July 2022 Market Insights

Brought to you by the Kenanga Digital Investing (KDI) team, here is our 6th Market Insights column. Our Head of Digital Investing, Cheong Yew Huan will discuss the latest in financial news and present his thoughts on making the most of today’s market.

Market Recap

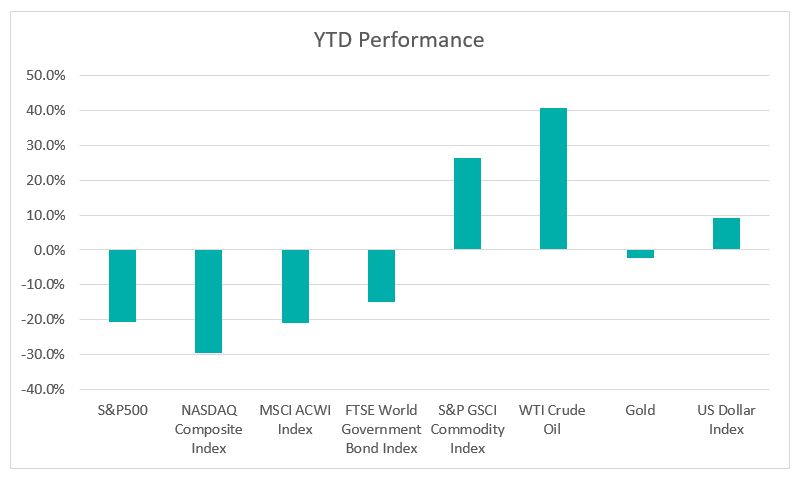

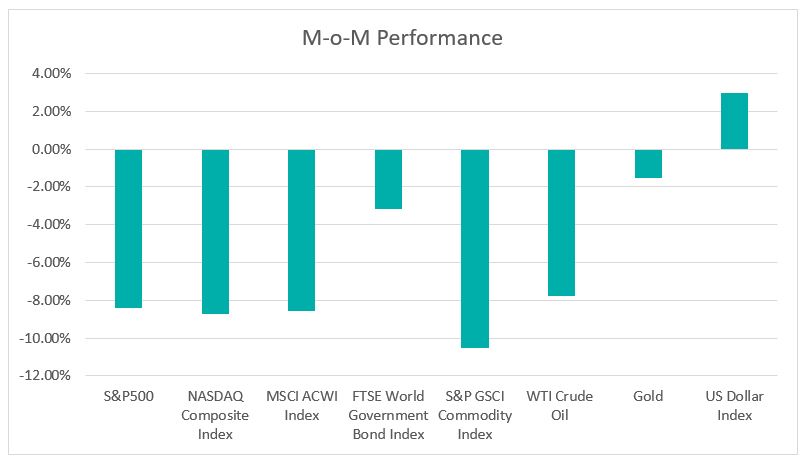

Chart 1: Index Performance in June 2022

Market

The first half of 2022 was dismal for global stock and bond markets. US equities entered bear market territory with the S&P500 posting its largest first-half decline since 1970, down 20.6% since the peak of the year. This is the fourth time S&P has entered a bear market. The previous bear markets happened in 2000 (US dot-com bubble), 2008 (subprime crisis) and 2020 (Covid-19 pandemic). The Nasdaq composite, which is representative of high growth and big technology companies, declined in five of the first six months this year and marked its worst 1H (-30%) in 20 years.

In June, the Federal Open Market Committee (FOMC) raised its benchmark Federal Funds rate by 75bps to a range of 1.5% to 1.75%, its most aggressive hike since 1994. Federal Reserve has hiked the rates by 150bps in total in the first half of 2022. (25 bps in March, 50bps in May and 75bps in June).

The Federal Reserve’s aggressive moves were in response to the inflationary pressures on the US economy. The latest inflation reports indicated an acceleration to a new 40-year high of 8.6% in May, surpassing the previous high of 8.5% recorded in March. The elevated inflation was due to supply chain disruption, and high energy and food prices.

Fed Chair Jerome Powell has reiterated that combatting inflation remains a top priority and aims at 2% inflation over the long run. Federal Reserve officials are now projected a Federal Funds rate of 3.4% by end of 2022, indicating additional 50 to 75 basis points hikes in the upcoming FOMC meeting in July and September.

