August 2024 Market Insights

Welcome to the August edition of the Market Insights column brought to you by the Kenanga Digital Investing (KDI) team. In this edition, Our Head of Digital Investing, Cheong Yew Huan, will discuss the latest financial news and share his insights on how to make the most of today’s market.

Market Recap

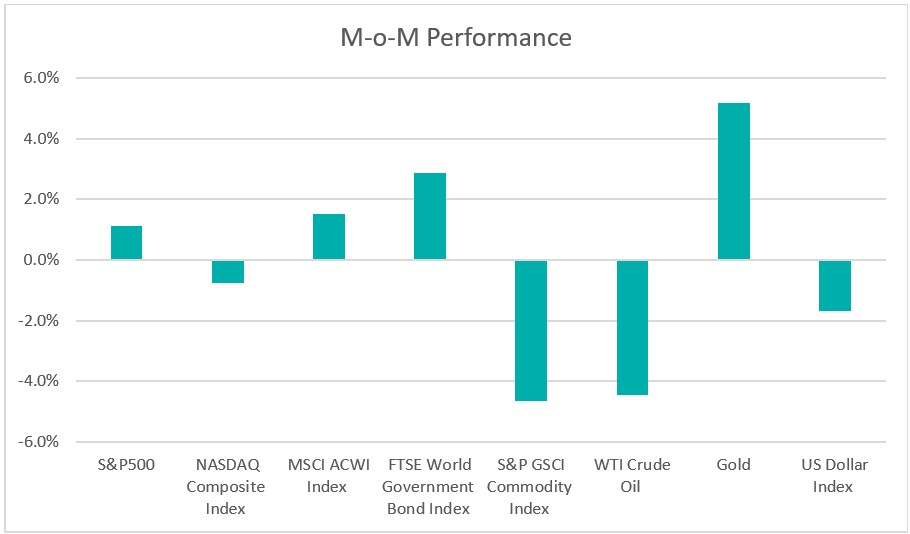

Chart 1: Index Performance in July 2024

Market

The performance of major U.S. stock indices was mixed during the month. The indices surged to all-time highs mid-month, bolstered by U.S. retail sales data suggesting that the Federal Reserve is approaching its easing cycle. Equities faced turbulence in the latter half of July as chip and megacap stocks, particularly Nvidia Corp and Microsoft Corp, declined ahead of their quarterly earnings releases. Value stocks remained relatively stable as investors shifted focus to underperforming sectors. Overall, the S&P 500 rose by 1.1%, while the Nasdaq Composite fell by 0.8%.

The market’s expectation of lower U.S. interest rates put pressure on bond yields. Further signs of slowing inflation fueled speculation that the Fed might act as early as September. U.S. Treasury yields continued to decline for the third consecutive month, with the two-year and 10-year yields dropping by approximately 50 and 40 basis points to 4.2575% and 4.0296%, respectively.

In commodities, WTI crude oil prices dipped by 4.5% to $77.90 a barrel as investors grew cautious due to expectations of lower demand. This caution was driven by signs of a slowing Chinese economy and weaker-than-forecast U.S. employment and business data, indicating that the economy of the world’s top oil consumer might be cooling. Meanwhile, gold continued to rally, reaching a record high above $2,400 an ounce, supported by increasing optimism about U.S. interest rate cuts.

The U.S. Dollar Index, which measures the dollar against a basket of other currencies, slipped by 1.7% to 104.10. This decline was driven by growing expectations for an interest rate cut by the FOMC in September.

Outlook

As widely expected, the Federal Reserve kept the federal funds rate target range unchanged at 5.25%-5.50% during its July meeting. Federal Reserve Chair Jerome Powell expressed confidence that recent inflation data indicates price pressures are on a sustainable downward path. This has led markets to anticipate a potential rate cut soon, with a near-100% probability of a rate cut in September, according to CME FedWatch. The Producer Price Index (PPI) increased by 0.2% in June, slightly more than expected, but economists still believe the Federal Reserve might start cutting rates by September. U.S. consumer sentiment fell to an eight-month low in July due to high prices, and the unemployment rate rose to a 2.5-year high of 4.1% in June, suggesting a weakening labor market. The Fed remains cautious, awaiting more data to ensure that inflation is truly under control before making any rate cuts. Investors are also faced with the decision of whether to remain invested in profitable technology companies or shift to value stocks and defensive sectors that might benefit from lower interest rates.

