May 2023 Market Insights

Brought to you by the Kenanga Digital Investing (KDI) team, here is our 16th Market Insights column. Our Head of Digital Investing, Cheong Yew Huan will discuss the latest in financial news and present his thoughts on making the most of today’s market.

Market Recap

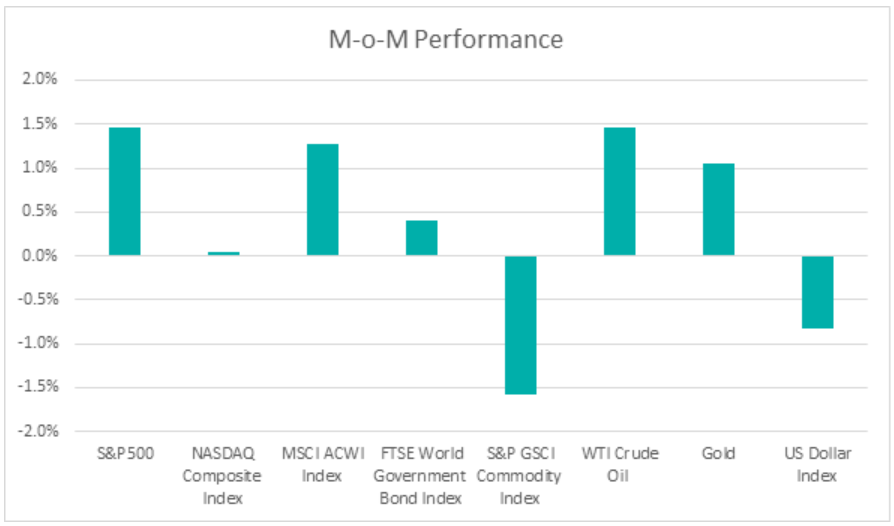

Chart 1: Index Performance in April 2023

Market

In the fixed-income market, US treasury yields decreased in response to indications of a decline in inflation. During the month, the two-year and ten-year treasury yields reduced by 19 basis points and 46 basis points respectively, and closed at 4.006% and 3.422%. The yield curve between the two-year and ten-year treasury yields remained inverted, with a negative spread of 58 basis points.

The S&P GSCI Commodity Index experienced a 1.6% decline during the month, primarily driven by the decrease in industrial metals and agriculture. Industrial metals were adversely affected by the headwinds of slower economic growth that are expected to dominate the economic landscape going forward. The corn, soy, and wheat prices also fell due to robust crop progress and declining demand. On a positive note, WTI Crude Oil recorded a 1.5% increase, bolstered by the unexpected production cuts announced by OPEC+ on 2 April 2023. Gold prices were supported by the decrease in Treasury yields and persistent concerns over the US banking turmoil.

The US Dollar Index, which measures against a basket of world currencies, dipped 0.8% to 101.66 during the month.

Outlook

Investors are eagerly anticipating the Federal Reserve’s monetary policy decision in early May for indications of the future direction of interest rates. Many investors are anticipating a 25 basis point rate hike. If this happens, it would mark the tenth consecutive rate hike, bringing the benchmark rate to a range of 5% to 5.25%.

In March, US inflation dropped to its lowest point in nearly two years, with year-over-year price increases reaching 5%. However, compared to February, prices only rose by a seasonally adjusted 0.1%, which is less than the month-on-month increases seen in both January and February. The core CPI, which excludes the food and energy components, rose 0.4% in March, which is slightly lower than the 0.5% increase seen in February.

The US first-quarter earnings for 2023 were better than anticipated. Factset reports that analysts are anticipating earnings growth for the second half of 2023 with projected earnings growth of 1.2% in 3Q 2023 and 8.5% in Q4 2023 respectively. Overall, analysts predict earnings growth of 1.2% for the full year 2023.

The spread between 10yr and 2yr US treasury yields has been inverted, indicating the market’s concerns about the possibility of further bank failures and credit pressures that could result from an economic slowdown and increased unemployment. As credit conditions tighten and inflationary pressures subside, it is expected that the Fed’s policy will remain restrictive.

China’s GDP expanded by 4.5% YoY in 1Q 2023, exceeding analysts’ expectations and positioning Beijing to meet its growth target of 5% for the year. Against the backdrop of challenges faced by the US and Europe, including rising energy costs and inflation outpacing wage growth, the performance of China’s economy will be vital to the global economy in 2023.

