How to Build a Passive Income Strategy

The internet has changed the world for the better in many ways, especially in making previously exclusive investment options accessible to more people. Robo-advisors and e-commerce platforms have given millions of people personal control over their future wealth generation. This has allowed those self-same millions to begin looking outside their active income towards generating wealth via a passive income.

Your active income is your salary. It requires you to actively participate in generating earnings. Passive income is earnings from a source that does not require you to actively participate in creating revenue or profit. A rental property or a silent partnership in a business are two examples of passive income streams where you earn money but do not have to be actively involved in the day to day management of the source.

These days, the global online marketplace has made multiple income streams an accessible option for millions of people. The digitisation of the way we work, the tools we use for communication and finance, and the ease with which money and resources can be shipped globally has made it affordable for most people to find passive income streams.

However, “accessible” is not the same as “easy”. You need to be financially savvy and well-aware of the amount of work required from you. You will need to put in the time, money and effort to build up your income to the point that it can tend to itself before you then focus on other areas of your life or on generating other income streams.

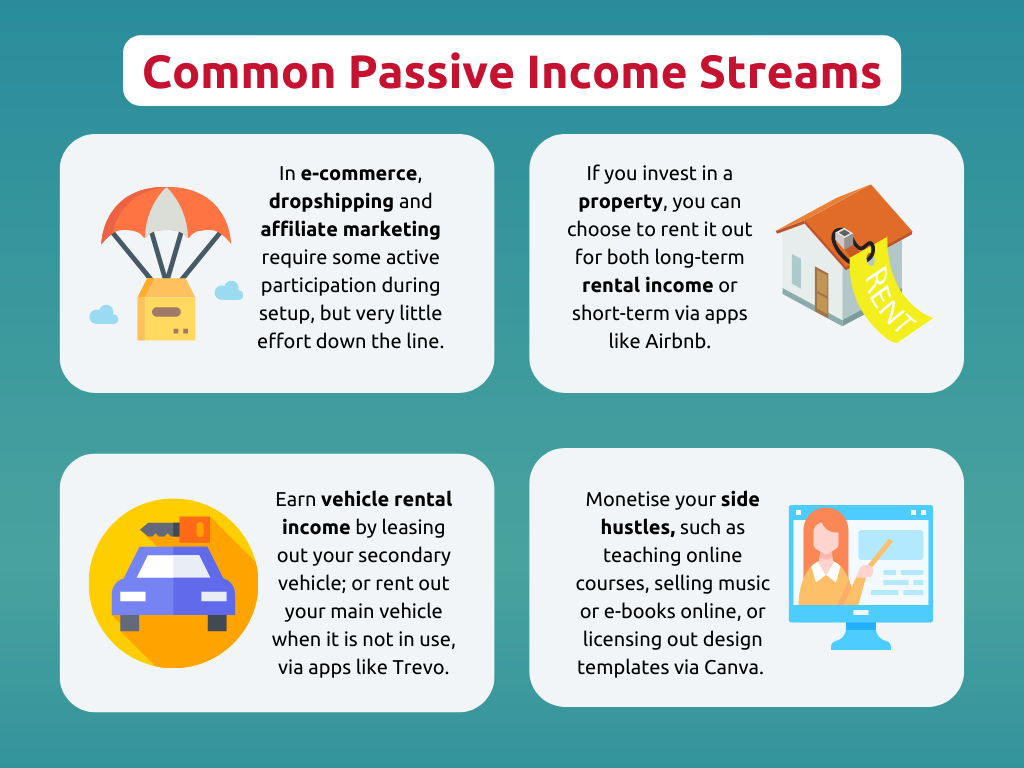

Let’s take a quick look into a few different types of passive income streams that take varying amounts of time and resource commitment.

Making money while you sleep

Some passive income streams require some active participation at the outset, but down the road will start earning money for you while you sleep. In the e-commerce space, dropshipping and affiliate marketing are popular options. Through dropshipping, someone buys inventory from a manufacturer or wholesaler and sells it on another platform. Meanwhile affiliate marketing allows website owners/bloggers/ publishers to earn a commission from another retailer or advertiser when an affiliate link is clicked on or similar.

If you have a bit more money to spare, you can invest in a rental property from which you can collect rental income with minimal upkeep or time investment after the first few years. On a smaller scale, you can explore vehicle rental income. With various apps in the marketplace pairing vehicle owners with holidayers or even ride-sharing drivers, your car can earn money for you instead of sitting idle in the parking lot.

If you are a creative person, your ‘side hustle’ can involve digital products such as teaching online courses, selling your music or e-books online, or developing original designs or templates to be licensed out via Canva or other design websites.

Passive Investing with KDI Invest

The advent of robo-advisors and low initial investment fees have made investing in the stock market another option for future wealth generation for people from a variety of financial backgrounds.

Robo-advisors such as KDI Invest always take into account your risk profile so that it will never invest your money in a venture that you would not choose. This tool also uses artificial intelligence to analyse trends in the market and company performance to make predictions that are data-driven.

In addition, because the robo-advisor does not rely on human emotion to make choices, you can rest assured that your income is not relying on a person who may make choices driven by fear or euphoria.

Guaranteed returns with KDI Save

Till you find the right passive income strategy, there is KDI Save. KDI Save generates guaranteed daily returns that exceed typical fixed deposit rates so you can start investing with a small amount. Over time, it will grow into the nest egg you need once you have decided which passive income stream is right for your needs.

In addition, there is no lock-in period, so you do not need to time your withdrawals or deposits to minimise fees or maximise other opportunities.

Often, fear of the unknown can make us take too long or make us too hesitant to take that next step. Relying on KDI Save gives you the assurance that when you take that step, it will not cause a dip in your current financial standing.

As your KDI savings grow, you can read more, discuss with entrepreneurs in the fields you are interested in, and get a clearer picture of what to expect from the income streams you are interested in pursuing. This greatly increases your chances of making better choices and generating better results.