January 2026 Market Insights

Market Recap

Market

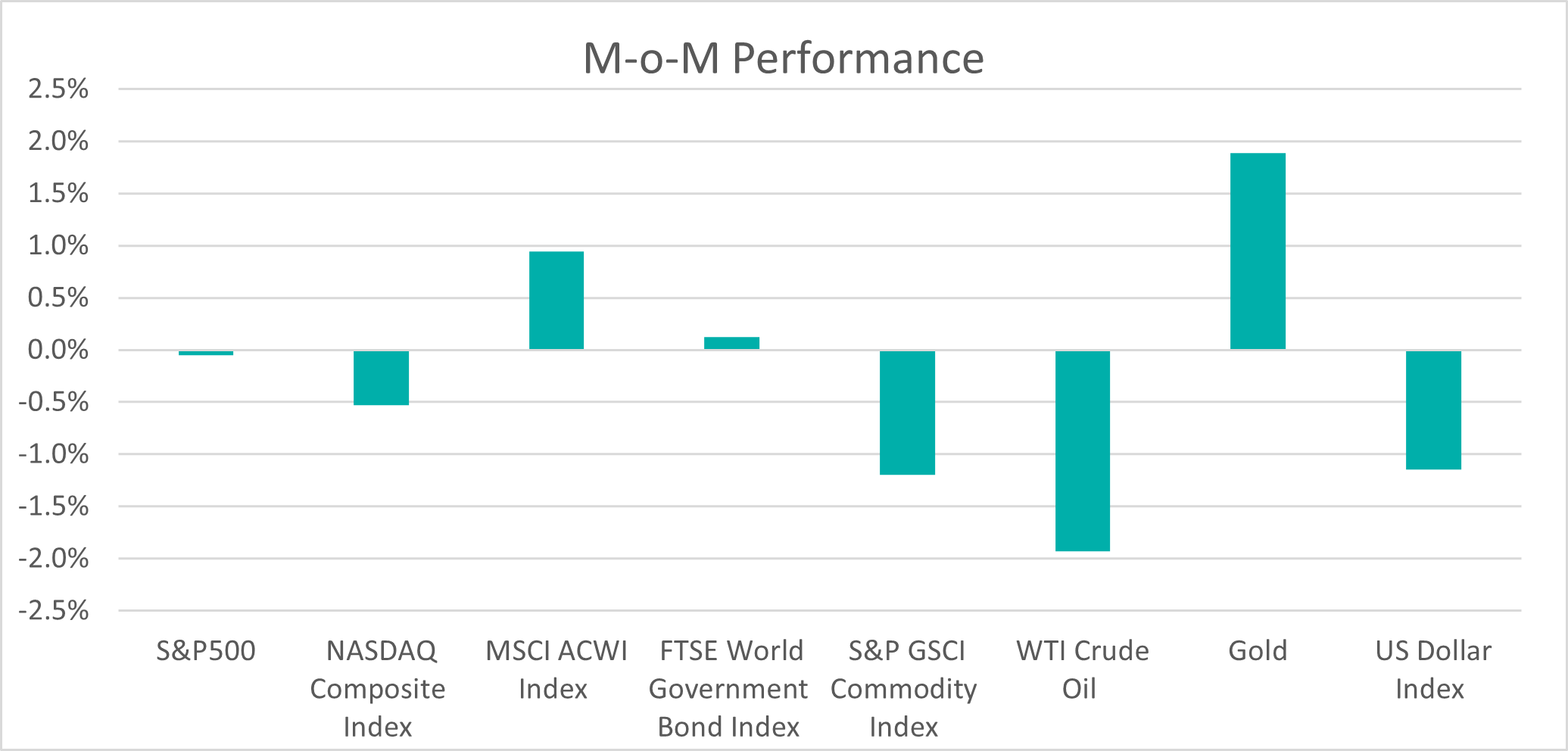

December 2025 saw US indices underperform their global peers as the “AI trade” took a breather. International equities, particularly in Europe and Asia Pacific (ex-Japan), emerged as the month’s winners, bolstered by a weakening US dollar and a broadening of market participation away from mega-cap technology. The S&P 500, Nasdaq Composite and MSCI All-Country World Index moved by -0.1%, -0.5% and 0.9% respectively for the month.

