1. Stocks

This is the investing-related term that people are most familiar with due to its constant usage on television and in films. Stocks are also known as shares because it represents the amount of the company you own as a shareholder.

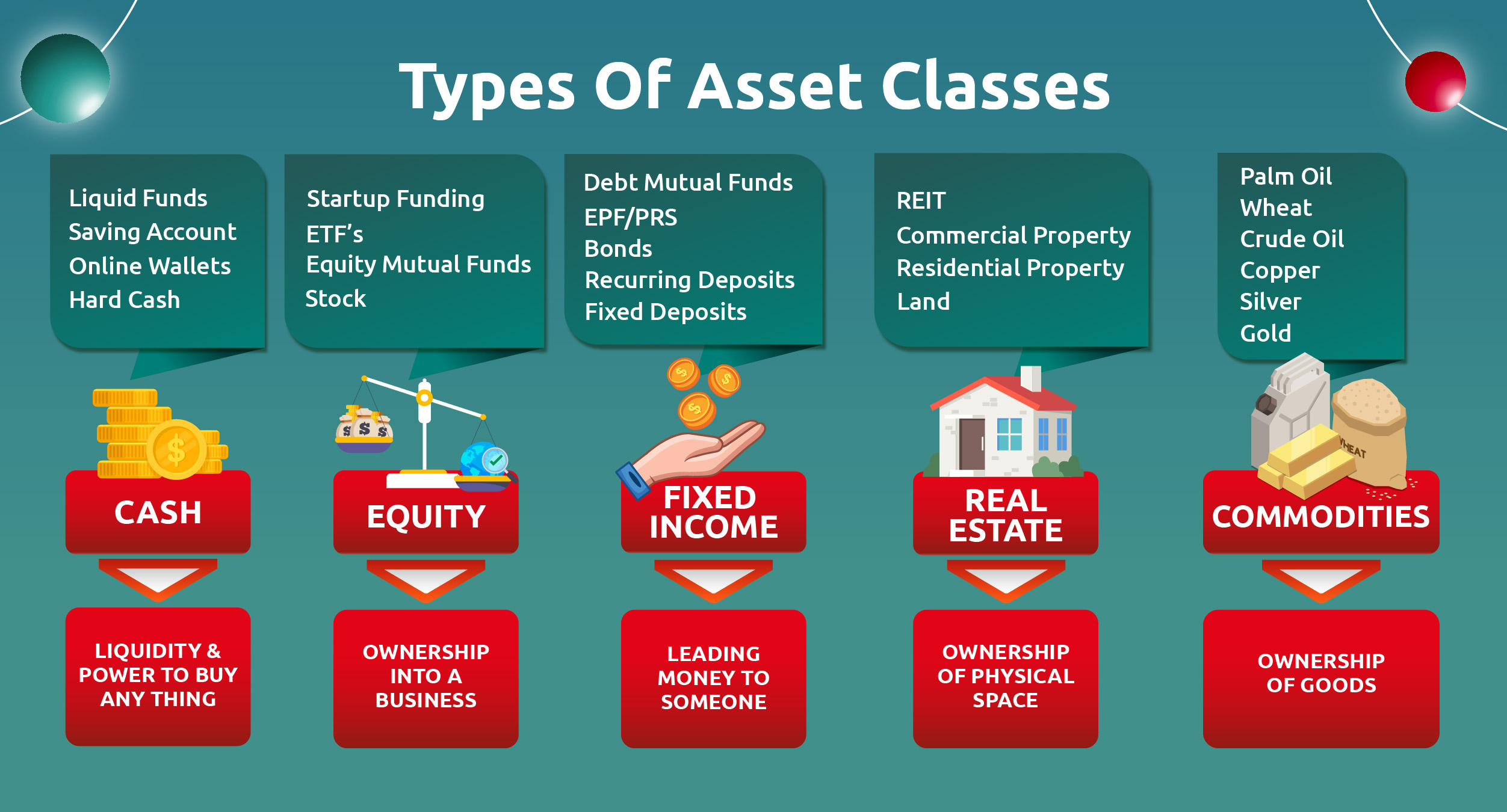

When people talk about equity, they are talking about shares. Your equity as a shareholder is the monetary value of the shares you own. However, it does not mean the exact value of the money you spent on buying stocks. Instead, the value of shares are determined by the prices at which they are traded, usually on a stock exchange. Others believe the implicit value of a share should be the total amount you could receive from the company – this is called a dividend.

Equities can generate money in two ways:

1. You become a shareholder and the company pays you a dividend.

2. You buy shares in a company and then sell the shares at a later date for a higher price.

If the company in which you are a shareholder makes a profit, it will split this money among its various obligations – paying off debt, buying equipment, investing in future growth, and similar. Once these obligations are cleared, the company will split the remaining money among its shareholders. The amount that you get is your dividend.

2. Bonds

Bonds have a lot of appeal because they are a fixed income asset and offer little risk. There are many types of bonds but the two types most people are familiar with are government bonds and corporate bonds. At a first glance, bonds may seem complex but they are a fairly simple debt instrument.

A bond is a promise to repay a loan. It is as simple as that, though of course, as investing is a for-profit business, the promise takes the form of several legally binding documents. These documents spell out the exact way in which the bond works for the lender and the borrower.

Typically, the lender will loan an amount of money to the borrower for an agreed upon duration of time. At the end of this period, the borrower will repay the lender the amount they loaned plus an additional amount generated from interest. According to Bank Negara , Malaysian bonds, also known as Malaysian Government Securities (“MGS”) are stable and offer attractive returns for investors. While not all bonds are easily accessible to ordinary investors, bond funds and bond ETFs are some ways that you could invest in bonds.

3. Commodities

Commodities refers to natural resources such as agricultural products, precious metals, and fuel sources. Examples of commodities are easy to recognise as many of them are products which see daily use in everyday life.

Agricultural products include rice, wheat, meat, and similar consumables. Gold and precious metals such as platinum, nickel, silver, and more are in our phones and make up a vast majority of our jewelry. New sources of energy like hydroelectricity and wind farms, and legacy sources such as crude oil and its derivatives remain in great demand across industries.

Commodities used to be traded primarily via futures contracts and only investors with money to burn (and sometimes, a delivery address) could safely take chances on commodities. More recently, advances in artificial intelligence and machine learning are providing less risky ways to incorporate commodities into your investment portfolio.

Financial instruments like Exchange-Traded Funds (ETFs) and robo-advisors have made investing accessible for a wider audience. ETFs combine some attributes of stocks and unit trusts. Robo-advisors offer you a low-risk, algorithmic way to invest in a basket of commodities.

Commodities are a good way to diversify your portfolio and offer a degree of security in the event of market uncertainty.

Still a Bit Lost? KDI is Here to Help!

Investing has never before been as accessible and affordable as it is today. But, it can be scary to enter into a new area, especially when your hard earned money feels at risk.

With this in mind, Kenanga Investment Bank Bhd (KIBB) – the largest independent investment bank in Malaysia – launched Kenanga Digital Investing (KDI) as an innovative portfolio management solution to help get you started in investing.

If you want to try out investing in the short term or to build up enough of an amount to get some serious assets into your portfolio, you can try KDI Save – a product that offers you all the benefits of a typical fixed deposit account without the usual lock-in period.

KDI Save gives you fixed returns while accumulating interest daily, has no penalties for early withdrawal, and, at a higher rate than the average FD account.

Ready to make a bigger splash? Try KDI Invest!

KDI Invest is a robo-advisory tool that offers you a secure way to access a basket of today’s most exciting investment assets. Relying on algorithmic investing to provide you with investing choices that reflect your risk profile, it also ensures a speed of reaction to market forces that only an analytical machine can provide.

Investors can gain diversified exposure, including to the “Magnificent Seven” stocks – Meta (META), Amazon (AMZN), Apple (AAPL), NVIDIA (NVDA), Alphabet (GOOG), Microsoft (MSFT), and Tesla (TSLA) via QQQ, an ETF that tracks the NASDAQ-100 index.

Set your feet on the path to future wealth with KDI.

Visit https://digitalinvesting.com.my/ to learn more.