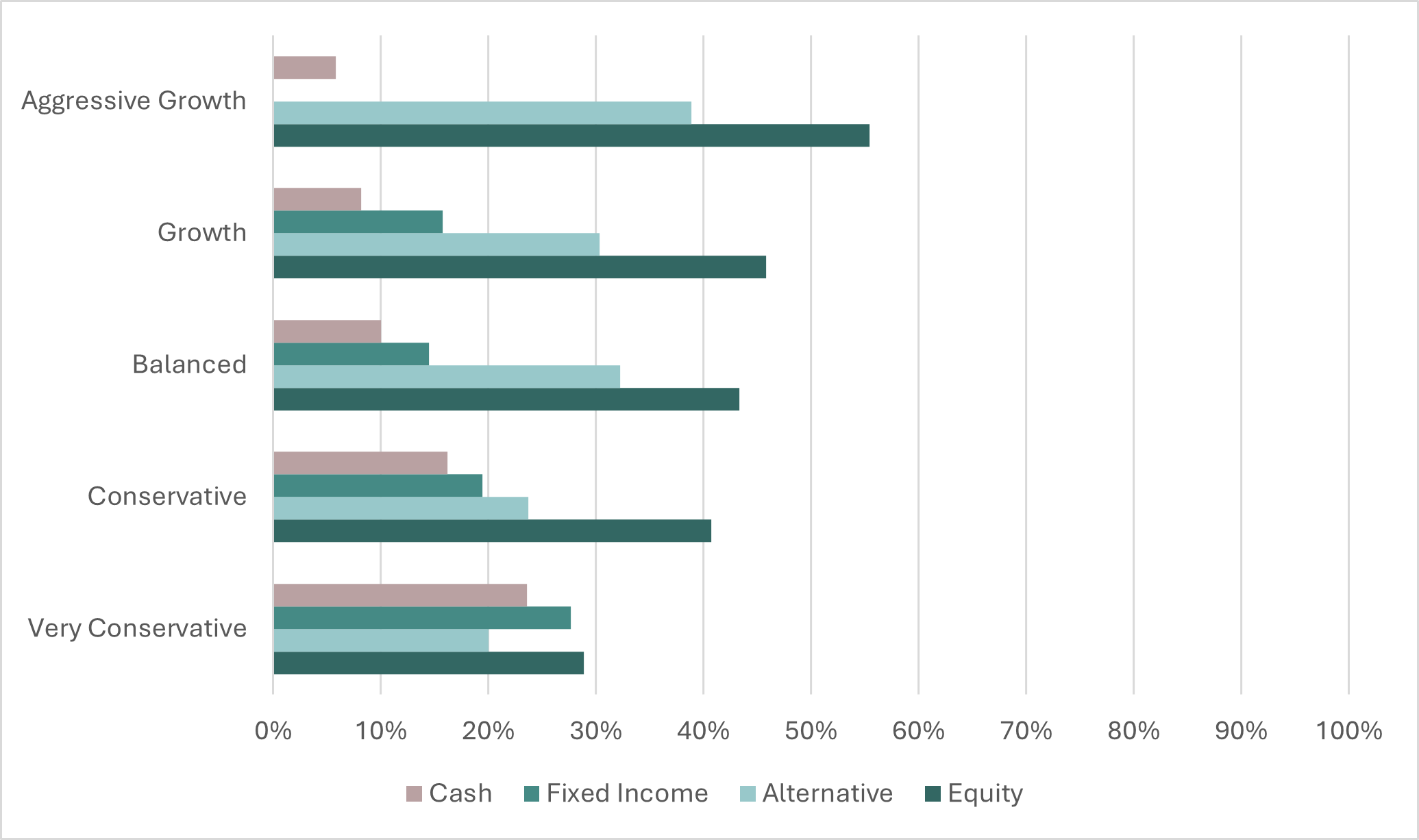

Chart 2: Asset Class Exposure as at 31 December 2024

Please note that the performance and asset class exposure mentioned above are derived from five proxy portfolios. The actual performance and exposure of KDI Invest portfolio may differ due to the customisation by our A.I. based robo-advisor that tailors the investment to individual risk profiles, as well as the timing of market entry.

Citation:

https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

https://www.reuters.com/markets/us/us-weekly-jobless-claims-fall-more-than-expected-2024-12-19/