The hunt for high returns ends here.

The hunt for high returns ends here.

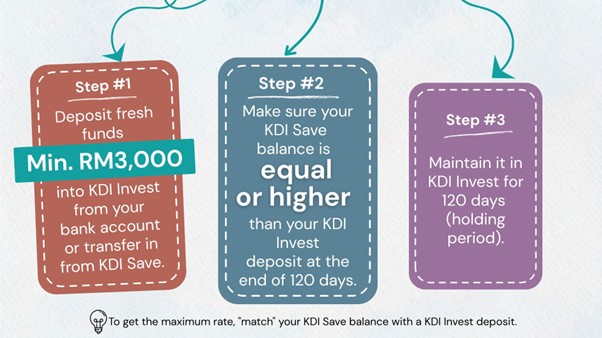

Deposit fresh funds into KDI Invest to boost your KDI Save returns with 6.5% p.a.*

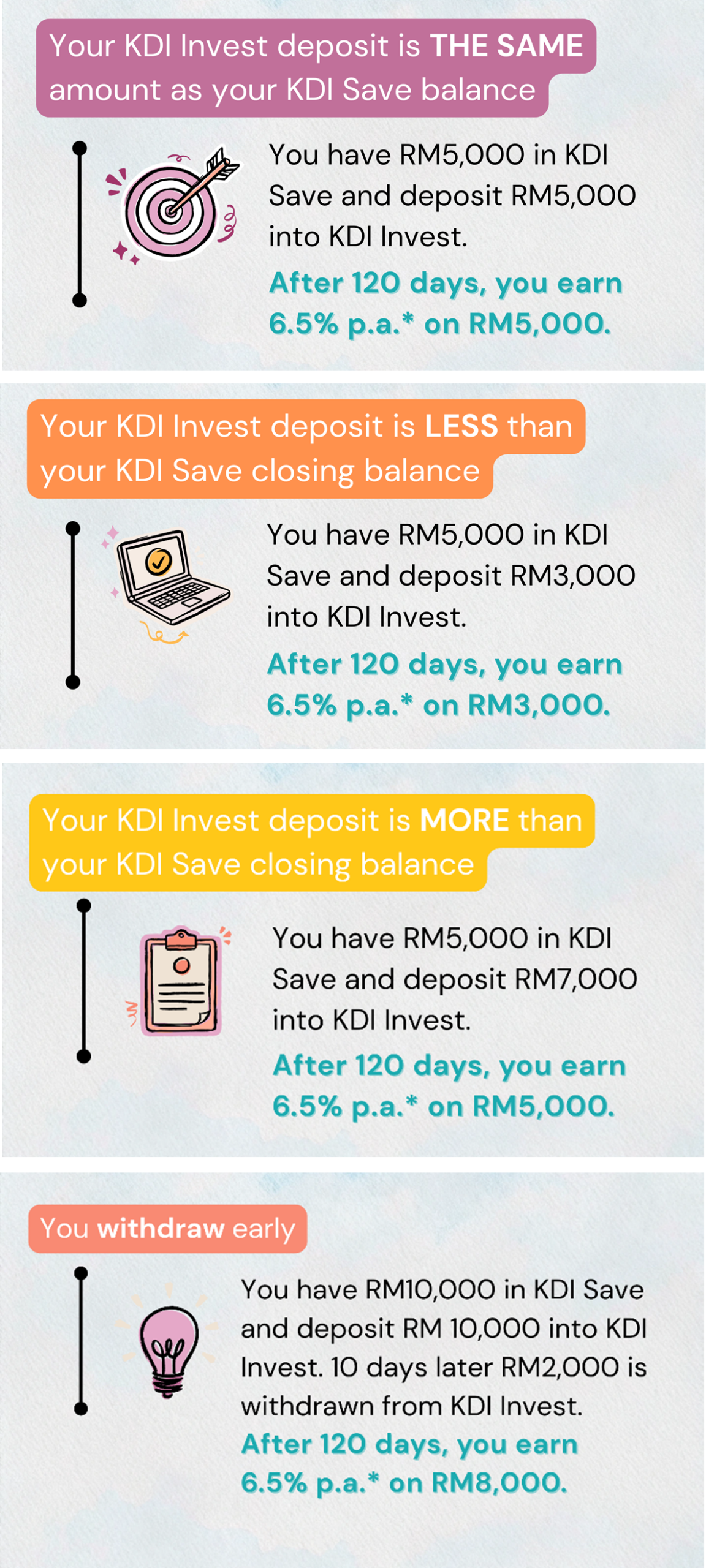

Here’s a quick look at how it would play out in different situations:

Ensure that the deposit is more than RM3,000.