China’s economy showed signs of slowing in the second quarter of 2024, with GDP expanding by just 4.7%, falling short of the 5.1% forecast and marking the slowest growth in five quarters. The economy has struggled to gain momentum, with the property market remaining challenging as new-home prices fell for the 13th consecutive month. In response, the People’s Bank of China (PBOC) unexpectedly cut the rate on its one-year policy loans by 20 basis points to 2.3%, the largest rate cut since April 2020, shortly after reducing a key short-term rate. Despite these supportive measures, investor sentiment around Chinese stocks remained weak.

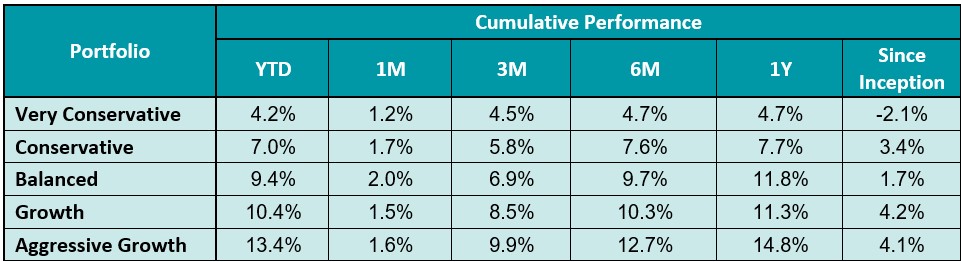

Table 1: KDI Invest Portfolio Performance as at 31 July 2024

The provided table offers information on the cumulative performance of selected KDI portfolios since their launch on February 15, 2022. The portfolio returns (in USD) range from -2.1% to 4.1%. Year-to date, all portfolios recorded positive returns within a range of 4.2% to 13.4%.

In July, the market experienced a decline in Treasuries and mixed movements in stocks. Earlier in the year, artificial intelligence-related stocks had surged, leading to high valuations and raising market concerns. Federal Reserve Chair Jerome Powell’s indication that inflation is trending downward suggests a higher likelihood of interest rate cuts in September. This potential change in monetary policy could influence asset class rotation and overall market sentiment. Investors are closely monitoring the U.S. presidential election, adjusting portfolios in response to growing uncertainty and increased market volatility. As the November election approaches, stock markets may become increasingly volatile. Overall, market movements will be driven by the election, expectations of rate cuts, and corporate earnings.

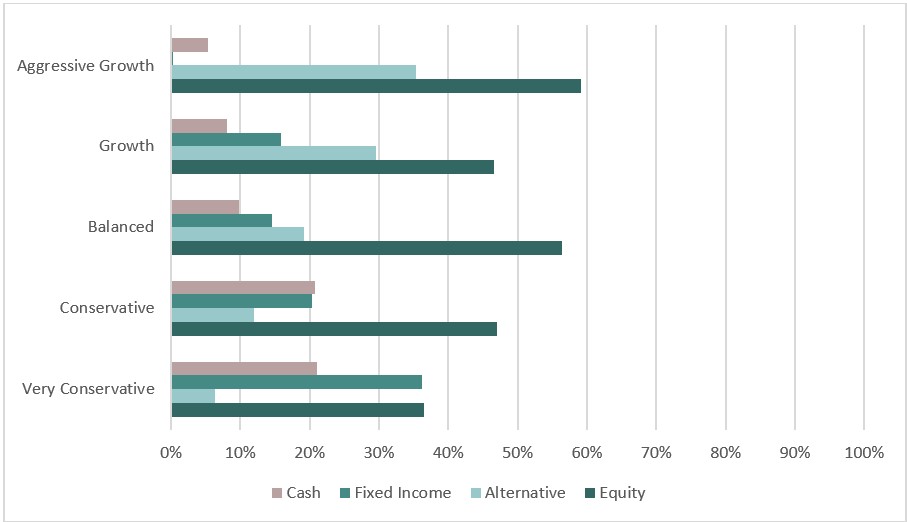

The KDI portfolios maintain diversification to navigate market volatility, with current equity allocations ranging from 36% to 59%. Fixed income constitutes up to 36% of the portfolio, while alternative investments make up to 35%. Cash holdings range from 5% to 21%.

Chart 2: Asset Class Exposure as at 31 July 2024

Please note that the performance and asset class exposure mentioned above are derived from five proxy portfolios. The actual performance and exposure of KDI Invest portfolio may differ due to the customisation by our A.I. based robo-advisor, which tailors investment to individual risk profiles, as well as the timing of market entry.

Citation:

https://www.morningstar.com/economy/september-fed-rate-cut-looks-likely-then-what