How Compound Interest Works (and Why It Matters)

In 1999, Warren Buffett – who was then worth US$30 billion – was asked how to make that amount of money. He said compound interest is an investor’s best friend: “I started building this little snowball at the top of a very long hill. The trick to having a very long hill is either starting very young or living to be very old.”

If you’re a budding investor, well it’s time to get to know your “best friend.” This article will explain compound interest and how it applies to almost every facet of your financial life. From your credit card debt to your fixed deposit rates, your best friend is there!

Why did Buffett reference a snowball? Compound interest is interest earned from the original principal plus accumulated interest. Not only are you earning interest on your beginning deposit, you’re earning interest on the interest. A snowball starts small, but as it rolls downhill it collects more snow and gets bigger. As it grows, it speeds up. So as your investments (or debt!) grow, they get bigger at a faster rate. Simply put, if you’re an investor setting money aside, compound interest can make you. Conversely, if you’re a debtor owing a certain amount of interest on your loans, compound interest – if not managed well – may just break you.

The Rule of 72

There is an easy rule of thumb to estimate how many years you’ll need to double your invested money at a certain interest rate: the Rule of 72. Essentially, you divide 72 by the number of years you plan to double your initial investment to find out the interest rate required to hit your target.

For example, if you want to double your initial investment of US$1,000 in 10 years, you will need to invest in a product that offers an annual interest rate of 7.2%. Here’s a handy calculator you can use. While doubling US$1,000 into US$2,000 in 10 years seems slow, this does not take into account if you top up your initial principal with additional investments periodically over the 10-year period.

To double down on the snowball on the long hill analogy, if you start investing while young, you have a long hill and thus can start investing small. Whether you are in your 20s or 30s, the principal amount doesn’t matter as much as getting off the starting blocks as soon as possible. The key is to start early, deposit frequently, and withdraw as little as possible.

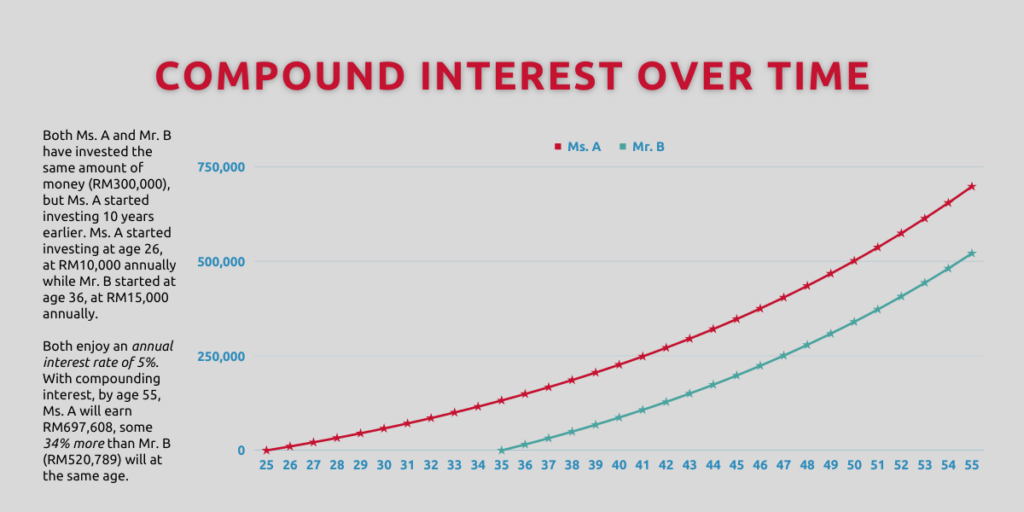

Even if you invest small amounts annually over the long-term, if you start earlier, you will earn more than a similar investor starting later but putting in more money. Here’s how compound interest works over time:

Of course, if you are a debtor, even the compounding interest from your credit card – which compounds daily! – can snowball quickly if you only pay down the minimum amount each month. With credit card interest rates rising as high as 18% per annum in Malaysia and additional late fees charged at 1%, it is important that you pay off credit card debt early and often. Reduce the negative impacts of compound interest on your debt, so you can invest more and maximise its positive impacts on your investments!

How To Compound Your Investments

Even as we emerge from a global low interest rate environment, most banks still offer interest rates for fixed deposits at around 2.0% to 2.5% per annum, with the higher end of the range dependent on locking in investments for six months or even up to a year.

With no lock-in period and fast withdrawals (1-2 working days), KDI Save understands the importance of liquidity and flexibility of withdrawal. With a fixed and stable interest rate of 3% per annum, you can earn daily returns with KDI Save as you wait for the right investment opportunities to come. Investments above RM200,000 will entitle you to a base return rate of 2.25% per annum.

Besides offering a higher interest rate than local banks, KDI Save contrasts with typical fixed deposits that have lock-in periods, and that only cash in your interest earned at the end of the lock-in period.

For those with a longer-term view and a larger risk appetite, KDI Invest gives you the opportunity to enjoy even higher compounded returns, with ultra-low annual fees of 0.0-0.7%. The robo-advisor builds you a diversified portfolio from a variety of U.S. exchange-traded funds (ETFs) that can be spread across multiple asset classes including stocks, bonds, foreign currencies, real estate, and commodities.

Best of all, you don’t have to do anything! KDI Invest’s Artificial Intelligence (AI)-driven algorithm will automatically adjust your portfolio to best reflect your risk profile in response to global financial news and market movements.

Start reaping the benefits of compound interest with as little as RM100 for your initial deposit with KDI Save or RM250 for KDI Invest. Remember: it’s okay if your snowball starts small, just make sure your hill is long enough to maximise your compounding interest!