May 2022 Market Insights

Brought to you by the Kenanga Digital Investing (KDI) team, here is our fourth Market Insights column. Our Head of Digital Investing, Cheong Yew Huan will discuss the latest in financial news and present his thoughts on making the most of today’s market.

Market Recap

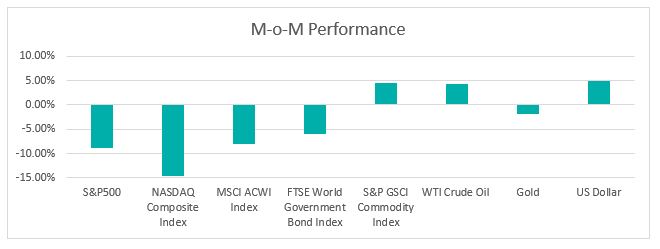

Chart 1: Index Performance in April

Equities fell again in April with S&P500 falling 8.8% during the month, the worst monthly slide since March 2020. The Nasdaq composite fell 13.3%, its biggest monthly decline since the 2008 financial crisis. The equity markets were impacted by Federal Reserve’s monetary tightening, rising rates, persistent inflation, China’s Covid lockdown and the ongoing war in Ukraine. Disappointing quarterly earnings results from tech giants Amazon, Apple and Google also drove weaker investors’ sentiment during the month.

Beyond the US, the longer-than-expected lockdown in Shanghai and other cities across China presents another challenge for global supply chains. The implementation of zero-Covid policy by China has restricted economic activity in major cities and forced companies to suspend their operations. The contraction in manufacturing activity and a slowdown in export growth have heightened the risks of a slowdown in global economic growth.

Bond market also came under pressure with FTSE World Government Bond Index falling by 5.88% in April as US 10-year Treasury yields approached 3%. The bond investors reacted to Federal Reserve’s more aggressive move in curbing inflation. With US inflation accelerating to 8.5% in March 2022, the highest since December of 1981, the Federal Reserve increased its benchmark interest rate by half of a percentage point in its May meeting. The Fed will likely carry out another half of a percentage point rate hike in the next couple of meetings, according to Fed Chairman, Jerome Powell.

With the growing concern over slowing global economic growth and the rise in US treasury yields, the US Dollar continues to attract capital from investors all over the world. The S&P GSCI Commodity Index remained an outperformer by posting a fifth straight monthly climb, its longest streak of gains since 2020. The escalations in natural gas and food commodities prices were driven by the ongoing war in Ukraine, which continues to threaten global supplies.

Market Outlook

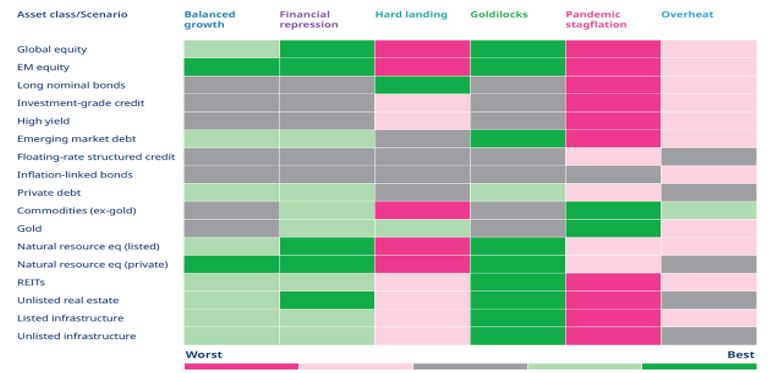

Chart 2: Asset Class Heat Map

Source: Mercer

Economic scenario description

Balanced Growth: Economic growth and inflation moderate, consistent with consensus forecast.

Financial Repression: Strong growth and inflation, supported long term by low central bank rates, designed to reduce debt.

Hard Landing: Growth slows sharply, as fiscal stimulus is reined in; deflation risk rises.

Goldilocks: Robust growth, driven by productivity gains, which also keeps inflation low.

Pandemic Stagflation: Pandemic stress re-emerges. Growth slows, but supply chains drive inflation.

Overheat: Central banks pre-emptively tighten policy to avoid risk of runaway inflation.

The chart above shows the performance of asset classes across different scenarios.

The chart suggests that we are probably at the “Overheat” stage given the current underperformance of equities and fixed income asset classes and the outperformance of commodities. With the global economy emerging from the Covid-19 pandemic and inflation soaring, Central Banks are starting to act by taking more aggressive moves in interest rate hikes.

With the inflationary pressure likely to persist, investors should ensure their portfolios are hedged against inflation going forward. For instance, diversify from traditional asset classes, since the fixed income asset class is impacted by rising bond yields while the sentiment on the equity market remains weak due to rising fears of recession.

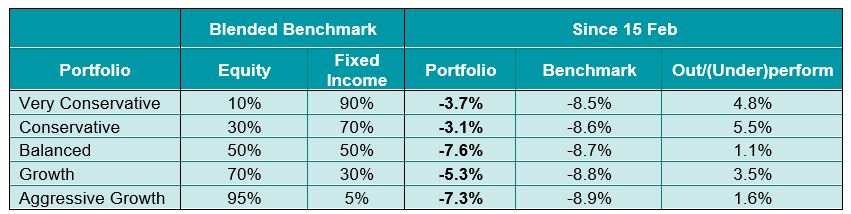

KDI Invest Portfolio Performance As at 30 April 2022

Remarks:

Benchmark: Equity: MSCI ACWI Index + Fixed Income: FTSE World Government Bond Index

Past performance is not indicative of future results.

The above table shows the performance of selected KDI portfolios since launch on 15 February. Our returns ranged from -7.6% to -3.1%. In April, the portfolio was negatively impacted by the sell-off in equity and fixed income markets. The Vanguard Total Stock Market Index Fund ETF (VTI) and Vanguard Total International Bond Index Fund ETF (BNDX) decreased by 8.1% and 3.1% respectively.

Portfolio rebalancing was triggered by the KDI A.I. in late April 2022. The portfolio rebalancing adopted defensive strategies by reducing equity risk, increasing cash holdings, and protecting against inflation.

The portfolio rebalancing includes:

• Reduced allocation in developed market equities across all portfolios. Added iShares MSCI Brazil ETF (EWZ) for growth and aggressive growth portfolios. With the material and energy sectors making up around 42% of the MSCI Brazil 25/50 Index, EWZ is likely to be supported by booming commodities prices.

• Added SPDR Gold Trust ETF (GLD) for inflation-hedge purposes.

• Increased exposure in iShares Short Treasury Bond ETF (SHV) to minimize the impact of rising treasury yield.

• Increased cash or cash-equivalent holdings exposure for a defensive move.

Please note that the above performance is based on five proxy portfolios. Actual KDI Invest portfolio performance may vary from the above due to the customization by the KDI A.I. based on investors’ risk profiling, as well as the timing of market entry.