November 2024 Market Insights

Welcome to the November edition of the Market Insights column brought to you by the Kenanga Digital Investing (KDI) team. In this edition, we introduce our Head of Portfolio Management, Wu Kin Hoe, to discuss the latest financial news and share his insights on how to make the most of today’s market.

Market Recap

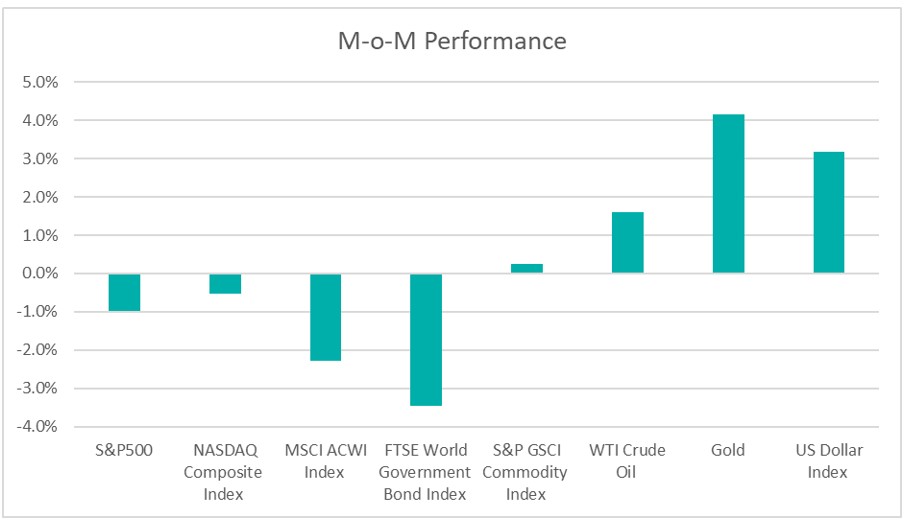

Chart 1: Index Performance in October 2024

Market

In October, global equity markets moderated as investors turned cautious ahead of the US election on 5th November 2024. The S&P 500, Nasdaq Composite and MSCI ACWI Index declined by 0.5 – 2.3% for the month, respectively.

U.S. Treasury yields had been trending upward since the US Federal Reserve’s (‘Fed’) rate cuts in mid-Sept 2024, as fears of widening fiscal deficits under a Trump presidency pushed up longer-term inflation and the risk premium on federal debt. Yields on the two-year and ten-year Treasuries rose by ~50bps month-on-month to 4.17% and 4.28%, respectively. According to CME FedWatch, market now sees a 75.2% chance of a 25-basis-point cut at the Fed’s December meeting.

In October, commodities had a mixed performance. The S&P GSCI Commodity Index rose by 0.2% over the month. Oil prices remained soft at US$69 per barrel amid easing tensions in the Middle East. Meanwhile, gold surged by 4.2% to US$2,744 per ounce, fuelled by growing demand for safe-haven assets due to US election uncertainty.

The U.S. dollar strengthened by 3.2% in October as the market scaled back its US interest rate cut expectations following better than expected US economic data and hawkish comments by the Fed Chairman Jerome Powell.

Outlook

Recent US economic data has been largely positive: Third Quarter GDP, annualized QoQ, came in at +2.8%, slightly below market expectation of +2.9% and prior quarter’s +3%, but above the +1.8% level Fed officials consider the long-term sustainable trend. September retail sales were stronger than expected at +0.7% MoM (consensus: +0.3%). PCE inflation rose at a 2.1% annual rate in September, near the 2% target set by the Fed for that index. However, the US added only 12k jobs in October, down from 254k in September, due to strikes and bad weather. Still, the unemployment rate held steady at 4.1%, and average hourly earnings grew at a 4% annual rate.

Given the stronger-than-expected economic data and US President-elect Donald Trump’s stance on tariffs and his history of expansionary policies, the US central bank may put on a slower and shallower path for interest rate cuts. Fed Chair Jerome Powell indicated a preference for smaller, quarter-percentage-point cuts in the future. Overall, the domestic economic outlook appears positive, with new government policies influencing the Federal Reserve’s monetary policy decisions moving forward.

Meanwhile, the Chinese government recently unveiled stimulus measures aimed at reviving the flagging economy and achieving the government’s growth target. The measures include rate cuts, lower reserve requirement ratios, property easing measures, cash handouts and policies to support the equity market. The efforts appear to have had positive economic impact with the latest industrial production, retail sales, PMI and GDP growth all surprising on the upside. The announcement of this stimulus package came as a positive surprise for markets, setting off a surge in Hong Kong and China equities and a strengthening of the Chinese yuan.

