A.I. And You: How A.I. Can Help Your Investment Portfolio

Artificial intelligence as a term is popular because it has enjoyed a steady and prominent role in movies and on television. Thus, when A.I.-enabled products and systems first hit the market, they were enthusiastically embraced by the general public. However, while A.I.-enabled products are novel and exciting; in certain sectors, it is still best to let the professionals handle their usage and application.

This is especially significant when it comes to the finance arena. Over the last decade, banking and investing has seen significant transformations due to A.I.-enabled products. Financing apps such as Peer-to-Peer (P2P) lending platforms have made loans available to people with limited access to traditional banking, while robo-advisors have allowed new demographics of people access to investing. But, access is not the same as expertise, and we cannot take chances with our financial future.

ChatGPT may be able to respond with an investment portfolio in answer to your queries; but, there is no guarantee that it truly is the right portfolio for you. Unguided A.I. tools are not sophisticated enough to take your real-world circumstances into account and could place your financial future in real jeopardy. There are a lot of opportunities available due to these A.I. enabled products, but there is also a lot of harm that can come from using them without adequate knowledge and fact-checking.

Using a guided approach to A.I., investment professionals like Kenanga Digital Investing (KDI) have stepped up to the task of providing platforms to help people invest with more confidence. KDI’s A.I.-enabled investment products are easy to use and can even be customized to invest according to the customer’s risk tolerance level.

Get To Know Your Robo-Advisor

A robo-advisor is a type of digital platform that provides investment and financial planning services. These platforms utilize an automated, algorithm-driven approach that not only requires little supervision, while also providing the added advantages of robust security features and low entry fees.

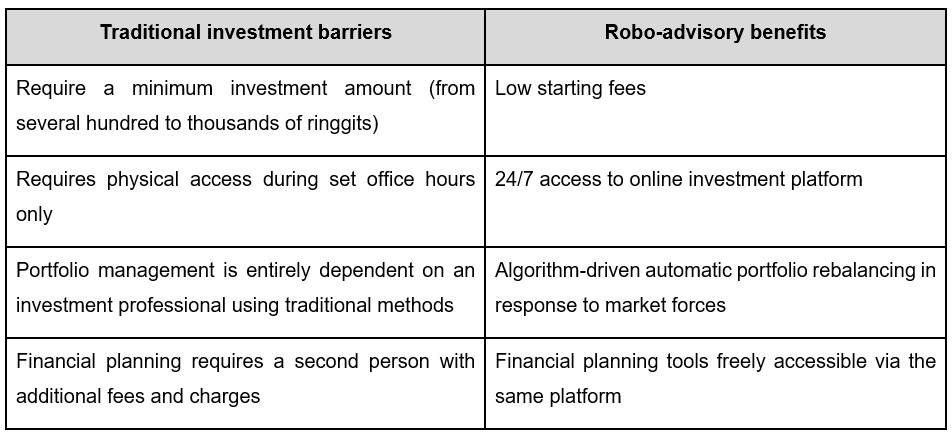

Traditional banking and investing models require a level of mobility and physical access that is not always possible for people who live outside urban areas. This meant that millions of people were denied the many benefits of investing, such as generating passive income and contributing meaningfully to their future retirement. Robo-advisory investment tools have completely changed the financial landscape for these people by overcoming traditional investing barriers.