KDI Invest- Optimising Your Portfolio with Fractional Shares

Investing can be daunting for beginner investors. With so many investment options and assorted costs associated with them, it can be overwhelming at times to settle on an optimum portfolio mix. Kenanga Digital Investing (KDI) believes that you should have the flexibility to save and invest according to your risk tolerance without having to pay unnecessary fees that will eat into your investment returns.

KDI Invest is a fully Artificial Intelligence (A.I.) driven robo-advisory platform with an emphasis on keeping costs low. This is achieved via pooled trades where the A.I. driven asset allocation system bundles together every single trade for the day and then methodically distributes the shares back to the respective owners. By doing this, KDI Invest is able to allocate the ETF shares in such a way that all investors receive precisely the value of their amount invested while still enjoying economies of scale. This is accomplished with fractional shares.

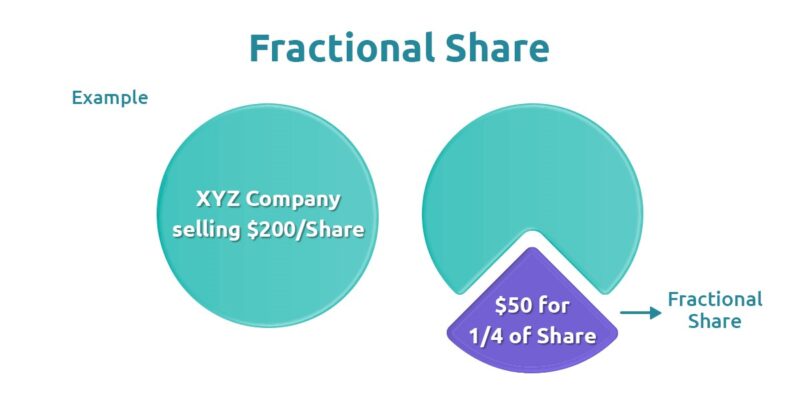

A fractional share is a slice of the original share. In this example, since you have sliced the share by a quarter, you now have 4 fractional shares at a cost of $50 each instead of $200 per share. The original share can be sliced further depending on the investment amount.

The Traditional Share Investment Backdrop

Before we delve further into fractional shares, let’s discuss how the share market works, both locally and globally, with a particular focus on the US.

In Malaysia, shares are usually traded in specific amounts, called board lots, of 100 units. This means that a share trading at RM8 will require a minimum initial investment of RM800 (RM8x100) for 1 lot. Aside from the standard board lots of 100 units, one can also purchase less than 100 units in what is called an odd lot. Trading in the odd-lot is usually less desirable due to its high liquidity premium, which indicates a wider bid-ask spread, making it more costly. With such a high entry barrier, it is often difficult for an aspiring investor to construct a diversified portfolio consisting of a wide range of performing asset classes.

However, the same cannot be said for the US market, where you can buy shares in 1 unit increments. Using the same example as above, shares in the US can be purchased at 1 unit, in this case, requiring a minimum initial investment amount of RM8 only (or USD2, assuming USD1=RM4). This also applies to Exchange-Traded Funds (ETFs) which is a basket of companies traded like shares on the exchange. US ETFs are the primary investment tool for KDI Invest.

Fractional Shares in The Picture

With financial innovation, the typical 1 unit of US shares can be further dissected into fractional shares. This feature is typically a bonus feature, offered by certain brokers that investors of KDI Invest are also able to enjoy. Fractional shares allow investors to only trade a portion of the shares in accordance with the availability of their funds. For instance, Microsoft (MSFT) shares which currently trades at $300 can be purchased with only $100 by buying 0.33 shares of Microsoft using fractional share trading. This is very useful as it allows an investor to have a diversified portfolio despite having a limited amount of funds.

In the example below, we show how investors can get exposure to major US tech stocks via fractional shares.

[1] Share prices are historical (as of 2 July 2021) and are presented for illustration purposes only

KDI Invest: In the Grand Scheme of Things

By leveraging the A.I. asset allocation system, KDI Invest can ensure that every client’s portfolio is accurately distributed according to the target allocation no matter the capital amount.

Upon deriving the optimal target allocation for each ETF by our proprietary algorithms, the trading and asset allocation engine employed by KDI Invest is capable of precisely calculating the exact proportion of ETF shares to be purchased and allocated to each portfolio, up to multiple decimal places. Thus, clients are able to effectively own a diversified portfolio as constructed without compromising on precision or cost.

Owning a diversified and fluid portfolio is what KDI Invest is all about. The best part of this whole thing? Investments in KDI Invest at RM3,000 and below are zero fees, with no hidden charges!

Visit us at Kenanga Digital Investing to find out how we grow your investment smartly with the least cost possible.