April 2025 Market Insights

Welcome to the April edition of the Market Insights column brought to you by the Kenanga Digital Investing (KDI) team. In this edition, Our Head of Portfolio Management, Wu Kin Hoe, will discuss the latest financial news and share his insights on how to make the most of today’s market.

Market Recap

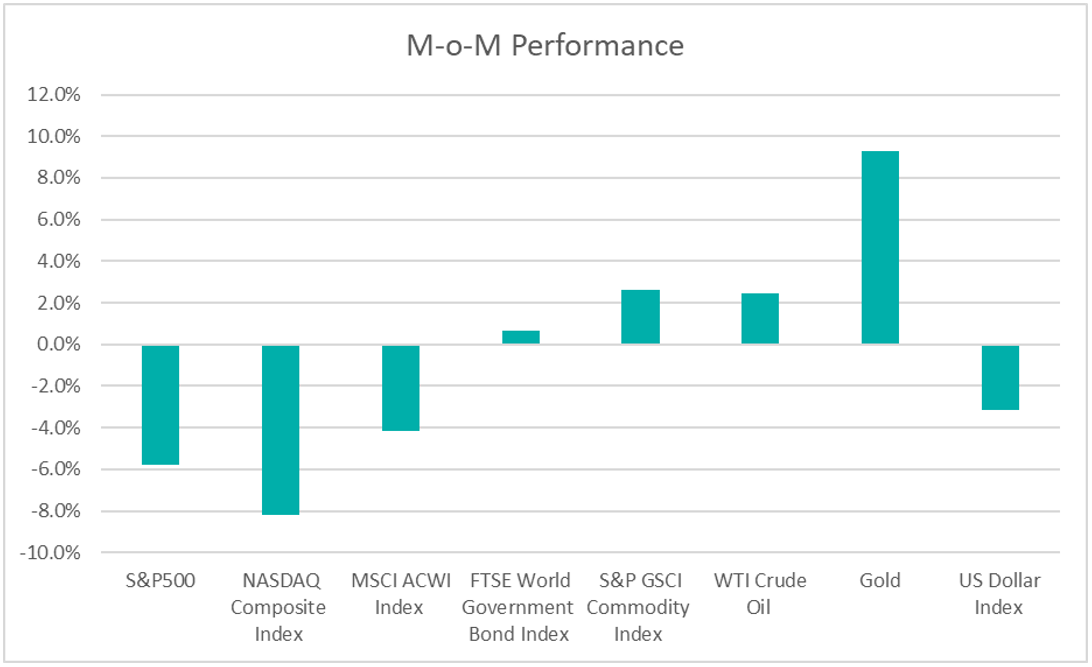

Chart 1: Index Performance in March 2025

Market

Global risk assets took a tumble in March 2025 due to the uncertainty surrounding US President Trump’s tariff proposals. The S&P 500, Nasdaq Composite Index and MSCI ACWI Index saw declines of 5.8%, 8.2% and 4.1% respectively for the month.

Treasury yields remained range bound, with a slight dip observed in the short end as market prices in higher likelihood of interest rate cuts. According to CME FedWatch, the market is now pricing in a 81% chance of no rate cut and 19% chance of a 25bps cut at the U.S. Federal Reserve’s (‘Fed’) upcoming 7 May 2025 meeting.

The S&P GSCI Commodity Index ticked up as geopolitical tensions and stronger-than-expected Chinese economic data supported oil prices. Gold rose to $3,124 per ounce, up 9.3% month-over-month, as investors sought safety amid uncertainties surrounding US President Donald Trump’s policies. Bitcoin showed resilience in the recent market turmoil, falling by just 1.8% in March.

The U.S. dollar weakened slightly against the Malaysian Ringgit at 4.4383, vs. February’s 4.4625 as policy uncertainties diminished the greenback’s safe-haven status.

Outlook

A string of recent US economic data points to an economy that is gradually cooling off. While inflation and employment figures remain stable, there were signs of softness in consumer spending and business activity data. US factory output came in higher than expected in February, which economists largely said was indicative of manufacturers ramping up production to get ahead of impending bilateral tariffs. Sentiment surveys among households and businesses have shown a noticeable slowdown, reflecting concerns over President Trump’s trade and tariff policies.

At its recent March meeting, the Fed decided to keep interest rates unchanged. The central bank revised its US growth forecast for 2025 downward and raised its inflation outlook, while still projecting two rate cuts this year, consistent with its December forecast. In a statement on March 19, the Fed acknowledged that ‘uncertainty around the economic outlook has increased,’ yet maintained a positive tone regarding the overall state of the economy.

China’s retail sales strengthened at the beginning of the year, with industrial output surpassing expectations. This data followed weaker-than-expected export and inflation indicators earlier in the month. Policymakers have put expanding domestic demand as the top priority this year. In the annual parliament meeting earlier this month, China’s leaders pledged stronger fiscal and monetary support for the economy, with a particular emphasis on spurring domestic consumption.