The other major central banks follow the Fed’s step in tightening monetary policy to combat inflation. The Swiss National bank raised its policy interest rate for the first time in 15 years while the Bank of England raised rates by 25bps to 1.25%. The European Central Bank also signalled its intention to raise interest rates in July given that Eurozone inflation hit another record high in May.

The Fed’s hawkish policy stance and elevated inflation have caused the bond market to react. The FTSE World Government Bond index declined 14.8% in the first half of 2022. Over the period, the 10-year US Treasury Yield rose 150bps from 1.512% to 3.017%.

The S&P Goldman Sachs Commodity Index gained 26% in the first half of 2022 but posted its monthly decline in June. The commodities have been broadly outperforming the major equities indexes but the prospect of recessions has spurred a broad sell-off in commodities in June. Crude oil prices were under pressure with Crude Oil WTI Futures falling from the recent peak of USD123/barrel and closed at USD106/barrel.

Outlook

The US economic outlook remains mixed with some economists opining that US economic growth is beginning to lose momentum. The real GDP contracted at an annual rate of 1.6% in 1Q 2022 while the Michigan Consumer Sentiment Index fell to 50.0 in June 2022, down from 58.4 in May. Residential construction is under pressure with the number of US housing starts plunging 14.4% to 1.55 million in May, the lowest since April 2020. The manufacturing sector also points to slower growth with The Institute for Supply Management’s manufacturing PMI falling to 53% in June, down 3.1 percentage points from the reading of 56.1% in May. The Fed officials have cut their outlook for 2022 economic growth, now anticipating a 1.7% growth in GDP, down from 2.8% in March.

The US economy is potentially heading to a hard landing as the Fed focuses on curbing inflation, according to the latest New York Fed dynamic stochastic general equilibrium (DSGE model) forecast. According to the model’s projection, there is an 80% chance that the US will experience a hard landing while the probability of a soft landing is 10%.

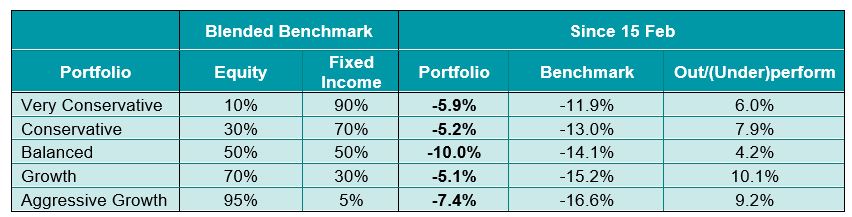

KDI Invest Portfolio Performance As of 30 June 2022

Remarks:

Benchmark: Equity: MSCI ACWI Index + Fixed Income: FTSE World Government Bond Index

Past performance is not indicative of future results.

The above table shows the performance of selected KDI portfolios since its launch on 15 February. The portfolio returns are ranging from -10% to -5.1%, outperforming the benchmark by 4.2% to 10.1%.

We believe the economy is likely to worsen before it recovers. The soaring inflation, aggressive tightening policy by global central banks, Russia’s invasion of Ukraine, supply chain disruption due to lockdowns in China, food and energy shortages, and growing recession fears continue to be primary headwinds in the second half of 2022.

With the market outlook being subject to various downside risks, KDI A.I. maintains a defensive strategy by keeping the portfolio risk at a low level. The largest ETF holdings across all portfolios is iShares Short Treasury Bond ETF (SHV) with exposure ranging from 25% to 39%. SHV is a safe-haven ETF with exposure mainly in US Treasury bonds with remaining maturities of one year or less, preserving investors’ capital in volatile markets. It has a very low credit risk and was down 0.34% YTD.

We believe the market fears will create great buying opportunities. The KDI A.I. will continue to conduct analysis and increase the portfolio risk when data-driven opportunities arise. The potential catalysts include a sign of inflation cooling and central banks adopting a more “balanced” stance in monetary policy. The earnings reporting which starts in late July could provide some insights into the direction of the markets.

Citation: