Though this strategy is about actively predicting the future flow of the economy, different investing professionals may assign different lengths of time as the best period in which to benefit from rotating into or out of a sector. The predictive nature of this strategy means that it is not in phase with the current economic cycle. A person utilising this strategy can be as little as three months to a whole year ahead of the economic cycle.

In addition to looking at past trends and reviewing reports from investment experts, people can analyse the financial news and digital performance indicator tools to make their predictions. In fact, it is better to look at a variety of sources before making any choices. An industry may publish very optimistic updates but if the economy it relies on is going through an unstable period, it might be safer to avoid investing into that sector for too long or in large amounts.

As you can guess, it takes a lot of knowledge and experience to carry out this kind of predictive analysis. Luckily, the digital revolution has given the field of investing several important and efficient tools. One such tool is robo-advisory, which has made investing more accessible for the common person than it has ever been before. Not only are robo-advisory tools such as KDI Invest cheaper as an entry point into investing, they are run on advanced algorithmic investing data that could carry out rotation into various sectors, asset classes and regions automatically.

The nitty gritty

Understanding the cyclical characteristics of each sector can help you to secure your investment portfolio from being vulnerable to loss during one phase or another of the market cycle. The different sectors perform better at different phases of the economic cycle.

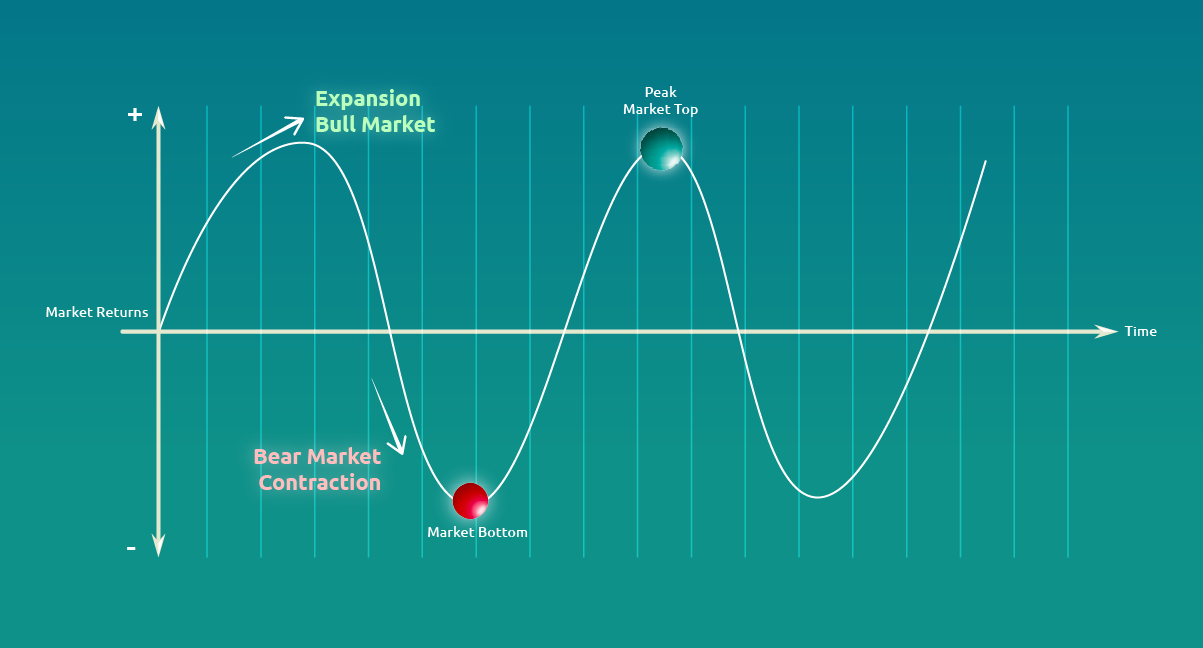

During a bull market or expansion – which is when the economy is on an upswing – people have more discretionary spending money and the economy feels stable. This is when people are more likely to purchase luxury goods or invest in technology. This is also when you can expect people to add more entertainment options to their budget such as faster internet or streaming services like Netflix and Viu.

During a bear market or contraction – investors are more cautious and people have to tighten their budgets. There may be fears of recession and people are more likely to let go of big ticket items like their cars, avoid taking out a mortgage, and even reduce or stop eating out. This is where you can see what can be described as defensive investing strategies where people focus on the essentials that will last throughout the phases. Utilities like electricity and water, healthcare products and services, and the literal “gold standard” of safe assets – gold and other precious metals, will see increased popularity.

Making it work for you

The first wave of indicators that can be used to predict the market are easily available to anyone. It just requires taking an interest in key economic indicators like the GDP, inflation, interest rates, etc.

Yet again, it gets complicated when we get down to the details. There is a lot of ‘noise’ you must cut through to get to the accurate information. It is easy to get carried away in reacting to short-term volatility, causing you to mistime your investments.

Plus, new investment products have simplified a lot of these processes. Sector Exchange-Traded Funds (ETFs) are a type of ETF which focuses on a specific group of companies within a sector. The companies have already been grouped by industry and you don’t have to worry about putting all your eggs in the wrong basket. Your investment will be spread across several companies within the industry or sector with which you feel most confident. This way, you reduce risk and still benefit from diversification.

Below are some popular sector ETFs:

SPDR S&P 500 ETF Trust (SPY)

Invesco QQQ ETF (QQQ) – tracking the tech-focused Nasdaq 100 Index

Energy Select Sector SPDR Fund (XLE)

Health Care Select Sector SPDR Fund (XLV)

Consumer Staples Select Sector SPDR Fund (XLP)

Consumer Discretionary Select Sector SPDR Fund (XLY)

It can be confusing to go alone, take KDI with you

The best way to make a rotation strategy work for you is to work with a knowledgeable partner. Better yet, with a robo-advisory tool!

KDI Invest is your next best step in laying the foundation for your future wealth. This innovative A.I investment tool is designed to reflect your financial goals and risk tolerance. The use of algorithmic investing and constant market monitoring means that it can make necessary adjustments at any time. Whether you are busy at work or relaxing at home, you never have to worry about manually checking and resetting anything. You can be sure that KDI Invest is investing your money the way you would choose and according to your risk preferences.

KDI offers US, regional and asset class rotation! Join now and get access to a selection of key sectors and asset classes, from technology and commodities, to property (REITS) and emerging markets.

Visit https://digitalinvesting.com.my/ to learn more.