KDI Save Revolutionizes The Way We Save Money. Here’s Why

Many of us were taught the value of money since we were young, with our parents instilling the importance of saving money even before reaching adulthood. Everyone knows they should save for rainy days, but unpredictable events like the pandemic of COVID-19 further proves the need to always have a backup fund to safeguard your financial interest.

Despite the age-old mantra, Malaysians do not seem to save enough for the future. Gross domestic savings as a share of GDP has been steadily falling since 1998 to 26.12%. Comparing the same metrics with our regional peers, Singapore recorded 54.08% while Thailand was at 29.43% during the same period. Explained in layman terms, Malaysians only save RM26.12 for every RM100 earned, compared to SGD54.08 for every SGD100 earned for Singaporeans, and THB29.43 for every THB100 earned for Thais.

Add in the ever-increasing inflation rate and dwindling interest rates from conventional savings methods, and you can say goodbye to your capital preservation plan as the value of your savings further erodes over time.

Current Savings Vehicles – Savings Account and Fixed Deposit

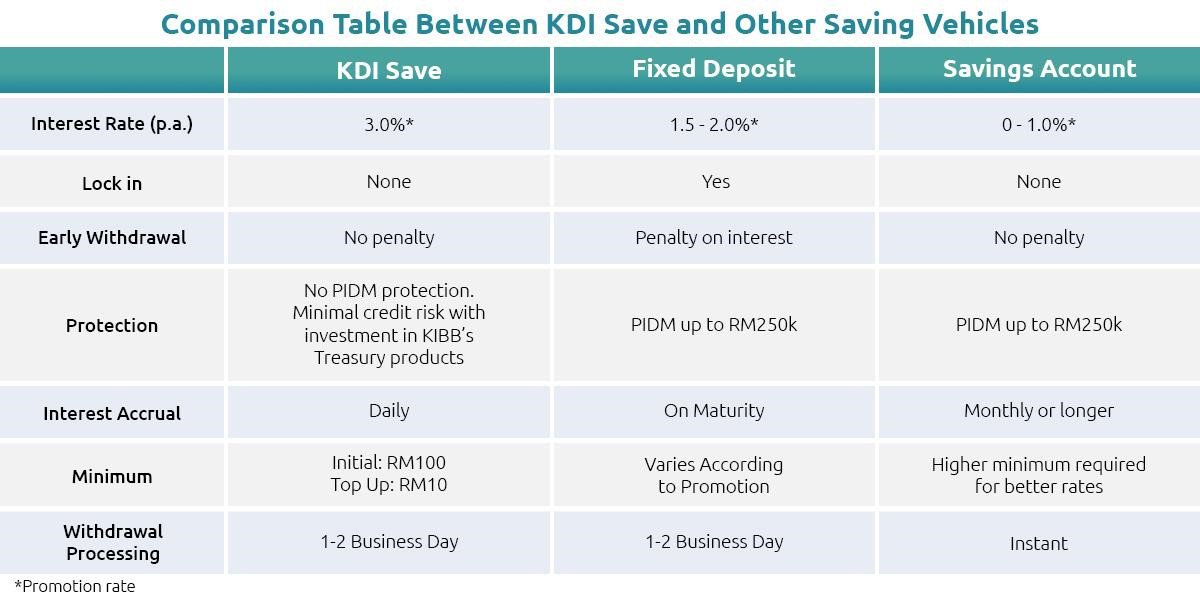

The way Malaysians save money typically boils down to Current Account / Saving Account (CASA) which yields low or negligible interest rate versus a Fixed Deposit (FD). FD’s pay a slightly better interest rate, at the expense of locking down your funds for a predetermined number of months.

Commercial banks in Malaysia have been promoting their own FD products with promotional rates that are higher than board rates, creating bargain hunters who seek better returns. These products may be conditional upon several caveats, such as “fresh funds” only, or the need to purchase other ancillary investments such as bancassurance products.

At a glance, one can surmise that the current environment, such as poor interest rates and the lack of innovation in the conventional CASA and FD’s may no longer entice well-informed Malaysians to save and preserve the value of their savings through these existing savings vehicles.

Is there a form of savings platform that has none of the disadvantages of CASA and FD, yet yields an even more attractive interest rate?

KDI Save – Combining the Best of Both Worlds

Initiated as one of the new financial innovations by the largest independent investment bank in Malaysia, Kenanga Investment Bank Berhad (KIBB), Kenanga Digital Investing (KDI) seeks to transform the current investment landscape by providing a breath of fresh air to the otherwise archaic industry.

As part of a wider investment ecosystem, KDI Save is Kenanga’s answer to the conventional trade-off between flexibility and better rates. With KDI Save, investors do not have to worry about missing out on accumulated returns in the case of early withdrawals, as investors are able to withdraw at any time without accrual loss.

Staying true to their objective, KDI now presents a one-time offer of market-beating interest rate of 3% per annum for an investment amount of up to RM200,000. Excess amounts above RM200,000 will be entitled to the base return of 2.25% per annum. This promotion is also valid for internal transfer from KDI Invest to KDI Save.

Save smarter with KDI Save and take advantage of the promotional rate!

Start saving with KDI Save from as low as RM100, plenty of flexibility and no penalty for early withdrawal.

Looking for a place to park your money while waiting for other opportunities? You will be glad to find out that KDI Save provides fast processing time of 1-2 business days only.

The promotion rate of 3% per annum is only valid until 31st December 2022, click here to start saving the smarter way.