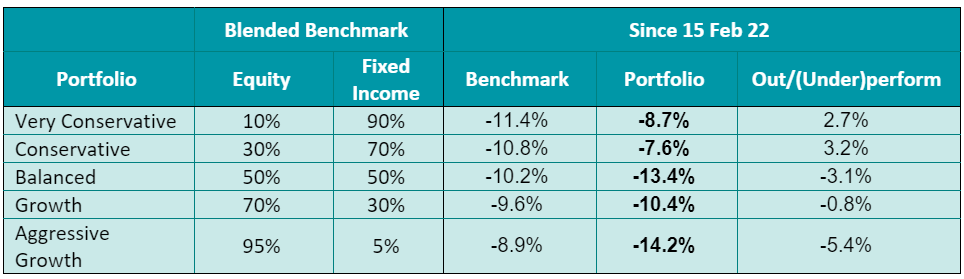

Table 1: KDI Invest Portfolio Performance As at 30 April 2023

Remarks:

Benchmark: Equity: MSCI ACWI Index + Fixed Income: FTSE World Government Bond Index

Past performance is not indicative of future results.

The above table provides information on the performance of selected KDI portfolios since their launch on February 15, 2022. All portfolios have experienced negative returns, ranging from -14.2% to -7.6%, which could be attributed to the volatile market conditions. The portfolios have also shown varied levels of outperformance or underperformance against the benchmark, ranging from -5.4% to 3.2%.

The collapse of two regional US banks in March heightened the risk of an economic downturn, leading to tighter credit conditions. Moreover, investor sentiment may have been impacted by concerns about the need to raise the US debt ceiling. Treasury Secretary Janet Yellen has warned that the Treasury Department may run out of measures to pay its debt obligations by early June. The failure to raise the debt ceiling will cause a “steep economic downturn” in the U.S.

The International Monetary Fund (IMF) has released its latest five-year global growth projection, which is the lowest since 1990 when the organization began issuing such forecasts. IMF predicts that global growth will reach 2.8% in 2023 and then hover around 3% through 2028, due to lagging productivity and the risk of fragmentation of the global economy. The recent collapse of several banks and weaker economic data have increased concerns about a potential recession.

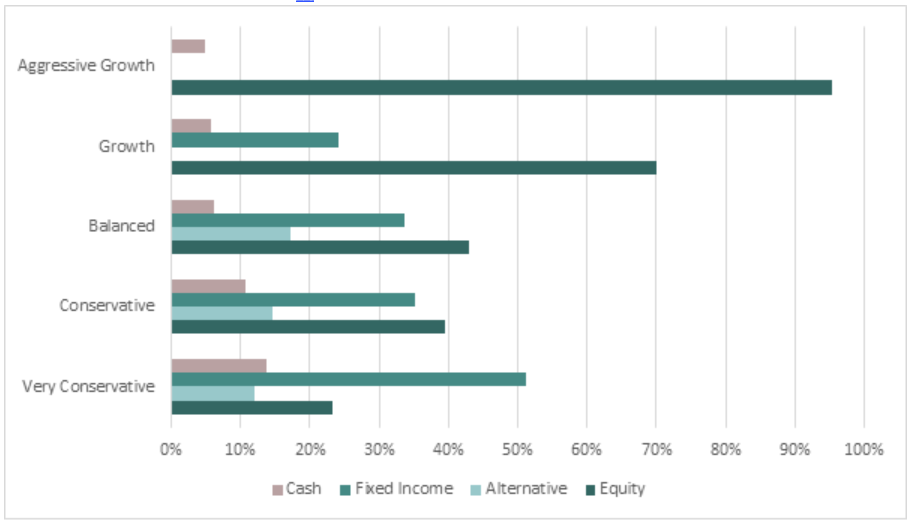

KDI A.I. will keep a close eye on the portfolio during periods of elevated market risk and modify asset allocation as necessary. The KDI portfolios remained diversified to mitigate risk while also potentially taking advantage of market opportunities.

Chart 2: Asset Class Exposure As at 30 April 2023

Please note that the above performance and asset class exposure are based on five proxy portfolios. Actual KDI Invest portfolio performance may vary from the above due to the customization by the KDI robo-advisor A.I. based on investors’ risk profiling, as well as the timing of market entry.

Citation: