Get Ahead on Your Retirement Goals

Introduction

What are your retirement goals? Do you dream of travelling or devoting yourself to your hobbies? Do you simply want to be financially independent, so you don’t have to rely on your children? Whatever your hopes are, investing can bring you much closer to your goals than simply saving money. Saving money may have worked for our grandparents, but the rising cost of living and the significant impact the pandemic had on all our finances make it clear that we need to have multiple financial cushions.

Even if you have good health insurance right now, it’s impossible to predict what you may need to live a healthy life in the future. Thus, for you to enjoy a long and stress-free retirement, you may need to consider diversifying your income streams with investments.

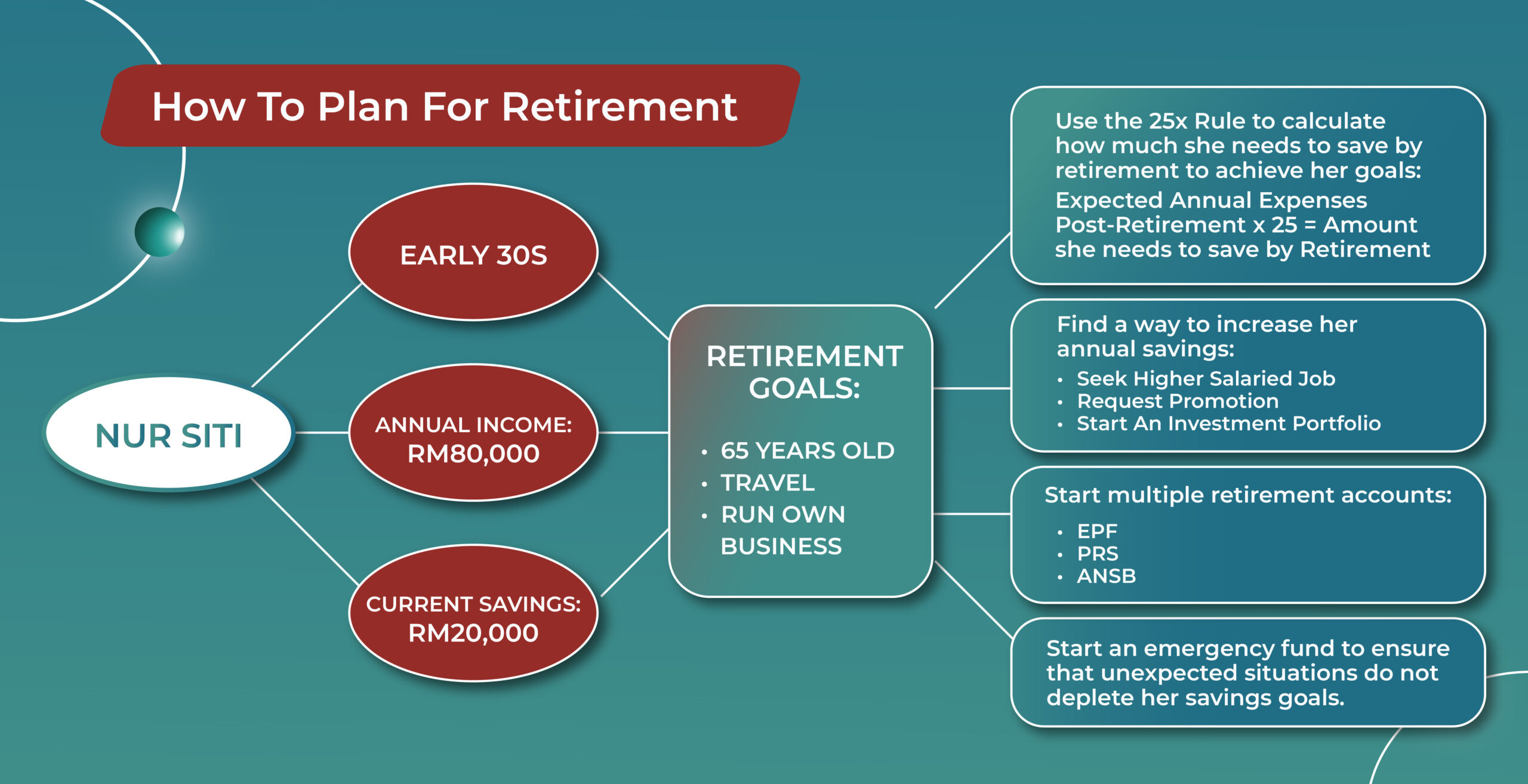

How to plan for retirement

First, have an open, honest conversation with yourself or your spouse about what you hope for in your post-retirement lifestyle. Knowing your post-retirement spending plans helps you to understand how much money you need every month to maintain that lifestyle. Prepare yourself to think about the unpleasant topic of how long you will be able to live this lifestyle. No one wants to think about dying but it is a reality that should be taken into account when planning your future. Are your parents and/or grandparents healthy? Have you lost any close family members to a hereditary illness? How likely are you to inherit it? What kind of medical costs will be managing such a condition require?

Then, look at your assets. List what you have that will be of benefit to you in retirement. Do you have a side hustle that will continue to pay off after you retire from your main job? Are you expecting any family inheritance? Do you know how much it will be? How much is in your savings right now and will you be able to grow that amount without touching it till your retirement? Do you have any debts that will follow you into retirement (mortgage, college fees for children)? How much more do you expect to earn over the period between now and retirement?

Use the 25x Rule to calculate how much you need to save by retirement to achieve your goals:

Expected Annual Expenses Post-Retirement x 25 = Amount to Save by Retirement

Once you have the answers to these questions, you will know how achievable your hoped-for retirement lifestyle is and what you need to earn to reach that goal. If the gap between your goal and what you can realistically earn till retirement is too wide, you may need to reevaluate your current lifestyle/earnings or post-retirement expectations.

Begin Today!

There are several steps you can take now to ease your way into a comfortable retirement. Start looking for ways you can pay off your debts before you reach retirement. Starting an investment portfolio isn’t just a good idea for you, it’s a good idea for your children too. If you invest well, the cost of their higher education may not be a significant burden on your post-retirement finances. If you are looking into taking on any new debt, consider the payment period against your correct earnings and evaluate if it is a necessary expense that will benefit you in retirement. Shop around and look for the best deal.