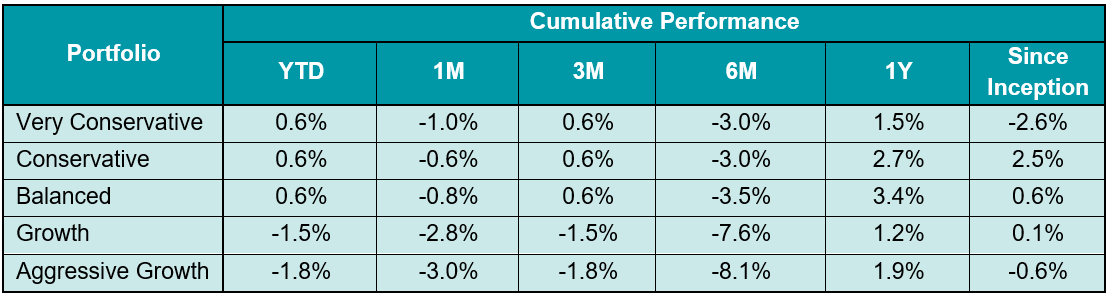

Table 1: KDI Invest Portfolio Performance as at 31 March 2025

The provided table offers information on the cumulative performance of selected KDI portfolios since their launch on February 15, 2022. The portfolio returns (in USD) range from -2.6% to 2.5%. Year-to date, the portfolios recorded resilient returns within a range of -1.8% to 0.6%.

The S&P500 index has declined by 4.6% this year to end-March 2025, led by declines in the consumer discretionary and technology sectors, as tariffs stoke recession worries. The healthcare, consumer staples and utilities sectors have held up better, indicating market rotation into defensive sectors.

Looking ahead, US trade and economic policies are expected to be major drivers of market volatility. President Trump’s promise of regulatory cuts and growth-focused policies initially lifted stocks following his November election victory. However, the shine has recently worn off due to growing concerns about their adverse economic and inflationary impacts.

KDI’s portfolios are well diversified to withstand market fluctuations, and we remain vigilant in monitoring changes, adjusting asset allocation when necessary. As market volatility rises, the portfolios may shift to a risk reduction mode to protect downside. This strategy aims to safeguard your investments during uncertain times while remaining poised to take advantage of favourable conditions. Our portfolios have outperformed the S&P 500 Index this year, thanks to strategic positioning in defensive assets as part of our risk reduction strategy.

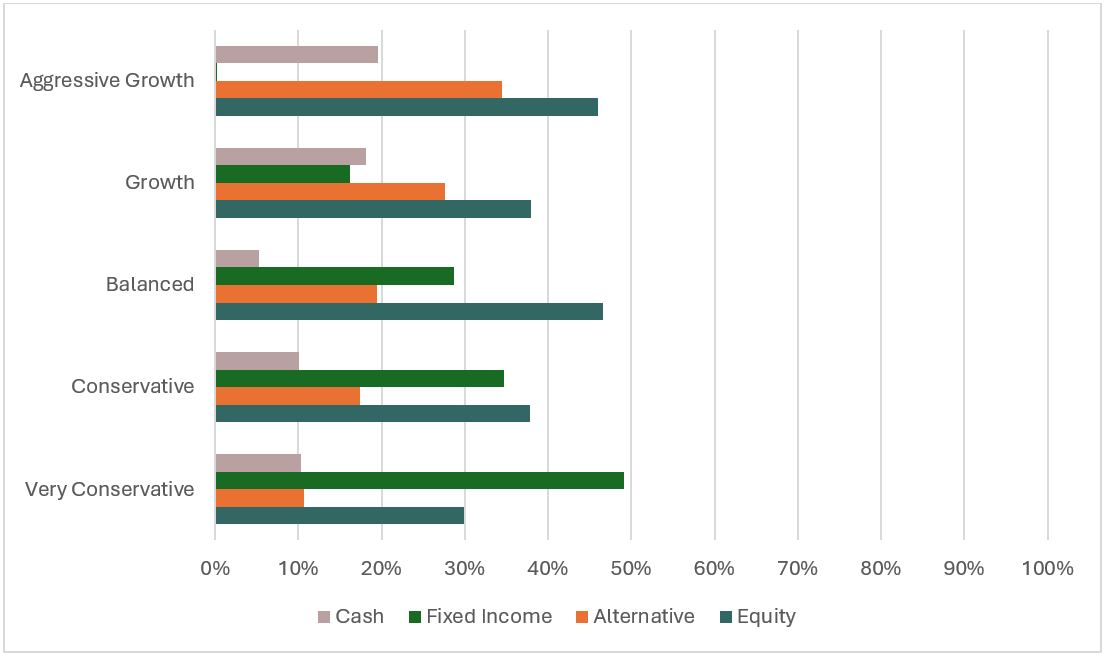

Chart 2: Asset Class Exposure as at 31 March 2025

Please note that the performance and asset class exposure mentioned above are derived from five proxy portfolios. The actual performance and exposure of KDI Invest portfolio may differ due to the customisation by our A.I. based robo-advisor that tailors the investment to individual risk profiles, as well as the timing of market entry.

Citation:

https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html