While short-term Treasury yields declined in line with the Fed’s cuts, long-term yields, such as the 10-year Treasury, saw a jump of 15 basis points to 4.17% in December. This steepening of the yield curve suggests that investors are pricing in a “higher-for-longer” growth environment or anticipating potential inflationary impacts from future fiscal policies and global trade tariffs. As the market enters January 2026, the probability of a further rate cut at the January 28 Fed meeting is estimated at a modest 16%, suggesting a likely pause in the easing cycle as the Fed assesses the impact of its previous moves.

Gold remained a standout hedge, finishing the year with historic gains, reflecting a market that is still deeply attuned to the risks of trade volatility and geopolitical shifts. Energy markets faced a challenging 2025 – WTI crude hovered around $57 per barrel in late December, reflecting a delicate balance between supply risks in countries like Venezuela and Russia and forecasts of a potential global oversupply in 2026.

Bitcoin corrected by 3% to $88,263 by end-December. This correction reflects a broader rotation out of speculative digital assets as investors sought safety in tangible hedges like gold and high-quality equities amid growing macroeconomic uncertainty.

The US dollar weakened against the Malaysian Ringgit, ending December-2025 at 4.0603, from 4.1328 in November. In 2025, the Malaysian ringgit appreciated by 9.2% against the U.S. dollar.

Outlook

The global economy showed unexpected resilience in the final quarter of 2025. U.S. GDP grew at an annualized rate of 4.3% in Q3—well above forecasts and the strongest reading since late 2023—driven by robust consumer spending and a rebound in exports. However, this figure comes with caveats: a 43-day federal government shutdown disrupted data collection, creating uncertainty around labour and inflation trends and possibly skewing estimates. The return of timely data in December helped stabilize markets, confirming that while the labour market is softening, it is not in free fall. Still, investors should note that some of this growth may reflect temporary factors rather than a sustained acceleration.

The Fed concluded 2025 with a 25-basis point rate cut, bringing the target range for the Fed Funds Rate to 3.50-3.75%. This move represented a continuation of the easing cycle initiated in response to moderating inflation and a softening labour market. By November 2025, the US inflation rate had decreased to 2.68%, with core inflation similarly moderating to 2.69%. Despite this progress, the final meeting of the year revealed internal divisions among voting members. Some officials emphasized the need to support slowing economic growth, while others cautioned against a premature easing that could reignite inflationary pressures.

China’s economy delivered a solid performance in 2025, with strong export momentum keeping growth on track without the need for major new stimulus. Manufacturers continued to move up the value chain, underscoring progress toward higher-quality development. Despite headwinds in property and consumer spending, the economy showed resilience: investment trends reflect a shift toward efficiency and innovation, retail activity remains supported by emerging consumption patterns and falling home prices are helping improve affordability. These dynamics signal that China is navigating structural challenges while laying the groundwork for sustainable, long-term growth.

