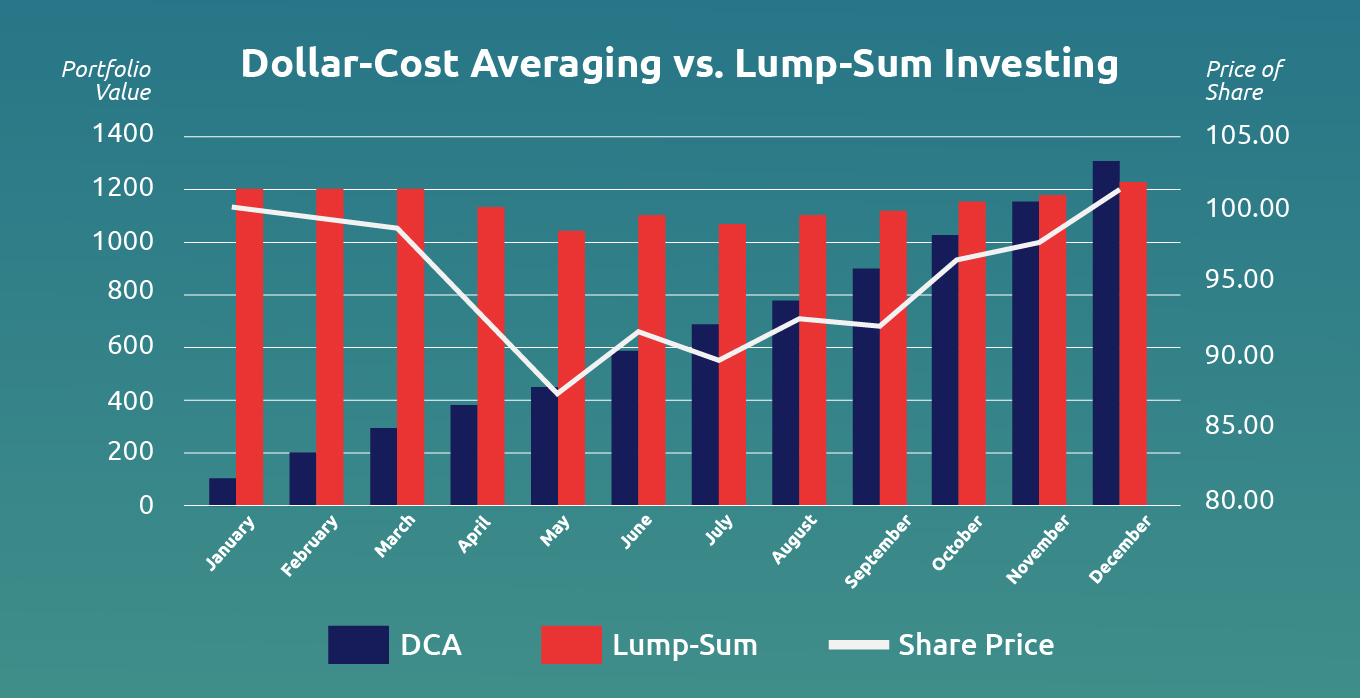

By investing a small pre-determined sum at regular, predetermined intervals, you lower the risk of any unpleasant results to your portfolio by lowering the overall cost of investing over time. Your dollar will buy more when the market is down but less when the market is up. But it will give you a feeling of consistency and you don’t have to watch the market like a hawk and try to predict upswings and downturns.

If you have an EPF account, you are already practicing a type of dollar-cost averaging – a predetermined amount of your salary goes toward your EPF account every month. If you don’t feel the pinch from the EPF deduction and find automatic investing to be low-stress, then you may find dollar-cost averaging works for you.

Keep in mind that the DCA strategy does not help identify if an asset is a good or bad investment. It keeps you in the market and shields you from taking a big hit if prices fluctuate over time. However, if your scheduled investment keeps buying into a downtrending asset, you are more likely to make a loss. You can easily avoid this with a robo-advisory tool to guide you.

What’s the Broader Appeal?

Highly risk averse people will find investing a fixed amount regularly to be a less scary way to build up their investment portfolio. This is because DCA helps take a lot of the emotion out of investing. You will not have to worry about investing at the ‘right’ time, you do not have to actively release the money each time, and it can be made automatic so it gets invested without you needing to make time for it in your busy schedule.

DCA prevents your overall portfolio health from being negatively impacted by a volatile market or uncertain asset. So this makes it attractive for fresh graduate workers or young people at the start of their career who cannot invest a substantial amount but want to start building up an investment portfolio.

The biggest appeal of this strategy is that it is a way to people who are new to investing to dip their toes in. You can experience investing in a way that reduces your concerns of hurting your finances and you can learn what your true risk tolerance level is which prepares you for future investment avenues and portfolio diversification.

Letting go at the right time

Kenanga Digital Investing (KDI) is committed to helping to demystify the investment landscape so that every demographic can achieve financial stability. An investing portfolio is increasingly becoming a necessity for future financial wellbeing, and robo-advisor tools have made it more accessible today than ever before.

DCA is a great way to get comfortable with investing regularly while you learn more about what investing can do for you. If you are unsure about committing to drawing the investment amount from your monthly budget, you can always take a small amount and invest it with KDI Save. This is ideal for low-risk, short-term savings that you can access and withdraw with zero penalty fees. Your money will actively be growing daily, giving you the sum you need for your DCA strategy without any extra hardship on your monthly budget.

However, once you get into the habit of investing and learn what your personal goals are for the future, you may need a more strategic approach to help you grow your portfolio. Diversification is a necessary step to making your portfolio work for you and this is exactly what a robo-advisory tool like KDI Invest can offer you.

KDI Invest can be a great enhancement of your DCA strategy as it is adaptable to market conditions, further relieving you of volatility worries. Through the DCA strategy you can figure out your risk profile. Then you can submit this risk profile to KDI’s highly adaptive robo-advisory tool, which will take it into account when choosing assets for your portfolio. Taking out the uncertainty, the risk, and the human fear factor out of the equation gives you a surer foothold on the path to your future wealth.

Visit https://digitalinvesting.com.my/ to learn more.