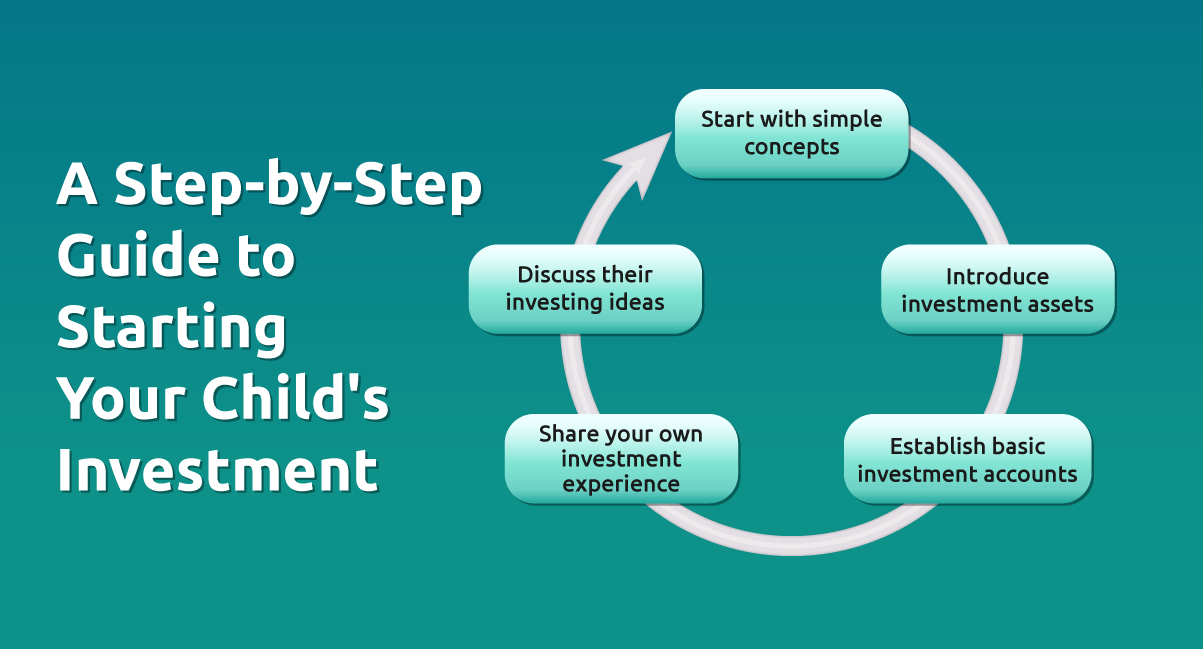

1. Where to start

Start with simple concepts like risk and reward. Tell them about well-known companies which have had ups and downs in the market. Explain how profitability can make a stock more valuable(reward) while bad news about the same company can make the stock lose value (risk).

This should be easy enough to do with brands that even children will recognise easily, such as LEGO and Marvel Entertainment. These examples would likely work better with older kids and teenagers. With very young children, you can use a piggy bank or other items in the house to demonstrate the concept.

2. Put it into practice

Once they have grasped the risk-reward relationship, you can move on to explaining the different types of investment assets. However, anything beyond this might start to become confusing. You can always brush up on your own knowledge with the KDI blog article Investing for Beginners! Or even better, for young children, make it into a game. Help them ‘invest’ their pocket money or money earned from doing chores.

The experience of understanding and managing their own ‘investment account’ can do an even better job of helping them to grasp more complex concepts.

If you have a teenager, they will benefit from a real investment account. KDI offers investment accounts from 18 years old and up, so get your child started on the path to financial well-being with their own investment account. As they become more comfortable in the use of their investment account, you can talk to them about other types of investing platforms and how different assets or platforms can help them achieve future goals. Their dreams may be small right now, but encouraging them in how to reach a chosen goal will prepare them to dream bigger later on. The 8 year old who wants to invest towards in-app purchases for Minecraft will someday become the 18 year old who wants to invest towards university or a home of their own.

3. Keep it consistent

Children learn better when they have a reference source to look toward. Once they have grasped the basic concepts of investing and you get them started with their own simple portfolio, it is imperative that you keep them focused. Children of all ages have so much going on in their lives and do not yet have the experience to distinguish what is important to retain for their future.

One great way to help them remain focused and interested in investing is to share your own portfolio with your children. You can talk to them about how you decided the different assets you have invested and discuss with them about the risk-reward potential of assets you are considering. Give them reading materials about investment philosophies and related topics such as Warren Buffet’s annual letters to shareholders.

Invite them to share their ideas and give their thoughts due consideration – discuss their ideas as seriously as you would take advice from a friend. This will help your child to feel confident and capable. Plus, it is a great bonding experience that shows your kids that you respect them and their opinions.

4. Equip your children for the future with KDI

KDI Save is a great way to introduce your children to the concept of compounding interest, through fixed deposits. KDI Save gives you all the benefits of a FD account but without the lock-in period. Younger children have a shorter attention span than traditional FD accounts take to mature. KDI Save gives you fixed returns, accumulates interest daily, and has no penalties for early withdrawal. This allows you to show your child how interest can snowball the value of an account,but within a period of time that can maintain their interest.

Your newly adult children may also benefit from a KDI Invest account. KDI Invest is a robo-advisory tool that offers your child access to a basket of today’s most exciting Exchange-Traded Funds. These ETFs offer diversified exposure to well known companies that your child is sure to know about – Nvidia(NVDA), Amazon (AMZN), and Apple (AAPL) to name a few.

Expanding their investment portfolio by introducing KDI Invest is also a great way to reiterate the importance of diversifying your portfolio. Additionally, KDI Invest uses algorithmic investing methods which take your risk profile into account. Teenagers are a lot less risk-averse than adults and a KDI Invest account might just be the best way for them to learn how to control their impulses.

Whether you choose both tools or just one, KDI is here to support you in making the first crucial step towards ensuring your child’s financial future.

Visit https://digitalinvesting.com.my/ to learn more.