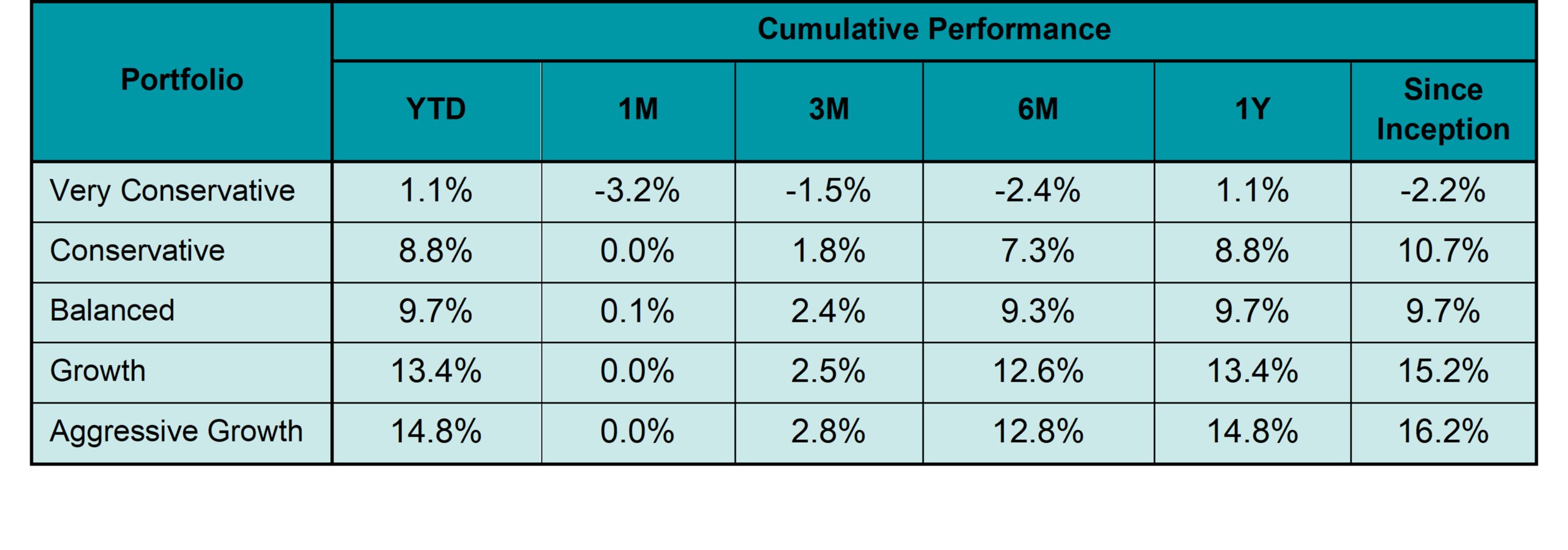

The provided table offers information on the cumulative performance of selected KDI portfolios since their launch on February 15, 2022. The portfolio returns (in USD) range from -2.2% to 16.2%. In 2025, the portfolios recorded returns within a range of 1.1% to 14.8%.

In December 2025, the financial sector emerged as the market leader, advancing 3.1% as the stabilizing interest rate environment improved the outlook for bank margins and lending activity. Conversely, utilities and real estate sectors experienced significant declines, dropping 5.1% and 2.1% respectively, as rising long-term yields impacted these interest-rate-sensitive areas. This rotation reflects a broader market shift away from momentum-driven growth toward sectors with tangible earnings and attractive valuations.

Trade tensions remained in focus in December 2025 as the U.S. administration doubled down on its “America First” approach. A major legal battle over the president’s authority to impose broad trade sanctions is heading toward a Supreme Court decision in early 2026—a ruling that could reshape tariff policy. At the same time, Washington signalled tougher trade measures on China, targeting sectors like semiconductors and shipping. While an October truce eased some pressure by lowering tariffs on Chinese goods from 42% to 32%, the U.S. continues to push for stronger trade positions globally.

