June 2023 Market Insights

Brought to you by the Kenanga Digital Investing (KDI) team, here is our 17th Market Insights column. Our Head of Digital Investing, Cheong Yew Huan will discuss the latest in financial news and present his thoughts on making the most of today’s market.

Market Recap

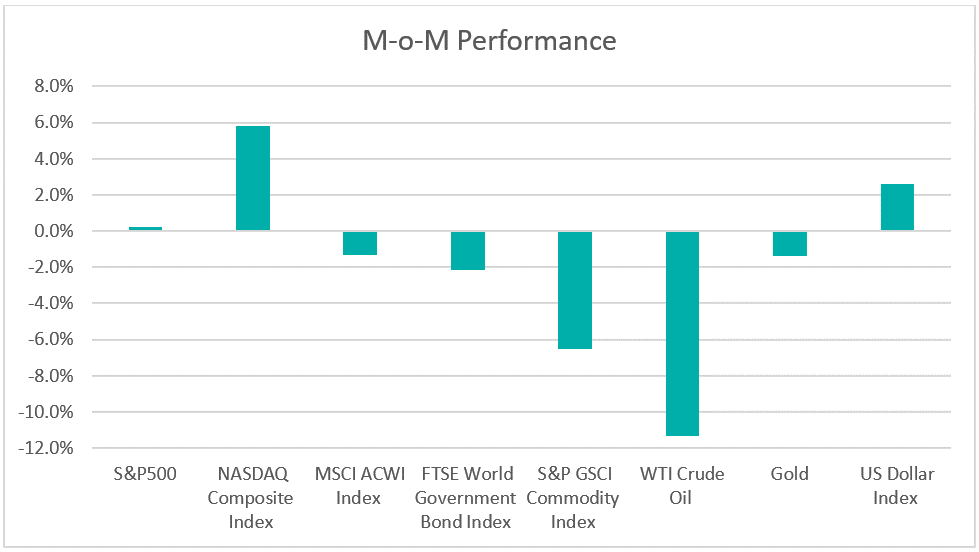

Chart 1: Index Performance in May 2023

Market

In May, the equity markets exhibited a mixed performance. The S&P index remained relatively flat, with a marginal gain of only 0.25% for the month. Investors had concerns about the debt ceiling impasse but anticipated a resolution as the US government’s debt ceiling was expected to be increased. On the other hand, the Nasdaq index experienced a significant rally of 5.8% driven by Nvidia’s strong first quarter earnings results, which exceeded analysts’ expectations. Nvidia reported revenue of $7.19 billion for the quarter ending April 2023, surpassing the Refinitiv consensus estimate of $6.52 billion.

The US fixed income market witnessed volatility due to concerns about the US debt ceiling. Ratings agencies Fitch and DBRS Morningstar placed the United States on a credit watch for a potential downgrade. Consequently, the yields on US Treasury securities increased, with the two-year Treasury yield closing at 4.4027% and the 10-year Treasury yield closing at 3.6426%. These changes reflect cautious market sentiment regarding the US debt ceiling.

The S&P GSCI Commodity index experienced a significant decline of 6.5% in May. This drop was attributed to concerns over weaker-than-expected global demand growth, which negatively affected the outlook for commodities. Specifically, WTI Crude Oil slipped by 11.3% to reach a price of US$68.09 per barrel. This decline was driven by an unexpected increase in US crude oil inventories and a decrease in China’s manufacturing activity, raising concerns about oil fuel demand. Gold prices also decreased by 1.4%, closing at US$1,962.73. However, gold had gained 7.6% year-to-date, driven by recession fear, and concerns about the possibility of the US defaulting on its debt.

In contrast, the US dollar index, which measures the value of the US dollar against six major currencies, experienced a 2.6% increase, reaching 104.33. This rise in the US dollar index signifies a strengthening of the US dollar relative to its peers.

Outlook

Investors reacted positively to signs of easing inflationary pressure in the US as consumer prices in April rose at a slower pace than expected. The Labor Department’s consumer price index (CPI) showed a 4.9% increase from the previous year, slightly below the anticipated 5% rise, raising the expectation that the Federal Reserve’s interest rate hiking cycle may be nearing its end. Meanwhile, credit ratings agency Fitch put the US’ credit rating on watch for a possible downgrade, highlighting concerns over the debt ceiling. A downgrade could impact the pricing of Treasury debt securities and potentially lead to market volatility. Fitch predicts that the US government will spend more than it earns, creating a deficit of 6.5% of the country’s total economy in 2023 and 6.9% in 2024. Overall, the US economy has shown resilience despite concerns about inflation, consumer sentiment, and US debt ceiling concerns.

China’s economy has faced an uneven recovery from the pandemic, with several indicators pointing to challenges. In May, factory activity contracted at a faster-than-expected rate, with the official PMI reaching a five-month low. Furthermore, April’s industrial output and retail sales growth fell short of expectations, highlighting weakening demand. These developments are putting pressure on policymakers to take measures to support the country’s economic recovery. The weak economic data has had an impact on the CSI 300 Index, with Chinese stocks losing favor among investors. Additionally, the yuan has weakened in response to the economic uncertainties.

