February 2022 Market Insights

Welcome to the first Market Insights column, brought to you by Kenanga Digital Investing (KDI). Every month, our strategists will share their takes on the latest in global finance and economic news and how best to capitalise on market movements.

Today, we kick things off with Cheong Yew Huan, Head of Digital Investing at KDI, who is responsible for building, monitoring and overseeing the AI-driven investment portfolio to meet clients’ long-term financial objectives. Cheong has more than 14 years of experience specializing in investment, including portfolio management, asset allocation strategy, investment advisory and regional equity research. Prior to joining KDI, he was the Associate Director Investment Consultant at an international bank in Malaysia, providing need-based investment advisory and tailoring a personalised asset allocation to clients.

January Recap

United States (US)

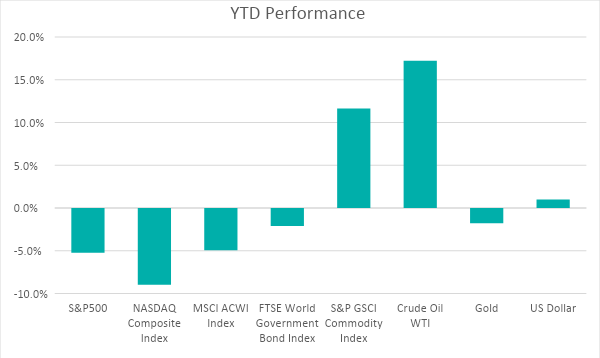

US equities fell in January with S&P500 down 5.26% and Nasdaq down 8.98% on a month-on-month (m-o-m) basis, mainly due to investors’ expectation of more aggressive rate hikes by US Federal Reserve.

The CBOE Volatility Index (VIX) surged to a 52-week intraday high on 24 January at 38.94. On a m-o-m basis, the VIX was up 44% and closed fairly high at 24.83 in January.

With the January Consumer Price Index rising 7.5% from a year earlier, the fastest pace since June 1982, the US Federal Reserve is set to begin raising interest rates to combat inflation and withdraw its pandemic stimulus measures.

During the post-Federal Open Market Committee (FOMC) meeting news conference on 26 January 2022, Federal Reserve Chairman Jerome Powell indicated that a rate hike could happen in March to prevent higher inflation from becoming entrenched. It would be the first rate hike in the US since December 2018.

In addition, the Federal Reserve expects to end the monthly bond-buying of USD30b in March, in conjunction with the rate increase. The reduction of the Federal Reserve’s balance sheet will happen after the process of raising interest rates has begun and would be conducted “in a predictable manner” primarily through adjustments to its reinvestments.

Economists are now expecting five rate hikes in 2022, with the highest expectation by Bank of America and Goldman Sachs of seven 25 basis-point hikes by the Federal Reserve this year.

Global

Outside of the US, many other countries have responded aggressively to the acceleration in consumer prices by raising interest rates since 2021. The Bank of England had hiked rates for the first time in more than three years in December 2021, from 0.1% to 0.25%. Other countries including South Korea, New Zealand, Brazil, Russia, and South Africa have also started to raise interest rates last year to tame inflation. In the Southeast Asia region, Singapore’s central bank tightened its monetary policy by slightly raising the rate of appreciation of the Singapore Dollar nominal effective exchange rate policy band. The off-cycle tightening move was warranted after core inflation in December 2021 was recorded increasing at its fastest pace in nearly eight years.

For Fixed Income, the yield on the benchmark US 10-year Treasury saw a significant increase in January from a low of 1.51% to a high of 1.87% at month-end. The yield on the 2-year Treasury also saw a significant spike in January, moving from a low 0.75% to a high of 1.22%. The 10-year / 2-year yield spread has flattened further to new 52-week lows.

While the US Federal Reserve and other major economies are widely anticipated to tighten their monetary policies, China went in the opposite direction by lowering its one-year loan prime rate (LPR) by 10 basis points to 3.7% from 3.8%. The five-year LPR was reduced by 5 basis points to 4.60% from 4.65%. Policymakers seek to revive economic growth as the loan demand in China has been affected by the slowdown in its property sector. December 2021 economic data indicated a weakening in consumption, given that the growth of retail sales slowed to 1.7% y.o.y in December 2021 from 3.9% in November 2021.

Commodities

Commodities was the best performing asset class with the S&P500 GSCI Index recording a positive return of 11.6% in January, driven by a surge in energy prices during the month. Crude oil and natural gas increased by 17.2% and 30.7% respective during the month, driven by the supply shortages and escalating tensions between the US and Russia in relation to Ukraine.

Outlook

The supply-chain disruption and high fuel prices suggests that inflation may persist for longer. A stronger than expected US inflation may cause an increase in cost of living, weaker consumer spending and thus lower corporate profitability, which could potentially lead to an economic slowdown.

In addition to the tensions in Ukraine, upcoming economic data and the Federal Reserve’s reaction will be the key drivers to market movement and volatility in near term.

Looking ahead, investors might ask, which asset classes will provide an effective hedge against inflation? We consider a diversified portfolio with exposure in inflation hedged asset classes such as Real Estate Investment Trusts (REITs), commodities, gold, or Treasury Inflation Protected Securities (TIPS) to be one of the most optimal hedging strategies.

For fixed income assets, we maintain caution as the current high inflation situation could force central banks to increase interest rates sharply, which negatively impacts bond prices due to its inverse relationships with interest rates.

Equity performance will be driven by a combination of inflation, corporate earnings and the macro environment. Equities are expected to perform well if inflation is at a moderate level and corporates are able to maintain their profit margin by passing down the rising material prices. However, equity will underperform in a stagflation environment, where economic growth is low/negative accompanied by hyperinflation. In this scenario, profit margins will be squeezed by rising raw material prices while revenue is impacted by weaker consumer sentiments.

Lastly

Concluding our first Market Insights column, we would like to extend our welcome and thanks to all our new, valued investors for starting your investment journey with us. In our monthly updates, we hope to continue sharing our thoughts on market outlook, investment strategy and portfolio performance.

If you are new to KDI, please feel free to visit our webpage at https://digitalinvesting.com.my/ to check out our two new products, KDI Save and KDI Invest.