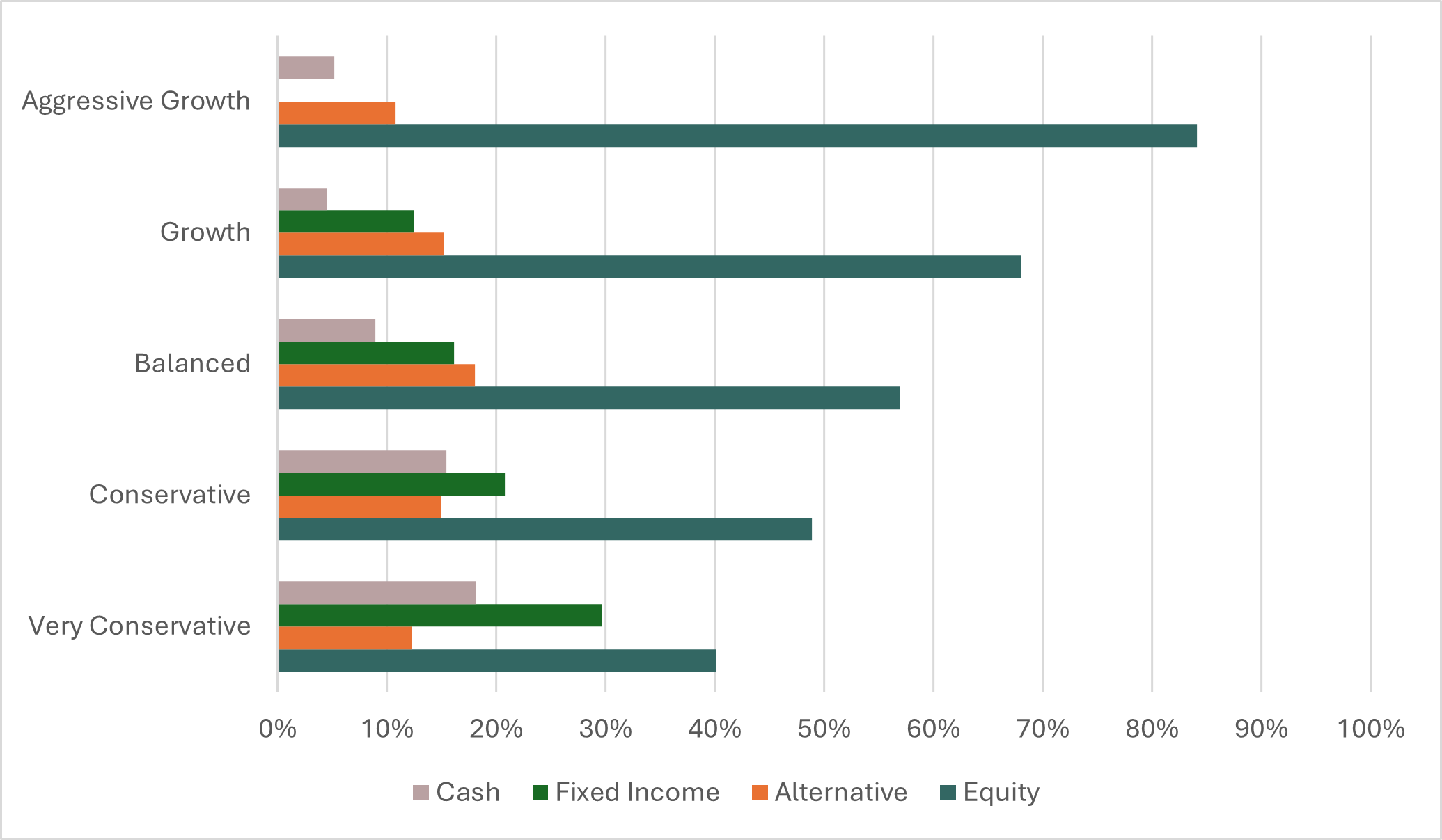

KDI’s portfolios are well diversified to withstand market fluctuations, and will remain vigilant in monitoring adjusting changes, asset allocation when necessary. As market volatility rises, the portfolios may shift to a risk reduction mode to protect downside. This strategy aims to safeguard your investments during uncertain times while remaining poised to take advantage of favourable conditions.

Kindly note that the performance and asset class exposure illustrated above are derived from five proxy portfolios. The actual performance and exposure of your investment portfolio may differ due to the customisation made by our proprietary algorithms that tailors the investment to your unique risk profile, as well as the timing of market entry.

Our Perspective: A Brave New Reality

As we begin 2026, we would like to wish you a very Happy New Year. We hope the year ahead brings you good health, stability, and continued progress toward your long-term financial goals.

