April 2023 Market Insights

Brought to you by the Kenanga Digital Investing (KDI) team, here is our 15th Market Insights column. Our Head of Digital Investing, Cheong Yew Huan will discuss the latest in financial news and present his thoughts on making the most of today’s market.

Market Recap

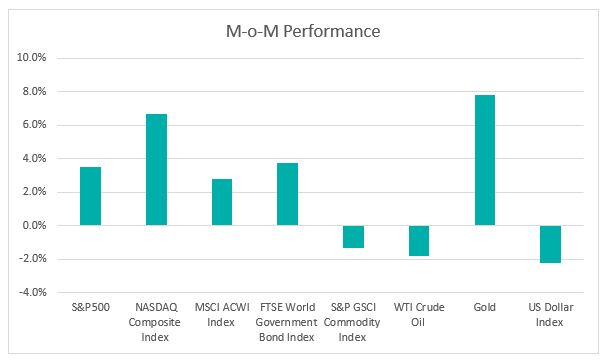

Chart 1: Index Performance in March 2023

Market

The equity market has been resilient during the month despite news of the collapse of, Silicon Valley Bank and Signature Bank, and an emergency takeover of Credit Suisse by Switzerland’s biggest bank, UBS. The collapse of the two US regional banks has triggered a sell-off in banking stocks as investors panicked over the possibility of other struggling banks in the system. Despite this, the S&P500 and Nasdaq Composite posted gains of 3.5% and 6.7% respectively during the month. Year to date, the S&P500 rose by 7.0% while the Nasdaq jumped 16.8%

In the fixed income market, the US 10-year Treasury yield fell by 45 basis points to 3.4676%, while the 2-year Treasury yield was down by 79 basis points to 4.053%. Investors’ concerns about the banking sector outweighed the Fed’s decision that the rate-hiking cycle is potentially near its end.

During the month, the S&P GSCI Commodity Index was down by 1.3%, and WTI crude oil hit a 15-month low mid-month before rebounding and closing at US$75.67 per barrel. The drop in oil prices was driven by concerns that risks in the global banking sector and a potential increase in US interest rates could spark a recession that oil demand could be negatively impacted. On the other hand, gold prices surged by 7.8%, breaking above US$2,000 as investors looked for a safe haven from the banking crisis.

The US Dollar Index, which measures against a basket of major currencies, fell by 2.3% in March 2023. The expectation that the Fed might pause rate hikes due to the collapse of two US banks and the rescue of a major European bank had led to weakness in the US dollar during the month.

Outlook

The Federal Reserve raised interest rates by a quarter point on March 22, 2023, but also acknowledged the possibility of further tightening. However, due to the recent turmoil in the financial sector and the closure of Silicon Valley Bank on March 10, 2023, the Federal Reserve may pause future hikes.

The economic data was mixed. The US Personal Consumption Expenditure (PCE) index, the Federal Reserve’s preferred inflation gauge, increased 0.3% last month after accelerating 0.6% in January. Consumer spending, which accounts for more than two-thirds of US economic activity, rose moderately in February, with an increase of 0.2%, below economists’ polled forecast of 0.3%. The sales of new US homes unexpectedly rose in February after posting a 12-month decline, suggesting the housing market is beginning to stabilize after a tumultuous year.

China’s exports fell 6.8%, while imports contracted 10.2% in the first two months of 2023, clouding the outlook for the economy as it gradually begins recovering from Covid-19 restrictions. China is targeting gross domestic product growth of 5% for this year, compared to 3% GDP growth recorded in 2022. The PBOC unexpectedly lowered the reserve requirement ratio for banks by 25 basis points, providing liquidity in the banking system. The PBOC’s action comes against the backdrop of heightened turmoil in financial markets in the US and Europe, as well as a still-uncertain recovery in China’s economy.

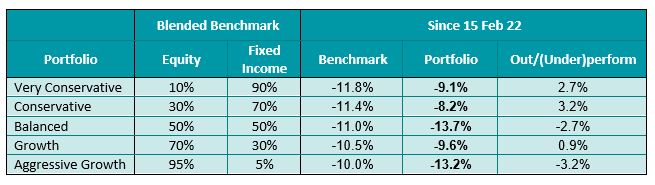

Table 1: KDI Invest Portfolio Performance As at 31 March 2023

Remarks:

Benchmark: Equity: MSCI ACWI Index + Fixed Income: FTSE World Government Bond Index

Past performance is not indicative of future results.

The above table provides information on the performance of selected KDI portfolios since their launch on February 15, 2022. Each portfolio has experienced varying negative returns which could be attributed to the volatile market conditions of when they were first established. The portfolios have also shown varied levels of performance against their benchmarks, ranging from -3.2% to 3.2%.

The collapse last month of two US banks and the take-over of Credit Suisse have sparked concerns about a broader financial crisis and increasing risk of a recession later this year. Inflation rates, interest rate hike cycle by hawkish central banks, 2Q23 corporate earnings and geopolitical tensions are the market drivers in the near term. Investor sentiment nears pessimism seen at lows of the past 20 years, according to Bank of America. Cash levels rose to 5.5% in March, up from 5.2% last month, in the first month-over-month increase since October 2022, and the largest since September 2022. The cash allocation has remained above the historical average of 4.7% continuously since December 2021.

The KDI portfolios maintained their diversification by investing in a range of asset classes, including equities with exposure up to 45%, fixed income with exposure ranging from 27% to 97%, alternative investments with exposure up to 22%, and cash holdings with exposure ranging between 3% and 17%.

Please note that the above performance and asset class exposure are based on five proxy portfolios. Actual KDI Invest portfolio performance may vary from the above due to the customization by the KDI robo-advisor A.I. based on investors’ risk profiling, as well as the timing of market entry.

Citation: