Market Volatility Can Be Contagious – Here’s How You Can Avoid Being Infected

In financial markets, volatility is the presence of extreme and rapid price swings. The more volatile an asset is, the more likely its price can change dramatically over a short period of time.

The recent bout of volatility in global markets came as inflation reached 40-year highs in the U.S., leading to fears of a recession. In reaction, the U.S. Federal Reserve has been hiking interest rates throughout the year.

The tech sector, which already was seeing selloffs due to weaker performance as people shifted away from digital products post-pandemic, were the hardest hit. U.S. stock indices were dragged down by sell offs in these supposedly stable “blue chips” like Meta, Amazon, Alphabet, and Microsoft.

With the U.S. being a major trading and export partner of Malaysian companies, this downward contagion bled to the local stock market, with Bursa Malaysia’s tech stocks following suit. There was also an underlying fear that more interest rate hikes will lead to the ringgit weakening and investments flowing away from emerging markets like Malaysia.

As the Russian war or the crypto collapse has shown, no one investor can truly prepare for all the sudden shocks in the financial markets or predict how quickly a phenomenon in the U.S. can impact Malaysian stocks. While you may not be able to avoid losses entirely in volatile markets, here are four strategies to hedge your losses as much as possible.

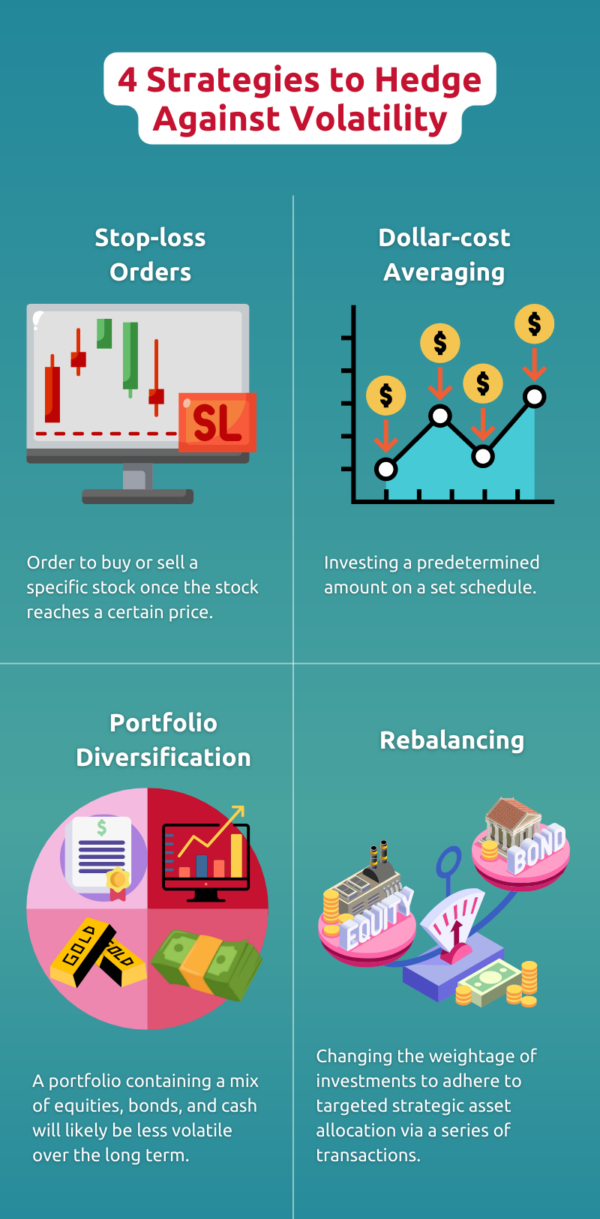

Strategy 1: Stop-loss orders

Retail investors typically do not have the time to monitor their stock market holdings daily, leaving it to professional fund managers. However, stop-loss orders can come in handy.

Per its name, a stop-loss is designed to limit an investor’s loss on a security position that makes an unfavourable move. A stop-loss order is an order placed with a broker to buy or sell a specific stock once the stock reaches a certain price.

Strategy 2: Dollar-cost averaging (DCA)

Dollar-cost averaging (DCA) involves investing a predetermined amount on a set schedule. Here, you invest your money in equal portions, at regular intervals, regardless of the ups and downs in the market.

Besides taking the emotion out of decision-making, DCA builds wealth over the long term for riskier investments such as stocks and mutual funds. However, there are certain assets that work better for DCA investing. Learn more in our in-depth DCA piece.

Strategy 3: Portfolio diversification

Another way to avoid being harmed by volatility is diversifying your portfolio. A well-diversified portfolio containing a broad mix of equities, bonds, and cash will likely be less volatile over the long term than a portfolio concentrated in only a few investments. Typically, losses in one type of asset will be offset by gains in another asset type. For instance, the volatility caused by the Russian war in February 2022 caused investors to flee stock markets for “safe havens” such as bonds, gold, and the U.S. dollar.

Strategy 4: Rebalancing

However, simply not putting all your eggs in one basket does not work in the long run if you don’t periodically practise portfolio rebalancing. Rebalancing is the changing the weightage of investments to adhere to targeted strategic asset allocation via a series of transactions.

Below is a simple graphic of a typical rebalancing. However, rebalancing should also take into account an investor’s long-term goals and risk appetite, especially as they age. Learn more in our rebalancing explainer.

Automate against volatility

Even with all these four strategies, it will still take some time for you to personally sell certain assets and move into other assets in volatile times. Why not instead automate your hedging against volatility?

Robo-advisors can protect you from the worst effects by taking the emotion out of investing. As an AI-driven robo-advisor, KDI Invest automatically initiates portfolio diversification and rebalancing based on your individual risk profile.

Your portfolio is diversified across dozens of U.S.-based exchange-traded funds (ETFs) that are highly liquid (bought and sold easily) and track a wide range of assets: bonds, stocks, foreign currencies, and individual commodities.

Thus, instead of personally having to set stop-loss orders on your stocks, waiting several days to transfer it to cash, and then buy gold (a typically stable, low-risk investment) at your local bank, KDI’s algorithm can pare down your equity ETF holdings and move immediately into gold ETFs at a blink of a (robot) eye.

Yes, volatility is part of investing. But if you want a hassle-free way of reducing its impact as much as possible, why not sign up for KDI Invest? Visit www.digitalinvesting.com.my/invest to find out more.