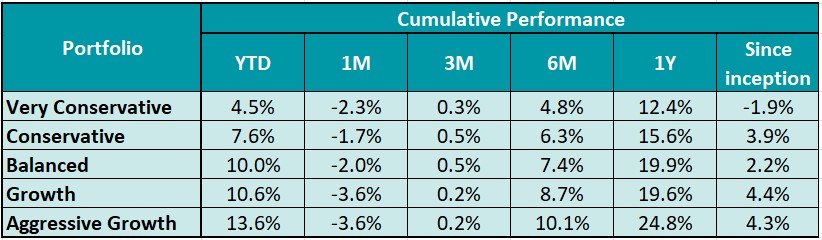

Table 1: KDI Invest Portfolio Performance as at 31 October 2024

The provided table offers information on the cumulative performance of selected KDI portfolios since their launch on February 15, 2022. The portfolio returns (in USD) range from -1.9% to 4.3%. Year-to date, all portfolios recorded positive returns within a range of 4.5% to 13.6%.

The S&P 500 Index rebounded to a record high after the US election on 5th November as Donald Trump returns to the US presidency. His plan for tax cuts and deregulation is seen as a boon to the US economy, though it might come with higher inflation and higher interest rates. Looking ahead, several factors, including the US economic outlook, shifts in the Fed monetary policy, stretched market valuations, and President-elect Trump’s communication style, could contribute to increased market volatility. Meanwhile, the US central bank cut interest rate by a quarter point on Nov 7. Fed Chair Jerome Powell said he was “feeling good” about the economy. Despite recent positive economic data, he added that the central bank will continue to pursue rate cuts as monetary policy remains tight.

KDI’s portfolios are well diversified to withstand market fluctuations, and will remain vigilant in monitoring changes, adjusting asset allocation when necessary. This approach enables portfolios to capitalize on opportunities and potential benefits that may arise from these risks.

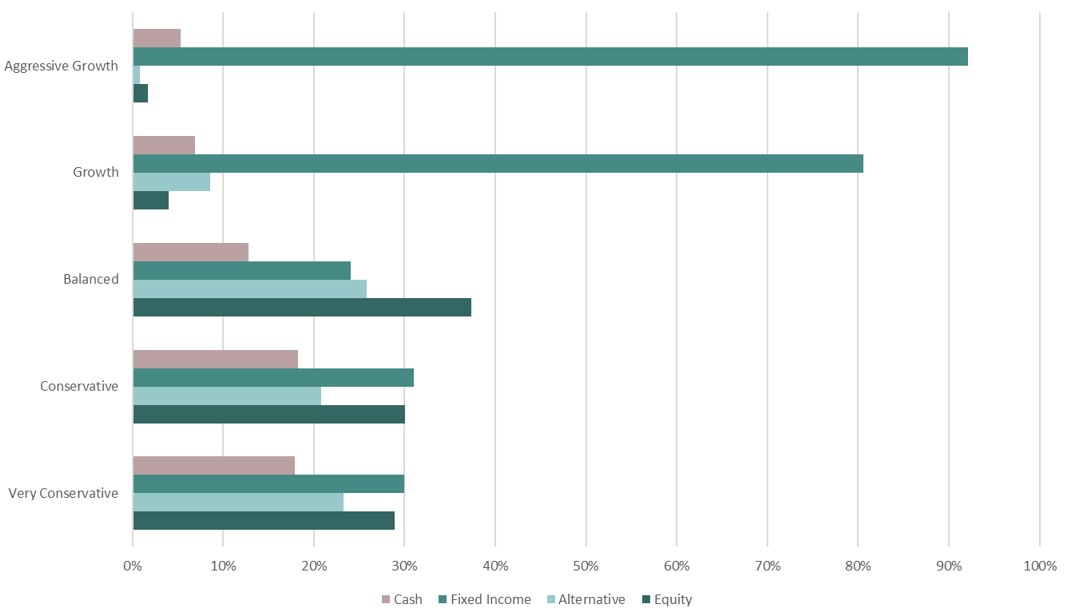

Chart 2: Asset Class Exposure as at 31 October 2024

Please note that the performance and asset class exposure mentioned above are derived from five proxy portfolios. The actual performance and exposure of KDI Invest portfolio may differ due to the customisation by our A.I. based robo-advisor that tailors the investment to individual risk profiles, as well as the timing of market entry.

Citations:

https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

https://www.reuters.com/markets/us/recent-data-has-kept-fed-rate-view-soft-landing-intact-2024-11-01/