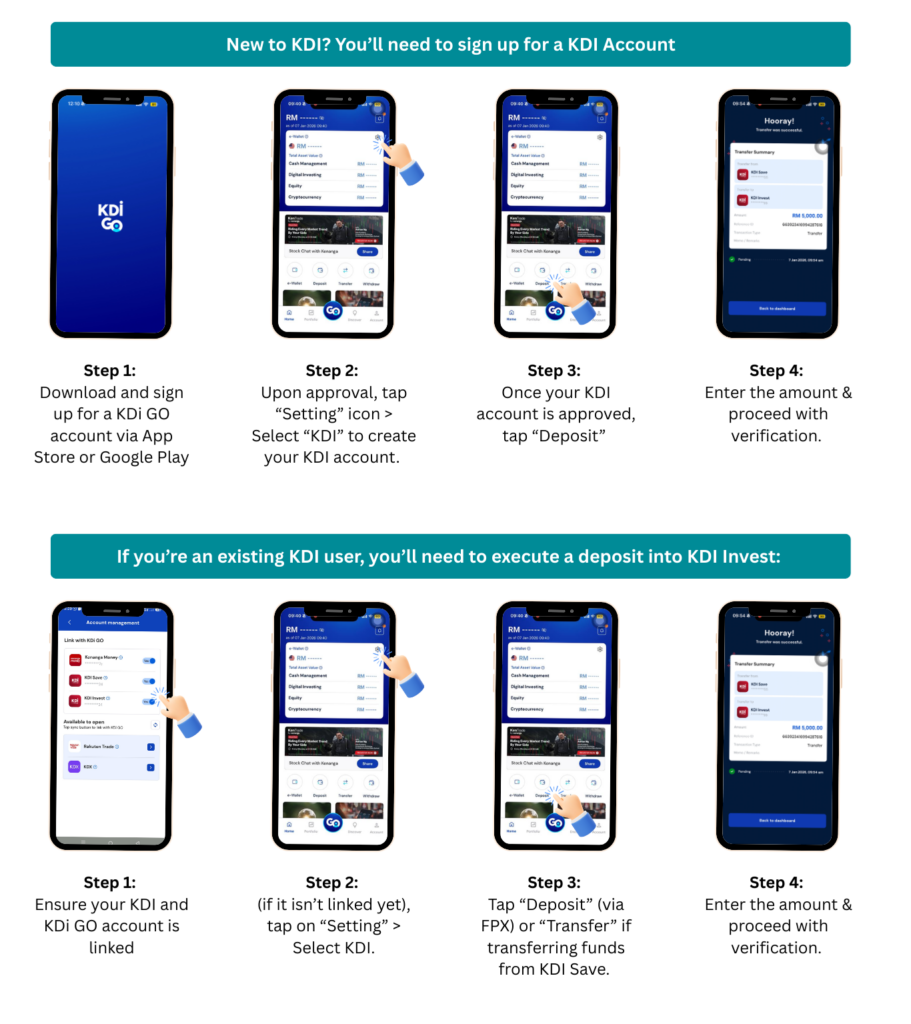

Have we sold you on the idea of investing with KDI? If the answer is YES, here’s what you need to do next!

Download and sign up for a KDi GO account via App Store or Google Play Store.

General Programme Information

KDI Invest Product Information

- FAQ – General Bonus Interest

- FAQ – Calculation of Bonus Interest & KDI Save Effective Rates

- KDI Invest Portfolio Performance

Still Need Help? We’re Here for You!

📧 Email: digitalinvesting@kenanga.com.my

💬 WhatsApp: https://wa.me/60162995351

This advertisement has not been reviewed by the Securities Commission Malaysia.

Disclaimer

Kenanga Digital Investing (“KDI”) is licensed by the Securities Commission of Malaysia as a Digital Investment Management Company. KDI is authorised to carry out the business of fund management blending innovative technology into automated portfolio management services offered to clients under a license issued pursuant to Schedule 2 of the Capital Markets Services Act (CMSA) 2007.

Investment involves risk, including the possible loss of capital you invest. Past performance does not indicate future performance. Historical returns, expected returns, and probability projections are provided for informational and illustrative purposes, and may not reflect actual future performance. KDI does not assume any fiduciary responsibility or any liability for any consequences, financial or otherwise, arising from any transaction in reliance on such information. Investors should rely on their own evaluation or consult an independent financial, accounting, tax, legal or other professional advisers to access the merits and risks before investing.

Any forward-looking statements, predictions, projections or forecast on the economy, stock market, bond market or economic trends of the markets contained in this material are subject to the market influences and contingent upon matters outside the control of KDI and therefore may not be realised in the future. No representation is made as to the completeness and adequacy of the information to make an informed decision.

Neither the information, nor any opinion, contained in this article constitutes a promotion, recommendation, solicitation, invitation by KDI or its affiliates to buy or sell any securities, investment schemes or other financial instruments or services, nor shall any security, collective investment scheme, or other financial instruments or services be offered or sold to any person in any jurisdiction in which such offer, solicitation, purchase, or sale would be unlawful under the securities laws of such jurisdiction. This is not intended to be an invitation or offer made to the public to subscribe for any financial product or other transaction.

This information has not been reviewed by the Securities Commission of Malaysia.