December 2025 reinforced the narrative of global markets broadening rather than a market breakdown. While U.S. equities paused after a solid run, international equities delivered more positive performance, supported by a weaker greenback and improving participation beyond mega-cap, technology stocks. Fixed income markets reflect growing confidence in economic resilience, with short-term yields easing following policy rate cuts while longer dated yields moved higher. Gold retained its lustre, finishing the year with historic gains and underscoring its role as a hedge against ongoing uncertainty. Energy prices remained subdued, while cryptocurrencies experienced a pullback as investors became more selective. The Federal reserve reduced the policy rate to target range of 3.50% – 3.75%, reflecting moderating inflation and a softening, albeit still orderly, labour market. Economic data also surprised positively, with growth remaining resilient, however, these figures should be interpreted cautiously given earlier data disruptions by the government shutdown earlier in October.

Looking East, China’s outlook remains a tale of two halves. The economy continued to show resilience via export momentum, while global trade policies remained a key source of uncertainty. China continues to benefit from its large cost advantages and control over rare earth mining, giving it a ‘leg up’ against the high tariffs on its exports. On the other hand, despite Beijing’s efforts to paint a picture of internal resilience, China’s property sector remains to be a drag on growth. We are monitoring developments closely, including the announced RMB 62.5 billion in fiscal support measures aimed at encouraging domestic demand.

In this environment, remaining invested with a disciplined and diversified approach remains essential. Taking a hard (and pragmatic) look at 2025 reminds us that markets are hardly predictable, and that leadership can shift quickly across regions and sectors. The ongoing move towards a more multipolar global landscape, together with heightened geopolitical uncertainty, further reinforces the importance of global diversification.

At KDI, we build global, multi-asset portfolios systematically. This is achieved by applying an objective, data-driven approach to portfolio construction to support your long-term financial goals. As the year unfolds, we continue to encourage investors to maintain a long-term perspective, which remains the most effective way to navigate a market environment defined by both resilience and uncertainty.

How about the opportunity to earn 6.5% p.a.* returns when you invest with KDI Save and KDI Invest?

*Terms and Conditions apply. This advertisement has not been reviewed by the Securities Commission Malaysia.

Citation:

https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

https://budgetlab.yale.edu/research/state-us-tariffs-november-17-2025

https://www.bbc.com/news/articles/c62n9ynzrdpo

Disclaimer

Kenanga Digital Investing (“KDI”) is licensed by the Securities Commission of Malaysia as a Digital Investment Management Company. KDI is authorised to carry out the business of fund management blending innovative technology into automated portfolio management services offered to clients under a license issued pursuant to Schedule 2 of the Capital Markets Services Act (CMSA) 2007.

Investment involves risk, including the possible loss of capital you invest. Past performance does not indicate future performance. Historical returns, expected returns, and probability projections are provided for informational and illustrative purposes, and may not reflect actual future performance. KDI does not assume any fiduciary responsibility or any liability for any consequences, financial or otherwise, arising from any transaction in reliance on such information. Investors should rely on their own evaluation or consult an independent financial, accounting, tax, legal or other professional advisers to access the merits and risks before investing.

Any forward-looking statements, predictions, projections or forecast on the economy, stock market, bond market or economic trends of the markets contained in this material are subject to the market influences and contingent upon matters outside the control of KDI and therefore may not be realised in the future. No representation is made as to the completeness and adequacy of the information to make an informed decision.

Neither the information, nor any opinion, contained in this article constitutes a promotion, recommendation, solicitation, invitation by KDI or its affiliates to buy or sell any securities, investment schemes or other financial instruments or services, nor shall any security, collective investment scheme, or other financial instruments or services be offered or sold to any person in any jurisdiction in which such offer, solicitation, purchase, or sale would be unlawful under the securities laws of such jurisdiction. This is not intended to be an invitation or offer made to the public to subscribe for any financial product or other transaction.

This information has not been reviewed by the Securities Commission of Malaysia.