June 2024 Market Insights

Welcome to the June edition of the Market Insights column brought to you by the Kenanga Digital Investing (KDI) team. In this edition, Our Head of Digital Investing, Cheong Yew Huan, will discuss the latest financial news and share his insights on how to make the most of today’s market.

Market Recap

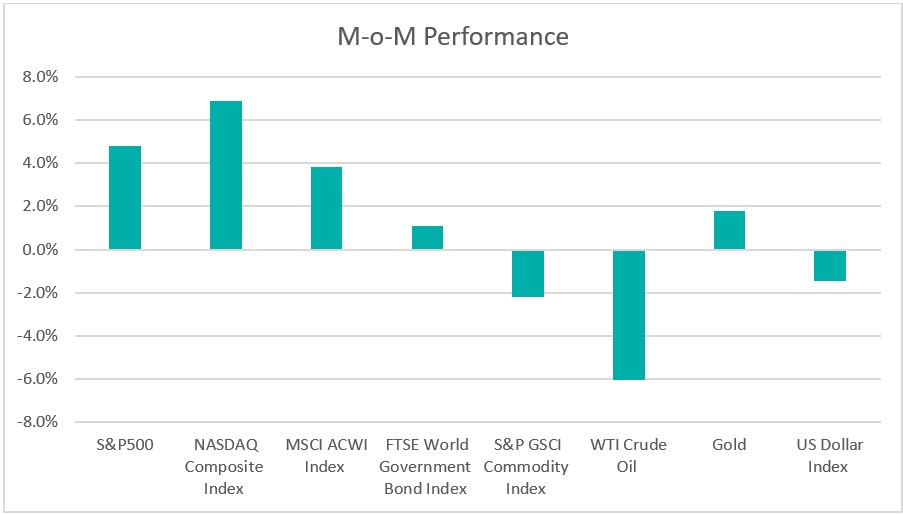

Chart 1: Index Performance in May 2024

Market

During the month, the Nasdaq surged by 6.9%, while the S&P 500 saw a notable increase of 4.8%. This positive movement was part of a broader rally in global equity markets, as reflected by the MSCI ACWI index rising by 3.8%. A significant milestone was the Nasdaq crossing the 17,000 mark for the first time, primarily driven by gains in Nvidia. Nvidia’s earnings, which surpassed analysts’ expectations, along with the booming AI computing sector, spurred a rally among other chipmakers. Additionally, a softer-than-expected employment report bolstered expectations of potential rate cuts by the Federal Reserve, further supporting the market’s upward trajectory.

The 10-year Treasury yield fell by 18 basis points to 4.4985%, while the 2-year Treasury yield dropped by 16 basis points to 4.8727% during the month. The market expects that the Federal Reserve will keep interest rates unchanged at the June FOMC meeting. Due to a slowing job market and lower inflation, the market foresees that the Federal Reserve will begin to loosen its policy in September, with a total of 50 basis points of rate reductions this year.

In the commodities space, gold prices surged to a new record high of US$2,327 per ounce by the end of May 2024. This increase was driven by several factors, including the decline in US Treasury yields and a weaker US Dollar. Additionally, hopes for interest rate cuts from the US Federal Reserve further boosted gold prices. Furthermore, the People’s Bank of China continued its trend of purchasing gold for the 18th consecutive month in April, while Chinese investors increasingly turned to gold as a safe-haven asset amid economic uncertainties. WTI crude oil prices experienced downward pressure due to soft refinery demand and abundant supply, resulting in a 6% decrease to US$76.99 per barrel during the month. Weaker global oil demand indicators prompted OPEC+ producers, comprising OPEC and allies like Russia, to maintain supply cuts.

The dollar softened slightly with the dollar index, which measures the US currency against a basket of six peers, dropping 1.5% to 104.67 on signs of a slowing US economy and job data.

Outlook

The economy is demonstrating significant signs of weakness, with job market data deteriorating as high interest rates hinder growth. The minutes of the May FOMC meeting reinforced concerns about the lack of further progress on inflation. Fed Chair Powell reiterated that it will likely take longer than previously thought to attain the confidence needed to lower interest rates. The report prompted investors to raise bets that the Fed would implement its first rate reduction in September. In other news, President Biden announced tariff hikes on Chinese imports worth US$18 billion, targeting strategic sectors such as semiconductors, batteries, solar cells, and critical minerals. The tariff changes will take effect from 2024 to 2026. These tariffs are aimed at boosting domestic manufacturing and reducing dependence on China but could also escalate trade tensions and raise costs for consumers and businesses.

