How Much Should You Save To Survive Another Pandemic?

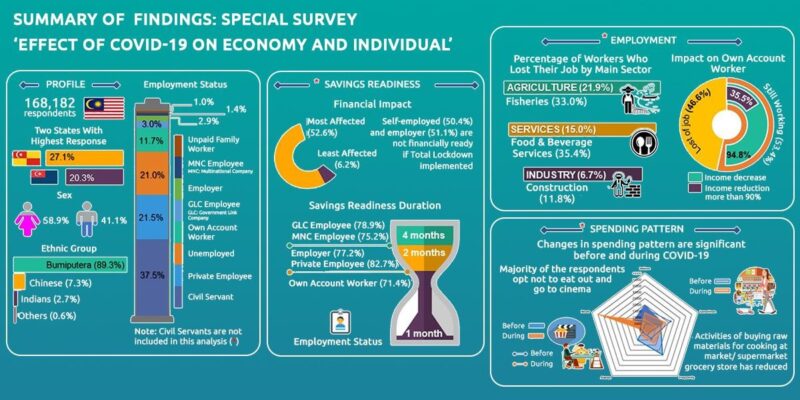

The economic & financial impact of the current COVID-19 pandemic has hit Malaysians hard. According to the special survey report by the Department of Statistics Malaysia (from 23rd – 31st March 2020) highlighting the effects on 168 thousand individuals aged 15 years and above:

- More than two-thirds (71.4%) of self-employed respondents have savings of less than 1 month. 77.2% of employers and 82.7% of private employees have financial savings of up to 2 months.

- 69.7% of those working less than 1 year and 63.2% of those working between 1-3 years reported that their financial savings will run out in less than 1 month.

- Almost all self-employed workers (94.8%) reported a reduction in monthly income.

Source: Department of Statistics Malaysia

During such troubled times, we do hear a lot of well-meaning but impractical advice like go and find a new job, innovate your way of doing business, change your mindset to adapt to the new normal, and so on. In the process of doing the obvious, a question instinctively springs to mind:

“How much do I need to have to survive this again?”

If you have come this far, you have done well in weathering the pandemic. The aftermath of the pandemic has proven how important it is to save, for we never know when the next rainy day will come.

The 50-30-20 rule

To figure out how much we should save, we should first employ a logical approach to determine our major expenses. For most of us, essential spendings such as food, accommodation, utilities, transport, and other miscellaneous living expenses usually make up 50% of an average individuals’ income.

For the average office employee in the heart of Kuala Lumpur, a typical breakdown for monthly cost of living might be:

Parts of the expenses such as accommodation and transport might be further reduced during loan moratorium, if those expenses are in the form of loans.

The subsequent 30% should be allocated towards discretionary spending which are non-essential expenses normally associated with maintaining one’s standard of living. This portion of spending is non-compulsory in nature and thus must be adequately monitored to avoid unnecessary spendings, especially in tight financial circumstances.

The final 20% should then be utilised to improve one’s living standard, such as savings or investments in order to attain long-term financial goals. For clarity, if you generate net earnings of RM6,600 per month, you should aim to save or invest at least RM1,320 per month as a cushion to weather through the pandemic.

How Long Should Your Savings Last?

There is no straight answer as to how long your savings should last. It comes down to your ability to estimate and forecast your monthly expenses and how long you need to survive on your savings before getting your next job.

Let’s reference the example of an average office employee in Kuala Lumpur. The table below illustrates the amount of savings required by varying the amount of time needed to survive the next hypothetical pandemic:

It is a pretty straightforward yet clear picture of how much this person needs to have their savings ready for another onslaught. Naturally, the most ideal option is to have the most amount of money available as a comfortable buffer. But, saving up almost RM20,000 may seem like an impossible task, or is it really?

It’s Not as Impossible as You Think

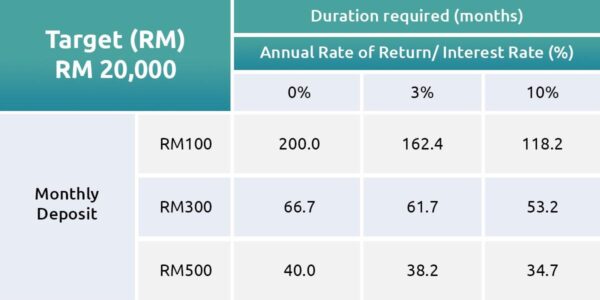

With the power of interest rate compounding, saving even large sums may take less time than you might expect:

With diligence and consistency, one could reach RM20,000 by putting in only RM100 each month at an annual rate of return of 3%, which would take 162 months rather than 200 months, if saved in a physical piggy bank. While, an annual rate of return of 10%, it would take a much shorter 118 months.

The main question remains: Where can I save my money with such attractive interest rates?

KDI Save is currently offering a promotional rate of 3% per annum from now until 31st December 2022 with a starting deposit of as low as RM100. If you are looking for potentially better returns by investing in diversified asset classes with best in class risk management, check out for KDI Invest.

Start saving and investing here.