ESG Investing: An Explainer – Part 2

Introduction

ESG is an acronym that has recently been gaining widespread attention in the global economic landscape. “Environmental, Social, and Governance” based investing gives investors and investment professionals a method to assess any business for more than its bottom line. ESG investing requires companies to reveal how they benefit the environment, protect its human resources, and how it conducts itself within the market. It is an additional measure outside the finance-only measures for evaluating investment assets.

This type of investing has seen steady growth ever since the younger generations began entering into the investment sphere. Today’s youth are much more environmentally savvy and care deeply about work-life balance. They represent a priority shift towards investment options that are representative of their values and ethics.

ESG & Business Sustainability

ESG remains an important and still growing area of interest for financial and investment experts because it allows a deeper analysis of any given company and/or asset. A company that has a great track record financially, may not have a business model that is lasting. These types of non-financial factors provide a way to assess future risk and projected growth of an asset by considering its most important business factor – sustainability.

The focus on ESG also encourages companies to consider the true impact of their business processes. This can help a company to think out of the box when planning their future goals.

ESG investing is just one of the ways that people can invest to ensure that they make personal value-based choices. You can choose one or mix and match to build a portfolio that reflects your priorities.

ESG & You

There are a wide variety of ESG strategies that focus on aspects closer to your interests. Socially Responsible Investing focuses on businesses that have a clear and positive impact on the environment, or the community it operates within. Someone who is deeply invested in their community may choose assets that will have a positive social impact benefitting community growth. This person would likely not invest in companies that sell addictive products like alcohol and tobacco.

Another type of value-based investing strategy is Impact Investing. This strategy is about ensuring a positive, productive outcome as a result of the investment – the asset/company needs to be able to prove the real-world benefit it provides.

Goals-Based ESG Investing

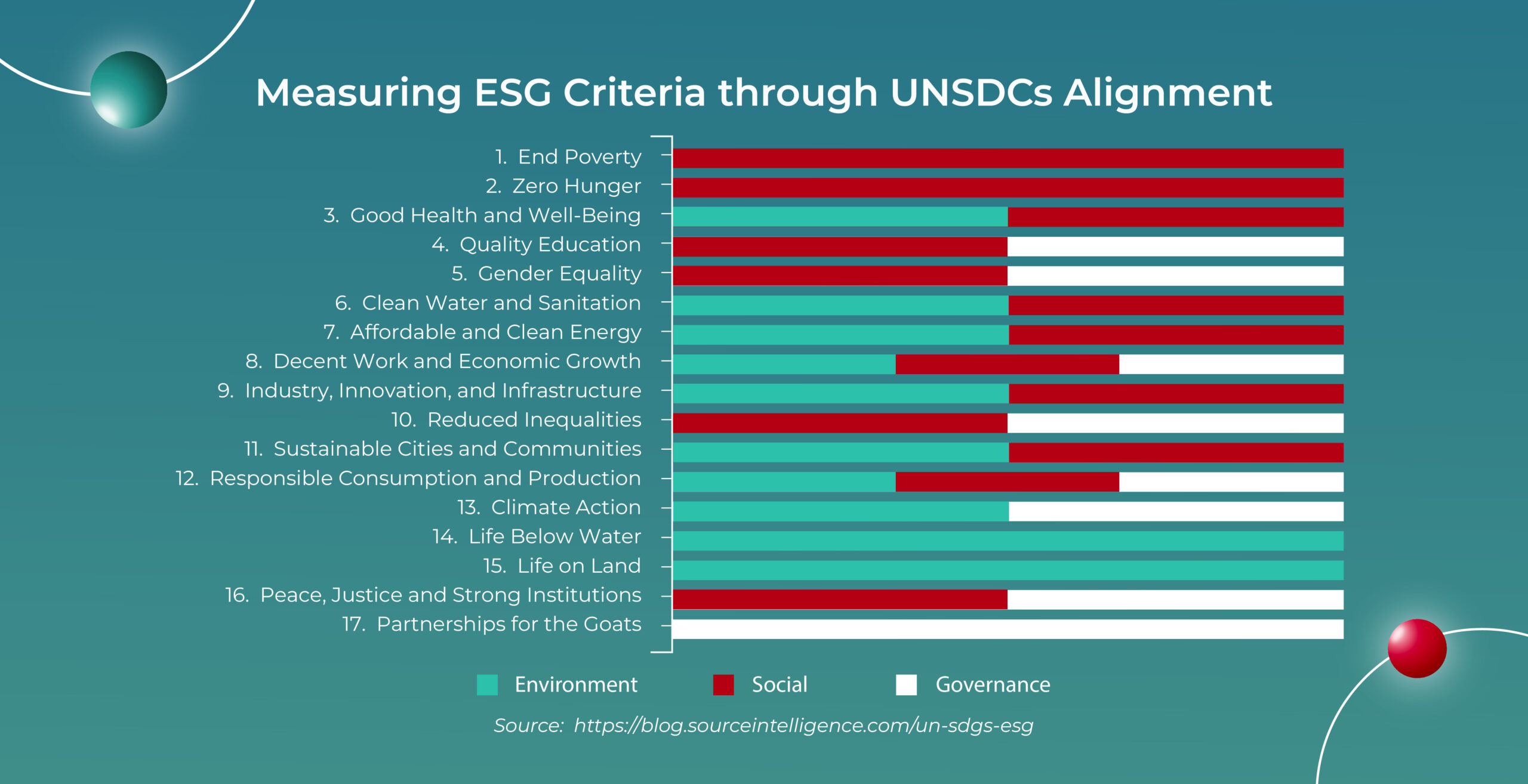

The United Nations Sustainable Development Goals are a great way to align the impact of a businesses’ ESG efforts with issues close to your heart. Companies like Kenanga Investment Bank Berhad have made the extra step in ensuring they are fully aligned with the UN SDGs by building their ESG framework around the most applicable SDGs for business impact and sustainability.

Environmental: this criteria focuses on the impact a company has on the environment. Climate change is a clear and present threat to our way of life and safeguarding the environment from further deterioration is essential to our future quality of life. The factors for analysis can range from the company’s carbon emissions to mitigation strategies they use to limit or end the use of toxic manufacturing materials. This would count towards SDG 11 Sustainable Cities and Communities as well as SDG 13 Climate Action.

Social: this criteria focuses on people. People are the most important resource in any business. Without a great staff, a business can only go so far before they lose trustworthy, hardworking employees. The factors for analysis can range from labour standards (working conditions, diversity hiring) to customer satisfaction frameworks that focus on empowering staff. Examples like this goes toward supporting SDG 5 Gender Equality.

Governance: this factor is perhaps the most important of the three because it is the one that sets the standard for the business. Think of it as the company’s conscience. Governance insists on transparency in conducting business and reporting company information. Meeting this factor encourages business and stakeholder integrity and avoids the perpetration of any corrupt business practices. The factors for analysis can range from ensuring that board members/executives take proper accountability when necessary to pursuing certification in safe practices within the workplace. This would count towards SDG 10 Reduced Inequalities.