What Are ETF’s & Why Investors Should Care?

The financial markets can often be filled with various complex-sounding instruments that baffle beginner investors, deterring them from exploring further. However, with the introduction of Artificial Intelligence (A.I.) focused platforms such as Kenanga Digital Investing (KDI), which emphasises the use of the digital algorithm for making investments, instruments such as Exchange-Traded Funds (ETF) are beginning to gain traction locally as the preferred investment vehicle for robo-advisors.

But what exactly is an ETF?

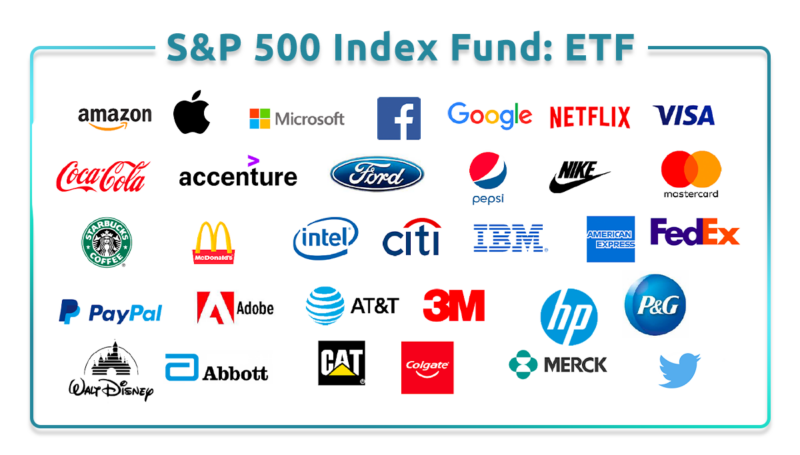

An ETF is an investment instrument that combines some attributes of stocks and unit trust. An ETF holds a basket of financial assets that usually tracks the performance of a specific index, which is a representation of asset classes such as stocks, bonds, commodities, or even currencies. ETFs can be traded on an exchange, where financial assets like stocks can be bought or sold at the prevailing market price. In essence, an ETF is a collection of assets that are wrapped together to be traded as a unit at a stock exchange.

Where can ETFs be found?

ETF are generally traded on major exchanges. Globally, there are as many as 7,600 ETFs that are traded worldwide. Most ETFs are found in US exchanges, where it was first invented. One of the biggest ETFs, the SPDR S&P 500 ETF Trust (SPY), with upwards of USD300bil in assets, is an ETF that tracks the S&P 500 index.

In Malaysia, we also have a number of ETFs that are traded on Bursa Malaysia. ETFs in our local bourse include FTSE Bursa Malaysia KLCI (FBMKLCI-EA) which is an ETF that tracks Malaysia’s KLCI Index; ABF Malaysia Bond Index Fund (ABFMY1) which provides conservative investors with exposure to fixed income; leveraged ETFs like Kenanga KLCI Daily 2x Leveraged ETF (KLCI2XL); and geographical ETFs focusing on countries like China (CHINAETF-MYR). However, KDI Invest trades in US ETFs to tap into greater liquidity and even more varieties of investments.

How is an ETF different from a Unit Trust?

Malaysians may be more familiar with unit trusts or mutual funds, which were popularised in the last few decades by fund management companies. Due to an additional layer of distribution channel, unit trusts usually have higher entry costs in the form of sales charges and annual management fees compared to ETFs.

While ETFs and unit trusts are both investment tools, unit trusts typically assign active fund managers who perform individual stock selections with an objective to outperform the market. In contrast to ETFs which are traded on exchanges, unit trusts are transacted solely with the fund management company or via a fund supermarket platform.

Pros and Cons of Investing in ETFs

Aside from lower overall fees, ETFs also offer a lower cost of entry, as US ETFs can be purchased for 1 unit or even fractions of a unit. In contrast, unit trusts usually require a minimum investment amount of RM1,000. Due to its structure, ETFs also offer an unrivalled level of diversification as they passively track a huge range of assets.

However, this is also where ETFs may lose out to unit trusts for return seekers looking for active portfolio management which aims to outperform the market. Nevertheless, research shows that up to 90% of ETFs outperformed their active counterparts over the long run, according to the latest S&P Indices Versus Active (SPIVA) report from S&P Dow Jones Indices.

How to Get Started with Investing in ETFs?

With so many ETFs spanning a range of asset classes and geographical exposures, investors can’t be expected to perform due diligence on each of them before making their investment decisions.

Enter KDI Invest, a fully automated A.I. digital investment management platform that changes the way you invest your money. KDI Invest optimises asset allocation in accordance with the Nobel-winning Markowitz Modern Portfolio Theory by deploying capital in a broad range of ETFs listed on US exchanges. By investing in US ETFs, investors can gain diversified exposure, including to MAANG stocks – Meta (META), Amazon (AMZN), Apple (AAPL), Netflix (NFLX), and Google (GOOG) via QQQ, an ETF that tracks the NASDAQ-100 index.

Looking for an investment portfolio that is tailored according to your risk preferences at minimal cost? You will be glad to know that KDI Invest offers 0% management fees for investments of RM3,000 and below! Click here to start your journey with KDI Invest now!

Citations:

https://seekingalpha.com/article/4435888-what-is-an-etf

https://www.oneetf.com.my/etfs-vs-unit-trust-funds

https://stockstotrade.com/what-is-an-etf/

https://en.wikipedia.org/wiki/List_of_American_exchange-traded_funds

https://www.spglobal.com/spdji/en/documents/spiva/spiva-us-year-end-2020.pdf