The European Central Bank (ECB) raised interest rates by 25 basis points to 3.25% as expected, citing the need to combat inflation. The move comes after the US Federal Reserve also raised its benchmark rate, possibly signaling the end of its series of rate hikes. However, the ECB indicated that further tightening might be necessary due to persistently high inflationary pressures. Recent data showed a significant drop in loan demand in the eurozone, suggesting that previous rate increases are starting to impact the economy and constrain growth. Germany, the largest European economy, faces the risk of a recession as its economy contracted in the first quarter, impacted by high inflation and decreased consumer spending.

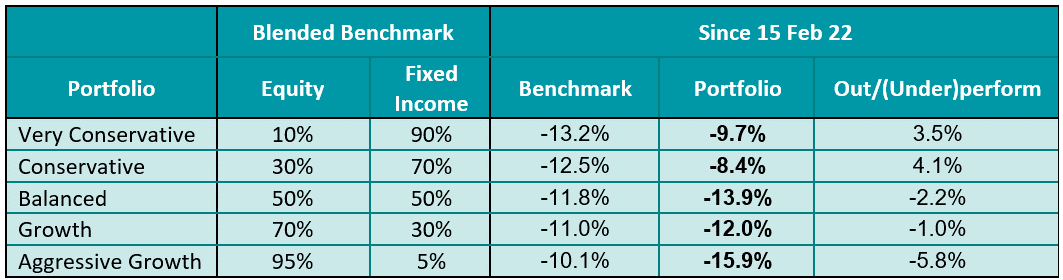

Table 1: KDI Invest Portfolio Performance As at 31 May 2023

Remarks:

Benchmark: Equity: MSCI ACWI Index + Fixed Income: FTSE World Government Bond Index

Past performance is not indicative of future results.

The above table provides information on the performance of selected KDI portfolios since their launch on February 15, 2022. All portfolios have experienced negative returns, ranging from -8.4% to -15.9%. The portfolios have also shown varied levels of outperformance or underperformance against the benchmark, ranging from -5.8% to 4.1%.

Global equities have experienced a positive re-rating this year, driven by improving investor sentiment, despite concerns of a potential recession. Market volatility has been easing as there is optimism surrounding the passing of the debt ceiling bill by the US Congress. The fixed income asset class has become more attractive due to rising yields along with Federal Reserve’s rate hikes. While China’s economic data suggests weakness, the US economy remains resilient with strong job market indicators.

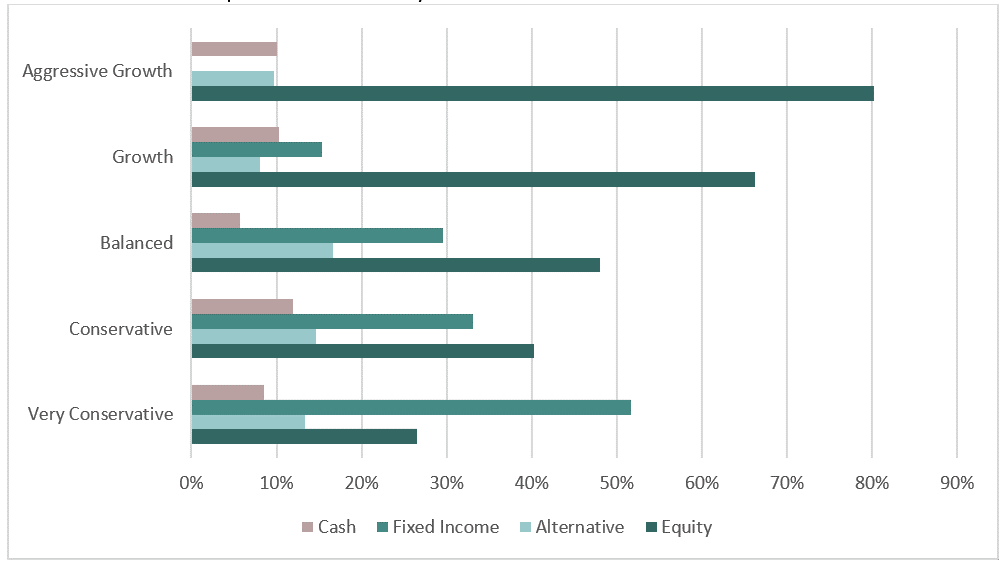

In terms of portfolio allocation, equity exposure currently ranges from 27% to 80%, with the Very Conservative and Conservative portfolios leaning towards fixed income, with allocations ranging from 33% to 52%. Cash holdings range between 6% and 12%.

Chart 2: Asset Class Exposure As at 31 May 2023

Please note that the above performance and asset class exposure are based on five proxy portfolios. Actual KDI Invest portfolio performance may vary from the above due to the customization by the KDI robo-advisor A.I. based on investors’ risk profiling, as well as the timing of market entry.

Citation:

https://www.cnbc.com/2023/05/25/nvidias-big-break-has-been-a-long-time-coming-jim-cramer-says.html