January 2023 Market Insights

Brought to you by the Kenanga Digital Investing (KDI) team, here is our 12th Market Insights column. Our Head of Digital Investing, Cheong Yew Huan will discuss the latest in financial news and present his thoughts on making the most of today’s market.

Market Recap

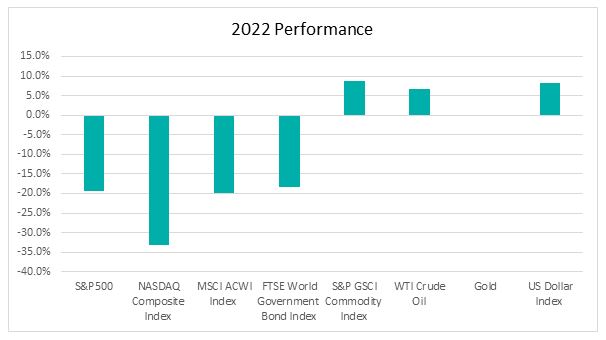

Chart 1: Index Performance in 2022

Market

2022 was a challenging year for investors. The stock market posted its worst yearly decline since 2008 as the S&P500 and the Nasdaq Composite dropped 19.4% and 33.1% respectively. US equity markets sold off sharply, with concerns focused on inflation, monetary tightening, China’s COVID lockdown, and the Russia-Ukraine conflict.

For bonds, the performance was one of the worst years in recent memory with the FTSE World Government Bond Index down by 18.3%. The US Treasury yields have moved higher in 2022 amid the aggressive policy tightening by the Federal Reserve. The 2-year and 10-year US Treasury yields rose to 4.42% and 3.87% respectively. The aggressive moves by the central bank put upward pressure on Treasury rates, with the 2-year to 10-year Treasury yield curve seeing its biggest inversion in about four decades, signaling increasing concerns about a potential recession.

Commodities have been the best-performing major asset class with the S&P GSCI Index gaining 8.7% during the year, driven by the spiking soft commodities and energy prices. Oil prices surged in March as the Russia-Ukraine conflict disrupted global oil trade flows. WTO oil prices are now trading around US$80 a barrel. Lately, oil prices have been steadily declining due to fears that a weakening global economy would slash fuel demand.

The US dollar Index has strengthened 8.2% this year. The index reached a record high in September and started to weaken against other major currencies as the market’s expectation of the Federal Reserve scaling back the pace of its interest rate hike going forward.

Outlook

The key driver in 2023 is whether inflation will ease sufficiently to allow central banks to step away from rate hikes and potentially begin easing.

The Federal Reserve raised the benchmark rate by 50bps to 4.25% to 4.50% during its last monetary policy meeting in December 2022. It was a seventh consecutive rate hike, following four straight three-quarter points increases. The Fed signaled that restrictive policy will likely remain in place for longer and at a potentially higher terminal rate than expected. The policymakers forecast that their key short-term rate will reach a range of 5% to 5.25% by end of 2023. This indicates that the Fed is poised to raise its rate by additional 75 basis points.

These higher interest rates are expected to lead to stagnant economic growth and possibly a recession. In China, a gauge of manufacturing activity jointly published by Caixin and S&P Global came in at 49.4 in November, remaining below the 50 mark for a fourth straight month. Companies reduced purchasing activity and headcounts as factory output fell at a faster rate than in the previous month.

Equities have downside risks with recession risk on the horizon. For fixed income, the yield curve inversion points to a slowdown in growth, which may have bolstered speculation that the central bank will still wind up cutting rates next year to get the economy growing again. The bond prices could potentially decline moderately going forward as the Fed lowers the pace of rising interest rates. Fixed income becomes more attractive given the rising yields along with interest rates hike and recession risk looms.

The commodities outlook is mixed given the expected slowdown in the global economy. The recession will reduce oil demand, but the supply side may tighten if more restrictions are placed on Russian oil exports.

The US dollar is expected to weaken if Federal Reserve pauses and unwind its monetary policy. The US dollar has appreciated against other major currencies in 2022 on Fed hawkishness and as a safe-haven during volatile times.

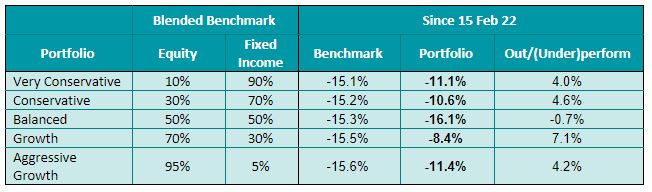

KDI Invest Portfolio Performance As at 31 December 2022

Remarks:

Benchmark: Equity: MSCI ACWI Index + Fixed Income: FTSE World Government Bond Index

Past performance is not indicative of future results.

The above table shows the performance of selected KDI portfolios since their launch on 15 February 2022. The portfolio returns (in USD) are ranging from -16.1% to -8.4%. The portfolio out/(under)performances versus the benchmark are ranging between -0.7% and 7.1%.

The downside risks persist in 2023 with a challenging economic outlook, due to the negative impact of aggressive interest rate hikes and surge in commodity prices, which deteriorates the global demand and consumer spending power.

KDI has taken a “risk off” approach in 2022 by underweighting equities and maintaining portfolio volatility at the minimum level. As of 31 December 2022, the equity exposure is maintained at a low level, ranging from 5% to 13% while fixed income exposure is ranging between 64% and 88%. Current portfolio holdings are mainly fixed-income ETFs that focus on shorter duration US Treasury and good quality government bonds. For equity ETFs, the portfolio exposure is diversified into developed and emerging markets. While the market may partially price in recession risk, KDI, where the investment decision is data-driven, will continue to look for investment opportunities amid market corrections.