Total up your financial responsibilities right now and consider which may last into your retirement:

- School/college fees for your children

- Mortgage and other debts

- Personal insurance coverage for you and your family.

Seeing the actual numbers will help you to strategize better on how to comfortably meet these responsibilities after retirement. Even if you are confident in your current investment portfolio, it will not hurt to diversify it further to earn more. Consider the different risk types and if there is a way to make them work for you.

Risk types with examples:

- Low-risk investments – fixed deposits, robo-advisors

- Mid-risk – real estate, dividend paying stocks

- High-risk – Stocks, mutual funds.

Utilise All Available Avenues

There are many easily accessible avenues that you can add on after your main retirement investing plans are launched. Your employee provident fund (EPF) is a good additional resource. Instead of thinking of your EPF money as a way to start your retirement, organise your retirement goals so that this money is a happy addition rather than the foundation of your retirement. If you work in the private sector, then your EPF fund is likely to be available to you as a lump sum once you retire. This money could be re-invested to generate more income during your retirement.

Look into diversifying your retirement plans by using established funds such as Private Retirement Schemes (PRS) and Amanah Saham Nasional Berhad (ASNB). There may be additional benefits to seeking out voluntary, private investments. For example, tax relief from PRS investments can be up to RM3000 per year.

Kickstart Your Retirement Savings with KDI Save and KDI Invest

Access to investing has only become available to everyone in the very recent past. So you may feel unsure if you can manage your investments well. Knowing this, Kenanga Digital Investing (KDI) offers products that use algorithmic investing designed to operate independently with minimum oversight from you. These investing tools can be programmed to take your risk profile into account as well, ensuring that the investments it makes align with what you yourself would choose.

If you are new to investing, try out KDI Save! This product allows you to invest in the short term and can even help you build up your savings so you can open a bigger, more diverse investment portfolio in the future.

If you already have a primary retirement savings and simply want to add on another source for retirement funds, you can dive right in with KDI Invest! This robo-advisory tool offers you access to some of today’s most exciting exchange-traded funds (ETF). You will gain a diversified portfolio and the security of knowing that this highly adaptive tool is able to react faster than a human to the market. Ease your uncertainty and worry for the future by allowing KDI to help you secure your dream retirement goals.

Visit https://digitalinvesting.com.my/ to learn more.