Chinese trade data and some property market developments had helped Chinese stocks continue their recent outperformance. China’s exports and imports returned to growth in April after contracting the previous month. Shipments from China grew 1.5% year-on-year in April after falling 7.5% in March. Imports for April increased 8.4%, beating an expected 4.8% rise and reversing a 1.9% fall in March. The Chinese government announced further steps to stabilize the crisis-hit property sector, allowing local governments to buy “some” apartments, relaxing mortgage rules, and pledging to deliver unfinished homes. The International Monetary Fund (IMF) revised up its China growth forecast by 0.4 percentage points to 5% for 2024 and 4.5% in 2025 but warned that the property sector remained a key growth risk.

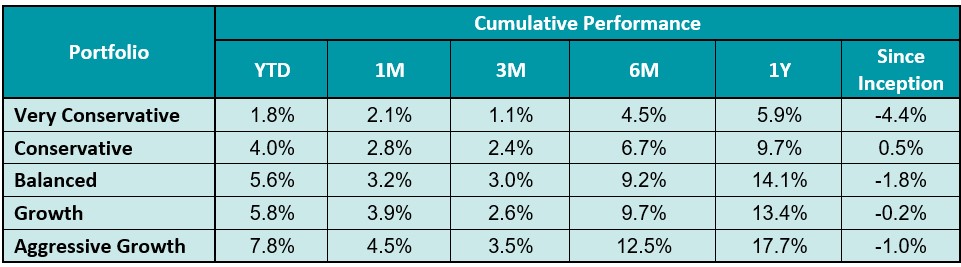

Table 1: KDI Invest Portfolio Performance as at 31 May 2024

The provided table offers information on the cumulative performance of selected KDI portfolios since their launch on February 15, 2022. The portfolio returns (in USD) range from -4.4% to 0.5%. Year-to date, all portfolios recorded positive returns within a range of 1.8% to 7.8%.

The month of May saw favorable returns from both stocks and fixed-income investments. New indications of a cooling economy and a quicker-than-expected decline in inflation might prompt major central banks to initiate interest rate cuts in the second half of the year. Political uncertainties surrounding the US presidential elections, along with risks stemming from conflicts in the Middle East and Ukraine, could also contribute to volatility throughout the year.

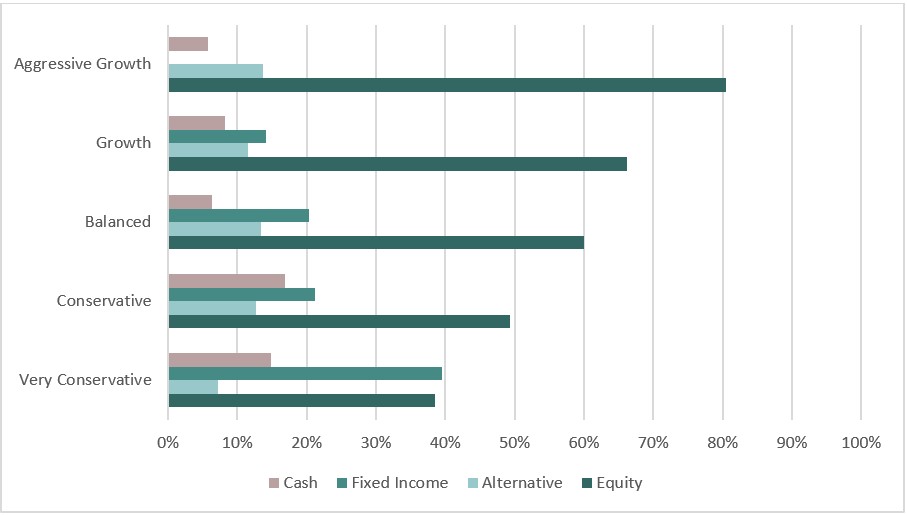

The KDI portfolios maintain diversification to ride through market volatility, with current allocations to equity ranging from 39% to 81%. Fixed income constitutes an allocation of up to 39%, while alternative investments, primarily in the gold ETF (GLD), make up to 14% of the portfolio. Cash holdings range from 6% to 17%.

Chart 2: Asset Class Exposure as at 31 May 2024

Please note that the performance and asset class exposure mentioned above are derived from five proxy portfolios. The actual performance and exposure of KDI Invest portfolio may differ due to the customisation by our A.I. based robo-advisor, which tailors investment to individual risk profiles, as well as the timing of market entry.

Citation: