Emotion-based Investing: Trust Your Head or Your Heart?

You should definitely trust your instincts in many areas of life. Especially when dealing with people, sometimes your intuition can pick up on subconscious cues that can serve you well when deciding whether to trust someone. We all have that one friend we would trust with any amount of money but you know you can’t leave them alone in the same room as the last slice of pizza.

When it comes to investing, active monitoring of your portfolio can be a good thing, but only if you know what you are doing. Bringing the reactivity of emotions into your investment decisions could lead to your portfolio becoming a martyr to your impulses.

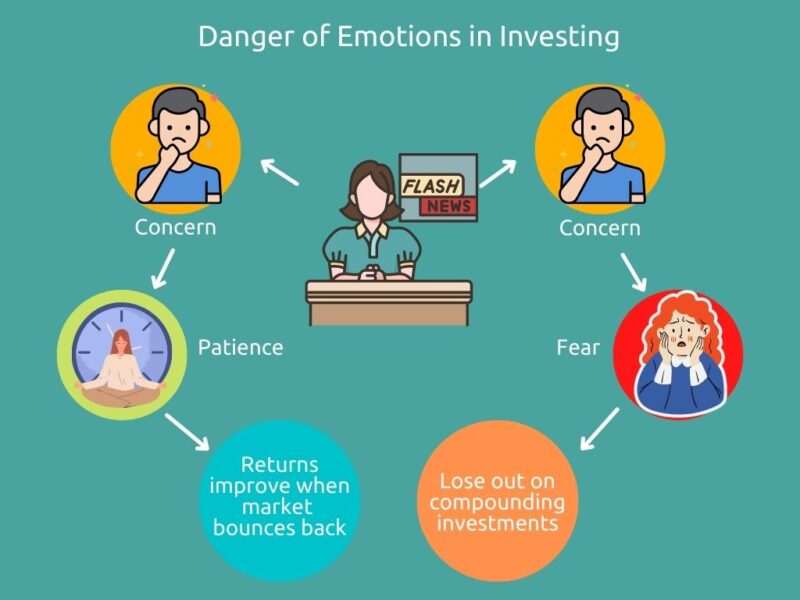

It is way too common to get confused and fearful because of media hype. But, in a world where the media pushes bombastic news stories designed to get an emotional reaction, how do you balance your gut feeling against the logical move?

Identify Your Motivations

If you read a news story or received a ‘hot tip’ from someone that is making you rush to make a change to your portfolio, then you definitely need to take the time to think it through. Verify the news across financial news platforms, such as on Bloomberg or the Wall Street Journal, to ensure that the facts of the story check out.

Emotions are powerful, and what feels right at the moment can turn out to be an overreaction once you have caught your breath and had a meal. The stock market can change quite suddenly from one day to the next, but this only happens in extreme cases.

Even then, keeping your investments as they are and riding out the volatility is likely going to serve you better in the long run. Taking the boring rational path is a better guarantor of your future wealth than letting euphoria or fearfulness drive your decisions.

Trust the Data

There is nothing wrong with feeling frustrated about being told to slow down when you are fearful for your investment portfolio or future wealth. The reality is that anyone who is not a professional investor or a financial advisor/ analyst just does not have the kind of access to knowledge to make well-informed decisions based on tips.

If you try to time market opportunities to newspaper headlines, you are basically putting your future wealth, and that of your loved ones, and a comfortable retirement on the back of a news that could already be priced in by the market.

You know how many hours you had to work to earn that money. If your investments have been losing value because of market volatility and the newspapers tell you every day that it’s all going to hell, it is perfectly understandable that you will feel fearful.

This is why you must make an effort to choose the right investment instruments for your needs. Robo-advisors and the like, which can adjust your portfolio to your risk tolerance levels, can help you to keep your emotions out of your investments by using dollar-cost averaging as a method to keep investing while reducing the impact of volatility on your investments.

Remove Emotions from the Equation

KDI Invest is a robo-advisory, A.I. investment tool that can automatically rebalance your portfolio to ensure that your investments match your individual risk profile.

The algorithm also diversifies your portfolio across multiple U.S-based exchange-traded funds (ETFs) to help you own a range of assets, from bonds and stocks to foreign currencies, to minimise loss no matter how volatile the market may be.

This investment tool integrates data analysis and machine learning to make data-driven choices that eliminate any human bias. Your future wealth generation is entirely driven by logic and efficiency.

KDI Invest is one of the most hassle-free ways to reduce emotional and financial impacts on your future wealth. Knowing it is safely managing your investments means that you can enjoy a lively discussion about inflation with your friends without any anxiety ruining your fun.